10 U.S. growth stocks that lit up earnings season (and what analysts think now)

The latest U.S. earnings season – one of the most pivotal in recent history – is largely in the rearview mirror. And despite all the noise around tariffs, trade tensions, and talk of “the end of U.S. exceptionalism,” many of America’s biggest companies delivered.

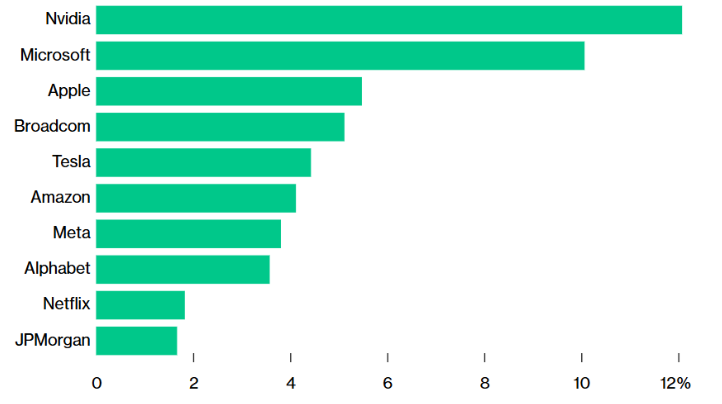

In this wrap-up, we look at the 10 stocks that have contributed the most to the S&P 500’s gains since 8 April - when the U.S. equity market bottomed - a list that includes the Magnificent Seven, along with Broadcom, Netflix, and JPMorgan.

Using AlphaSense, we’ve dug into analyst notes, earnings transcripts and other data to bring you the highlights: who impressed, who missed, and what Wall Street is saying about the most important growth stocks in the U.S. right now.

The overall view - AI saves the day

A picture says a thousand words — and the chart below adds weight to the argument that American exceptionalism is alive and well, but it's largely riding on the back of AI.

Led by Big Tech stocks, the S&P 500 has clawed its way back to within striking distance of record highs. Since the market bottomed on April 8, the Magnificent Seven have powered nearly half of the index’s 19% rally.

What’s more, profit estimates for the group in 2025 have held steady through earnings season. Bloomberg Intelligence expects 15% growth for the cohort, roughly double that of the broader S&P 500 and right in line with pre-season forecasts.

According to a media transcript sourced through AlphaSense, Joshua Brown, CEO at Ritholtz Wealth Management, pointed to JPMorgan research which found "AI" was mentioned 2.6 times more than "tariff" during S&P 500 earnings calls.

"Every single important CEO in cloud computing and chips and software came out and said, 'Not only are we affirming our spending guide for capex, in some cases we're actually raising it.' If we didn't get that, we're not in an S&P that's 3% from the high," Brown said.

10 U.S. Growth stocks - reactions and price targets

With the broader outlook still looking constructive, let’s dive into the 10 stocks leading the U.S. equity market recovery.

#1. NVIDIA (NASDAQ: NVDA)

- Revenue: $44.06B (+69% YoY; beat estimates, despite write-offs from China export bans)

- EPS: $0.96 (vs $0.93 expected)

- Data centre revenue: $39.1B (+73% YoY)

You'd be hard pressed to find anyone that rates NVIDIA anything but "buy." Brown colourfully described the company as the most important player in the AI ecosystem.

"Nvidia's situation is it's the sun, and AI is a solar system revolving around it. So I'm long," he says.

Bull case: Wedbush described the result as “robust,” noting broad-based demand despite China headwinds. Morgan Stanley and BofA raised targets to $170–$180, citing NVIDIA’s infrastructure dominance in AI.

Bear case: The lone voice of caution came from Joel South at 24/7 Wall St, who warned that NVIDIA’s only real vulnerability is if the AI story unravels.

"The only reason the shares trade at such a high valuation is that it is directly linked to AI and its prospects. Without it, it will return to being known as a gaming GPU company with some links to crypto mining," South says.

NVIDIA CEO Jensen Huang, along with several analysts, also warned that China’s rapid advancements in AI could pose a competitive threat to U.S. chip dominance.

Consensus price target after earnings: $175.

