Why I like the good Carbon (Graphite)

The energy transition seemed so simple to begin with.

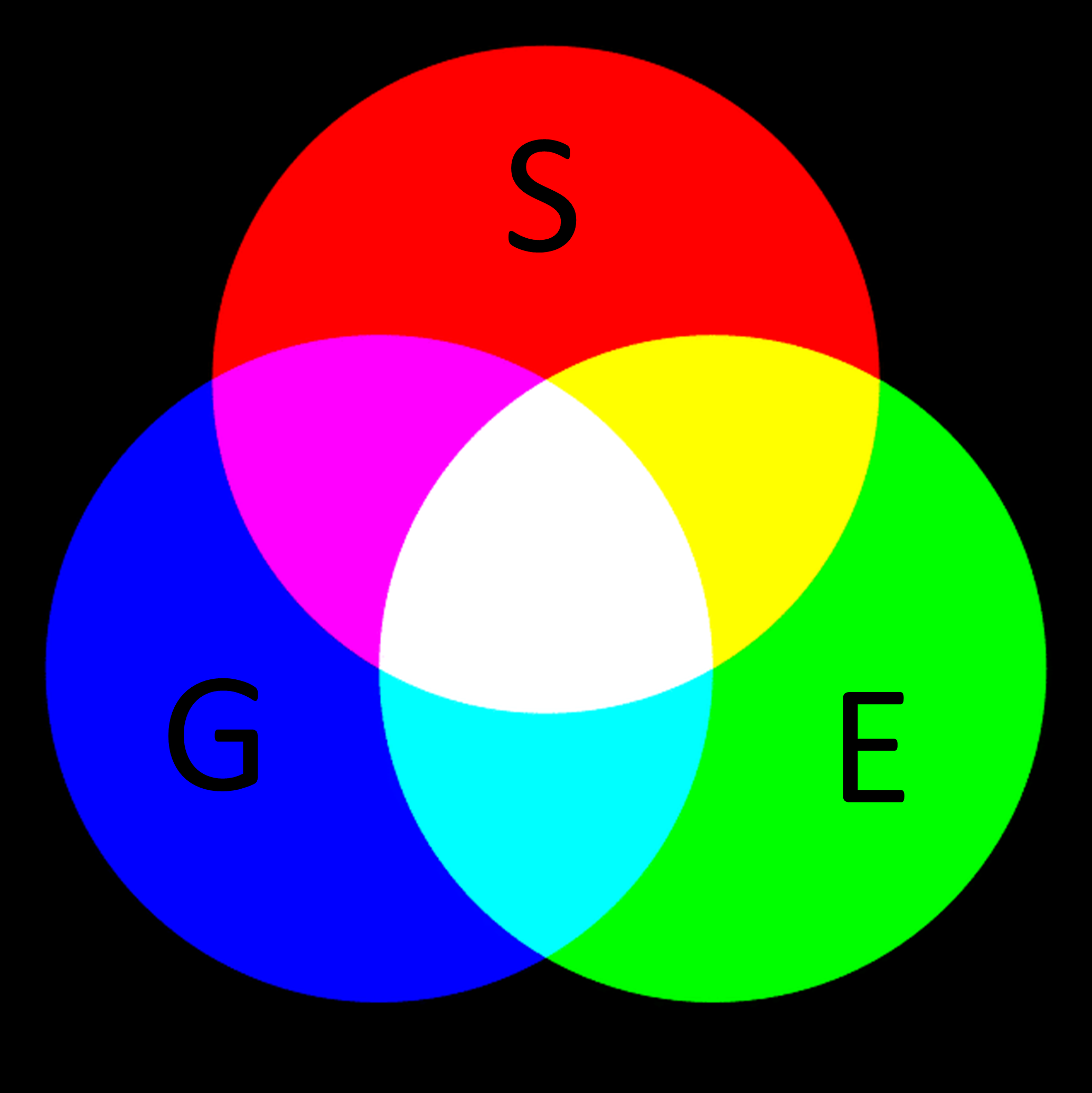

All you needed was these three letters:

If you put a portfolio together with these three letters you would achieve the white light of a sustainable and responsible portfolio. It is not a terrible idea, but the real world has more letters than that. Some are indispensable like "C" for Carbon.

