The worry list for shares (and the good news!)

From their lows last year, global and US shares are up 17% and Australian shares are up 13% as investors have been buoyed by evidence of peaking inflation, anticipation that central banks are near the top, resilient growth and profits and enthusiasm for Artificial Intelligence (AI) following the launch of ChatGPT late last year pushing up related stocks. This has resulted in solid year to date returns. But is it sustainable?

The worry list for shares

Recent weeks have partly been dominated by the political soap opera around the US debt ceiling. A deal has now been reached suspending the ceiling out to January 2025 with caps on spending. There is still room for setbacks in terms of getting it passed by Congress ahead of Treasury’s 5 June deadline, but odds are it will pass providing a short-term boost for shares (which looks to have been factored in) allowing shares to focus on other things. However, right now there is a still a large worry list for shares:

First, share market gains from last year’s lows have so far been more narrowly based favouring defensive or growth sectors (like tech) relative to cyclicals and value than would be normal at this point. In fact, so far this year AI related stocks have accounted for all of the rise in the S&P 500 with the Dow Jones index actually flat year to date.

Second, leading economic indicators are continuing to point to a high risk of recession in the US and elsewhere. This can be seen in yield curves and the US leading economic index is also signalling recession.

Third, a recession would mean a sharp decline in company profits which is not currently expected by the consensus.

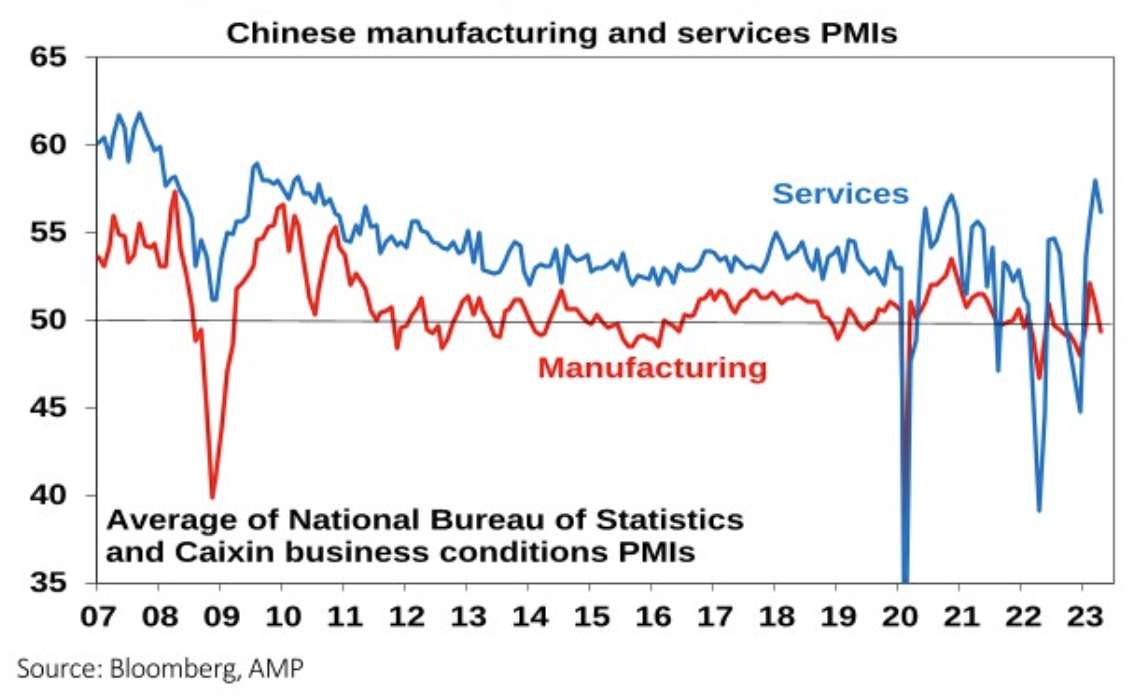

Fourth, the Chinese economic recovery has started to disappoint. In particular, it’s concentrated in services as opposed to manufacturing. This may mean less of an impetus for global growth.

