PDN

Listed Company

Paladin Energy Ltd (ASX PDN)

Followers

223

Exchange

ASX

Sector

Energy

Industry

Energy

Popular News mentioning ASX PDN

Smart money eyeing near-term gold producers in hope of 2024 bullion breakout

Independent Journalist

Watch

Buy Hold Sell: 2 standout ASX names for FY26

Livewire Markets

Advertisement

Latest News on Paladin Energy Ltd

BHP

BHP Group Ltd

ASX:BHP

Followed by 2283 people

BOE

Boss Energy Ltd

ASX:BOE

Followed by 224 people

CXO

Core Lithium Ltd

ASX:CXO

Followed by 381 people

Livewire Markets

AEE

Aura Energy Ltd

ASX:AEE

Followed by 72 people

AGE

Alligator Energy Ltd

ASX:AGE

Followed by 144 people

BMN

Bannerman Energy Ltd

ASX:BMN

Followed by 65 people

Livewire Markets

29M

29METALS Ltd

ASX:29M

Followed by 244 people

BHP

BHP Group Ltd

ASX:BHP

Followed by 2283 people

BOE

Boss Energy Ltd

ASX:BOE

Followed by 223 people

Livewire Markets

PDN

Paladin Energy Ltd

ASX:PDN

Followed by 223 people

ZIP

ZIP Co Ltd

ASX:ZIP

Followed by 129 people

Livewire Markets

ADT

Adriatic Metals Plc

ASX:ADT

Followed by 143 people

BOE

Boss Energy Ltd

ASX:BOE

Followed by 223 people

FML

Focus Minerals Ltd

ASX:FML

Followed by 7 people

Independent Journalist

Covering Paladin Energy Ltd

Barry FitzGerald

Independent Journalist

Buy Hold Sell

Livewire Markets

Kingsley Jones

Jevons Global

Chris Conway

Livewire Markets

Ally Selby

Livewire Markets

Sara Allen

Livewire Markets

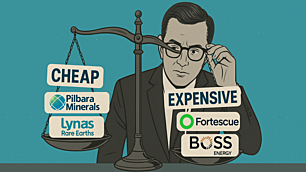

Paladin Energy Ltd (ASX:PDN) is an Australian publicly listed company that trades on the Australian Stock Exchange. The company's stock code is PDN. Livewire Markets has 40 experts who have published 225 articles that have featured Paladin Energy Ltd. You can view all those wires here. The last time time PDN was featured was on the 16 September 2025 by Carl Capolingua in the wire “PLS and LYC are overvalued, yet FMG and BOE are cheap… ASX mining stocks valuation insights”. Get the latest PDN share price and other key information like PDN Financials on Market Index.