#2. Microsoft (NASDAQ: MSFT)

- Revenue: $70.1B (+13% YoY)

- Net income: $25.8B (+18% YoY)

- EPS: $3.46

- Cloud revenue: $26.8B (+21% YoY)

Microsoft is the diversified giant that keeps humming, delivering growth across key technology themes including AI, cloud computing, business productivity and gaming.

Bull case: Out of 46 analysts, 42 are either a "strong buy" or "buy" on the stock, citing Azure's strength, margin gains, and cost savings from reducing its headcount by 6,000 earlier this year.

Bear case: Like Microsoft, it's not the company, it's the price that's the issue. Bearish analysts warn that Microsoft’s 35x forward P/E leaves little margin for error, and there are also concerns around the durability of AI monetisation and enterprise software demand.

Average price target after earnings: $540.

#3. Apple (NASDAQ: AAPL)

- Revenue: $95.4B (+5% YoY)

- EPS: $1.65 (+8% YoY)

- Services revenue: $26.6B (+11.6% YoY)

- Tariff impact: Estimated $900M increase in costs next quarter

If magnificence could be measured on a scale, Apple would find itself toward the lower end. A cloud hangs over its ability to innovate, execute a clear AI strategy, and deliver the kind of jaw-dropping products that once defined the brand.

Bull case: TD Cowen maintains a Buy with a $275 target, pointing to strong services growth and supply chain diversification across India and Vietnam.

Bear case: Jefferies (Underperform, $170.62) and Barclays ($173) flag weak innovation, slow AI rollout, and geopolitical friction with the U.S. government over domestic manufacturing.

Average price target after earnings: $235.80.

#4. Broadcom (NASDAQ: AVGO)

Broadcom, a major semiconductor player powering the AI boom, is reporting earnings on 6 June. But its stock is running hot, setting an all-time high of $251.87 in today's U.S. trading session and analysts appear upbeat about its latest earnings.

Bull case: Broadcom continues to ride the AI wave, with its custom chip business gaining traction and VMware integration unlocking new software revenue streams. Deutsche Bank, BMO, and Wells Fargo all see AVGO as a top pick in semiconductors.

“AVGO offers a rare blend of upside from AI infrastructure, a stabilising cyclical base, and VMware-driven software growth. It remains one of our favourite names in semis," Deutsche's pre-earnings report notes.

Bear case: The VMware deal, while promising, still carries integration risk. And with the stock up over 60% year-on-year and now hitting fresh all-time highs, expectations may be priced for perfection.

Average price target after earnings: $250 on average (expect this to change after AVGO files earnings).

#5. Tesla (NASDAQ: TSLA)

- Revenue: $19.34B (vs $22.93B expected, and -9% YoY)

- EPS: $0.27 (vs $0.53 expected, and -40% YoY)

- Net margin: 7.3%

- Return on equity: 10.3%

- Valuation: ~180x forward earnings

Tesla remains the most controversial name on this list — not only due to its founder's Elon Musk’s increasingly polarising behaviour, but because its once-dominant grip on the EV market is slipping.

Yet as Livewire’s Tom Richardson pointed out, the stock is in the midst of a confounding rally despite cracks in the foundation.

Bull case: Supporters remain optimistic about Tesla’s optionality: the promise of full self-driving, robotaxis, and its humanoid robot Optimus. Vertical integration and a structurally lower cost base continue to be cited as durable advantages over legacy automakers.

Bear case: The fundamentals are hard to ignore - missed expectations, declining margins, and a lofty valuation that leaves no room for missteps. High-profile investors like Gary Black of the U.S.-based Future Fund ETF have exited the stock entirely, citing a deteriorating outlook and weak volume growth.

Average price target after earnings: $289.43.

#6. Amazon (NASDAQ: AMZN)

- Revenue: $155.67B (+8.6% YoY)

- EPS: $1.59 (vs $1.38 expected)

- AWS revenue: $29.3B (+17% YoY)

- Operating income: $18.4B (+20%)

- Net margin: 9.3%

Amazon has been the relative laggard among the Magnificent Seven, with its stock climbing just 66% over the past five years, well behind peers. Tariffs pose a material headwind for its sprawling e-commerce business, while its aggressive spending across AI infrastructure and content raises questions around profitability.

