Value hunting: 13 stocks at 52-week lows (and if any of them are good ideas)

This article was first published on Market Index on Monday 6 February 2023.

There’s nothing pretty about a 52-week low and more often than not, the stocks that end up on that list are some of the market’s most discarded and disliked companies. But for investors who love trawling through the value bin - it’s a treasure trove.

Market Index’s 52-week lows scan shows users which companies are making 52-week lows on the given day.

In this article, we’ll explore what kind of filters investors can use to help better differentiate the companies that may appear in the 52-week low scan and a closer look at stocks hitting yearly lows.

A five-filter 52-week low strategy

Luke Wiley, the Senior Vice President of UBS and the author of The 52-Week Low Formula, provides a more tangible methodology and criteria for buying fundamentally sound companies trading near 52-week lows.

His five key criteria (and in that order) include:

Durable competitive advantage: Companies that have a history of “combating or responding to changes in technology, consumer demand and global logistics.”

Required minimum free cashflow yield: “If you are going to take on the risk of purchasing a company, the free cashflow yield needs to be more than slightly larger than a 10-year Treasury bond. Note: The 10-year Treasury bond yield is widely viewed as the risk free rate

Required minimum return on invested capital: Ensures the company is earning more than its cost of capital. If return on invested capital is lower than the cost of capital, then the company has failed the test.

Required minimum free cashflow to long-term debt ratio: “Highly leveraged companies - those with long-term debt that greatly exceeds several years of their annual free cash flow - will find it crippling to service its debt during downturns.” Wiley prefers a long-term debt of no more than three times current net earnings

% change from 52-week low: “Identify companies trading below their historic and recent high prices, companies with more sellers than buyers.”

