5 crypto themes to watch in 2023

The crypto market is full of landmines at the best of times.

On top of its usual volatility, which is typically the highest of all asset classes, investors must also potentially deal with “rug pulls”, ponzi schemes, pump and dumps, and hacks. In addition, the crypto market is operating under its first rising rate environment since bitcoin’s inception in 2009.

“Crypto winter” hit in 2022 and calling it disastrous would be an understatement.

Bitcoin prices dropped more than 67% last year, taking the rest of the crypto market with it. There were major projects that failed due to faulty design, such as the Terra ecosystem collapse, and the bankruptcy of centralised exchange FTX. In addition, there was a wave of other bankruptcies affecting individual businesses in the crypto industry due to poor business models or being highly leveraged.

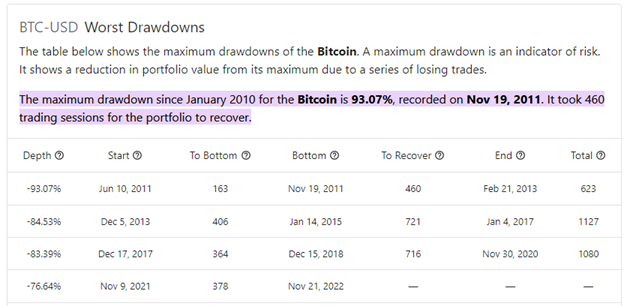

While the recent drawdown has been striking, it’s important to remember that deep drawdowns and failed businesses are nothing new to the crypto ecosystem. There have been bear markets just as bad – if not worse – in 2017/18, 2013/14 and 2011. And in these periods, there were also several notable collapses – Mt. Gox and Bitconnect among them. Only now, there are more investors and there is more awareness around the industry than ever before.

Source: Portfolioslab. Past performance is not an indicator of future performance.

It has been more than 14 months since the market peak in November 2021. And crypto equities have had a roaring start to 2023 so far, with bitcoin and the rest of the market rallying from the local lows set in November following the FTX debacle. They’re now trading back to levels which were hit last September.

Additional bankruptcies and liquidity issues over the coming months can be expected in the crypto sector. It’s also possible there could be a retest of the local lows. But according to some analysts, the worst of winter is behind us and there are early signs that a crypto spring may eventually arrive.[1]

Let’s look at five themes that could potentially be a feature of 2023 for crypto:

Theme 1 - Fed pivot

Although the first half of 2023 continues to look weak due to tightening by the US Federal Reserve and softer fundamentals, the market outlook from JP Morgan indicates that “the sell-off, combined with disinflation, rising unemployment and declining corporate sentiment, should be enough for the Fed to start a pivot.”[2]

A Fed pivot (change in monetary policy) may drive an asset recovery which could potentially push equity and crypto markets higher, while a positive macro environment could kick-off a genuine, sustained rally in the crypto sector.

Theme 2 - Regulatory clarity

The current lack of regulation, unclear regulatory frameworks, and regulatory guidance on cryptocurrencies have all created a difficult environment for investors and businesses alike. It is expected that jurisdictions will work more closely to be aligned. Institutions such as the Financial Action Task Force (FATF) and the Organisation for Economic Co-operation and Development (OECD) are helping drive this for the global banking system. With proper government oversight and regulation, investors and businesses will be able to make informed decisions and know what protections are in place.

Theme 3 - The bitcoin halving

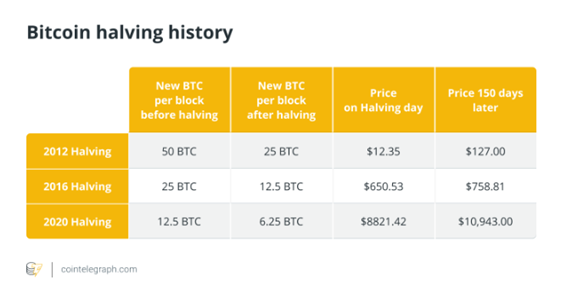

Historically, bitcoin cycles have displayed fascinating and uncanny levels of consistency between cycles. Catalysts for past rallies have been bitcoin halving events, which are when the reward for bitcoin mining is cut in half. The halving takes place every four years and the next one is expected to take place in April 2024, where the block rewards for miners will be reduced to 3.125 BTC. Based on past cycles, the price of bitcoin has risen in advance of the halving because the halving directly relates to bitcoin’s deflationary tendency and squeezes its supply, which tends to help the price of BTC rise further.

The chart below, provided by Cointelegraph, shows the historically effects of each halving and the impact on the price of BTC 150 days after the event has taken place.

Theme 4 - Only the strong survive

The 2022 crypto bear market has not been an easy one. There have been several bankruptcies, unscrupulous practices, the exposing of companies with poor business models, and the irresponsible use of leverage. But companies that have survived the most recent winter are much stronger, have less competition, and may be left with a much higher chance of survival.

Theme 5 - Emerging use cases

For crypto to be taken more seriously, more use cases must emerge. The allure of crypto to date has been FOMO (Fear Of Missing Out) and “number go up” returns. While many believe blockchain technology is here to stay, which has the potential to change the way business is done and shape whole industries, pundits are still divided on cryptocurrency and the real-world use cases for it. In general, cryptocurrencies and crypto equities are highly correlated to the price of bitcoin. Bitcoin and Ethereum combined account for about 60% of the market. While many cryptocurrencies will undoubtedly disappear from existence, the few that survive need to show more use cases than digital art and claims to the metaverse, which is still evolving.

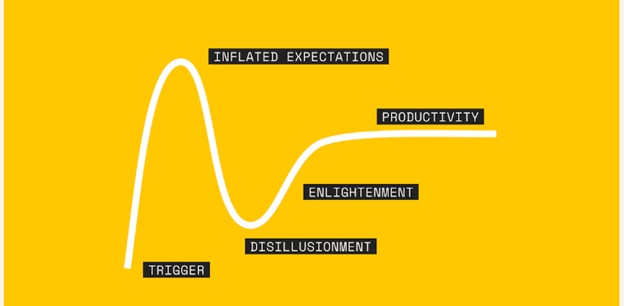

The hype cycle

All emerging technologies go through a hype cycle – from a trigger, to inflated expectations, to disillusionment, enlightenment, and productivity. It could be argued that crypto is going through a hype cycle now, having hit its period of inflated expectations and experiencing a period of disillusionment. But just like other emerging tech, such as the internet and dot-com era, it may continue to move forward, as technology continues to develop, which could bring it to a stage of enlightenment and productivity. The themes outlined above are some that may be expected to emerge in 2023 and potentially get us to through to the next stage.

There is no way to forecast the future and it is still very early in the technology’s cycle – but this is exciting, as it can create opportunity for both investors and businesses alike.

2 topics