Bull case: Amazon Web Services (AWS) remains a standout, with growth reaccelerating and driving operating leverage across the business. Bill Ackman's Pershing Square hedge fund swooped into its stock after it fell 30% this year, betting earnings will grow and tariffs won't be as bad as predicted.

Bear case: Sceptics warn that AWS growth could decelerate, while rising AI infrastructure costs and margin dilution from retail may weigh on overall profitability.

Average price target after earnings: $244.09.

#7. Meta Platforms (NASDAQ: META)

- Revenue: $42.31B (+16% YoY)

- Net income: $16.64B (+35% YoY)

- EPS: $6.43 (+37% YoY)

- Operating margin: 41%

- Capex: $13.69B

Meta – the parent company of Facebook, Instagram, and WhatsApp – has quietly become a digital advertising juggernaut.

While most users scroll through Reels and Stories without a second thought, businesses big and small are paying a premium to put those ads in front of your eyes. With nearly unmatched reach and targeting capabilities, Meta has effectively monopolised and monetised mobile attention at scale.

Bull case: Wedbush and Guggenheim raised targets to above $700 in May. Meta’s leadership in open-source AI and monetisation gains across messaging and Reels are key strengths.

Bear case: High capex, continued Reality Labs losses, and AI monetisation lag. Valuation now demands strong execution.

Average price target after earnings: $701.05.

#8. Alphabet (NASDAQ: GOOGL)

- Revenue: $90.2B (+12% YoY)

- EPS: $2.81 (+49% YoY)

- Google Cloud revenue: $12.3B (+28% YoY)

- Operating margin: 34%

No major tech company has faced more existential hand-wringing from investors in the age of AI — and yet, the numbers tell a different story. Despite fears that AI chatbots could cannibalise search traffic, Alphabet posted its strongest top-line and earnings growth in years.

As Xinyu Ru of Fawkes Capital Management notes: AI isn’t a threat to Google, it’s an opportunity.

Bull case: The company is embedding generative AI across Search, Gmail, Docs, and Maps — while Google Cloud continues to win share, and YouTube remains a digital advertising juggernaut. Tigress Financial, Bernstein, and Citi have all raised price targets, citing robust momentum across Alphabet’s multi-engine monetisation strategy.

Bear case: The U.S. Department of Justice and EU regulators are circling. Antitrust actions could force divestitures — with the ad business a likely target. Some analysts also warn that AI-generated answers in Search may reduce click-throughs and weaken Alphabet’s advertising model over time.

Average price target after earnings: $199.75.

#9. Netflix (NASDAQ: NFLX)

- EPS: $6.61 (+25% YoY)

- Operating income: $3.3B (+27% YoY)

- Operating margin: 32%

- Market cap: ~$500B+

Watching Netflix's stock soar - up 92.33% in the past 12 months - has been better than most blockbusters. The company is conquering digital streaming while delivering popular hits like TV series Adolescence and films (Back in Action, Ad Vitam and Counterattack), while increasing monetisation of its platform.

Bull case: Evercore raised target to $1,350; BofA to $1,490. Analysts highlight global TAM, rising margins, and success of the $7.99 ad tier. Mahaney says Netflix is “just getting started.”

Bear case: JPM downgraded to Neutral, saying most upside is now priced in after a 34% YTD rally. Valuation is ~38x 2026 earnings.

Average price target after earnings: $1,195.

#10. JPMorgan Chase (NYSE: JPM)

- Net income: $14.6B (+9% YoY)

- ROE: 18%

- Dividend: $1.40/share (+12% YoY)

- CET1 ratio: 15.4%

JPMorgan Chase is to American investors what the Commonwealth Bank is to Australians — a dominant force with a premium valuation.

But unlike CBA, JPMorgan trades at a more compelling price, which is why Plato’s Dr. David Allen believes it may be time to swap the local favourite for a global banking powerhouse. Backed by its vast scale, diversified business model, seasoned management under Jamie Dimon, and consistent execution, JPMorgan offers resilience and upside.

Bull case: TD Cowen sees upside to $305. JPM’s scale, capital strength, and leading role in capital markets offer long-term resilience.

Bear case: Rising expenses, slowing net interest income, and deteriorating credit quality could weigh on earnings. Trades at a premium to peers.

Average price target after earnings: $266.20.

3 topics

10 stocks mentioned