Why Livewire readers are investing in these 9 ETFs and 1 LIC

Recently on Livewire, you might have seen our new 'Listed Series', focusing on creating the perfect portfolio using Exchange Traded Products (ETPs). To kick off the series, we released a survey in which you were able to discuss your strategies and name top picks for Exchange Traded Products on the ASX. Over 900 readers took the time to submit responses.

Last week I discussed the overarching investment strategies Livewire readers are taking to the ETP space, and in this wire I'll dive deeper into the top 10 listed products on the Australian Securities Exchange (ASX) as voted by Livewire readers.

I've also pulled out some of the common themes as to why investors are allocating to these products.

1. Vanguard Australian Shares Index ETF (ASX: VAS)

Largest holding of 11.09% of respondents.

Funds under management: $12,095.29 million.

MER (% p.a): 0.10

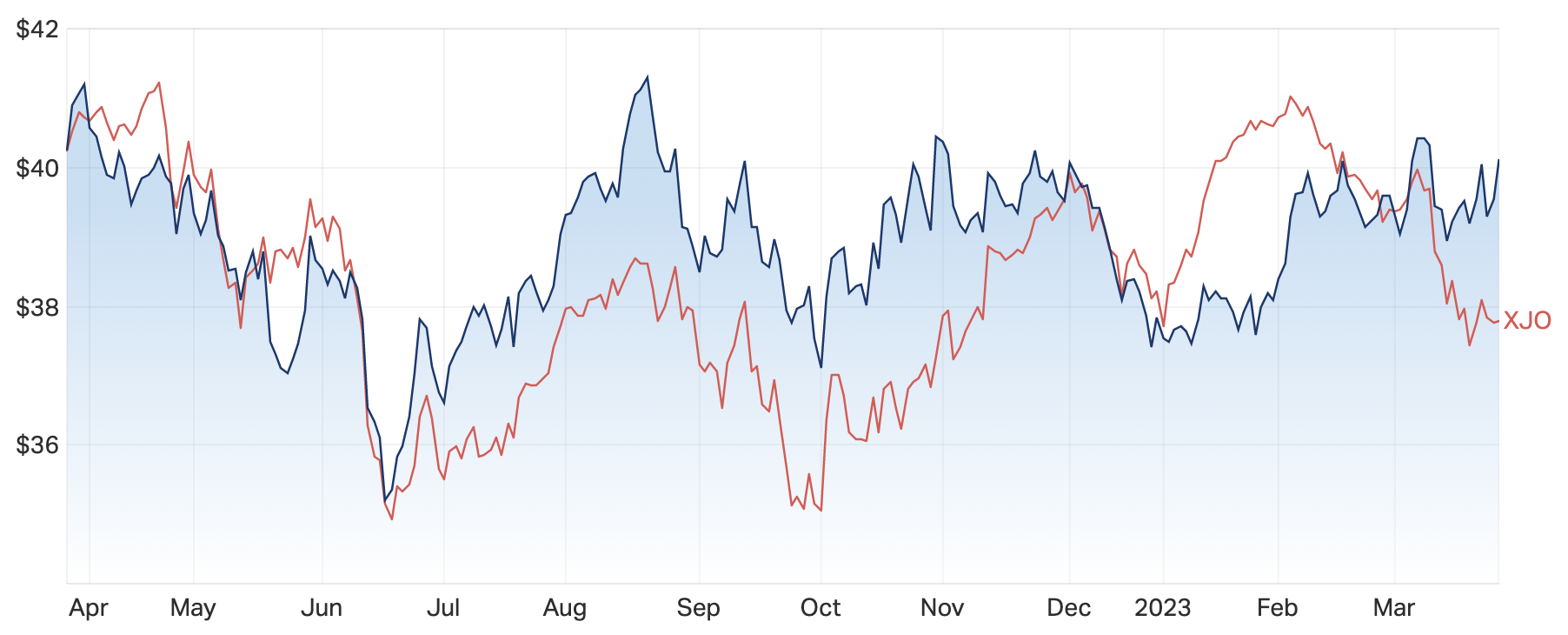

VAS 1-year chart vs ASX200

Market Index Snapshot: "Vanguard Australian Shares Index ETF (VAS) provides low-cost, broadly diversified exposure to Australian companies and property trusts listed on the Australian Securities Exchange. It also offers potential long-term capital growth along with dividend income and franking credits."

