Why Coolabah Capital's Christopher Joye thinks the "mother of all default cycles" has started

For the first time in 15 years, bonds are back in vogue and their income-paying qualities are well and truly in the spotlight. For government bonds, yields have had a long climb from the basement to where they are today (3.8% for an Australian 10-year bond). In the corporate space, some major bank bonds are finally yielding more than their share prices. CBA’s Tier 2 bonds are paying about 6.3% pa, more than its shares even after you gross up the equity for franking credits.

But, as with anything, no two fixed-income instruments are alike. You only need to look at the Credit Suisse collapse for an example of that. In one weekend, AT1 hybrid holders, who thought they would be ranked above shareholders in the pecking order, instead found themselves wiped out. And many Australian investors had reached for this risk, suffering 100% losses, much as they did when they bought high-yielding Virgin Airlines bonds before the pandemic.

Stories like this help explain why Coolabah Capital co-founder and CIO Christopher Joye is so adamant about remaining a nimble investor in this environment. As part of the Coolabah Active Composite Bond Strategy, Joye and his team trade anywhere between 50 to 100 times—worth some $300 million to $400 million—per day in the global high-grade credit market.

In this, the last interview of Livewire's inaugural Undiscovered Funds Series, Joye sits down to discuss the opportunities and pitfalls in today's fixed income landscape.

He also shares some thoughts on the contentious housing market, the advent of a new global corporate default cycle, and the themes he thinks investors are underpricing right now.

This interview was taped on Wednesday 31 May 2023.

EDITED TRANSCRIPT

An introduction to Coolabah's two most recent fund launches

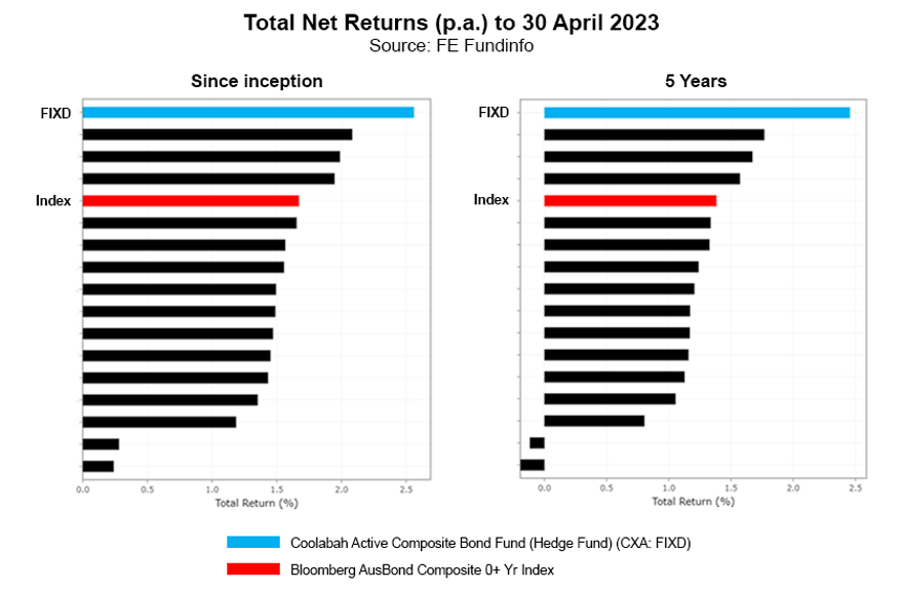

Coolabah Capital Investments recently made two product moves. The Coolabah Active Composite Bond Strategy, which is currently yielding 6.1% after fees, was recently opened up to retail investors through the CBOE Australia Index. The fund, which launched in 2017 for institutional investors and has outperformed the Composite Bond Index and key peers since inception, combines quantitative models with deep research to identify the most mispriced opportunities in the “long duration” fixed-income market.

"Most managers have historically underperformed the benchmark because they tend to bet on the direction of interest rates. We don't do that," Joye told me.

A second “high yield” strategy focused on cheap, bank-issued floating rate notes was launched in December 2022. The strategy, which was created in response to client demand, also has a secret weapon to maximise investor returns.

"We use gearing - and very low-cost gearing - to enhance the yield to around 8% net of fees. We think that's a really interesting and diversifying solution for those who are still looking for high yields but are worried about the default cycle and illiquidity," he said.

Today's fixed income market

The reasons why investors should consider fixed income as part of a portfolio are well-telegraphed. Of most importance to Joye specifically is the attractive yield you can get on some low-risk bonds, far outpacing housing rents and equity dividends.

"A-grade office properties pay 4.5% today. You can get better returns on cash [term] deposits," he said.

"We see a lot of discontinuity between the yields in our liquid asset classes and the yields in liquid, high-grade bonds," he added. “Senior-ranking major bank bonds are paying almost 5% pa. The major banks’ Tier 2 bonds are paying 6.3% pa. And these yields will only rise further as the RBA increases its cash rate.”

From a macro viewpoint, Joye is looking at several different storylines that are playing out right now.

- Coolabah's models suggest an 89% chance of a US recession within the next 24 months, and a two-thirds probability of a recession in the next year

- The corporate default cycle will likely get worse (already the worst since 2009)

- The RBA's own terminal rate forecasts cannot be trusted

And given the Active Composite Bond Strategy is all about finding mispriced bonds, I pressed Joye to tell me what he thinks is the most underpriced risk in markets right now.

"There is a bit of cognitive dissonance and a lot of 'hopium' in respect of risk right now, folks praying that commercial property, private credit, high yield bonds and equities don’t radically reprice, which they more than likely will" Joye said.

What's in the fund?

Although the components of the fund are very actively traded, the general composition is dominated by government bonds, senior-ranking bank and corporate bonds, and some Tier 2 bonds.

Senior securities are the highest-ranked assets on a pecking order of investors. In the event of a company's default, senior security holders are paid first. Because Joye is keen to avoid any exposure to companies with any risk of being in the firing line of a default at all, the fund is most active in the "too big to fail" section of the market: namely, government bonds, big bank bonds and ultra-high-grade corporates, like a Pfizer.

"We're heading into a default cycle very clearly right now with global corporate defaults already the highest since 2009. We would argue that the bonds we focus on – government bonds and Aussie major bank senior and tier two bonds - have very low default risk," he said.

Both funds also pay out quarterly distributions. The Active Composite Bond strategy pays a running yield of 6.1% per annum and the floating rate high yield strategy pays a running yield of 8% after fees. Distributions are paid out quarterly.

Looking for higher income?

The Coolabah Active Composite Bond Fund (Hedge Fund) seeks to deliver superior risk-adjusted returns to the Bloomberg AusBond Composite Bond Index through harnessing Coolabah’s active credit alpha style that focusses on systematically exploiting mispricings to generate capital gains in addition to yield. It is now available as an exchange quoted managed fund on Cboe Australia under the ticker FIXD

Additionally, the Coolabah Floating-Rate High Yield Fund (Managed Fund), targets delivering higher yields than other traditional fixed income investments. The Coolabah Floating-Rate High Yield Fund invests in a portfolio of Australian bank and insurer issued floating-rate notes with enhanced yields.

For more information about our income solutions please visit our website.2 topics

1 contributor mentioned