Time for Recaps

If investors haven't entirely turned off the tap, it has certainly been turned down to a trickle. The $US146 billion of equity capital raised globally in the March quarter still sounds like a big number but has plunged 69% from $US476 billion a year earlier and 58% from the $US347 billion in the preceding December quarter (based on data from dealogic). Activity to date suggests the current quarter will be lower still.

After taking funding for granted for many years, many businesses are set to find sourcing new cash increasingly difficult as 2022 progresses - if they haven't already realised that the market dynamics have changed.

Recapitalisation Opportunity

The great opportunity in this is for investors to identify situations where capital availability can make a huge difference to valuation, either in isolation or with a few changes and greater fiscal discipline.

That’s the kind of recapitalisation opportunity we at Equitable Investors are now hunting for. We think the recapitalisation opportunity is a huge one and an exciting time for a firm such as ours that applies bottom-up, fundamental research and constructively engages with companies.

Back in March 2020 when markets had their COVID shock, there was an onset of panic over funding and a number of recapitalisation opportunities emerged. But the stress was short lived as central banks and governments flooded the world with capital in response, while somes businesses found great opportunity out of the pandemic and consumers found different ways to spend.

This time around the central banks are trying to “take away the punch bowl”. We know some active capital providers in the local market have placed a freeze on new investments. Capital is now expensive (or valuable depending on your perspective).

Hunting among the Burning Platforms

The analogy of a "burning platform" compares a situation where one is standing on a deep-sea oil platform that's on fire with a dire business situation - the situation is so bad you are forced to take action to jump off.

We’ve identified almost 400 “cash burners” on the ASX, excluding the resources sector. Nearly half of these cash burners did not have the funds to make it past 12 months, based on their March quarter cash burn.

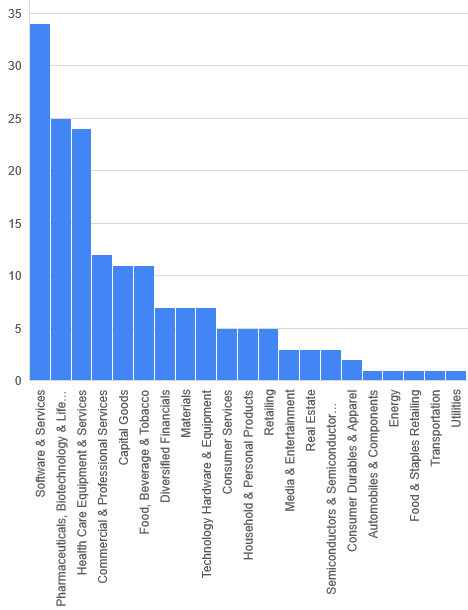

It may not be a complete surprise to you that the sector with the most companies facing one year or less of cash funding is Software and Services. Biotech and Health Care unsurprisingly represent nearly 30% of these companies.

Some of these companies will take action promptly by changing their cost base, raising funds, consolidating or taking some other strategic decision. Others will react too slowly and likely suffer more as a result. There will be some that can't find a way out.

Over 20% of the cash burners we identified had access to no more than two quarters of cash.

When an ASX listing reports it has less than two quarters of cash remaining, it is asked in the “4C” quarterly cash flow report to advise what steps it is taking to raise further cash.

Some have concrete plans of action in place. Some are in active discussions with financiers. Companies have signalled in their 4C responses that they are variously pursuing working capital facilities, relying on the support of major shareholders or engaging with brokers or investment banks.

Others appear to be living in hope, such as the company that said it had engaged a broker to complete a capital raising “once the technology can be demonstrated to potential investors”. That demonstration has since been deferred.

3 topics