It should come as no surprise that according to recent reports, the largest ETF in so many Livewire reader's portfolios is the largest on the ASX, with over $12 billion in funds under management.

VAS also aligns closely with the key strategies outlined by Livewire readers in last week's wire:

- Preference for passive investments

- Creating a diversified portfolio

- Low cost

- Highly liquid

Survey respondent quotes related to (ASX: VAS):

- "Vanguard has an excellent reputation"

- "AU exposure, franking credits"

- "High income and franking credit return"

2. BetaShares NASDAQ 100 ETF (ASX: NDQ)

Largest holding of 4.84% of respondents.

Funds under management: $2,628.16 million

MER (% p.a): 0.48

NDQ 1-year chart vs ASX200

Market Index Snapshot: "BetaShares NASDAQ 100 ETF (NDQ) track the performance of the NASDAQ-100 Index, before fees and expenses. The Index provides investors with exposure to the performance of the 100 largest non-financial securities listed on the NASDAQ stock market, by market capitalisation. The Index contains category-defining companies across major industry groups such as technology, telecommunications and retail."

Another of the largest ASX-listed ETFs, NDQ is a passive fund with over $2.6 billion in funds under management. NDQ also introduces the aspect of access to a portfolio of international assets, particularly with respect to some of the American tech stocks which make up the index (A strategy specifically called out by readers).

Survey respondent quotes related to (ASX: NDQ):

- "NDQ provides diversity away from the Financials and materials top heavy Australian index by adding exposure to technology."

- "add balance to portfolio through exposure to international markets, particularly US"

- "Exposure to the US tech market providing growth opportunity."

3. iShares S&P500 ETF (ASX: IVV)

Largest holding of 3.44% of respondents.

Funds under management: $5,058.69 million

MER (% p.a): 0.04

IVV 1-year chart vs ASX200

Market Index Snapshot: "iShares S&P 500 ETF (IVV, formerly iShares Core S&P 500 ETF) is an exchange-traded fund seeking investment results that correspond to the price and yield performance of U.S. large-cap stocks, as represented by the Standard & Poor's 500 Index (the Underlying Index). The fund is managed by BlackRock Fund Advisors."

IVV is a highly diverse fund covering US-based stocks. With over $5 billion in funds under management, it's one of the largest exchange-traded products on the ASX. IVV benefits from several aforementioned strengths, including:

- International exposure.

- Exposure to American tech stocks.

- Passive index structure.

- Strength of S&P index.

- Very low cost (Equal to lowest on this list).

Survey respondent quotes related to (ASX: IVV):

- "iShares is a good provider"

- "Low-cost exposure to US S&P500 index"

- "S&P 500 has bottomed"

4. Vanguard MSCI Index International Shares ETF (ASX: VGS)

Largest holding of 3.34% of respondents.

