3 fundies' founder-led favourites

In the first part of this collection, we learnt what drives outperformance in founder-led companies. We then discussed the main risks to consider and the industries where they tend to crop up. So now, it is only natural that we pivot to the which: Which founder-led stocks are our guest fund managers eyeing.

In the fourth and final wire of this series into founder-led companies, I asked our fundies to suggest one company that is set to be the next generational name. They delivered three very different companies and one theme that all exhibit strong founder-led fundamentals, including:

- A tendency to adopt a longer-term mindset when making decisions a

- A higher degree of investment into research & development

- An entrepreneurial spirit

- An unrivalled understanding of the business and what makes it tick and the customers it services.

- Alignment between shareholders and management

I reached out to the following guests to hear their insights:

- Maroun Younes - Fidelity Global Future Leaders Fund

- Shaun Weick - Wilson Asset Management

- Emma Fisher - Airlie Funds Management

- Andrew McAuley - Credit Suisse

.png)

Constructing a legacy

Shaun Weick - Wilson Asset Management

A founder-led business we believe ticks all of the boxes with a significant runway for shareholder value creation over the medium term is Maas Group (ASX: MGH), a leading independent and vertically integrated construction materials, equipment, services provider and property development company.

The company was founded in 2002 by CEO Wes Maas after returning to his hometown of Dubbo following a five-year stint playing league in Sydney, which included winning two reserve-grade premierships with the Parramatta Eels. Upon his return, Wes drew his $14,000 in life savings to purchase a bobcat, forming a single for-hire bobcat operation.

From humble beginnings, the business has grown substantially, today generating over $400 million revenue and north of $100m in earnings per annum.

The group employs more than 600 people, has more than 760 pieces of machinery and operates over 22 quarries, working on some of Australia’s largest infrastructure projects. Aside from civil and mining contracting, it manufactures equipment from a dedicated facility in Vietnam and has a property development arm.

In undertaking our due diligence leading up to the successful IPO of the company at $2 per share in December 2020, we came across a news article from over 10 years ago in The Sydney Morning Herald. With the banks of the Macquarie River in Dubbo forecast to break due to extensive flooding, workers at Maas Group spent 30hrs using the machinery they were trying to protect to build a dry moat, with walls about five metres high, to enclose excavators and bulldozers and the main shed, the result of which can be seen in the image below.

To us, this highlighted the entrepreneurial spirit that exists within the company and speaks to the culture of the broader team and “can do” attitude.

Another key attraction of the company is the strong alignment that exists with shareholders. Wes continues to hold 69% of the shares outstanding in the company (worth over $950m today), accounting for the vast majority of his personal wealth. At the time of IPO, employees within the company were also granted significant equity in the business, ensuring that “skin in the game” exists at all levels of the organisation.

With strategically located quarry assets, significant latent capacity (approximately 30% utilisation currently) and a substantial pipeline of infrastructure spend expected over the next 3 to 5 years, we believe the outlook for the business is compelling, and expect growth to be further enhanced by bolt-on acquisitions. The property development business remains an underappreciated aspect of the Group, providing exposure to high growth corridors across the residential and commercial real estate with the potential for separate listed structures in the future.

Keeping it cool

Emma Fisher - Airlie Funds Management

One stand-out founder-led company we own is PWR Holdings (ASX:PWH). PWR is a high-end manufacturing company based in Queensland, and has become a true global success story. The business was founded by CEO Kees Weel, who took an early interest in cars as a young apprentice mechanic in the 1970s. As a keen tinkerer, he thought he could try his hand at making radiators. Fast forward 50 years and his company now makes some of the best radiators and cooling systems in the world, as evidenced by PWR supplying every Formula One team with their cooling needs.

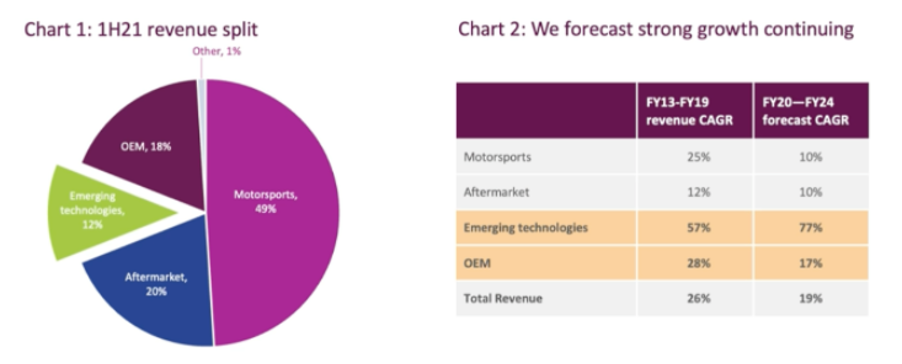

As per the below chart, the business is more than just the exciting motorsports division. In our view, the most exciting reason to own PWR is the emerging technologies division, which is currently 12% of sales. PWR are working on developing cooling systems for electric vehicles, which require more cooling per car than a traditional internal combustion engine. Further, the team is working with a number of large, global companies to develop cooling systems for aerospace and defence applications.

