5 investment lessons from the pandemic era

Capital Group

For global investors, the past 16 months stand out for me as a period that is both intensely painful and incredibly instructive. On or about March 23, 2020, the Standard & Poor’s 500 Composite Index and MSCI All Country World Index hit bottom, establishing the fastest bear market in history as the COVID-19 pandemic spread across the globe.

Last week, in stark contrast, equity markets hit new record highs, bringing us full circle from the depths of 2020 to the heights of 2021. Given these remarkable milestones, my colleague Steve Watson, Equity Portfolio Manager, shares below some of his learnings from this most unusual time in history.

I’ll start with a brief summary of my mindset as we entered 2020. In late 2019, I felt confident that the markets were well-positioned for a period of strong returns. Inflation and interest rates were low and looked likely to remain so. Banks were eager to lend, and companies seemed willing to invest in productive capacity again — as opposed to share buybacks and questionable acquisitions.

True to my beliefs, I entered 2020 invested as suggested above, with little cash and plenty of cyclicality reflected in my largest holdings. In less than three months, as the global economy came to a virtual standstill and fear gripped the markets, my pro-cyclical positioning looked problematic, to say the least. But context is important. And to understand that helps to understand my investment style.

.png)

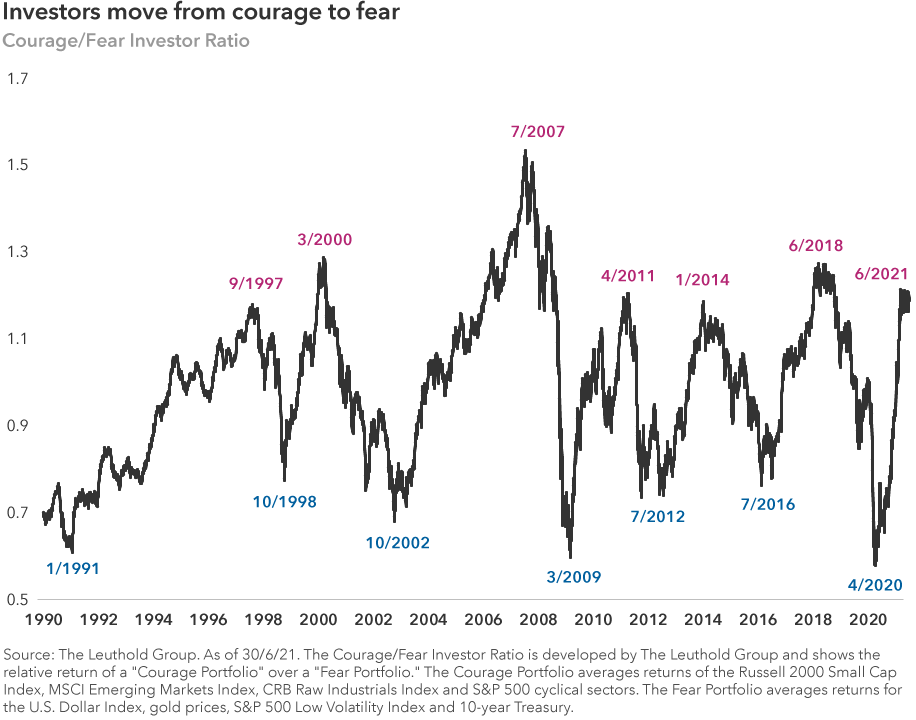

Friends and colleagues sometimes say, “Steve is the kind of guy who runs into burning buildings.” I find that a bit extreme, but it’s true that I am a contrarian investor at heart. As long as I’ve been in this business, I have believed that the market swings from excessive enthusiasm to extreme pessimism. An investor with a reasonable degree of objectivity can benefit from selling the former and buying the latter.

It’s an approach that has served me well for the past 30-plus years, but it also frequently causes pain and tends to pay off mostly during the early stages of market upturns, as pessimism gives way to optimism. Warren Buffett said it best: Be fearful when others are greedy and greedy when others are fearful.

That’s me in a nutshell. Now, here are five lessons I learned or relearned in the pandemic that I’m using in my portfolios today:

1. Market crises are inevitable

The advent of the pandemic-driven stock market crisis led me to think of past market traumas I have experienced. I counted 21, including the collapse of the Soviet Union, the bursting of the technology bubble, the global financial crisis and now COVID-19.

I offer this list of events only to highlight the fact that market disruptions are a fact of life for investors. My list suggests we get one of these events every 18 months or so.

No one could have predicted the pandemic but, in hindsight, it would have been wise to consider the chance that something would come along and disrupt the incredible bull market of the previous decade. If history is any indication, it would also be wise to believe that we’d get through it and emerge stronger on the other side. And, indeed, we have.

