US markets give back early strength, Australia inflation preview, ASX 200 set to rise

ASX 200 futures are trading 34 points higher, up 0.47% as of 8:50 am AEDT.

Major US benchmarks fade from session highs, cash-like ETFs attract largest inflows since 2020, Tesla's German plant hits production target ahead of schedule, US capital goods orders rebound in January, a preview of Australia's inflation data due Wednesday and the growing likelihood of a 'no landing' scenario.

Let's dive in.

S&P 500 SESSION CHART

MARKETS

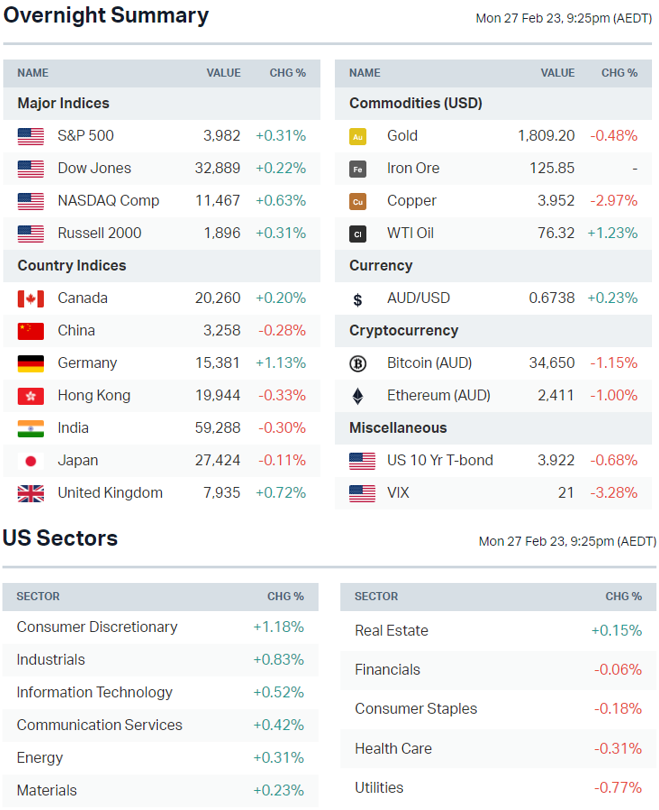

- Major US benchmarks tried to bounce but closed off session highs of S&P 500 (+1.2%), Dow (+1.1%) and Nasdaq (+1.5%)

- Fed’s implied terminal rate is up to 5.4% and year-end not far below 5.30%

- War threatens Europe's 2023 stock rally (Bloomberg)

- Cash-like ETF attracts US$2.5bn in biggest haul since 2020 (Bloomberg)

STOCKS

- Tesla's (+5.4%) German plant hits 4,000 cars per week ahead of schedule (Reuters)

- Snap (+0.7%) rolling out OpenAI-powered chatbot (CNBC)

- Palantir (-0.8%) to cut around 2% of staff to reduce costs (Bloomberg)

EARNINGS

No high-profile earnings overnight. Busy week ahead for retail results including Costco, Target, Lowe's, Best Buy, Dollar Tree and Macy's.

ECONOMY

- U.S. core capital goods orders post largest gain in five months (Reuters)

- Eurozone core inflation refusing to slow (Bloomberg)

- China's factory activity likely continued to grow in February (Reuters)

- Australia recession risk rises as RBA seen hiking more than Fed (Bloomberg)

Deeper Dive

Sectors to watch

What a hopeless attempt at a bounce overnight. It just goes to show how frail markets are at the moment and how bearish narratives have gained a lot of traction in recent weeks. Even as markets pull back rather aggressively, its interesting to see something like CNN's Fear & Greed Index remain in 'Greed' territory. The Index reflects what emotion is driving the market, from 0 to 100, with 0 being extreme fear and 100 being extreme greed. Its currently 62 and started the year at 38. Does this mean more pain is needed to flush sentiment back to neutral/fear territory?

Most of our overnight sector ETFs finished higher but many closed well off session highs. There were a few that managed to buck the trend with a strong close, including Solar, Copper, Lithium and Rare Earths.

Normally I would go into more detail about overnight sector performance or sectors to watch, but the market remains in this vulnerable state. ASX 200 futures are pointing towards a positive start, but a lot more is needed.

Economy: Australian inflation preview

Australia's monthly inflation indicator and fourth quarter GDP print will be released on Wednesday at 11:30 am AEDT.

The ABS monthly inflation indicator is expected to show a deceleration in January from 8.4% to a comparatively milder 8.1%. Even if we see a downside surprise, inflation will still be approximately four times the RBA’s target. In short, it means more rate rises are coming.

Three of the Big Four banks’ economic research teams now have an RBA terminal rate above 4%, with ANZ going one step further revising their respective forecasts for house prices.

“With the cash rate set to rise to 4.1%, maximum borrowing capacity is set to be reduced by around one third. This will continue to weigh on buyers’ ability to pay and thus prices … We expect capital city prices to fall 10% in 2023, to bring the total peak-to-trough decline to 18%.”

But is part of our inflation problem due to the resilience of corporate profits? On the one hand, corporate profits increased 30% in the September 2022 quarter compared to pre-pandemic levels. But the average consumer is also right to ask why and how Commonwealth Bank made a $5 billion profit in the first half while so many others are struggling.

“What the data says is that profits are rising across Australia. Collectively, firms have never had it so good," said Richard Denniss of The Australia Institute.

For GDP, the consensus is for a 0.7% quarter-on-quarter increase which is slightly above the last print of +0.6%. And as Joey Politano of Apricitas Economics pointed out, Australia is in that unique and beautiful position of not only growing but staying ahead of the competition:

“Nominal gross employee compensation, a valuable indicator of core price pressures … is growing rapidly and has exceeded what would have been expected in the absence of the pandemic.”