Funds under management: $5,412.11 million

MER (% p.a): 0.18

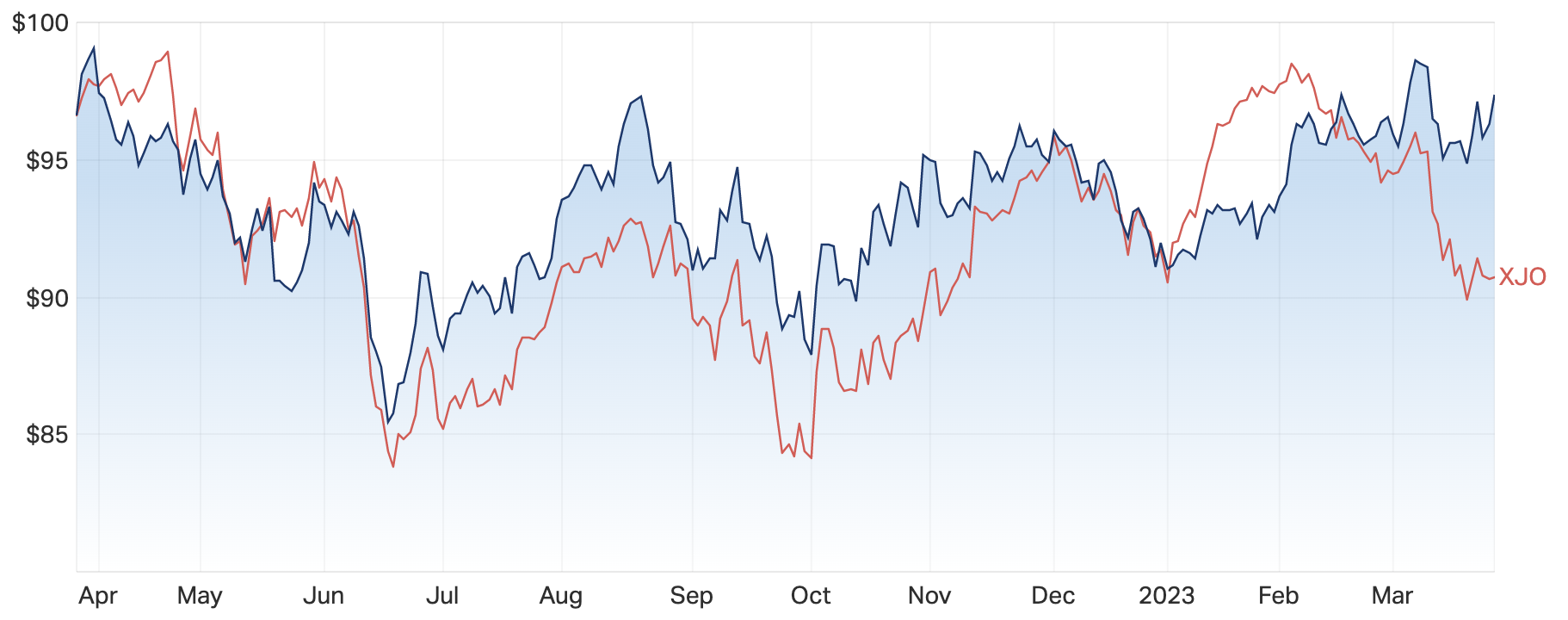

VGS 1-year chart vs ASX200

Market Index Snapshot: "Vanguard MSCI Index International Shares ETF (VGS) provides exposure to many of the world's largest companies listed in major developed countries. It offers low-cost access to a broadly diversified range of securities that allow investors to participate in the long-term growth potential of international economies outside Australia. The ETF is exposed to the fluctuating values of foreign currencies, as there will not be any hedging of foreign currencies to the Australian dollar."

Like many on this list, VGS is a fund aimed at following a particular index. VGS is unique in this context, however, in that it aims to track a portfolio of large companies from a wider range of developed countries. At a relatively low MER of 0.18% p.a., VGS offers a great deal of diversification to Australian investors at a low price, justifying its place in this list.

Survey respondent quotes related to (ASX: VGS):

- "Vanguard has an excellent reputation"

- "Top Global Companies, better value, lower risk"

- "I don't want to invest directly overseas so this gives good access to a good range of such companies"

5. WAM Leaders Limited (ASX: WLE)

Largest holding of 2.91% of respondents.

Market Cap: $1,707.94 million

MER (% p.a): 1.00

WLE 1-year chart vs ASX200

Market Index Snapshot: "WAM Leaders Limited (WLE) is a listed investment company managed by Wilson Asset Management (International) Pty Limited. The company invests predominantly in top 200 S&P/ASX listed companies and provides investors with exposure to large-cap companies and investment management expertise of Wilson Asset management."