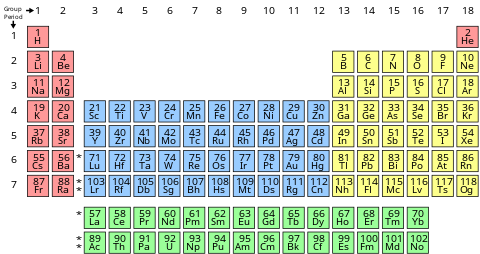

The Periodic Table is something most folks feared in High School. I was a strange kid, so I liked it. In fact, as an entrepreneurial child, I made money selling some very schmick periodic table prints I bought from a company in Perth. I bought them for 5 cents each and sold them to desperate children for 25 cents each. So, yeah. I liked it.

Needless to say, my current business operates differently.

There is money to be made now, often quite easily, by linking the Periodic Table to some utilitarian need in Modern Life. The one you live every day.

Look at the green U numbered 92 in the bottom row, just down the road from number 94 Pu. The U is Uranium, and the Pu is Plutonium. both fissile materials useful for nuclear reactors. You can mine the first one, but not the second one. You have to make that in a reactor.

The so-called Transuranic elements, above number 92, are created in a lab.

All of these things in the Periodic Table are so-called elements. Some of them are stable, and others not so. However, they share one thing in common. You cannot easily make one from any other, except through nuclear reactions, in a limited way. Usually, that is uneconomic, unless you are the Pentagon, and you want to build a bomb from Plutonium.

Why is this relevant to sustainable investing?

It is pretty simple, in practice. As every High School Student learned, in the living days of terror that was chemistry class, the elements are what you make everything from through chemistry.

The old Du Pont chemical corporation tagline says it all:

Better living through chemistry.

Great album, by the way.

Up at the top of the table we have Numero Uno: "H" for Hydrogen.

Andrew Forrest, from Fortescue Metals Group FMG.AX has been talking a lot about hydrogen and its potential as an energy carrier for export of green energy from electrolysis. This is not a bad idea, but the shipping technologies need to be proven up at scale.

One approach is to build a giant thermos flask, stick it on a ship, and then pump it full of liquid Hydrogen at minus 253 degrees Celsius. That is pretty cold and requires some very clever materials scientists and metallurgists to make a thermos flask that won't crack open.

Kawasaki Heavy Industries in Japan has been working on this for a long time. They have their so-called Hydrogen Road strategy. The company is listed in Tokyo, ticker 7012.T. I am active in the Japanese market, and like a number of names in this area. I won't detail all of them here.

The point is that the energy transition is a global challenge.

You live locally but do think globally in your search for those companies that are making a difference. The days of single-market investing are over (totally).

For every element of the Periodic Table that is used in some aspect of the renewable energy transition, you will find a company, expertise, and a source, somewhere on Planet Earth.

This brings me to batteries and the electric vehicle metals.

- Lithium (Li)

- Nickel (Ni)

- Cobalt (Co)

- Manganese (Mn)

- Rare Earth Metals (REE)

We wrote a wire, mid last year, on the Magnificent Seven of EV Metals.

- NIC.AX Nickel Industries Ltd

- IGO.AX IGO Ltd

- AKE.AX Allkem Ltd

- PLS.AX Pilbara Minerals Ltd

- LYC.AX Lynas Rare Earths Ltd

- ILU.AX Iluka Resources Ltd

- S32.AX South 32 Ltd

The performance of this basket has been pretty good in the past seven months (see the attached report below for more detail and an easier reading experience).

The worst performer in the Australian Critical Minerals basket was Lynas Rare Earths LYC.AX, at a return of 0%. We shall not go into great detail here, except to mention that the upcoming license renewal for their Gebeng plant in Malaysia has weighed on sentiment. The best performer was lithium darling Pilbara Minerals PLS.AX, up 111.5%.

Evidently, the Australian market has gotten some critical minerals religion.

