You only get one Tesla: Taking a punt on Rare Earths and the mighty Dreadnought Resources

Rare Earth stocks ride the Tesla rollercoaster

Speculative stocks will generally travel the greatest distance on a journey from beginning to end via that jagged mountain range we call the land of investor sentiment. Thrust skyward towards the peak of euphoria, only to tumble raggedly into the deep canyons of despair.

They are invariably the source of excitement and, ideally, a fountain of opportunity.

The only thing you need for a truly engaging ride, is one great team pursuing a big hairy goal, beset by some entrenched, and partisan, source of naysayers railing on how it can't be done.

The bourse is one giant stage purpose built to settle a public score.

One ring. One bull. One bear. Two go in, only one comes out.

Roll up! Roll up! Place your bets. Happens every day on the stock market.

The reason that I make this introduction is straightforward.

Most everything about the future, except death, taxes, your beauty, and my grace, are matters of pure speculation.

Even with that short list, some assertions are doubtful.

The past weeks have seen a broad retreat in rare earth stocks on the local bourse, with the announcement from Tesla, to pursue rare-earth-free electric motors for future designs.

This is a big topic, which warrants an extended discussion. However, to keep you engaged let me cut to the chase with two obvious bookend calls on value in rare earth stocks.

Firstly, the entire issue revolves around the availability of so-called magnet rare earths, which were largely controlled by China, over the past thirty years. The supply chain concerns that naturally followed have been met by a broad exploration and development boom.

This ought to be sufficient to meet Western demand, on a secure basis, at prices that are at or around the present levels. There is plenty to see, in terms of future rare earth supply potential, and less to see around scaremongering in the lack of alternatives to China.

Secondly, the design trade-offs back and forth between permanent magnet motor designs and the many alternative varieties of magnet-free induction motor will likely never end.

Opportunity knocks in Rare Earth stocks

The two stock ideas that we have today reflect the recent manic trajectory into despair.

On the continuation of presently profitable production of vital magnet rare earth materials into a friendly offtake partner, in Japan, we are happy to back Lynas Rare Earths LYC.AX, as a long term buy at prevailing prices. A perfect storm of negative sentiment offers a great entry.

On the rapidly developing potential of Australian sourced rare earths to nix any prospect of a permanent supply shortfall, we like the exploration progress and potential of Dreadnought Resources DRE.AX, with their Mangaroon Project in the emerging Gascoyne Province.

Our title emphasizes the Dreadnought Resources story for one simple reason.

The future of supply for critical minerals will absolutely depend on new discoveries being made and innovation in how to develop them.

This is a game for entrepreneurial and vigorous young firms, each with a case to prove.

Critical Minerals are today a niche market, with potential to make transformative changes to future technologies through innovative materials science, electronics and engineering.

What stands out about this moment, is the high level of faith investors display in firms that are positioned as "technology firms" and the low level of faith displayed in entrepreneurial firms devoted to addressing resource scarcity with new supply solutions.

We think that failure to invest in new supply of critical minerals is a mistake.

That is why we are happy to: "Take a punt on the Mighty Dreadnought".

The present failure of investor imagination can now work to your benefit.

That is an innovative entrepreneurial firm intent on proving up the case that the Gascoyne Region of Western Australia, could well harbor an entire new province of carbonatites.

These are the jewels of present hard-rock sourced rare earth production, and the region around the Gascoyne is proving highly prospective for rare earth bearing mineralization with signature high proportions of Neodymium and Praseodymium, at levels above 30% NdPr in the Total Rare Earth Oxide (TREO) component of the resource.

For a more circuitous but, I hope, entertaining route, read on below.

The 2023 Tesla Investor Day announcement

The Tesla Investor Day is an annual event, which is sure to garner much interest. Elon Musk may be prone to mumble, but he does have vision and the work ethic to make it happen.

Well, some of it, anyway. The bits that don't eventuate are generally in the identifiable genus of Musk Mind Fluff. Stuff that sounded crazy enough to be exciting, and sure to be remembered as that thing you thought was wild, and cool, but would probably never actually happen.

There are no robot-taxis, on Mars, yet.

The terra firma of Tesla is where their pronouncements have some solid grounding in physics.

That is a Musk thing, to be sure, but frankly, not solely his thing.

It is a Nature thing too. You can complain about the Laws of Physics, but the only way you ever get to change them is to scrub out whatever mistake you made and be a little closer to Nature.

I have a lot of time for that, so the Master Plan Three is totally fine by me.

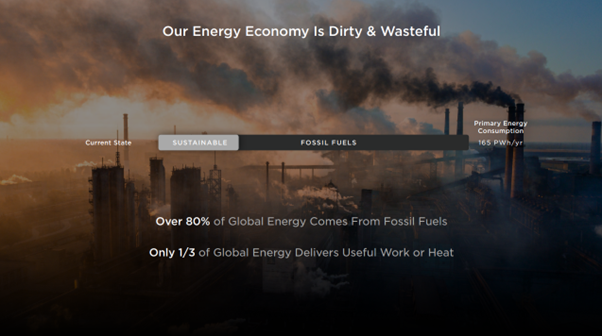

Master Plan Three is a well-presented pitch on a physics-inspired plan to phase out fossil fuels.

The introductory slide above contains the basic math. The world uses a lot of energy, and more than 80% of that comes from Fossil Fuels. However, only about a third of that contained fossil fuel energy is ever converted to useful work or heat. The rest is wasted. It goes to entropy.

This may sound like a morality tale, but it isn't.

When Nature gave us her Laws of Thermodynamics, she was quite particular about energy, and what happens to it. At the end of the day, most of it goes to heat, which is energy, but it gets dissipated into that jumble we call cozy, but not hot.

Leastways, not hot enough to fry your egg.

This is the fate of all free energy through the miracle of entropy and the arrow of time.

Tesla did not mention entropy in their Master Plan, but it is an inviolable component of that real master plan which runs our universe, the one that was penned by Nature.

entropy, the measure of a system's thermal energy per unit temperature that is unavailable for doing useful work. - Encyclopedia Britannica

What starts hot, won't stay hot, and what is hot can only deliver useful energy in so much as it is hot compared to someplace else. Your stove is useful precisely because it is hotter than your fridge, from whence you selected the egg, bacon, or beans. You can't fry that egg in the fridge.

The Universe used to be a hot place, 15 billion years ago. Now it is about three degrees Kelvin, more or less. Image of the Cosmic Microwave Background from the Planck mission (European Space Agency).

The people at Tesla are adept at translating a complex situation into a simple calculus. In the case of the energy transition, there is a lot of fossil fuel energy to replace, but some uses of that are inefficient, compared to alternatives, so primary energy use could be less.

