4 biotech bargains with realistic upside

As the broader market is looking increasingly expensive and concentrated, Orbis has been looking for value in undervalued sectors, such as biotech. In its latest Quarterly Commentary, Orbis takes a closer look at four of these opportunities. This article was first published on 30 September 2025.

Investing is ultimately about the balance between price and value—what you pay versus what you get. Most often, “value” depends on uncertain future outcomes, and the key risk is overpaying for a flock of expensive birds in a distant bush. Far more compelling are those rare opportunities to buy at deeply discounted prices that give little or no credit to future upside.

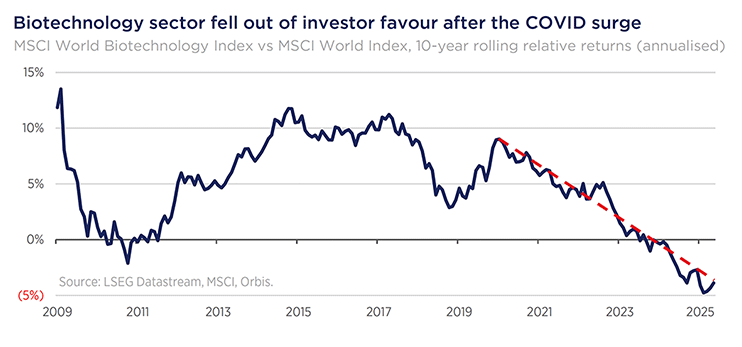

At a time when the broader market looks increasingly expensive and concentrated, we’ve been able to find deeply undervalued and idiosyncratic opportunities in select biotech shares. During the pandemic, investors eagerly funnelled capital into the sector, but since then their attention – and their money – has shifted to the shiny new promise of AI. Meanwhile, scientists in biotech never stopped innovating, working relentlessly to turn breakthrough research into new medicines.

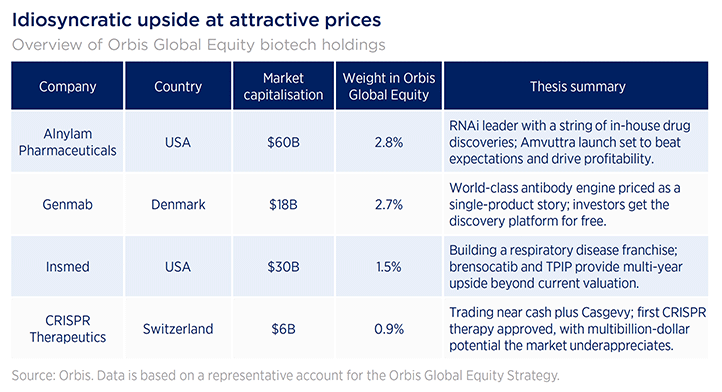

As a result, companies like Alnylam Pharmaceuticals, Genmab, Insmed, and CRISPR Therapeutics—together representing roughly 8% of the Orbis Global Equity Strategy—have quietly built innovative drug discovery and development platforms that are delivering life-changing therapies to patients, yet have attracted only a fraction of the AI darlings’ capital flows. For example, at today’s prices you can buy Genmab equity for the value of their existing drugs alone and pay very little for perhaps their most valuable asset—a proven and highly productive R&D platform.

In the section below we take a closer look at each of these opportunities in turn.

Alnylam Pharmaceuticals (NASDAQ: ALNY)

This company stands at the forefront of RNA-interference (RNAi) therapeutics, a technology capable of silencing specific gene expressions and reducing harmful proteins. After decades of development, RNAi has proven safe and effective in treating serious diseases like Transthyretin amyloid cardiomyopathy (ATTR-CM). Each of Alnylam’s four marketed medicines and two partnered medicines were invented in-house—a remarkable R&D productivity streak highlighting its scientific prowess.

Earlier this year Alnylam received regulatory approval for its next-generation ATTR-CM medicine, Amvuttra. We believe Amvuttra represents a best-in-class treatment that will significantly benefit patients. With the first commercial quarter results now in, Amvuttra has exceeded market expectations by a wide margin, validating our initial thesis. Alnylam’s management team, led by CEO Dr. Yvonne Greenstreet, continues to demonstrate both scientific rigour and strong commercial execution. This stronger-than-expected sales ramp puts Alnylam firmly on track to achieve profitability this year and strengthens its position among biotech giants like Vertex and Gilead.

Genmab (NASDAQ: GMAB)

Distinguished by its proven antibody discovery engine that has yielded eight approved medicines, Genmab is approaching patent expirations for its flagship product, Darzalex, in the late 2020s and early 2030s. Investors routinely flee when a patent cliff looms, fixating on the certain loss of legacy revenue while discounting whatever might replace it. Genmab sits squarely in that sentiment trough. Today its shares trade for less than the value of already-approved drugs, implying the world-class pipeline and discovery engine are worth nothing.