However, there is a problem with our positioning. We left out graphite, the non-metal electric vehicle material. You see, as we mentioned in Introducing the Graphite Kid, there is more to this story than just metals. They don't call this area Battery Chemistry for nothing.

There is a considerable range of battery cathode chemistry options:

- Lithium cobalt oxide

- Lithium iron phosphate

- Lithium manganese oxide

- Lithium nickel cobalt manganese oxides

It is just like the terrible days of High School Chemistry. You can understand why the fund marketing industry ran with the story of three letters, E, S & G, to make it all sound easy.

These different battery chemistries, which continue to evolve, have different advantages and disadvantages around important performance characteristics:

- Safety and fire risk

- Energy density of storage

- Life cycle of charge and re-charge potential

- Cost of materials

For electric vehicles, the main competition is between Lithium-Iron-Phosphate (Li-Fe-P) and the performance option of Lithium Nickel Cobalt Manganese (Li-NCM).

Many of you are already researching this topic when considering a new car purchase.

I won't dwell here except to call out "P" for Phosphorous in our Periodic Table.

(Not Potassium. That is "K" to keep things confusing, but rational. "K" for Kalium)

Very good for strong bones and teeth, along with "Ca" for Calcium!

None of us would be here without Phosphorous. Yay! Round of applause, please.

Earlier I mentioned the word "cathode" which is the positive electrode of a battery, The negative electrode is called the anode.

You always need two electrodes to make a battery, the cathode (positive) and the anode (negative). The electrons which carry the electric current travel from their source at the anode to the sink at the cathode.

Some people make a big deal out of lemon batteries, but I am a potato man myself.

You need different metals for each electrode to make the electrochemistry work. You also need a conductive fluid in between to act as an electrolyte. In the case of lemon batteries there is citric acid in the lemon that makes it work. For potatoes, it is phosphoric acid. Old skool.

You get the picture; batteries have some common aspects to make them work:

- negative anode material

- positive cathode material

- electrolyte in between

The word electrolyte I used there refers to the same electrochemistry as this stuff:

I knew someone who took too many antacid calcium pills once. Don't do that. You will do a fair impersonation of a "crazy" gibberish person until you get your electrolyte balance right again. Electrolytes are in your brain and your body is a battery. When the electrolyte balance is out of kilter your nerve signals stop propagating correctly. Unpleasant for you, could be funny for other people, as long as you did not take too much calcium. There is a limit.

Heavy exercise sessions can deplete "Mg" for Magnesium as well as "Ca" for Calcium. Then you will cramp up because the wiring in your muscles is not carrying the nerve signals properly. Cramps are the body's way of saying that your electrolyte balance is out.

Returning to electric vehicles:

Should Elon Musk quake in his boots over the Potato Battery?

Probably not. You cannot store much electrical energy in a potato or a lemon.

Us smart simians can accomplish great tasks on minimal wattage:

That famous monkey who took the selfie runs on fruit. You need more than that for a car.

I ordered one of these months ago (twiddles thumbs - waiting, Elon, waiting).

When you look at the specifications for any of these electric vehicles, there is around 500kg of weight in the battery module. The numbers on Lithium by weight are influenced by how you measure it: as Lithium metal equivalent, or as the compound used in the battery.

The market research firm Adamas Intelligence published a free study: State of Charge: EVs, Batteries and Battery Metals. This is a good starting point for self-directed investors. They include estimates of the actual battery materials deployed in worldwide EV fleets. This is detailed research of the bottom-up kind that is difficult to do at home.

You will get more from reading the study, but here are some takeaways:

- Average battery capacity in kWh is growing year on year.

- Materials used per car is also growing year on year.

- Car units are growing year on year.

The bottom line is simple to relate:

Battery Materials Used per Year = (Cars per Year) X (Battery Materials per Car)

This means that battery materials usage is growing faster than the car market is growing.