- Fifth, weakness in copper, oil (despite OPEC production cuts), and other industrial commodities suggests weakening demand and this is also being reflected in the growth sensitive Australian dollar which recently broke below support at $US0.66. This is in part related to the relative weakness in manufacturing in China and partly explains the relative underperformance of the Australian share market so far this year – its up 2.5% compared to a 9% rise in global shares.

Sixth, US banking stress is continuing resulting in additional tightening in lending standards as other banks seek to avoid a Federal takeover.

Seventh, while the debt ceiling is close to resolution it will entail less spending than would otherwise have been the case (around 0.2-0.3% of GDP less) and the withdrawal of the liquidity boost the Treasury has been providing investment markets.

Eighth, while central banks are probably at or close to the top, they remain hawkish and risk doing more – potentially over-tightening. The RBNZ (with a cash rate of 5.5%) and Bank of Canada (at 4.5%) look to have peaked. However, the ECB (3.25%) and Bank of England (4.5%) look to have further to go.

Both the Fed (at 5.13% and the RBA (3.85%) are concerned about sticky inflation. We think they have done enough but their bias is towards further tightening. At this stage, the Fed is likely to pause at its June meeting but may still do more at its July meeting. In Australia, continuing hawkish commentary from the RBA with risks around wages, poor productivity growth and rising home prices (which are reversing the negative wealth effect).

On wages, watch the June minimum wage decision as a 7% minimum wage rise would add around 0.45% to wages growth directly plus more indirectly due to its influencing effect. Along with the 15% rise in wages for aged care workers with potential to flow on others in the hospitality industry and an acceleration in public sector wages, it would likely take wages growth to beyond the level consistent with the inflation target. All this means that the risk of further RBA rate hikes is very high. Further rate hikes will exacerbate the economic downswing and add to the already high risk of recession.

Ninth, investor sentiment leans slightly on the optimistic side which is bearish from a contrarian perspective – albeit there is no sign of euphoria and investor positioning in shares looks underweight which is positive from a contrarian perspective.

Finally, the period from May to September is often rough for shares albeit with a bounce along the way in July (particularly in Australia).

But it’s not all negative

However, while the worry list is long there are some positives for shares.

First, US and global shares are still tracing out a pattern of rising lows and highs from last October, which technically is still consistent with a bull market. (This is not the case in Australian shares though.)