The first and only Listed Investment Company (LIC) featured on this list, WLE was often named by survey respondents due to faith in the management, particularly with reference to Chief Investment Officer Geoff Wilson. The expertise of Wilson comes at a price though, with (ASX: WLE) holding the highest MER on the top 10 list at 1% p.a.

Survey respondent quotes related to (ASX: WLE):

- "Good management - Wilson Asset Management"

- "Concentrates on the big end of town. Confidence in Geoff Wilson."

- "It's active, I like Geoff Wilson, and it's doing ok"

6. Vanguard Australian Shares High Yield ETF (ASX: VHY)

Largest holding of 2.91% of respondents.

Funds under management: $2,771.76 million.

MER (% p.a): 0.25

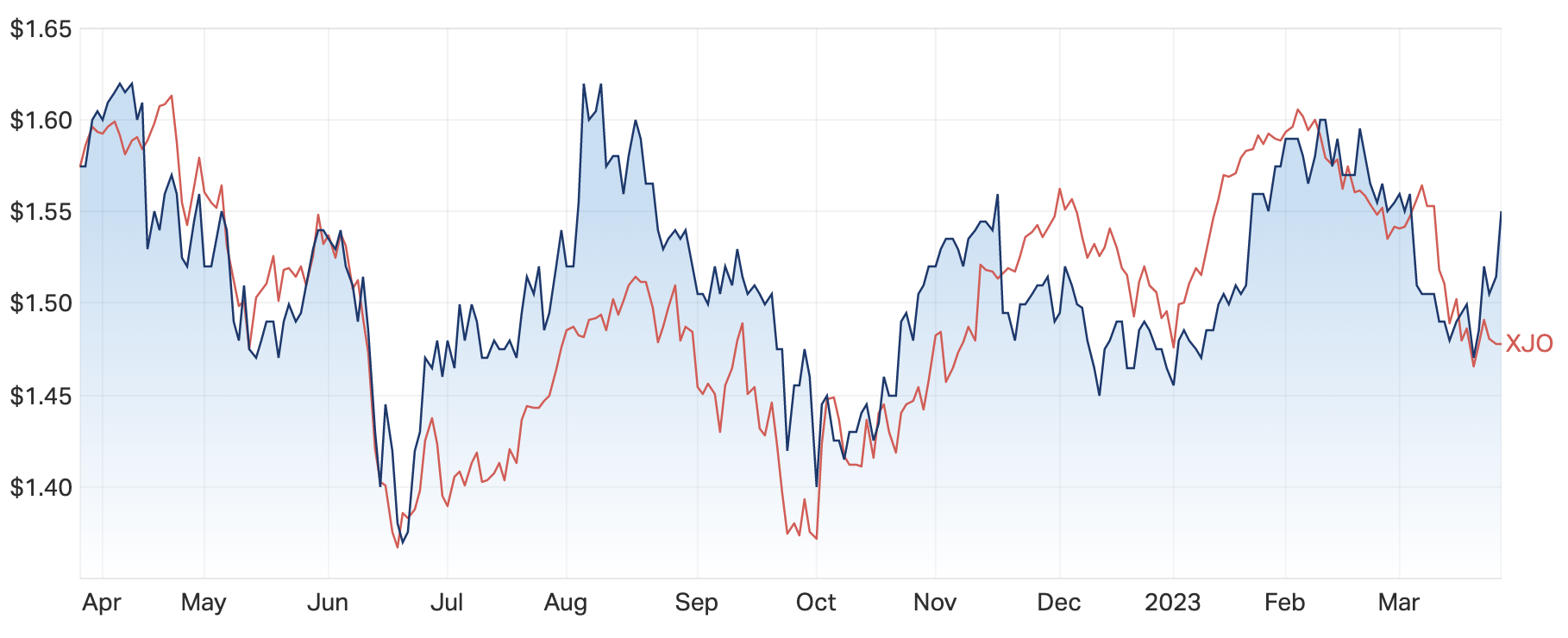

VHY 1-year chart vs ASX200

Market Index Snapshot: "Vanguard Australian Shares High Yield ETF (VHY) is an exchange-traded fund that seeks to match the return (income and capital appreciation) of the FTSE ASFA Australia High dividend Yield Index before taking into account fund fees and expenses and provides a tax-effective income stream with the potential for capital growth in the one investment."