Meanwhile, a slate of late-stage assets and a growing roster of partnered drugs are only beginning to contribute revenue, with sales and royalties that extend well into the 2030s. Genmab’s R&D machine is still run by its scientist-founder, Dr Jan van de Winkel, whose more than two-decade tenure and sizeable equity stake have fostered disciplined capital allocation and scientific excellence. The company’s recent acquisition of ProfoundBio adds antibody-drug-conjugate technology that slots neatly into Genmab’s core expertise, expanding the opportunity set without stretching the balance sheet. Yet, the market still treats Genmab as a single-product story, allowing investors to buy the stock at a price that’s lower than the value of its commercialised drugs’ cash flows alone and get a world-class discovery platform for free.

Insmed (NASDAQ: INSM)

The newest addition to our biotech holdings, Insmed, has achieved a major milestone with the recent FDA approval of brensocatib (brand name: BRINSUPRI) for bronchiectasis—with a clean label and strong pricing. This marks the first approved therapeutic option for patients with this chronic lung disease, whose quality-of-life burden is comparable to that of chronic obstructive pulmonary disease. We anticipate a rapid adoption curve that should push the company toward sustained profitability.

The attraction, however, goes well beyond a single drug. The second pipeline asset, TPIP, has now achieved key clinical validation in pulmonary arterial hypertension as well as idiopathic pulmonary fibrosis, reinforcing its potential as a transformative therapy for patients suffering from deadly lung diseases. Combined with its already approved ARIKAYCE for Mycobacterium avium complex lung disease, the launch of brensocatib and the progress of TPIP are helping Insmed build a powerful respiratory disease franchise—a disease-focused strategy that has proven lucrative for other biotech leaders.

Despite a recent rally following BRINSUPRI approval and TPIP clinical readouts, shares remain well below our estimate of their intrinsic value, leaving substantial room for multi-year appreciation. Insmed is led by its long-time CEO Will Lewis, who took the helm when the company’s market capitalisation was under $100 million (now $30 billion). During his tenure, the company has created significant shareholder value through disciplined R&D bets. A continuation of this strategy should lead to further value creation that the market is not pricing into the shares.

CRISPR Therapeutics (NASDAQ: CRSP)

Five years ago CRISPR was a popular stock among growth-oriented investors, known for pioneering CRISPR gene-editing technology. However, the biotech sentiment implosion has been so profound that we can now buy CRISPR at a discount to just the cash on its balance sheet plus the value of its commercialised therapy, Casgevy, which is used to treat sickle-cell disease and transfusion-dependent β-thalassemia.

Guided by scientist-CEO Dr Samarth Kulkarni, CRISPR Therapeutics became the first company to get a CRISPR-based therapy approved by regulators. Because every patient must clear eligibility screens, undergo stem-cell harvesting, and be treated at a steadily expanding network of specialised centres, uptake follows a measured, step-like curve, unlike conventional drugs that generate revenue almost immediately after approval. Our market assessment suggests Casgevy is a multibillion-dollar opportunity with a strong competitive position and no visible patent cliff. And partnering with Vertex gives Casgevy the commercial muscle it deserves while allowing CRISPR to remain research-focused. Despite this, the market’s expectations remain muted, constrained by the therapy’s unusual launch trajectory. That disconnect in share price is magnified by the company’s healthy balance sheet: management raised substantial capital when financing was readily accessible, enabling CRISPR to keep funding high-upside research while ma

For biotech investors, long-term returns hinge on two things: whether drug sales ultimately exceed market expectations, and whether each additional dollar of R&D earns an attractive return. Companies that succeed at both compound capital over time, while those that fail destroy it. That’s why our research emphasises two essentials—identifying underappreciated drugs and backing disciplined management teams with a proven ability to allocate capital. As summarised in the table below, the Orbis Global Equity Strategy currently owns four businesses we believe meet this high bar, each trading at undemanding valuations that offer limited downside and meaningful upside.

Taking a step back, it’s been exciting to see a number of compelling bottom-up ideas emerging from our “stockpicking engine”. At a time when global equity markets—particularly in the US—are broadly expensive and increasingly concentrated, it’s nice to be able to find pockets of idiosyncratic value that don’t require heroic assumptions about the future.

Commentary contributed by Graeme Forster, Orbis Investment Management Limited, Bermuda, and Mo Zhao, Orbis Portfolio Management (Europe) LLP, London

To learn more about Orbis, please visit our website

4 stocks mentioned