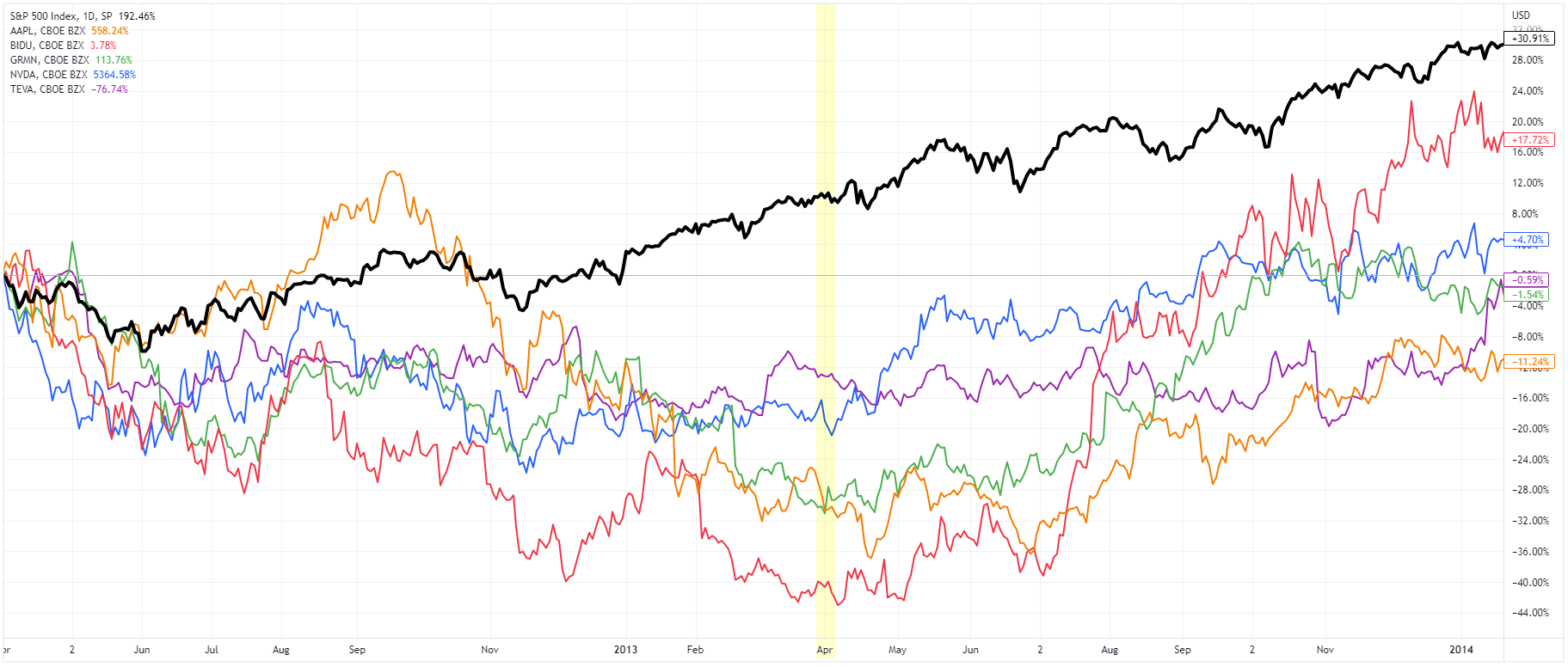

In 2012, Wiley was filtering the companies that would contribute towards his 52-week low strategy. He had a list of companies that passed the first four filters and making final tweaks to those that would make the final cut. To his surprise, the trailing 12-month return of the companies on that list, benchmarked against the S&P 500, was -25.4%. His list had lost -2.8% in a time when the market had rallied 22.6%.

There was indeed some method to the madness as six months later, those same companies returned 17.9% while the S&P 500 was up 12.5%.

Surprisingly, there are quite a few household names that were on that list including Apple, Baidu, Garmin, NVIDIA and Teva Pharmaceutical.

Tips from an Aussie fund manager

Chris Stott – Chief Investment Officer of 1851 Capital – says his fund generally steers clear from stocks hitting roll year lows.

“Establishing the reasons why a stock is making new lows is the key. Examples include earnings downgrades and dividend cuts,” he says.

“Generally, to gain comfort we need to be confident that a company has exited an earnings downgrade cycle. A new management team entering an underperforming company can provide a catalyst for review.”

A recent example includes Peter George – who successfully led the turnaround for the beleaguered Retail Food Group (ASX: RFG) and more recently, joined the struggling online book retailer Booktopia (ASX: BKG).

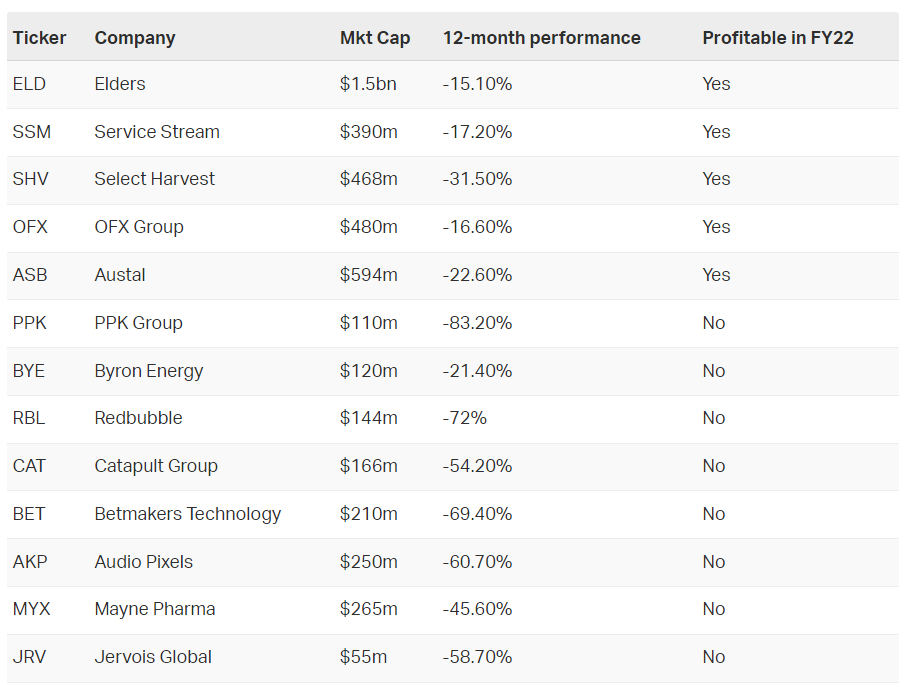

Stocks making 52-week lows

Here's a list of companies that have made 52-week lows in the past week (thinly traded stocks have been excluded).

