US core inflation picks up in January on stronger services

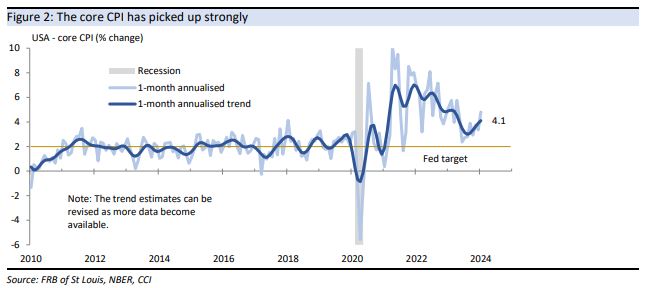

With Fed Chair Powell recently pushing back on market expectations that the FOMC could start cutting rates at its 19-20 March meeting, the US core CPI came in strong in January, increasing by 0.4% after a 0.3% rise in each of November and December.

On CCI's estimation, trend annualised monthly core inflation has picked up from around 3% mid last year to about 4%, signalling that it should still take time for the Fed to achieve sustainably low inflation.

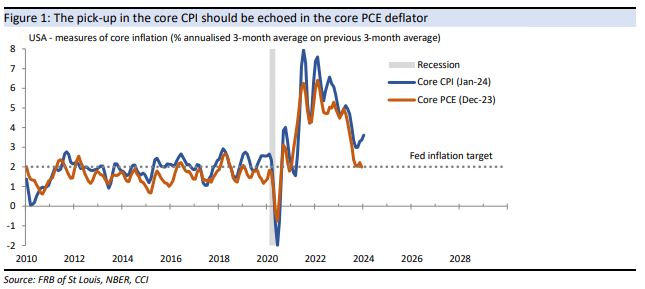

That is, the pick-up in the core CPI raises the prospect that the Fed’s preferred measure of inflation – the differently-constructed core PCE deflator – will start to increase a little, having recently slowed to around the Fed’s 2% inflation target on an annualised basis.

There is some market speculation that residual seasonality affected the January CPI at the margin, although only last week the BLS undertook an annual seasonal re-analysis of the data.

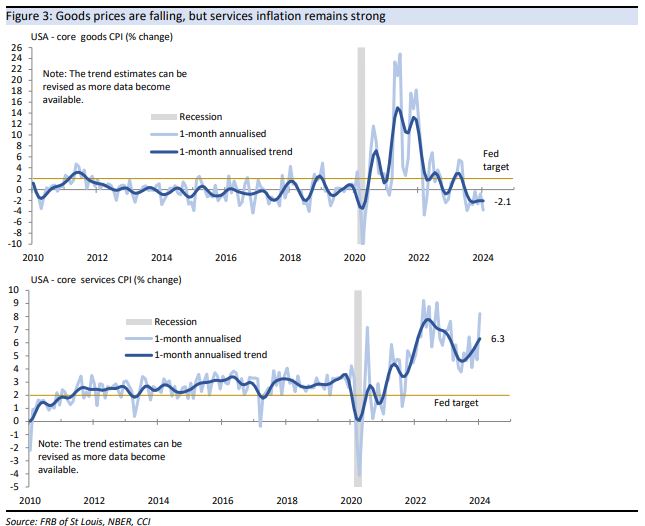

In terms of the drivers of the core CPI, core good prices fell at a slightly faster rate of 0.3% in January, having declined every month for most of the past year. On a trend basis, annualised monthly core goods disinflation continues to run at about 2%.

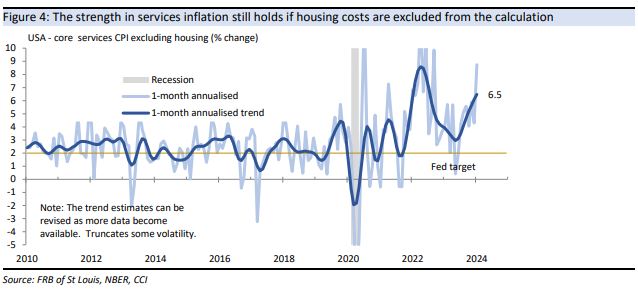

In contrast, core services prices rose at a faster rate, up 0.7% in the month, which was the largest increase since late 2022. On a trend basis, annualised monthly core services inflation has picked up to just over 6% (or 6½% excluding housing costs).

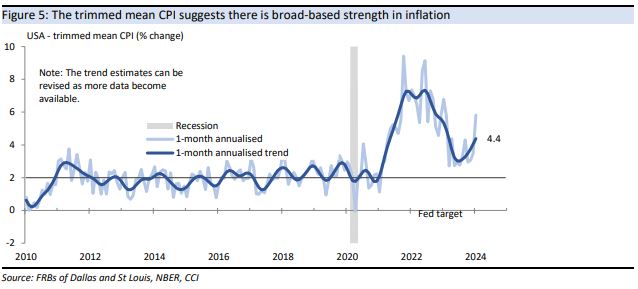

The distribution of price changes also shows that US inflation has become more broadly based, in that the trend annualised monthly trimmed mean CPI inflation rate has picked up to 4½%.

4 topics