The Master Plan Three emphasizes both energy efficiency gains from new processes but also new sources.

However, that is not the end of it, because some of the better ways to turn energy into useful work and heat are ideally suited to the supply of primary energy from sustainable sources.

It took Tesla 169 slides to lay out the plan, and I don't have that much space.

I know a little physics, so I will put it in a nutshell:

There are four forces in Nature, but only one is readily controlled, and that is electromagnetism. Gravity is useful, if you plan to go from a higher place to a lower place, but otherwise you can't control it very well. The weak force can make your radioactive waste go away, if you wait long enough. The strong force is awesome but comes with an embedded kaboom. Tough to bottle.

In essence, electromagnetism is the stuff that makes most, not all, of our technology work, and that includes chemistry and the biochemistry of natural processes. This is good. You can do a lot of what you need to do just by using electromagnetism, via electrons, light and electricity.

To make this clear, our Sun is gravity and the strong force in harmonious dynamic balance.

The ultimate source of all sustainable energy on Planet Earth (NASA Solar Dynamics Observatory).

There is a capable nuclear fusion reactor parked just eight minutes away as the photon flies. It is held together by the attractive force of gravity and progressively blown apart by the fires of nuclear fusion. For now, it is comparatively stable. In about five billion years it will expand enough to swallow the Earth, and ultimately turn into a White Dwarf star.

Nuclear fusion reactions within the interior of the Sun are doing two things: supplying us with a pretty steady stream of sunlight and building up the heavier elements of the Periodic Table.

That Planck image of the Cosmic Microwave Background harks back to the creation of the universe itself, in the Big Bang. In the beginning, there was indeed light. Then we wound up with a bunch of particles that fell out of that original photon soup.

For some reason, that nobody actually understands, most of them wound up being positive protons, negative electrons, and neutral neutrons.

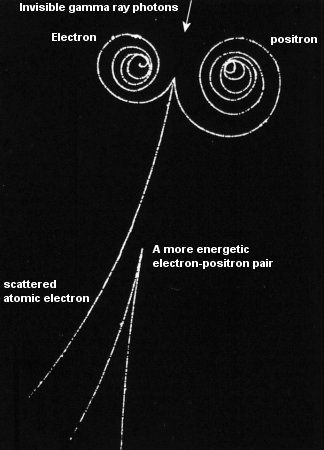

Oddly enough, each of these has a pair partner which is properly its opposite. This is the kind of opposite from whence sparks are prone to strike. If two such antiparticles met, like when Harry met Sally, they can just disappear, in a puff of light, right back to the original bliss.

Fortunately, our universe is a highly asymmetrical place. It is left-handed, in a particular way, totally Southpaw. Wherever all the antiparticles went, they are mostly not here. This is good because it gave us well-behaved electricity and magnetism. Electrons do useful work and wherever their magnetism came from, we don't need to worry about it going away.

The late Steven Weinberg wrote a great book called The First Three Minutes explaining how we think the universe came into being, and how it got to be made of roughly 75% Hydrogen and 25% Helium, with not a lot else besides, other than rocks like Earth and interstellar dust.

The important bit, for sustainable investment, is that everything mined on Earth, and almost all materials used in modern technology originate from the nuclear processes in stars. Oddly enough, most of the really useful metals are only formed in stellar collisions or explosions.

The elements we find on Earth today are pretty much the entire inventory of all that we can use to manufacture artefacts and technology. They began life in a star that exploded.

Some suggest that all gold on Earth came from colliding neutron stars.

Pure poetry for any geologist parked in the Pilbara, looking for the valuable stuff, and running short of beer on a starry night.

The elements we have on this planet are our cosmic inheritance. They are what the death of formerly vital stars bequeathed to us. We owe our planet to them.

Fortunately, we have our own Sun, next door, that can keep the place humming.

The energy to make our economy move need not be found here on Earth. While fossil fuels have powered our economy since we first used fire, the contained energy of that came from ancient sunlight. It was transformed through photosynthesis to biomass. Coal, oil and natural gas formed through geological processes of fossil sedimentation and conversion.

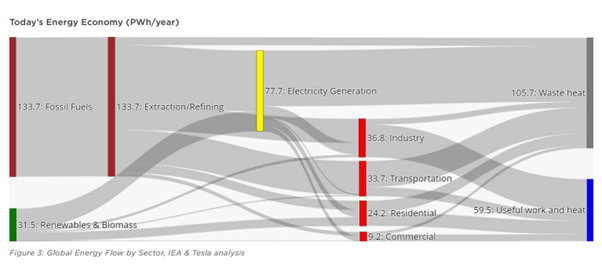

We got a huge lift from the natural inventory of sunlight that was stored in fossil fuels but are now in need of a new script. Unlike the more marketing-oriented Tesla Investor Day spiel, the Tesla Master Plan 3, does a good job of collating a body of thinking by the US Energy Agency (USEA), International Energy Agencey (IEA), and others, on the energy and material flows in our present global economy. Sure, it is branded as the "Tesla Plan", but it is soundly framed.

Extract from the "Tesla Master Plan 3" showing flows in the energy economy (IEA and Tesla Analysis)

The key point to understand, and this is uncontroversial, is that the energy mix coming in from the left is dominated by fossil fuels, but that the conversion of that useful energy into useful work and heat is limited by the physical plant and processes used in the middle.

The result is much useful energy that turns into useless waste heat.

This will always be the case, to some degree, as the physical laws of thermodynamics do place limitations on conversion efficiency for many processes.

100% conversion of available energy into useful work and heat won't happen.

However, the chemical combustion processes used to convert fossil fuel energy into useful work (motion for a car) or useful heat (natural gas for heating), involve losses.

The entire thrust of the Tesla Master Plan 3 is that combustion of fossil fuels to produce heat can be supplanted, in many cases, by use of electric powered heat pumps to move ambient heat energy around, from outdoors to indoors, or vice versa, for heating and cooling.

Equally, the combustion of fossil fuels for creating useful work, through reciprocating engines or turbomachinery, can often be done with a lower waste heat output using more efficient electrified systems. Renewable energy generation, battery storage, and electric motors.

Do not mourn - for the new dawn becomes electric

In both approaches, the key word is electric. As I mentioned, the force of electromagnetism is the one most amenable to technology development. It is the one we can control best, and it is the one that offers the widest scope for engineered solutions to our energy problems.

This comes at a necessary cost. If you are moving from a non-electric solution to an electric solution you need to scrap the old plant and make an investment in new plant.

This is not a capital expenditure light energy transition before us.