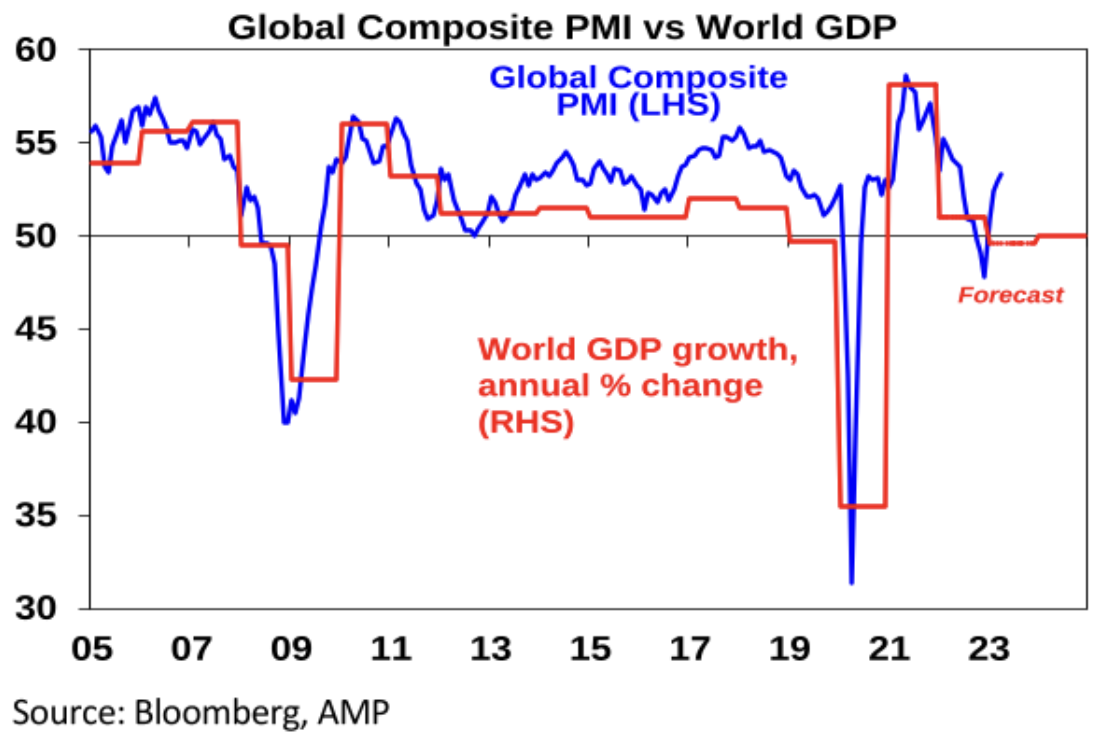

Second, so far global economic conditions have held up far better than feared. In fact, business conditions according to purchasing manager surveys (PMIs) have improved since late last year suggesting growth will surprise on the upside.

Related to this so far company profits globally have held up better than expected. The complication is that the strength may be exaggerating things as it’s being driven by services but manufacturing is weak and its normally a better guide to cyclical conditions and is warning of weaker conditions ahead.

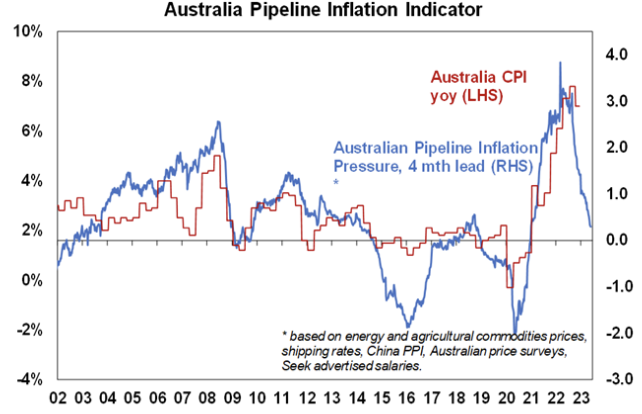

Reflecting this along with other indicators our Pipeline Inflation Indicators for the US and Australia have continued to fall pointing to a further decline inflation ahead. If correct this will provide scope for central banks to ease monetary policy later this year or early next.

Fourth, enthusiasm for AI has the potential to push share markets higher directly in terms of IT stocks that will benefit from related demand associated with an upgrade to AI, but also via a productivity boost to high labour industries that will boost growth and profits and lower wages. Of course, as we saw with the late 1990s tech boom, the benefits could take time to materialise and investor interest could get frothy setting up a short term pullback.

Implications for investors

We remain of the view that shares will do okay on a 12-month view as central banks ease as inflation cools. But given the long list of negatives, global and Australian shares are vulnerable over the next few months to a correction. There are several implications for investors:

Unlike last year, government bonds should provide protection for investors as bond yields have potential to fall if recession worries rise.

For short term investors it’s a time to be cautious.

However, while times like these can be stressful, for superannuation members and most investors the best approach is to stick to basic investment principles.

Share market pullbacks are healthy and normal - their volatility is the price we pay for the higher returns they provide over the long term;

It’s very hard to time market moves so the key is to stick to an appropriate long-term investment strategy;

Selling shares after a fall locks in a loss;

Share pullbacks provide opportunities for investors to invest cheaply;

Shares invariably bottom with maximum bearishness;

Australian shares still offer attractive income versus bank deposits; and

To avoid getting thrown off a good long-term strategy, it’s best to turn down the noise around all the negative news flow.

1 topic