"No Landing" part deux

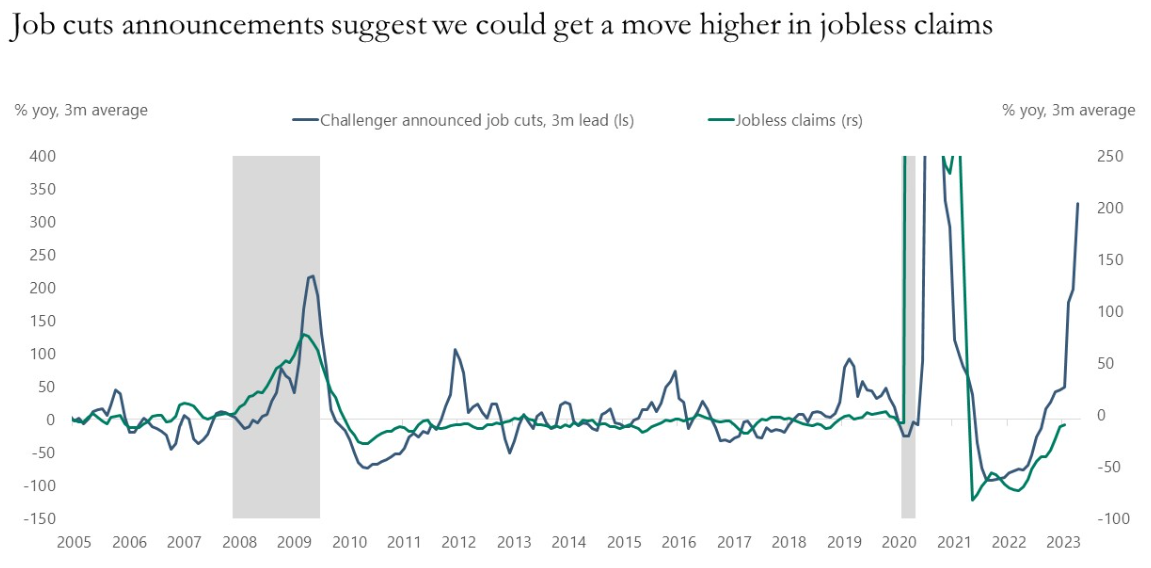

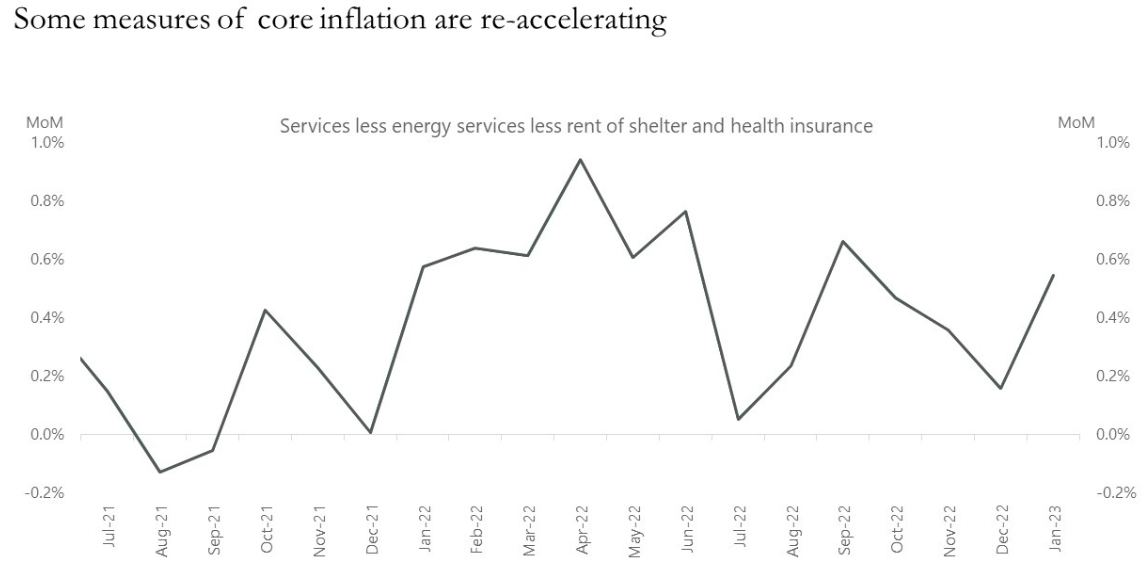

Two charts will follow in this next section, a short update to the new economic scenario sweeping Wall Street. Torsten Slok of Apollo Global Management believes we won’t see a hard or soft landing - but rather inflation will re-accelerate and unemployment will tick back up. The following two charts help explain this view:

(Is the US labour market not as resilient as they say it is? A monster jobs report in January would negate that thesis but the job cut announcements from major firms are not exactly helping matters.)

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Domino’s Pizza (DMP) – $0.674, Evolution Mining (EVN) – $0.02, Amcor (AMC) – $0.173, MA Financial (MAF) – $0.14, Origin Energy (ORG) – $0.165, Accent Group (AX1) – $0.12, Bega Cheese (BGA) – $0.045, Worley (WOR) – $0.25

- Dividends paid: Abacus Property Group (ABP), Stockland (SGP), Charter Hall (CHC), GPT Group (GPT), Dexus (DXS), Mirvac (MGR), Scentre Group (SCG), Janus Henderson (JHG)

- Listing: None

Economic calendar (AEDT):

- 11:30 am: Australia Housing Credit

- 11:30 am: Australia Retail Sales

- 6:45 pm: France Inflation Rate

- 12:30 am: Canada GDP Growth Rate

2 contributors mentioned