Will the AI rally turn out to be dotcom 2.0?

Fueled by the commercial hopes of AI, the Nasdaq has seen an eye-watering rally over the last two months leaving many wondering if they should buy now or if they have missed the boat. The move has happened so fast investors have had little time to consider the lofty AI hopes, falling into the classic fear of missing out (FOMO) trap.

In these situations, it is important to take a breath, step back from the hype, and assess the investment without your “AR” goggles on.

Do the numbers don’t add up?

“AI is the next technology revolution”, “AI will change business forever”, and “AI isn't the future, it's already here” are all phrases being thrown around in describing how AI will revolutionise business and our lives, but looking through the hyperbole, what is the addressable market?

Computers should be good at math, right? Let’s ask ChatGPT.

According to a report by Grand View Research, the global AI market size was valued at over $62 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of over 40% from 2021 to 2028.

Data for ChatGPT only goes up to 2021, putting the addressable market cap around $1.3T by 2030. Using the updated numbers from ChatGPT’s quotes research report, Grand View Research, the addressable market would be $1.7T by 2030.

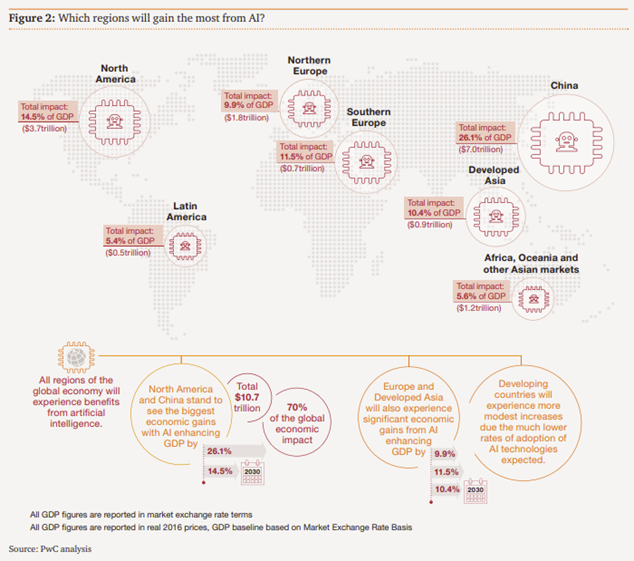

Now let’s ask the humans at PwC:

In a study released by the global consulting powerhouse, “AI analysis, Sizing the Prize” PwC is estimating that AI could have a $15.7T impact on global economic growth over the next 7 years. Based on PwC analysis below, North America receive a total economic impact of $3.7T by 2030 if there are no speed bumps.

To put this in perspective, so far this year, $3.6T has already been added to the market caps of the Big 7, largely due to the AI euphoria. This leaves just 2.7% left to price in for the total addressable market at the turn of the decade. That seems like very little wiggle room for any regulatory, technological or implementation delays, which are inevitable.

Not to mention the cost of developing AI and the prospect of laws that would force tech companies to publish summaries of copyrighted data used to train their AI models opening the door for writers, researchers and artists to claim compensation for use of original material.

Revolutions are never smooth sailing

Labour productivity is likely to account for 55% of the GDP gains which is great for business owners, but not so great for workers.

There has been a similar period in history where scientific and technological development transformed societies, especially in Europe and North America. It was the industrial revolution, and it certainly wasn’t smooth sailing.

During this period, a legendary group of English textile workers called “the Luddites” were displaced after the Spinning Jenny massively increased the productivity in the textiles. Unable to legally form trade unions or strike, the labourers instead wielded sledgehammers to strike a blow against industrial capitalism.

While I’m not predicting civil unrest, social media has caused rapid backlash for governments and companies in today’s “cancel culture” and while computers don’t vote… Luddites can.

At the recent G7 meeting in Hiroshima, world leaders, while recognising AI’s innovative potential, worried about the damage it might cause to public safety and human rights. Launching the Hiroshima AI process, the G7 commissioned a working group to analyse the impact of generative AI models, such as ChatGPT, and prime the leaders’ discussions by the end of this year.

Regulation - The enemy of technology is red tape

Regulatory change will likely be the biggest issue with AI, as governments move far slower than technology.

In the 1970s, futurist J Storrs Halls wrote about global economic stagnation that slowed technological advances in his book “Where is My Flying Car?” From the failure to adopt nuclear energy and the suppression of cold fusion and nanotechnology to the rise of a counterculture hostile to progress, many of the sentiments from the book remain relevant today.

Another example of the long runway for the commercialisation of new technologies is self-driving cars which have been going for over a decade now and are unlikely to be allowed for at least 2 more years with billions being sunk into the technology from automakers for no benefit as yet

Two of the most hopeful areas where AI will be adopted are finance and healthcare. In finance, robo-advice is the great white hope however Australian regulators are notoriously slow in changing advice rules with the Hayne Commission taking well over 2 years for changes to even be agreed, let alone rolled out. Healthcare, on the other hand, is an area where efficiencies in research collaboration will be huge. Outside that EU leaders are already looking into curbing AI use in medical technology due to safety fears.

AI is only as good as its data and if bias goes in, bias comes out. for this reason, the EU’s forthcoming AI Act proposes a very strict, precautionary approach with bans for AI systems in unacceptably high-risk areas. Machine learning systems are designed to discriminate, to spot outliers in patterns. That’s good for spotting cancerous cells in radiology scans but could be discriminatory for things like credit applications.

So should you buy into the AI rally?

The short answer is "definitely not at these prices" with the market already pricing in inflated benefits on an unlikely timeline.

In fact, with most of these stocks now sitting at 18-month highs in terms of PE, I think the opportunity is playing the short-side via Betashares Leveraged Short Nasdaq ETF (ASX: SNAS).

When things settle back to reasonable prices, I think investors using the Global X FANG+ ETF (ASX: FANG) ETF as a proxy for the AI revolution will be the best approach in the early stages. With higher interest rates and a looming US recession, the cashed-up mega caps will be safer in the near term and have the capital to pounce on any up-and-coming AI developers.

3 topics

9 stocks mentioned