The estimated, point-in-time as of 2022 H1, intensity of usage per car was:

- Lithium Carbonate Equivalent (LCE) 18.8kg/car

- Nickel 14.1kg/car

- Cobalt 3.0kg/car

- Manganese 3.8kg/car

- Graphite 28.4kg/car

if you multiply that by EV sales, measured in millions of units, you get a lot of material. The growth rate in EV sales varies a bit but climbed rapidly in the last three years. Tesla has a stated target to grow at around 50% CAGR per year through 2030.

We should expect high rates of growth in electric vehicle metals demand.

In order to reduce stress on metals pricing, Tesla has already moved around half of their global production to Lithium-Iron-Phosphate batteries. This cuts out the scarce metals "Co" for Cobalt, "Ni" for Nickel, and the not so scarce but still necessary "Mn" for Manganese.

Evidently, innovation in battery chemistry can reduce demand for some scarce metals.

However, look above at the number for Graphite - it is the largest of all at 28.4kg/car. This stuff goes into the battery anode, while the other stuff goes into the battery cathode. You need both to make the battery and there are not a lot of good substitutes for graphite.

Oh yeah, there is no "Gr" for Graphite because it is an allotrope of pure "C" for Carbon. Nor is there any "D" for Diamond, or "Gp" for Graphene. They are all allotropes of pure Carbon. You can get carbon from hydrocarbons by burning them. Of course, that is diesel soot.

The picture here is interesting. Presently, Graphite used in battery applications is probably less than 10% of global demand. However, those growth rates for batteries are substantially higher than the industry as a whole. It is probable that we will see the anticipated uplift in demand form electric vehicles start to affect the market a few doublings out.

A unit growth rate of 40% per year, produces a doubling every two years. That is three to four doublings in market scale out to 2030. The lower mark is likely more feasible, since EVs are now around 10% of market. Three doublings, for an uplift factor of 8x, would be sufficient.

If mining were the only source of graphite, a doubling in market size over ten years would amount to a 7% CAGR for material. However, graphite can also be sourced synthetically. Ironically, this involves high-temperature treatment of amorphous carbon from calcined petroleum coke and coal tar pitch. You can use the bad carbon to make good graphite.

Naturally occurring graphite is mined as flake. The composition and regularity of the flake and fines is very important for different applications. Quality graphite commands a premium.

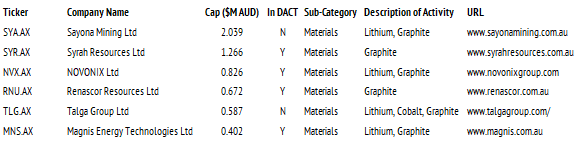

There a number of listed graphite plays on the ASX.

Sayona Mining SYA.AX has the Kimberley Graphite Project but is more weighted to Lithium development and exploration projects. Our Magnificent Seven portfolio has two top-tier Lithium producers in Pilbara Minerals PLS.AX and Allkem AKE.AX. That slot is taken.

NOVONIX NVX.AX is also very interesting but is more a battery technology play. This will develop into a very important area of focus for investors, but is best considered within a process technology framework, like our other selection Calix CXL.AX in cement kilns.

Among the three majors this leaves us with Syrah Resources SYR.AX.

We had called out the opportunity here in our wire The Graphite Kid. However, at that time the stock had run quite hard, and we suggested waiting for a pull back. That duly arrived, and we consider that now is a good time to add it our Australian Critical Minerals portfolio.

The natural graphite operation at Balama in Mozambique, is a simple low strip open cut mine, that produces around 350ktpa of high-quality graphite concentrate. The 50-year mine life at Balama supports the Syrah vertical integration strategy. The key to this is their Vidalia Active Anode Material (AAM) plant in the USA, which will supply into the North American market.

This combination of a long-life producing mine, ex-China supply chain, and US beachhead to supply growing demand for US manufactured battery anode material is attractive to us.

Given the recent pullback in the share price, we are adding it to our ACM portfolio.

