Why we prefer Australian shares (and bonds) over global rivals right now

The RBA delivered another 0.25% rate hike in February. It has more to come. Rates are modestly restrictive, inflation is still too high, and the Bank wants to restore some credibility. But the RBA does not want a recession, particularly when this is unnecessary and avoidable. We expect Martin Place is set to deliver two more 0.25% rate hikes then pause in Q2. If we are right, that will extend Australia’s economic cycle and support Australian equities through 2023.

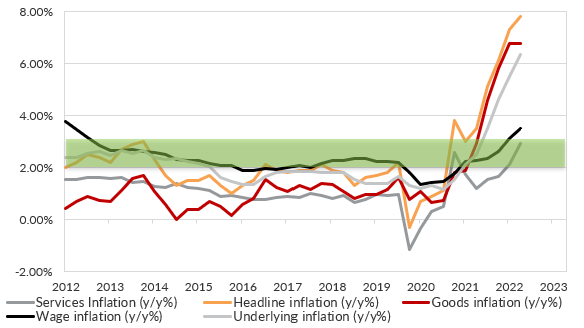

Inflation is too high

Inflation is far above the RBA’s target. It seems likely that inflation has peaked and will begin to trend lower, but the RBA has the opportunity to implement at least one more hike (and probably two) to get rates modestly above neutral, which we estimate to be around 3.00%.

The RBA’s statement indicated that rates are likely to move higher in coming months. Fortunately, the Bank sensibly moved to 0.25% rate hikes in October. This more cautious approach gives it time to be data dependent as inflation begins to cool.

Chart 1: Measures of inflation are above the RBA’s 2%-3% target band

Growth is slowing rapidly

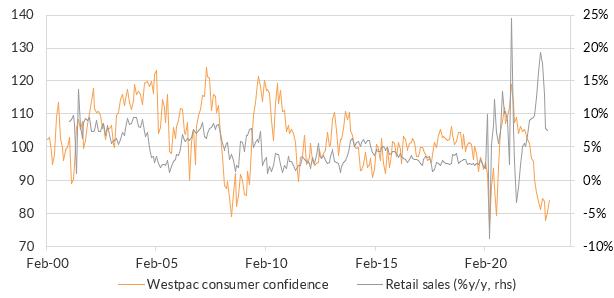

Inflation will cool. Global inflation has already peaked. But Australia’s domestic inflation will also start to ratchet lower. Economic growth is already clearly slowing as a result of the rate hikes to date. Credit growth has rolled over. The value of retail sales slowed, even as inflation pushed prices higher. Consumer confidence has taken a hit and the housing market has stalled.

Chart 2: Consumer confidence and retail spending has declined sharply.

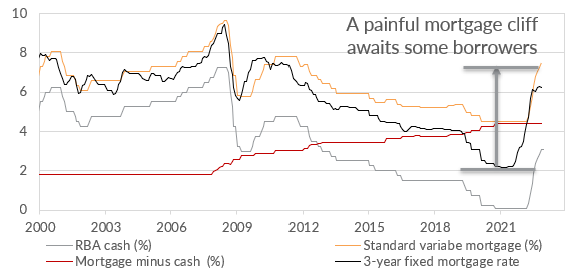

The much publicised “mortgage cliff” – the roll off from very low fixed rates to very high variable rates – is coming. That is going to add pain to households who have seen their debt service costs surge through 2022. Consumers are going to begin to tighten their belts in 2023. and this has a lot further to run.

Chart 3: Rolling off low fixed-rate mortgages to high variable mortgages will bring some pain.

Recession is unnecessary: A pause is coming soon

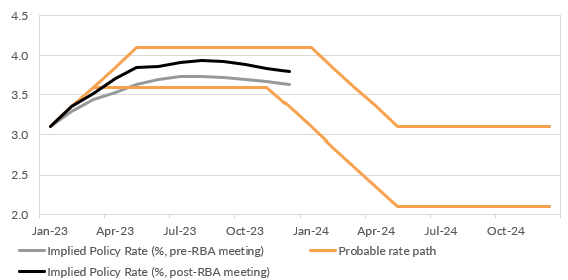

The RBA took rates to modestly restrictive with its 0.25% rate hike in December last year. We estimate neutral to be around 3.00% so the February rate hike puts the cash rate on a path to genuinely restrictive policy settings.

The Bank will take the opportunity to hike once or twice more as inflation remains elevated, but the next step is an extended pause.

That means March is going to be the final or penultimate rate hike. Markets had already priced what we thought was a broadly sensible outlook before the RBA hike. The slight shift higher in pricing remains sensible. Markets have not been shocked by the RBA’s statement and there is no sense that the RBA has lost control of the narrative.

Chart 4: Market pricing for the cash rate remains sensible after the RBA meeting.

Equities can rally and bonds provide protection

Two more rate hikes will not derail the economic cycle in Australia. Australia retains significant economic momentum, the labour market is strong, and China is reopening and re-engaging with Australia. A recession is avoidable and completely unnecessary to bring inflation back to target. The RBA appears to have no desire to cause one.

In this scenario, the economic cycle will extend. Earnings will be supported through 2023 and equities should perform well. We favour Australian equities over international developed economies for the near-term.

We also expect Australian government bonds to perform well. Market expectations for rate hikes look sensible. Inflation is likely to slow faster than both markets and the RBA expects. That should help the inflation premium decline even as the term premium has maxed out. Yields at current levels offer reasonable income, but importantly good diversification and downside protection. We continue to hold a modest overweight to Australian government bonds in our portfolios.

Don’t sit on the sidelines

2022 was a terrible year for diversified portfolios. The temptation to run to cash amid the stagflation talk was high. But inflation is slowing quickly, growth retains momentum, and the RBA is not rushing to cause a recession. A recession is possible at some stage in the medium-term, so it pays to be prudent. But we continue to think 2023 could be a year of FOMO for many investors if they wait for an avoidable and unnecessary recession.

3 topics