VHY again tracks very closely to ASX200, but has the additional benefit of the strong Vanguard brand name, which was quoted by the survey respondents as a reason for investment.

Survey respondent quotes related to (ASX: VHY):

- "Vanguard has an excellent reputation"

- "Long-term growth"

- "Exposure to Australian shares"

7. SPDR S&P/ASX 200 FUND (ASX: STW)

Largest holding of 2.48% of respondents.

Funds under management: $4,802.67 million.

MER (% p.a): 0.13

STW 1-year chart vs ASX200

Market Index Snapshot: "SPDR S&P/ASX 200 Fund (STW) is an exchange-traded fund seeking to provide investment results that correspond to the price and yield performance of the 200 largest and most liquid publicly listed entities in Australia, as represented by S&P/ASX 200 Index (the Underlying Index). The responsible entity of the fund is State Street Global Advisors, Australia Services Limited."

STW is very similar to betashares' (ASX: A200), but the two are differentiated by the index brand used (the S&P index is used for STW, while A200 uses Solactive). The S&P index appears to resonate more with investors, as despite the higher fees of (ASX: A200) it has greater funds under management, and more livewire users listed it in the survey results.

Survey respondent quotes related to (ASX: STW):

- "Broad Australia exposure"

- "Core holding"

- "Safety and diversification"

8. iShares Global 100 ETF (ASX: IOO)

Largest holding of 2.26% of respondents.

Funds under management: $2,452.35 million.