Furthermore, if you only directed investment capital to those activities that presently do not require any process adjustment, then everything else will fall by the wayside.

In short, the world won't make this energy transition without substantial capital investment.

However, the point made by the folks at Tesla is a sound one.

When you square up electrification as a substitute for any existing waste heat source, there can be very substantial primary energy gains to be had by making the conversion. It is like finding new primary energy, for free.

In simple terms, reducing waste heat can help reduce the need for primary energy, while achieving the same, or better, results in useful process output.

The primary energy savings of transitioning to less wasteful heat conversion can help pay for the additional capital expenditure and technology development required.

This is an excellently framed position, from the standpoint of energy transition economics.

We have no quarrel with this viewpoint and think it is a positive step in reframing the energy transition debate in such a way that the costs are properly set alongside the benefits.

The role played by Physical Efficiency Limits

Returning to our discussion of the Sun, there is plenty of room to grow primary energy through solar photovoltaic conversion. The math of energy efficiency potential on solar cells shows a significant potential for further improvement. There is plenty of room to the ceiling above.

While current thin-film systems convert around 11% of sunlight to electricity, and state of the art monocrystalline solar cells, around 23%, it is known that single-junction solar cells can perform at 31-41% conversion efficiency. This is the famous Schockley-Quiesser limit.

The Australian photovoltaics pioneer, Professor Martin Green, explored overcoming these constraints via so-called Third Generation Photovoltaics, using layered cell designs.

Third Generation Solar Cells can potentially exceed the Schockley-Quiesser limit of 31-41% efficiency.

The book above is a modern classic in the use of thermodynamical principles for the analysis of energy conversion efficiency limits. Chapter 3 entitled Energy, Entropy and Efficiency, lays out the essential principles for analysing the ultimate limit for Solar Conversion.

It is a good conversation starter...

How much of the sunlight we receive from the Sun might conceivably be converted into electricity?

Of course, there is a practical answer: about 23% for state-of-the-art solar panels.

However, the ultimate theoretical answer is higher: ideally around 95% for a perfect Carnot cycle solar collector. Don't worry about that too much, as you can't really make one.

There is a little Devil in the works called entropy production between the source at the Sun and the collector. Allowing for that, with the model of Landsberg, you get 93.3%, and adjusting for further entropy production in the collector, you get to the Black Body Limit of 85.4%.

You may wonder what drives such precise limits.

It comes down to three things, the laws of physics, the temperature of the Sun (6000 Kelvin) and the surface temperature of the Earth, where the collector lies (around 300 Kelvin). If you put the entire thing into Deep Space, that second number is 3 degrees Kelvin and you can actually get pretty close to 99.95% conversion efficiency, in theory.

Right now, 90% or more of installed solar photovoltaic systems operate at 15-20% conversion efficiency. Present thin-film solar panels operate at around 10% but third-generation solar cells, built with thin-film technology, can allow us to move up that efficiency curve.

How high could that go?

According to Green, somewhere around 86.8%!

It is an aspirational theoretical target. To get there, you need to do a lot of development in the quantum technology of thin-film based quantum band-gap engineering.

Per aspera ad astra - through adversity to the stars!

Humanity won't get closer to that ultimate goal without effort and investment.

The good news, for every young physicist, is that we old physicists only ever got 26.5% of the way down the path that leads forward. However, the point of Tesla's observation is that we don't truly need more primary energy to be in a better place. Actually, we just need better electrical energy conversion and storage. We can still run forward, anyway.

Electromagnetism and Conversion Efficiency Limits

The above constraints are general because they relate to thermodynamics, and processes that involve the exchange of energy that leads to heat and entropy generation.

This turns out to be most interesting in the context of magnetism.

One thing that fascinated me, as a kid, was sprinkling iron filings on a blank sheet of paper with a horseshoe magnet underneath. I am sure you have seen the pattern made.

Magnetism is interesting because magnetic fields do no work on moving electric charges.

Work is a funny concept in physics. It relates to an exchange of energy. Since energy is conserved, doing no work involves no inherent loss of energy.

You might think that never doing any work is pretty useless.

However, when we look at the iron filings, you can see how they line up with the magnetic field created by the magnet. This can be puzzling for any intelligent child.

How come the magnet does not get worn out by me doing this a billion times?

That is pretty strange, when you think about it. I did. I tried to wear my magnet out.

I wore my teacher out with dumb questions, but not my magnet.

The entire elaborate theory of electromagnetism explains why. It turns out that electricity and magnetism are simply two sides of the same coin. Move a charge in an electric field, and it will want to swing some in a direction perpendicular to how it moves, and also the field direction.

If you fire an electron one way through a magnetic field, it curls to one side. Positrons are opposite.

Since electricity is electrons in motion, and moving electrons create magnetic fields, you can see that one set of electrons moving one way can well influence a whole bunch of others.

However, it gets even more interesting. Every electron is actually made like a tiny spinning top and has its own permanent magnetic field that never ever wears out.

Even the legendary Duracell Bunny would be done before that electron spin top gave out.

Is there perpetual motion involved?

Kind of, but not really.

The electric charge does not wear out, but neither does the magnetic field. What does happen is that the electron itself can move according to how it is poked and prodded by others.

This is the perpetual dance of electric and magnetic fields that is responsible for all of our technology, outside of nuclear physics, which includes chemistry and biochemistry.

For our purposes, the key thing to understand is that electric fields can do work on electrons but not magnetic fields. This is hard to grasp but has important implications.

Good permanent magnets require no sustaining source of energy to maintain their magnetic field. There are no losses in the magnet staying magnetic.

As I said, this is not perpetual motion, or endless free energy, but it is very useful.

When I was a child, I did try and wear out my horseshoe magnet, but couldn't.

Now I know more physics and can tell you how to do it.

If you want to wear out a good magnet, then just heat it up. Go on, put the magnet in your oven, and keep heating it up. If you have a typical ferrite magnet, maybe 450 Celsius.

After that, the little electrons, which will remain magnets, no longer line up with one another and their combined field goes away. Individually, they remain magnetic, but the collective magnetic field just averages out to nothing. The magic is gone. Your magnet is toast.

Since we know that moving electrons can create magnetic fields, you could readily take a different tack and make yourself an electromagnet.