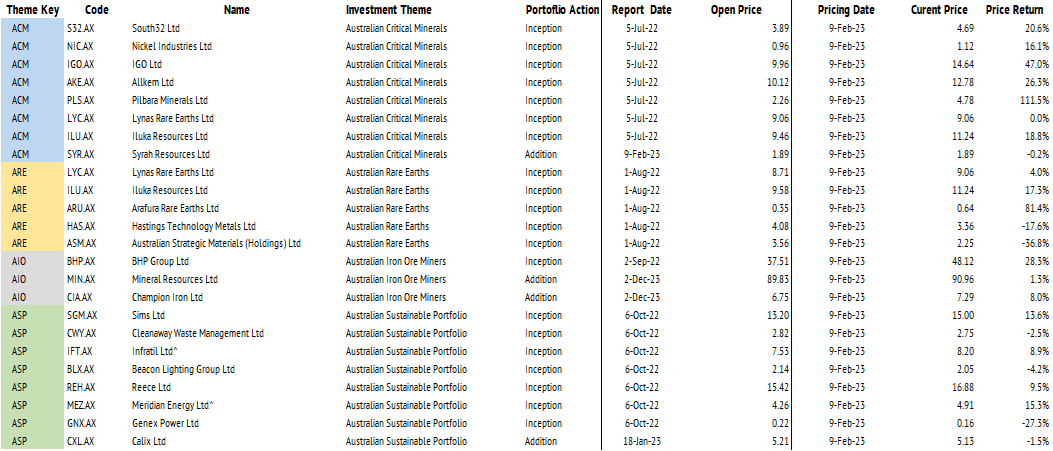

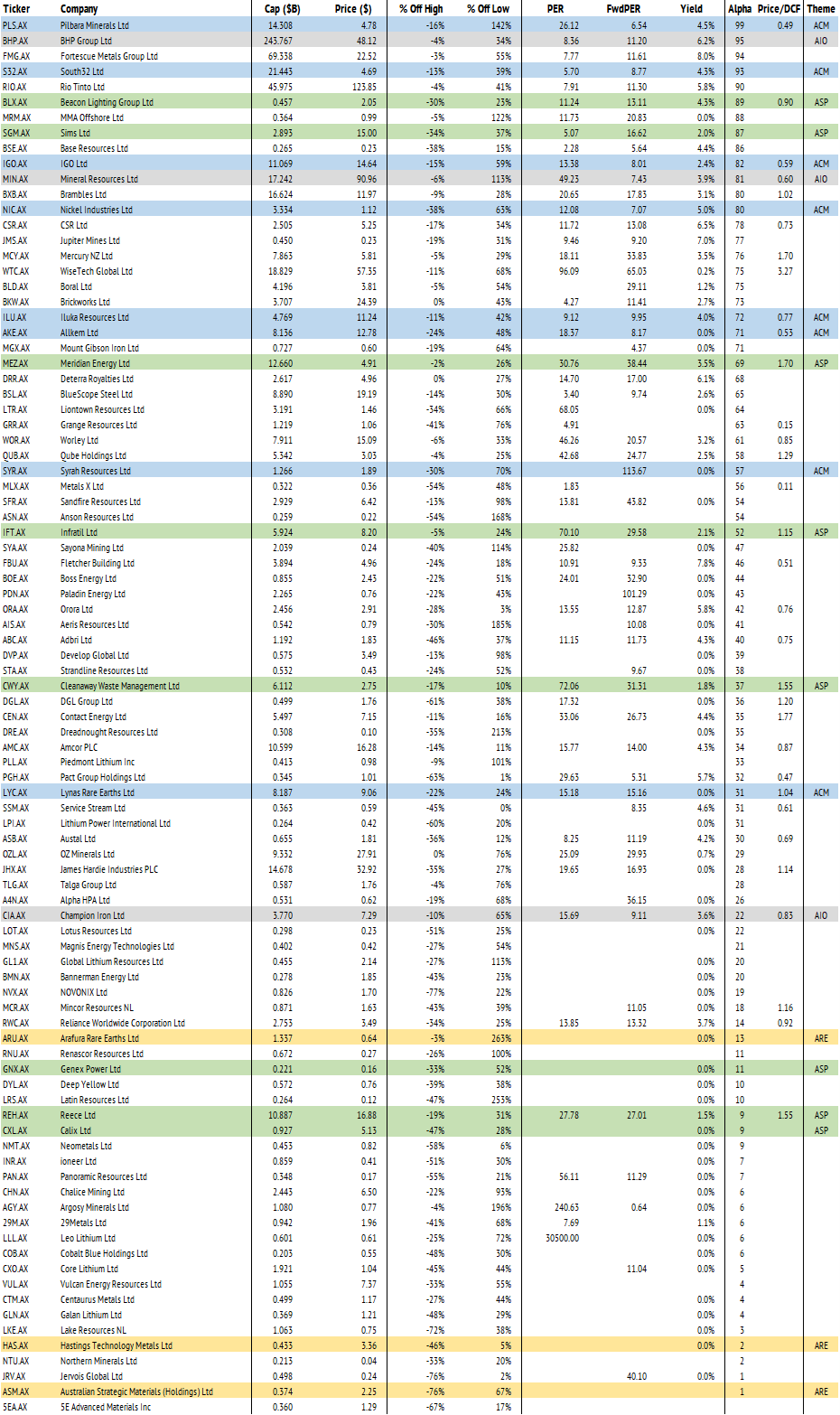

Portfolio Screening Update

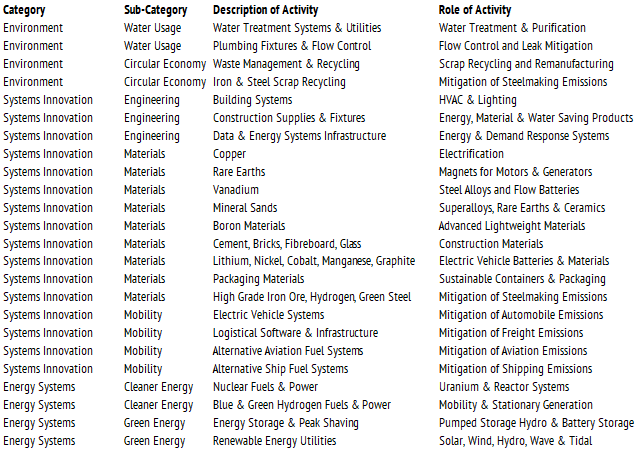

Over the past eight months we developed a series of thematically constructed buy lists of stocks that we believe will play a role in the energy transition.

- Australian Critical Minerals (ACM)

- Australian Rare Earths (ARE)

- Australian Iron Ore (AIO)

- Australian Sustainable Portfolio (ASP)

These were introduced in previous wires.

ACM - The Magnificent Seven of Electric Vehicle Metals

ARE - What the heck is Terbium?

AIO - Is iron ore done and dusted?

ASP - Why is sustainable investing so difficult?

You can (re) read those wires for our rationale in constructing each thematic basket.

Going forward, we have rolled each of these into our Unified Sustainability Framework.

This is not a substitute for consideration of traditional ESG metrics. However, it does serve as a useful adjunct to ESG to alleviate the shortcomings I mentioned here and here.

When we combine this framework with conventional stock-screening it becomes a great deal easier to build sustainable portfolios and converse on why the stock selections matter. In the figure below, we show the latest stock screening results, with our thematic selections color coded, and the theme mnemonic shown at the far right.

You will find these tables in the attached PDF, which is easier to read on a large screen.

Going forward, we will update these and frame our stock commentary in this way.

If you have any questions, feel free to ask me below.

If you like what we do, then please follow me at the button link at the top of this article.

Go Good Carbon! Get some.