MER (% p.a): 0.40

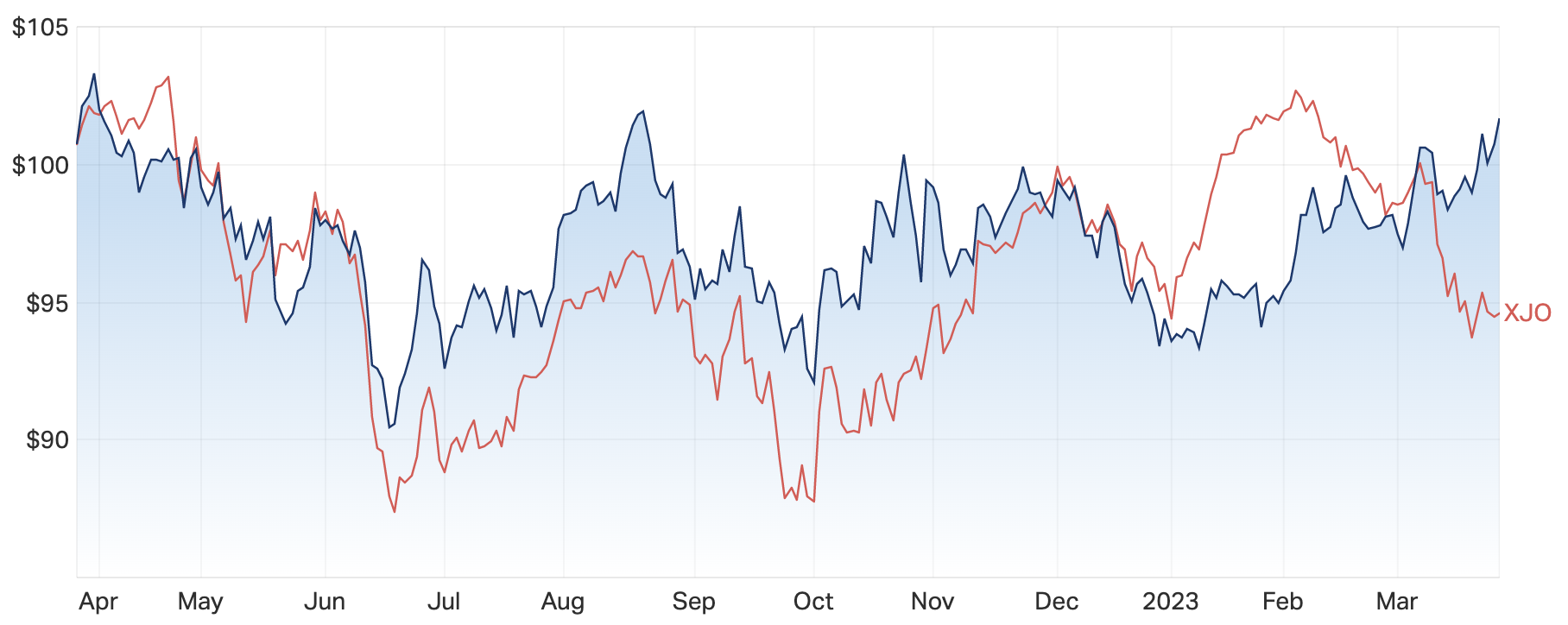

IOO 1-year chart vs ASX200

Market Index Snapshot: "iShares Global 100 ETF (IOO, formerly iShares Global 100) is an exchange-traded fund seeking investment results that correspond to the price and yield performance of global large-cap stocks, as represented by the Standard & Poor's Global 100 Index (the Underlying Index). The fund is managed by BlackRock Fund Advisors."

Survey respondents often quoted a desire for exposure to American stocks, in particular American tech stocks. The weighting of this portfolio is currently 71.54% United States-based stocks. Furthermore, the top three holdings of the fund are Apple, Microsoft and Amazon, with weightings of 14.21%, 12.45% and 5.21% respectively.

Survey respondent quotes related to (ASX: IOO):

- "Ex Australian exposure to growth"

- "Wanted exposure to tech sector"

- "US tech"

9. BetaShares Australia 200 ETF (ASX: A200)

Largest holding of 1.94% of respondents.

Funds under management: $2,692.10 million.

MER (% p.a): 0.04

A200 1-year chart vs ASX200

Market Index Snapshot: "BetaShares Australia 200 ETF (A200) is to provide an investment return that tracks the performance of the Solactive Australia 200 Index (the Index), before taking into account fees and expenses. The Index is designed to provide exposure to 200 of the largest companies listed on the ASX, based on their free float-adjusted market capitalisation."

The BetaShares Australia 200 ETF aims to fulfil the need of investors for cheap, and simple diversification with a relatively low-risk profile. With an MER of 0.04 (% p.a) A200 is the (equal) lowest fee product on this list, and one of the lowest on the market overall.

Survey respondent quotes related to (ASX: A200):

- "Good broad exposure to the ASX200"

- "Exposure to market risk only, low fees"

- "Core Portfolio - Australian Exposure"

10. BetaShares Global CyberSecurity ETF (ASX: HACK)

Largest holding of 1.72% of respondents.

Funds under management: $652.91 million.

MER (% p.a): 0.67

HACK 1-year chart vs ASX200

Market Index Snapshot: "BetaShares Global Cybersecurity ETF (HACK) provide simple and transparent exposure to the leading companies in the global cybersecurity sector. It is a core component of a global equities allocation providing transparency and diversification benefits."

Hack aims to track the Nasdaq CTA Cybersecurity Index's performance, before fees and expenses. It fits neatly with the strategy of easy diversification which was frequently quoted by users when filling out the survey. On the downside, fees are relatively high for an ETF, as a result of the extra management required to maintain a sector-specific portfolio.

Survey respondent quotes related to (ASX: HACK):

- "Cybercrime on the rise"

- "Liked the thematic of cyber security, this is a long term (>7 years) holding"

- "Cybersecurity is a dominant world issue"

5 topics