Which bank? What the brokers love and hate in 2024

Mortgage holders may be forgiven for thinking the banks are Scrooge McDuck-style pools of money. After all, those rising repayments must be going somewhere and banks are even exceeding their regulatory capital requirements on average. Commonwealth Bank (ASX: CBA) and the other majors also announced record profits last year. Surely an investment in a bank is akin to a licence to print money.

But it’s a market of increased competition where margins are tighter than ever. Non-majors are nipping at the heels of the big four, having gained some share during the Royal Banking Commission. It turns out that the banks do actually “live in your world”, at least to the extent that inflation and rising interest rates are not the boon they might hope.

While we talk of the Big Four, there’s a clear disparity in pricing and strategy across each. Moving further down the food chain, some non-majors are looking better value than others.

If you were looking to invest in the banks today, where should you choose?

While the brokers seem largely in agreement on who looks expensive, there’s more variation when it comes to what looks appealing.

In this wire, I’ll take a closer look at what’s happening in the industry and which banks might warrant a closer look.

Clouds on the horizon in Bankworld

The last decade has seen the banks hit with their fair share of controversy – and no stranger to the economic challenges facing us all.

Early signs suggest 2024 will hold its fair share of challenges for the banks – a repeat of the record profits of the last year are looking far less likely.

Sector wraps from Morningstar and Goldman Sachs both discuss factors such as high competition placing pressure on margins and slowing credit growth off the back of inflationary pressures on consumers and institutions alike. You can read more analysis from Goldman Sachs in this wire by my colleague Carl Capolingua.

Goldman Sachs notes that competition has meant that banks are effectively earning around the cost-of-capital on those oft-complained mortgage rates – it’s not exactly the cash cow people might think.

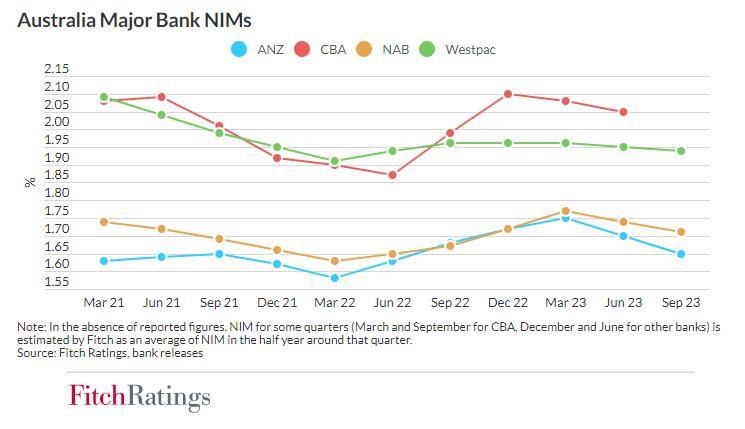

In a further demonstration of this, Fitch Ratings points out that all majors experienced narrowing net interest margins in the second half of the 2023 financial year. This is a trend that will continue into the 2024 financial year – and is worth watching in upcoming reports from February-May 2024. You can see the falls in the chart below.

The RBA’s projections for the year should also raise some concerns in bank headquarters.

We’re facing a softening economic environment where GDP growth is expected to be moderate, unemployment is tipped to rise, and most bank economists are forecasting rate cuts towards the end of the year.

The banks are not immune from the implications of this – a difficult environment for businesses and consumers will continue to hit credit growth, and while banks may take the opportunity to lag in implementing any rate cuts, competition may force the issue – rate cuts don’t translate positively to margins.

On the last point though, it’s worth noting that Goldman Sachs anticipates a less competitive environment in the coming year.

When it comes to dividends though, investors may have less to fear.

The banks have been engaging in buybacks – and Morgan Stanley forecasts $3.5 billion of new share buybacks to be announced in the next two years – potentially double this in a soft-landing scenario.

What does this all mean?

Less shareholders to pay out dividends to may inflate the earnings per share, and often push up the value of the remaining shares. It also suggests board confidence in the future of these businesses.

Where to invest

Both Goldman Sachs and Morningstar concur that in the big four, ANZ (ASX: ANZ) is a BUY. This is also reflected by Market Index’s broker consensus tool.

Goldman Sachs views further upsides to ANZ and anticipates improving profitability in the institutional business. It is trading at a discount to peers, at $26.55/share.

Tyndall’s Brad Potter also recently nominated ANZ as a banking pick for similar reasons.

“ANZ is differentiated from the other Big Four banks as it is underweight retail and has a large institutional bank with strong operating momentum. This is driven, in part, by a growing transaction banking business and a consistently performing trading markets business,” Potter said.

Investors will also be awaiting the decision from the Australian Competition Tribunal on 20 February on ANZ’s proposed acquisition of Suncorp Bank (ASX: SUN) – previously blocked by the ACCC.