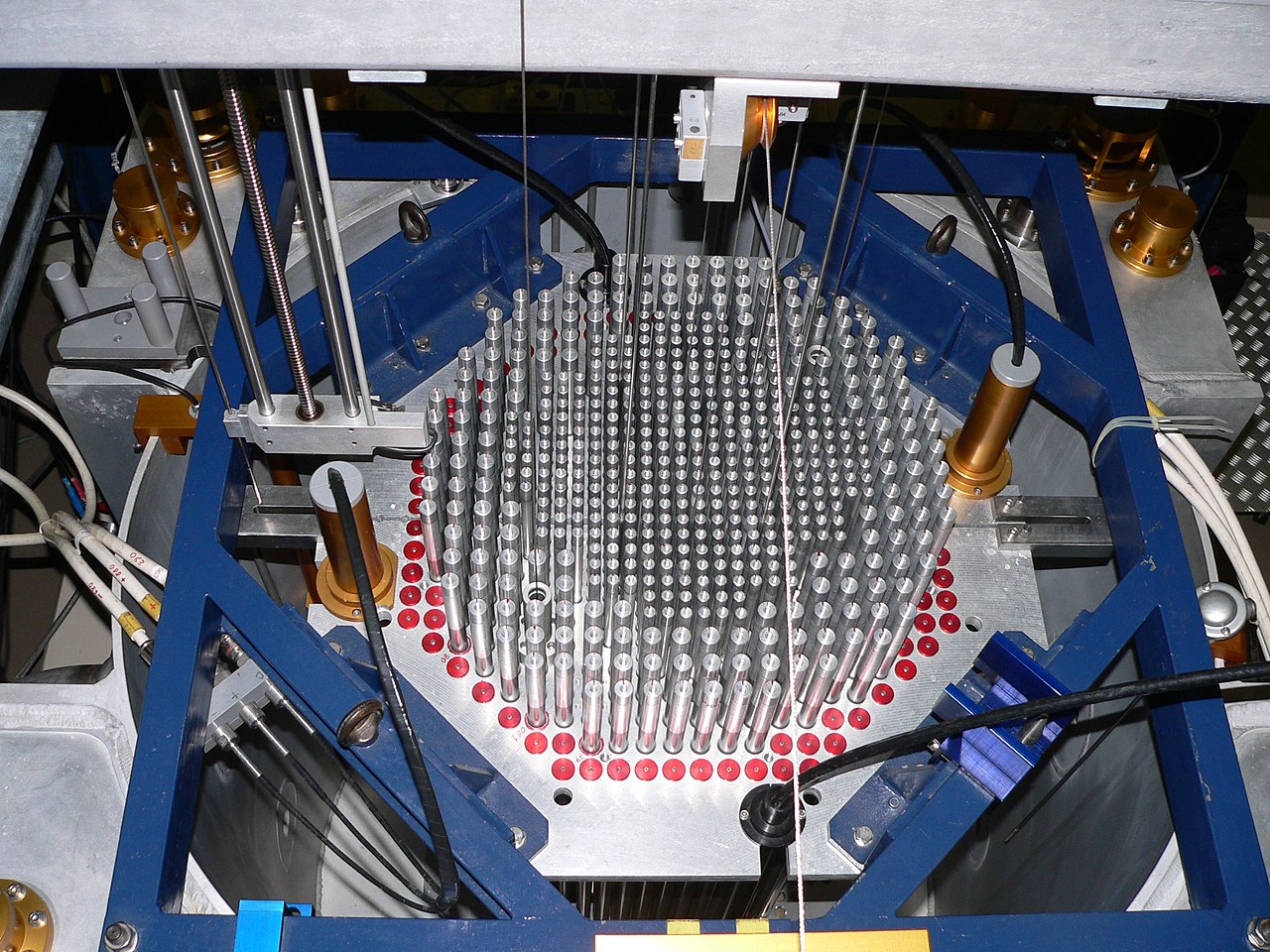

Picture: Scanning Tunneling Microscopy image of graphite, acquired under ambient conditions. Measured at the Dept. for Earth and Environmental Sciences, LMU and Center for NanoScience (CeNS), Munich. From Wikimedia Commons here.

Fun stuff: Each fuzzy ball is one "C" for Carbon atom. They are all the same, as atoms. Some get incorporated into carbon dioxide or methane, which contribute to global warming in the upper atmosphere. Of course, chemical reactions can sequester this carbon in carbonates.

Our chemistry teacher said that you could not actually see atoms. However, that was the 1970s and we only just got color TV in Australia (wow, that was a wait).

That was then. Not being able to see atoms. However, now you can.

The picture is from a Scanning Tunneling Microscope.

This was such a big deal that its inventors won the 1986 Nobel Prize for Physics.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics

8 stocks mentioned