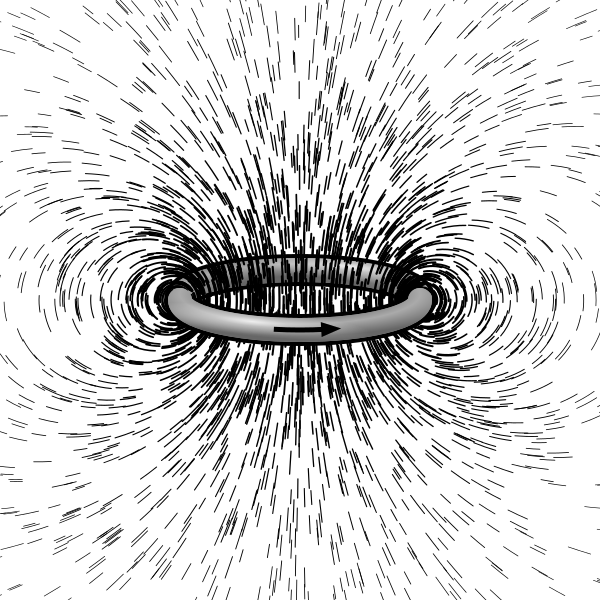

Send an electron racing around a loop of wire and you will get an electromagnet.

Everything about this is rather cool, when you think about it.

Electrons are magnets themselves. if you can get them to sit still, in the one place, all line up, cooperate, and not go random, you get a nice permanent magnet. Alternatively, you can build any type of copper wire racetrack you want, shoot electrons along it, and make a magnetic field that way. Since different magnets push against one another, you can actually take any combination of permanent magnets and electric current to make a motor.

Electro machinery has been with us for well more than a hundred years, and there is a huge amount known about how to design electric motors and generators.

One of the biggest innovations of electric motor design was the alternating current induction motor that uses only electromagnets, with the rotating part energized by induction.

These are different from the old direct current motors in toys in that they have no brushes to transmit electric current to the rotating coil inside the motor. This is neat and efficient.

Since those early innovations, there have been very many variations of motor and generator design that address the energy trade-offs of weight, power, cost, efficiency and reliability.

You can make motors and generators with permanent magnets or without.

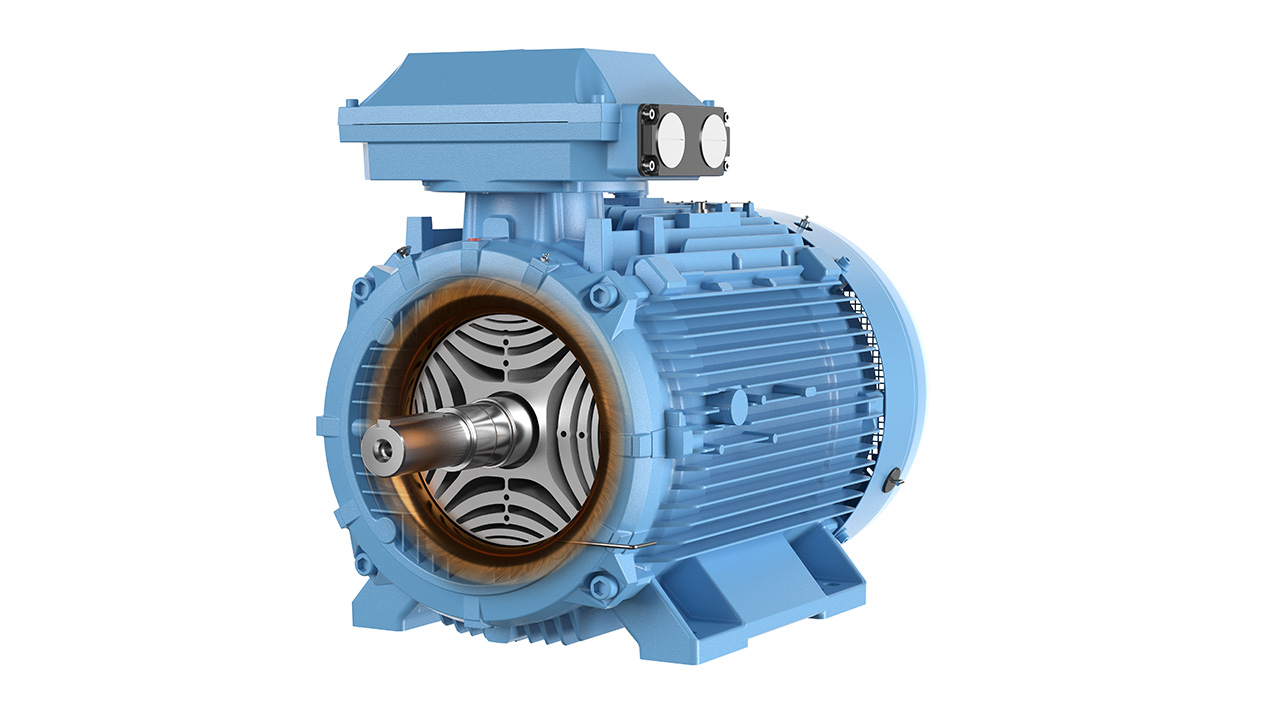

One recent innovation is the Synchronous Reluctance Electric Motor (SynRM), developed by automation, robotics and control engineering giant ABB.

The ABB Synchronus Reluctance Electric Motor (SynRM) has no permanent magnets.

These designs for electric motive power will transform many applications where very high efficiency is required without the need to use a permanent magnet to create the field.

Nonetheless, when we look around there are very many permanent magnet motors. The really fancy ones use expensive, but effective rare earth permanent magnets.

Consumer drones use Neodymium-Iron-Boron permanent magnets for performance reasons.

The Neodymium-Iron-Boron (NdFeB) magnet generally rules the roost for any electric motor application that demands high field, high electrical efficiency, high torque and low weight.

The reason for this is simple. Since the magnetic fields in permanent magnets do no work, they require no current source to maintain. You do need a current source in one part of the motor to make the opposing magnetic field, but only when the motor is operating.

Since electric current in a wire loses energy via heat dissipation, the achievable performance of permanent magnet motor designs is generally higher, and they are more compact. You can move the bar, in some cases, with clever design work, but the useful part about permanent magnets is that field comes for free and is always there to push against to make motion.

Inside every permanent magnet, there are a gazillion little electron Duracell Bunnies happily pirouetting around, in unison, like Disney on Ice.

Kind of right, but don't use that line on exam day.

The value of rare earth magnets is that they generate a very high stored energy product. This technical term picks up on the key question:

How strong a magnetic field can I get in one place?

The answer is that it depends on a lot of factors, but with a rare earth permanent magnet you can rest assured that you get a compact and high-strength magnetic field that is always on.

Sometimes this is a problem, but when the "always on" aspect doesn't matter, you are good to go, and, most importantly, you don't need to worry about leaving the magnet switched on.

The permanent magnet is always on, and the cool part is that it won't go off.

The not going off bit won't cost you anything. You don't need to worry about the power bill.