The first filter I applied was whether or not the company was profitable in FY22.

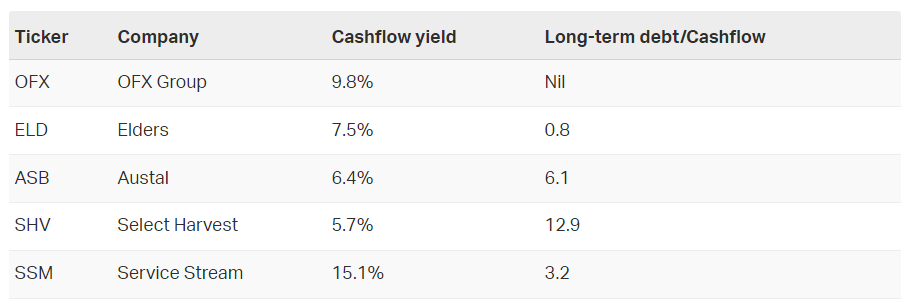

Among the profitable ones, I then created another table to observe two of Wiley's five filters: Required minimum free cashflow yield and Required minimum free cashflow to long-term debt ratio.

The cashflow yields were all higher than the current 10-year treasury yield (3.6%) but only two companies made it through the long-term debt to cashflow filter (Wiley says he prefers it if the ratio is less than three).

Here are some interesting observations about the two companies that made the cut. (Or at least some of the filters)

OFX: Payments and foreign exchange services

Zero gains: OFX's earnings have gone nowhere since 2014 and the same goes for its share price. In FY15, the company posted net profits of $24.3m and $24.5m in FY22.

The story so far: OFX experienced a major derating between 24 to 30 January 2023, where the stock fell -17.8% after a December quarter update noted softening transactions for the business' higher value consumer segment.

Higher value property, wealth and salary transfers use cases were down significantly on the prior quarter, with an increase in some lower value use cases such as mortgage repayments and travel.

Historical valuation: Despite its choppy growth history, OFX has traded at an average price-to-earnings of 22.5 since 2014. The recent selloff has dragged its PE ratio to 17.8. However, can its earnings withstand recent factors such as changes in consumer transaction behaviour, rising interest rates and inflation?

Elders: Diversified agricultural services

The story so far: Elders copped a -23% selloff after the release of its FY22 results on 14 November 2022. The results were rather positive at face value, with revenue up 35% year-on-year and adjusted earnings per share up 38.7%. The changes to management and FY23 outlook were the main let downs, notably:

- "... recent extreme rainfall events across the eastern states have created some uncertainty in affected cropping regions and concern about reaching full harvest potential for both summer and winter crops."

- "Cattle and sheep prices are expected to soften in the medium term, driven by falls in domestic re-stocker demand, with volumes also balancing out in the short term."

- Operating cashflow -28.5% year-on-year reflecting a higher inventory build to meet anticipated increases in winter cropping demand

- Managing Director and CEO Mark Allison's retirement announcement. He took up the role in May 2014

Softening growth plus overhang: Elders is in an awkward place as its growth story takes a short-term hit thanks to the above reasons. On top of that, there's also the overhang of who will fill Mr Allison's shoes.

Commitment to growth: Still, Elders has set itself a high bar for shareholder return, targeting "5% to 10% growth in EBIT and EPS through the agricultural cycles ... [and] a compelling RoC of at least 15%."

Macquarie's thoughts: A 15 December 2022 note reaffirmed an Outperform rating and $14.35 target price for Elders. The analysts said a mixed FY23 outlook could see earnings fall by -6.0% in FY23 but the company has "enough controllable factors to support earnings growth going forward." From a valuation perspective, the broker said the stock is "attractive trading" on 11.4 times FY23 forward earnings, relative to its 2-year average of 14.1 times.

Never miss an insight

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors. And while I ask the questions of some of Australia’s best strategists, economists and portfolio managers, if you’ve questions of your own, flick me an email on content@livewiremarkets.com.

2 topics

15 stocks mentioned

1 contributor mentioned