When it comes to the remainder of the Big Four, there is also clear consensus across the market that dividend-darling Commonwealth Bank is on the nose.

Both Goldman Sachs and Morningstar argue that it looks expensive – and it rates as a Strong SELL in Market Index’s broker consensus tool.

“On a forward P/E of almost 20 times and a fully franked dividend yield of just 4%, valuation metrics are stretched and leave little room for disappointment,” wrote Morningstar analysts Nathan Zaia and Winky Yingqi Tan.

It saw falls in its market share for home loans late last year (both Westpac and Macquarie grew their share late last year) and is growing its loan book at a slower rate compared to competitors.

All of this said, MPC Markets’ Mark Gardner believes investors should keep a watch on Commonwealth Bank, along with Macquarie Group (ASX: MQG). He’ll be watching for falls in share prices.

“These two banks are the best in the sector and have been great performers when you “buy the dip”,” he said.

It also remains one of the Livewire and Market Index reader base's most-tipped stocks in 2024. As of 24 January 2024, it is trading at highs over $114/share.

There is somewhat more variation in views when it comes to Westpac and NAB.

When it comes to Australia’s oldest bank, Market Index’s broker consensus tool tips Westpac (ASX: WBC) as a SELL. Morningstar disagrees, viewing it as undervalued and with strong potential.

“We think the share price overlooks the potential for the bank to lower its cost/income ratio and improve ROE, relative to peers,” wrote Zaia and Tan.

It’s a view shared by Macquarie which recently upgraded Westpac to an ‘OUTPERFORM’ rating.

As of 24 January 2024, it is trading at $23.57/share.

The last of the big four, NAB (ASX: NAB), rates as a Hold on Market Index’s Broker Consensus tool. Goldman Sachs however views it as a BUY.

The broker tips the exposure to business lending as a positive for NAB and notes it has delivered the best performance on productivity growth.

Touchstone Asset Management were also proponents of NAB in an article last year.

“We have owned NAB, and we think that’s the pick of the bunch – relatively less exposed to some of the concerns we have and looks more reasonable,” they said.

As of 24 January 2024, it is trading at $31.85/share.

Turning to the non-major banks

The non-majors include MyState Bank (ASX: MYS), Bank of Queensland (ASX: BOQ), Bendigo & Adelaide Bank (ASX: BEN) and Judo Capital (ASX: JDO). For those wondering, honorary major Macquarie Group tends to be classified as a diversified financial, along with AMP (ASX: AMP) and Suncorp.

Morningstar views MyState Bank as looking good value, arguably the cheapest of the bunch, though it notes that it has a higher risk proposition and a weaker competitive positive, but is positive on its prospects otherwise.

“MyState commands a tiny 0.3% share of the Australian home loan market, but with investment in its digital offerings and expanded sales team, has demonstrated an ability to profitably grow loans,” wrote Zaia and Tan.

Morningstar views it as better placed relative to non-bank lenders, though its margins are likely to fall more than major banks.

It is not covered by Market Index’s broker consensus tool and was priced at $3.20/share on 24 January 2024.

Morningstar is also positive on Bank of Queensland (while Goldman Sachs rates it as a SELL).

The broker anticipates BOQ to benefit from easing competition and cost savings from consolidating banking platforms and digitising more processes.

Market Index’s broker consensus tool positions it as a Strong SELL.

Bank of Queensland was covered in a recent episode of Buy Hold Sell and was a sell for First Sentier’s David Wilson and Atlas Funds’ Hugh Dive. Both expressed concerns over net interest margins and competition.

As of 24 January 2024, it was trading at $5.895/share.

Both Morningstar and Goldman Sachs were NEUTRAL on Bendigo and Adelaide Bank, while it ranks as a SELL on Market Index’s broker consensus tool.

On the other hand, Judo Capital is tipped as a BUY by Goldman Sachs (as well as on Market Index’s broker consensus tool). Its fair value estimate was also upgraded by 9% at Morningstar today (Wednesday 24 January 2024).

Goldman Sachs views Judo Capital’s exclusive focus on small and medium enterprise (SME) lending as favourable – the growth outlook for SMEs is positive. It has strong fundamentals and volume growth.

It was trading at $1.115 on 24 January 2023.

Best of the banks in short?

Based on the broker consensus of the majors, investors should steer clear of Commonwealth Bank and take a closer look at ANZ in particular, though Westpac and NAB look promising.

In terms of the non-majors, Judo Capital is looking best positioned, though you could also take a contrarian approach to Bank of Queensland like Morningstar. There’s limited coverage on MyState, though Morningstar is positive on it.

But are the brokers right?

No one has a crystal ball and if nothing else is clear, it’s that the brokers don’t always agree.

What are your tips for the banking sector?

1 topic

11 stocks mentioned

1 contributor mentioned