The Rare-Earth-Free Traction Motor

This digression brings us to the big Tesla Investor Day reveal.

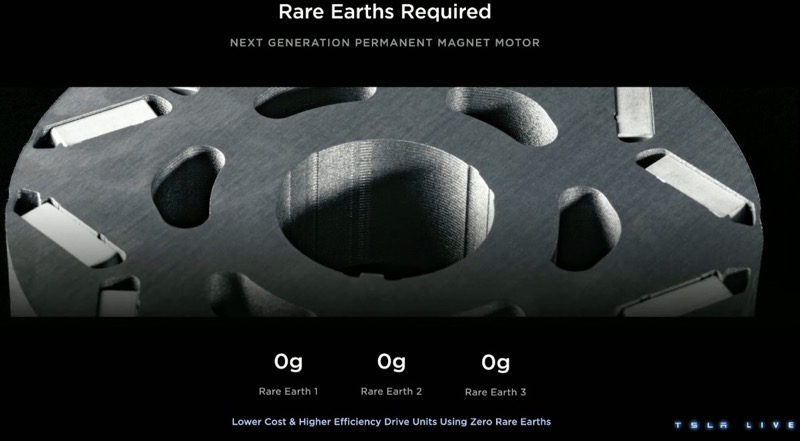

The future rare earth requirement for the next generation permanent magnet motor is billed as zero.

This set the cat amongst the pigeons as the next generation drive motor design was pitched as a permanent magnet motor that does not use rare earths, with not much additional detail.

Speculation is the only thing we have to go on, as there is no more detail than that.

Can you build electric vehicle traction motors without rare earths?

Yes, and Tesla themselves used an induction motor design prior to the Model 3.

Are other car companies developing motor designs without rare earths?

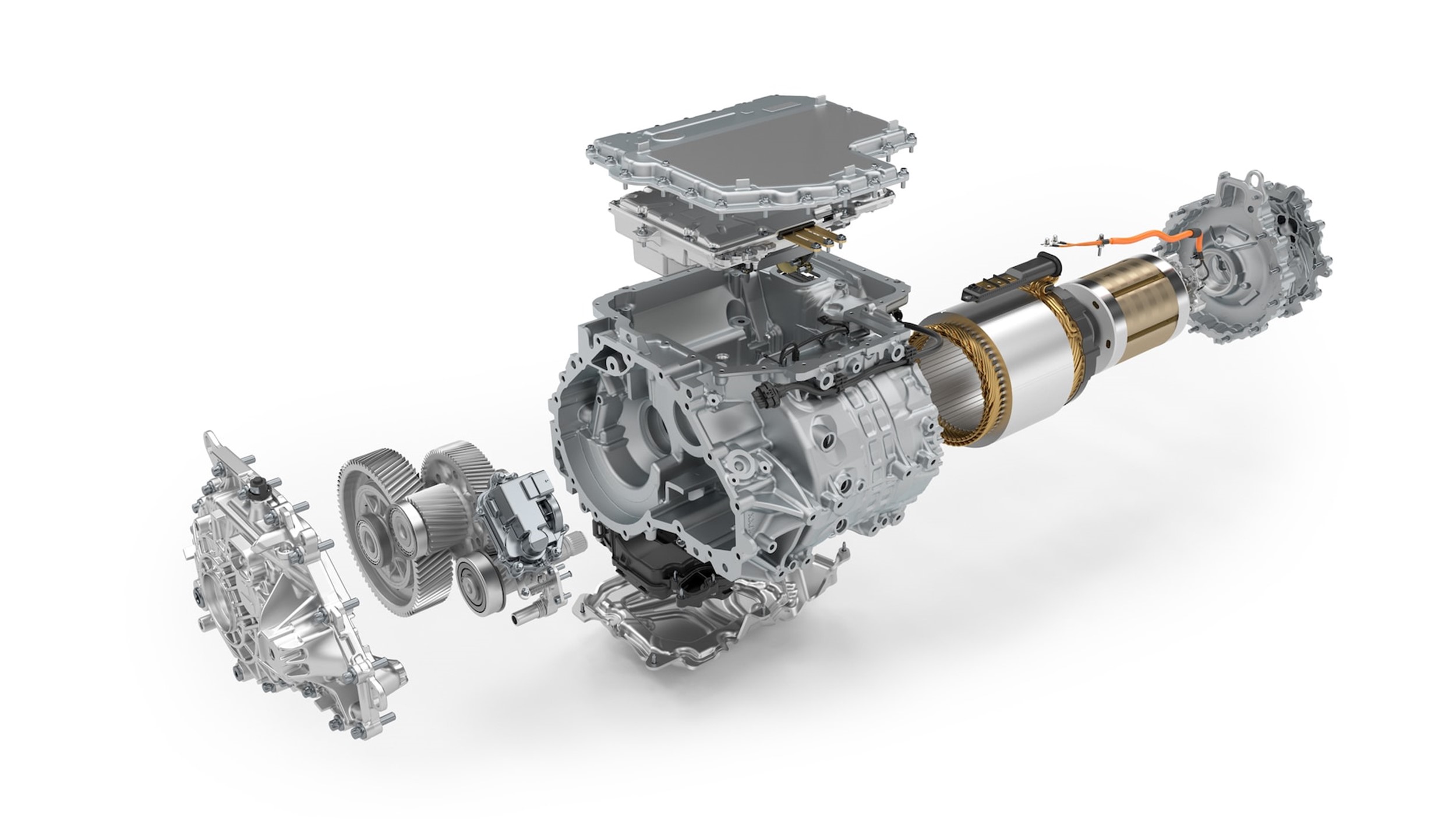

Absolutely. BMW is going with a three-phase AC synchronous motor with this design.

The BMW fifth generation motor for the iX M60 uses no rare earths and no permanent magnets.

If you put enough effort into the task, you can usually find an engineering solution to one problem, availability of rare earths, by accepting a different problem: adding the control systems and power electronics for an AC Synchronous Motor.

Engineering is innovation central, and Tesla is not the only player in that game.

German company Schaeffler is leaning into the rare earth supply chain sourcing challenge by upping the ante on design efficiency, with their revolutionary E-Wheel Drive.

The Schaeffler integrated E-Wheel Drive puts the rare earth permanent magnet motor in the wheel hub.

Speculation is a delicious game changer if only you can bet right on who will prove right.

In the wash-up to the Tesla Investor Day reveal of their plan to go rare-earth-free, one might think that it is all over for rare earths, bar the shouting. However, we don' think so.

Let's explain why.

What is Jevons Paradox?

Our firm is named for the English economist William Stanley Jevons, who made great contributions to economics during the tumultuous Industrial Revolution.