2. Interpreting history isn’t an exact science

This relatively short list of events offers other important lessons, as well, including the fact that history does not necessarily repeat itself in ways you might expect. It’s easy to draw false parallels, and I did exactly that during the early months of the COVID crisis.

For instance, I lived in Hong Kong through the SARS (Severe Acute Respiratory Syndrome) epidemic in 2003. I was quick to make overly simplistic comparisons between SARS and COVID. But while SARS was terribly frightening to live through, relatively speaking, it was a fairly minor event. Drawing conclusions about COVID from the SARS experience proved to be a mistake, leaving investors unprepared for the extent and duration of this pandemic.

I will add that I was also similarly surprised by the swiftness and power of the governmental response — both fiscal and monetary — to the COVID crisis. That response arguably helped minimize some of the damage to my pro-cyclical positions during the early months of 2020.

3. Growth or value? Both, at the right entry point

While I acknowledge some discomfort with the overly broad and vague labels “growth” and “value,” I’m going to use them here even as I agree that they lack nuance. The fact is, my fairly limited selection of growth-oriented stocks saved my skin during the worst days of 2020. These included some technology shares, particularly in the semiconductor industry, as well as some consumer-oriented internet and e-commerce companies.

Despite my value bent, I remain a strong believer in the resilience of the tech sector. Entry point is important to me; therefore, many of my tech-related investments are long-term holdings initially added before the market recognized their potential. I like to purchase shares when they are down and out, but I also like to hang on for long enough to let the market catch up with the true value of the company in question. As a result, some of my holdings today don’t look contrarian, but they likely did at one time.

As these stocks rallied amid the pandemic, I gradually trimmed some of them to make room for more unloved areas of the market, including energy, financials and travel.

4. Dividends play an important role

Speaking of unloved areas, I have long placed an emphasis on dividends as the principal mechanism for the transfer of value from a company to its investors. I’ve also maintained the expectation that dividends will continue to serve as a stabilizing factor during times of market turbulence.

Sadly, the latter characteristic has been weakened over the last decade and seemed to fall away completely at times in 2020. But I’m not willing to say that yield is useless. Our current unprecedented monetary conditions, coupled with the market’s devotion to fast-growing, society-changing companies, has tossed aside lots of historical norms.

That said, I do not think the value of the dividend as a wealth-transfer mechanism linking companies and investors has ended. In my view, it is more important than ever. And I continue to hold a number of high dividend payers, as well as dividend growers, in my portfolios.

Simply put, I loved dividends before the pandemic and continue to love them now.

5. Dr. Copper delivers a healthy diagnosis

My outlook, as wrong as it was in the first quarter of 2020, hasn’t changed much today.

Just as the markets have come full circle, I find myself feeling much like I did in late 2019: I am still fully invested and I expect global markets to be higher a year from now. My portfolios are still characterized by a pro-cyclical tint, meaning I favour companies that I believe will benefit from a reacceleration of global economic growth.

I could be wrong, of course, but I feel heartened by the diagnosis of Dr. Copper. Copper, as you may have heard, is the commodity with a PhD in economics, given its keen ability to help predict the path of the global economy. Copper prices bottomed in late March. They are telling us now that the economy is mounting a strong recovery and will likely continue to do so. Copper may also be warning about mounting inflationary pressures, but for the time being, I do not see inflation, or higher interest rates, as a threat to global equity markets.

I am also finding more attractive opportunities outside the U.S. In particular, emerging markets are currently far more attractive from a valuation perspective than the U.S., and my portfolios generally reflect that view.

In short, we now have all the elements, once again, that I was so confidently wrong about in late 2019 and early 2020. A critic might say that I have trouble learning my own lessons. But I would respond that perhaps the plague year was an anomaly. And perhaps we can now live again with investment styles influenced by market history, and place a greater emphasis on the expectation of a return to historical norms.

It’s possible even — dare I say it — that growth is ready to hand the baton back to value and non-U.S. markets are poised to outpace the U.S. in the years ahead.

We shall see.

Put today’s investment insights into a long-term perspective

Capital Group believes in a smarter way of investing that combines individuality and teamwork into a tailored approach to help investors meet their goals. For more insights click 'FOLLOW' below.

1 contributor mentioned

Matt Reynolds is an Investment Director at Capital Group. He has over 20 years of industry experience including head of Australian equities – core at Colonial First State Global Asset Management. He holds a bachelor's degree in Economics from The...

Expertise

Matt Reynolds is an Investment Director at Capital Group. He has over 20 years of industry experience including head of Australian equities – core at Colonial First State Global Asset Management. He holds a bachelor's degree in Economics from The...