PWR is a great example of the benefits of investing alongside a passionate founder. Earlier this year we visited the PWR headquarters on the Gold Coast and at the first stop of our site tour, Kees presented us all with a copy of the company's annual cookbook. Kees showed us the on-site cafeteria that had been built so that the welders and engineers could have healthy, freshly cooked meals for free.

That sort of passion for the culture and experience of the team is really infectious and something we love to see in the companies we invest in.

(Editor's note: You can hear more about Emma's PWR thesis in the following podcast)

.jpg)

The outerwear brand set to outlive competitors

Maroun Younes - Fidelity Global Future Leaders Fund

One company we like that is held in the Fidelity Global Future Leaders Fund is luxury outerwear brand Moncler (BIT:MONC). Whilst initially formed in 1952, the business was greatly struggling by the time Remo Ruffini purchased it in 2003. Moncler was listed in late 2013 at a little over €10 per share and has since increased over fivefold to €54.94 per share (as at 6th September 2021).

What do we like about Moncler? Firstly, outerwear is a relatively attractive category within luxury retail. It’s not as mature as other categories and remains more fragmented. In addition, outerwear is benefiting from a number of favourable trends such as the growing spend on athleisure and vacation wear.

Over the last five years, Moncler has been able to grow sales and earnings at rates in excess of 10% per annum. It typically enjoys gross margins of around 70%, return of equity in excess of 20%, employs minimal debt, generates lots of free cash and has increased book value and dividends per share5.

Remo Ruffini remains heavily involved - as CEO he has been instrumental in reviving the business since he acquired it. He is also the architect behind the company’s very successful ‘Genius’ project - an innovative project whereby well-known designers create exclusive and distinct collections on a periodic basis. He also maintains a 26% shareholding in the business worth over €3.2b, meaning he stands to make substantially more from increasing the value of his shareholding than from his annual CEO remuneration.

The covid pandemic has naturally had an impact on the operations of the business. As a luxury brand dealing primarily in winterwear bought and worn on vacations, the series of lockdowns all across the world meant that 2020 revenue took a rare backwards step. Like all great business however, Moncler has bounced back strongly in 2021.

Going forward, we expect the business to continue to grow both its top and bottom lines. In particular the growing middle and affluent class in Asia, and China more specifically, are a key target market for Moncler.

ESG Matters - families do it better

Andrew McCauley - Credit Suisse

Our latest research looked at this universe of companies through an ESG lens and concluded that equity markets have generally rewarded companies with strong cash flow returns and relatively strong earnings momentum as well as companies with strong ESG credentials.

In our research, we show that, on average, the financial performance and share-price returns for family-owned companies is stronger than for non-family-owned companies. This, in our view, might be related to the fact that family-owned companies have on average had better-quality characteristics and those that score well on ESG factors (as measured by Refinitiv) also receive a similar favourable focus from investors.

You can find a list of the best performing founder-led and family-owned names from an ESG lens on page 33 of the attached report.

These names include:

- Fortescue Metals Group (ASX:FMG)

- Walmart (NYSE:WMT)

- Wipro (NSE: WIPRO)

Plus a spread of stocks from around the globe.

Conclusion

3 brilliant names and one crucial theme for the future - what isn't to love about founder-led companies? In a time of continued uncertainty, the resilience of these businesses may be crucial in seeing out periods of shock. Jeff Bezos once said:

“We're not competitor obsessed, we're customer obsessed. We start with what the customer needs and we work backwards.”

This obsession with customers as well as a clear alignment of incentives between investors and management are staples of the founder-led approach. What are your favourite companies in this area?

Thank you for joining me and our guests for this collection. Please check out the previous editions where we explored the benefits of founder-led companies, prominent sectors they feature rise and the risks investors must keep in mind.

Finally, in order to conclude this series I have also launched a Fund Manager Q&A with Lawrence Lam from Lumenary Investment Management, whose investment strategy revolves around the idea of finding companies that are founder-led.

Related wires:

Why you can't miss Livewire’s Income Series:

The Livewire 2021 Income Series gives investors best in class education and premium content to build a bulletproof income portfolio.Click here to view the dedicated website, which will include:

- The list of income-focused ETFs, LICs and funds.

- Detailed fund profile pages, with data powered by Morningstar.

- Exclusive interviews with leading fund managers.

- Videos and articles to help you perfect your income strategy.

4 topics

3 stocks mentioned

6 contributors mentioned