The famous Jevons paradox stems from his observation that coal consumption greatly increased in England after the development of James Watt’s steam engine.

The increased efficiency of steam engines, through constant development and refinement, did not lead to any reduction in demand for coal. The opposite effect occurred: increased resource efficiency in use promotes more use of the resource.

Demand grows when the efficiency of resource usage grows.

Who knows if the Schaffler E-Wheel Drive will take off? However, such innovation exploits the full advantage of a rare earth permanent magnet. It is compact, has high torque, and can be made simpler from a control and power management standpoint.

These attributes promote new design opportunities, things you may not have tried before.

Once you have one working E-Wheel Drive, you potentially have many wheels, all with power. You have changed the game by reinventing the wheel itself.

The legendary pulling power and off-road capability of a four-wheel drive vehicle can easily be made all-wheel drive, no matter how many wheels you have.

Maybe the future semitrailer uses 18-Wheel All-Electric E-Wheel Drive?

How would a Cybertruck stack up against that?

The Speculative Nature of Competitive Dynamics

Innovation is a competitive game, and it is rare for one player alone to hold all of the cards.

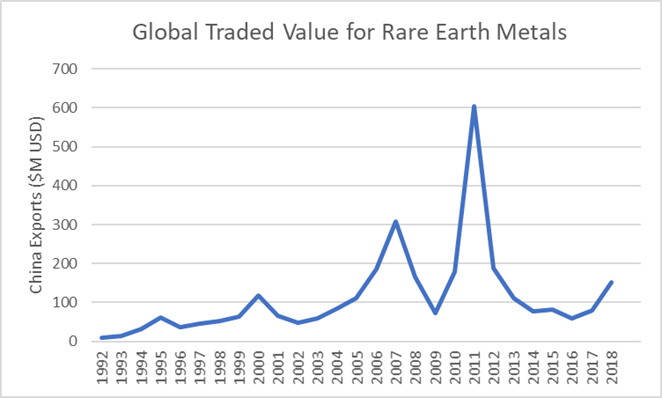

Way back in 2010-2011, China moved to restrict rare exports to Japan, over a row on disputed island territory claimed by both nations. The resulting rise in rare earth prices backfired on the Chinese, since it led to thrifting of rare earth usage in major areas like wind turbine design.

The overall rare earth market value temporarily shrank as a result.

The 2010-2011 China rare earth embargo backfired by leading to substitution.

In hindsight, it looked like China held all the cards, but they folded when the embargo wound up shrinking the overall market value for rare earths. It proved to be an own goal fiasco.

Perhaps China would be foolish enough to try that again, but we don't think so.

China has the largest electric vehicle market in the world, around 50% of vehicles sold, and has the largest electric vehicle manufacturing industry, not to mention the ancillary components.

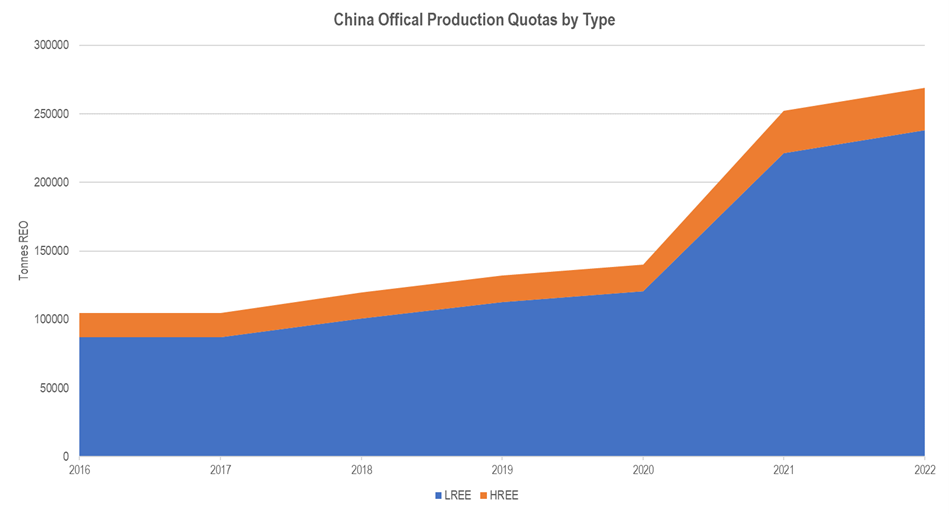

Twice a year, the Chinese Ministry of Industry and Information Technology (MIIT) set their official quotas for rare earth mining and separation operations within China.

Supply within China is not restricted, as you can see.

The effect of domestic EV

demand is clear in the official increase in China rare earth production quotas.

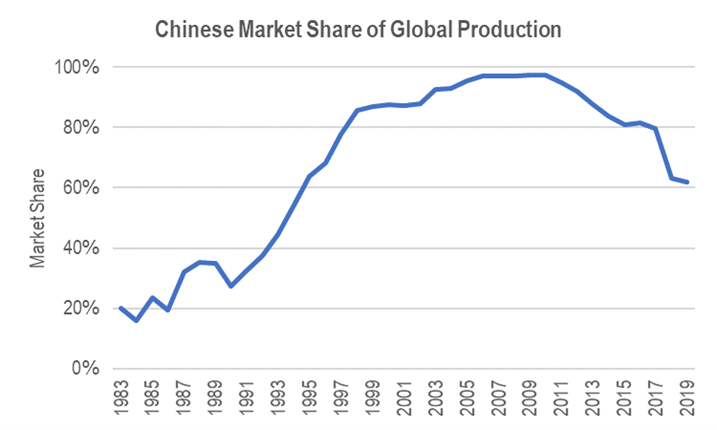

The post-2020 bump reflects the rapid growth in the electric vehicle industry in China. When we look at the Chinese share of global mining, it is actually decreasing. This is down to new sources such as the MP Materials mine that was restarted in the USA, and Lynas in WA.

Chinese Market Share of Global Production. Source: USGS (1983-2019).

The other big factor driving market development has been the decline of Chinese sourced heavy rare earths as resources are becoming depleted. Myanmar has become a swing producer, but for obvious reasons, Western firms are now developing new resources.

Australia is in the Box Seat as the new Swing Producer

The geopolitical tensions between China and the United States have elevated the security of supply chains for critical minerals to global prominence. These are the metals and materials that are needed to support technology development, from solar cells through nuclear plant and on to semiconductors, optoelectronics, electro-machinery and quantum technology.

Fortunately, the Australian Government has a developed Critical Minerals Strategy, which aims for collaborative development of our own resource endowment with downstream customers and like-minded trading partners. Our fund industry needs to support this enterprise.

The Tesla Master Plan has doubtless excited some technology-oriented investors.

However, little of this will come to fruition if critical minerals remain in tight supply.

I have mentioned Jevons Paradox because I firmly believe that this is the one law of human economic nature that Elon Musk does not fully understand.

It is great to emphasize resource efficiency, to address perceived scarcity, but ultimately using less of any scarce resource will promote demand to use more of that scarce resource.

We will not escape these chains by pretending that the critical minerals do not actually matter. They are the heart and soul of new plant and process.

Tesla may be intent on eliminating rare earths supply risk, but that focus may prove entirely premature. Recent discovery programs in Australia have demonstrated far greater rare earth resource potential than was previously anticipated.

Amongst these, are ionic clay deposits in places like Uganda, by Ionic Rare Earths IXR.AX and the development of possible onshore Australian heavy rare earth sources from clays, as with Australian Rare Earths AR3.AX, and xenotime hard-rock deposits such as Northern Minerals NTU.AX, and the undeveloped potential of xenotime from mineral sands, which is made more feasible by the Australian Government commitment to back Iluka Resources ILU.AX Eneabba rare earths refining facility. That is before we consider the close cooperation between South Korean automotive interests, through Hyundai and Kia Motors, in helping progress the plans of Australian Strategic Materials ASM.AX to further scale up their Korean rare earth metals plant.

On the supply side, we think that much progress has been made on reducing the strategic risks associated with an overly concentrated China-centered rare earths market. As China seeks to export electric vehicles, it is rational for them to source rare earths elsewhere.

There is the mooted "China rare earth export ban" which relates more to magnet technology than to magnets themselves. All is grist for the speculative mill, but we think it sensible to remark on a key question for the durability of NdFeB magnet demand.

To understand that we need some perspective on the development of permanent magnets.

Future Permanent Magnet Technology

Once James Clerk Maxwell wrote down his equations, the development of electromagnetic engineering became possible. This started with the observation that an electric current could create a magnetic field, and a magnetic field could exert a force on an electric current.

People are now excited by quantum technology. They should be.

This is just the natural evolution of technology once we better understood the inherently quantum nature of the forces of electromagnetism.

We have name for this body of knowledge.

It does not appear anywhere in the Tesla Master Plan, but it is a piece of mid 20th Century physics called quantum electrodynamics. These days, you do get a lot of hype from the captains of the technology industry, but I won't go down their chosen pathway.

I will state the Jevons Master Plan with this one simple line:

If you want to make the world electric, to solve the energy transition problem, then you had best learn some quantum electrodynamics, and maybe study some magnetism. I mean, you need to do some work, but that is the work.

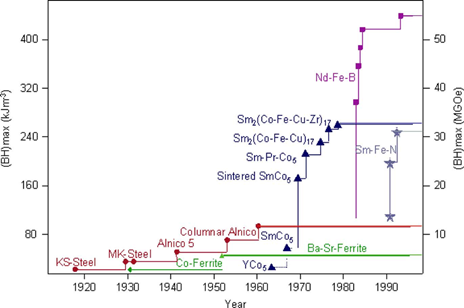

Earlier, I mentioned the merits of the world-beating stored-energy product performance metric held by Neodymium-Iron-Boron (NdFeB) permanent magnets. Higher numbers are better and the highest in widespread practical use come from rare earth magnets.

Progress in the stored energy product for magnet

materials in the 20th Century (Coey, 2011)

For context, it has been rumored that Tesla may plan to use some form of ferrite magnet. That is the green line, marked Ba-Sr-Ferrite, for Barium-Strontium-Ferrite.

Ferrites are cool, for a magnet engineer working around the year 1950.

Of course, we don't know. This is idle speculation. I doubt that it would be just that.

A stronger bet might be a nanoparticle-based Iron-Nitride. You can see the promising upward leap from Samarium-Iron-Nitride around the year 1990. That looks like a better prospect.

It still uses the one rare earth, Samarium, but that one is cheap right now.

Niron Magnetics is proposing to commercialize rare earth free magnets based upon a form of iron nitride. This is potential progress, but I would hasten to add the elements which appear in the chart above have a habit of appearing, and then appearing again, and again, and so on.

- Iron (Fe)

- Nickel (Ni)

- Cobalt (Co)

- Rare Earths (Nd, Pr, Dy, Tb, Sm, Gd)

- Othe dopants (N, B, Zr, Sr, Ba, Cu etc)

If we do get a major new wave of magnet development, I would warrant that many of the new types will also include rare earths. Since these all occur together, it would be no bad thing to find good new magnet candidates that used Samarium (Sm).

I would expect plenty of PowerPoint to come in the cause of raising money.

Money is useful to help get things done.

However, I did not find much that was useful to me from the Tesla presentation.

The people who actually get this job done will be those who learned their QED properly and then adapted Density Functional Theory for Magnetism and Magnetic Anisotropy, to the proper task, delivering a working magnet, and not a slick slide about a future possibility.

There will definitely be progress along this road, but we don't know exactly where, how and when, much less who will be involved. The basic picture is that rare earths are useful.

As a theoretical physicist, who can actually spell DFT, I expect rare earths to remain useful.

The Performance Option exerts a Magnetic Consumer Attraction

While the message of a sustainable future resonates with consumers, their own purchase decisions may not reflect their answers to focus group survey questions.

While Tesla first entered the electric vehicle market with the secret master plan:

- Build sports car

- Use that money to build an affordable car

- Use that money to build an even more affordable car

- While doing above, also provide zero emission electric power generation options.

They have now pivoted towards securing market share with affordable mass market cars.

It is actually the same exact plan, but now on a grander scale to build on earlier success.

This is good, but Tesla is not the only electric car maker with noble aspirations.

There is a company, called BYD (Build Your Dreams), that was founded in 1995 by a Chinese chemist, named Wang Chengfu, who believed that the future was electric.

He could see the growing role played by rechargeable batteries, understood that these entirely depended on sound chemistry, and that there was a market opportunity to create lower cost solutions to energy storage by competing with Japanese rechargeable battery makers.

I do recall some prior Tesla presentations on the future of Lithium-ion batteries involving a particular battery chemistry based upon Nickel, Cobalt and Manganese.

You don't see those presentations nowadays because Tesla switched gears and copied BYD in adopting the less critical minerals constrained Lithium-Iron-Phosphate (LFP) technology.

Chalk that one up to Wang Chengfu, and his team, working to make batteries both cheaper and also safer from the type of fire risk that can occur with other battery technologies.

Of course, Tesla is on the US exchange, as TSLA, and is an All-American Story.

In contrast, BYD is on the Hong Kong exchange, as 1211.HK, and is an All-China Story.

When the geopolitics gets ugly, you are supposed to root for the right side.

That All-American Investing Legend, Warren Buffet, considers the right side to be value.

Way back in 2008, Warren Buffet took a 10% stake in BYD. He saw their potential of:

‘’One day becoming the largest player in a global automobile market that was inevitably going electric.’’

Warren is avowedly not a technology focused investor, but he is no slouch on the future.

If you look up the sales data, you will find that both BYD and Tesla are locked in a race to determine who will win that prize: the largest player in the global EV market.

When the choice comes down to two clear contenders you could well bet on both of them.

However, from a valuation perspective, BYD is the clear winner right now.

It is perhaps natural that the All-American story is now pivoting towards an affordable mass market car. In contrast, the All-China story started in that place, and is now pivoting towards a desirable luxury car that might achieve higher margins to further fund R&D.

This is a stark reminder of why origin stories matter.

Firms that stay true to their roots, and build a strong sustainable culture, are likely to develop into the durable leaders of tomorrow. The All-American Story differs from the All-China Story. However, this is as things should be. Smart firms build upon their strengths.

In the case of Tesla, if they are no darn good at chemistry, they can license LFP batteries and buy them from BYD. In the case of BYD, they might wind up licensing self-drive technology.

Innovation makes the world go around and only the dumb refuse to learn from others.

Here is my take on the BYD secret master plan:

- Provide zero emission electric power generation and storage options.

- Use that money to build an affordable electric Bus for grannies and schoolchildren.

- Use that money to build an even more affordable car and expand to a full range.

- Build sports car. Have some fun. Make some money.

it is kind of the opposite of the Tesla plan, but winds up in the same place: success.

If you don't believe me then check out this video for the BYD U9 Sportscar:

Last time I looked, there was no Law of Nature which states:

Elon Musk is the only guy on Planet Earth who is allowed to have some fun.

Obviously, the people down at BYD are not averse to a little fun.

I guess this is Communism with Chinese Characteristics.

The bottom line, this electric vehicle market is now driven as much by performance and the street cred value of your ride, as it is by the noble aim to save our environment.

Current Opportunities in Rare Earths

That was some detour through the lands of hype, from the origin of the universe, to the Tesla Plan for All of Us. In case you think I am a hater, I am not. I finally get to take delivery of my brand-new Tesla Model 3 Long Range, Two-Motor, All-Wheel Drive, on April 27th.

Cool bananas.

The Model 3, in red, is far enough along the road towards an affordable car for me.

Hopefully, I can use the present correction in rare earths to make enough money to pay off whomever I need to in order to import a left-hand drive Four-Motor YangWang U9.

This is not a mid-life crisis thing.

The car can actually hop on the spot, and I really like that.

I live in Canberra, so being a left-hand drive Communist goes with the territory.

Obviously, I used up so much time and space venting on the need to properly make an effort to understand some actual physics, and not just make stuff up in public PowerPoint, that I have left little time or space to fully discuss Australian opportunities in rare earths.

This does not matter, really.

There are so many that only an idiot implanted in Tesla engineering cannot actually see any.

In the attached report, we lay out the current valuation landscape.

Have a look. It is free. Download it. Read it. Like my article if you like such things.

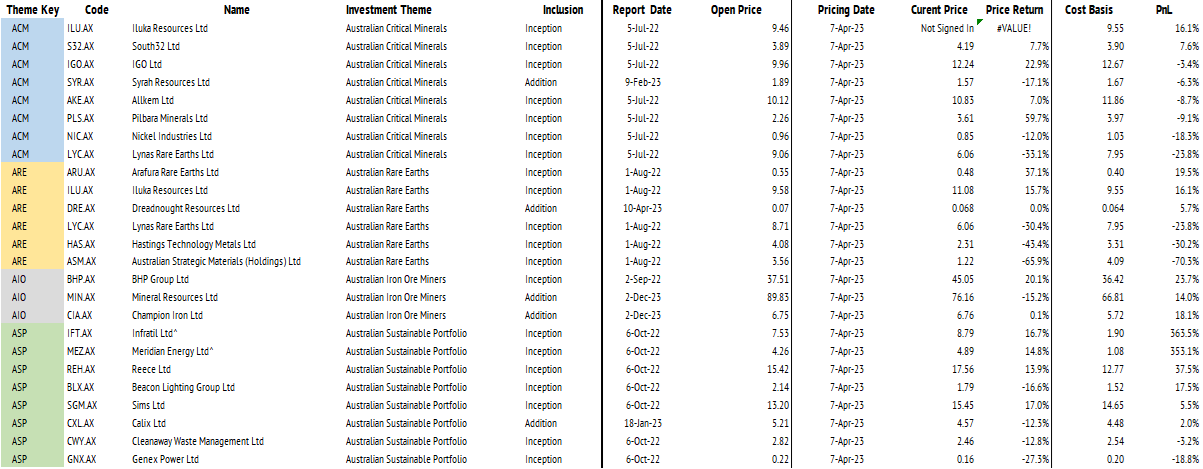

The performance table for our four thematics shows that the Australian Rare Earths (ARE) is the big laggard, with a major drawdown over the last three months.

Arafura Rare Earths ARU.AX and Iluka Resources ILU.AX are in positive territory, but the rest are well down. In seeking value, we reiterate our view that Lynas Rare Earths LYC.AX has the best grade operation outside of China, with a substantial and growing resource.

The negative sentiment has now driven the stock deeper into value territory. We rate the stock to be a long term buy and recommend patient accumulation. It might actually be time for us to start writing single-stock research because the local street appears to be fully clueless.

We also add the exploration junior Dreadnought Resources DRE.AX to our model list. This firm has a very active, and thus-far productive, drill campaign in the Gascoyne Region of WA, a rapidly emerging province for rare earth rich carbonatite deposits. Their Yin maiden resource came in at a respectable 14.36Mt @ 1.13% (TREO), with significant upside potential through the 2023 drill program to further exploration of the Mangaroon Project.

We consider the stock to be a speculative buy, to take advantage of current weakness, and position for forthcoming news flow from their Mangaroon drill program.

In spending all this time and space making the larger case for critical minerals investment, we did not have much room to talk properly about the district promise of the Gascoyne.

There is time enough for that.

The local fund industry is pretty ignorant. They did not pay much attention in school.

With Elon Musk spreading marketing messages, the opportunities will just keep coming. The bottom line for rare earth investors is this:

You only ever get one Elon Musk.

Happy investing.

Picture credit: the Dreadnought Exploration Team sharing a top-rock selfie from Mangaroon.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

2 stocks mentioned