5 thrilling themes to follow in 2022 (and the ETFs to play them)

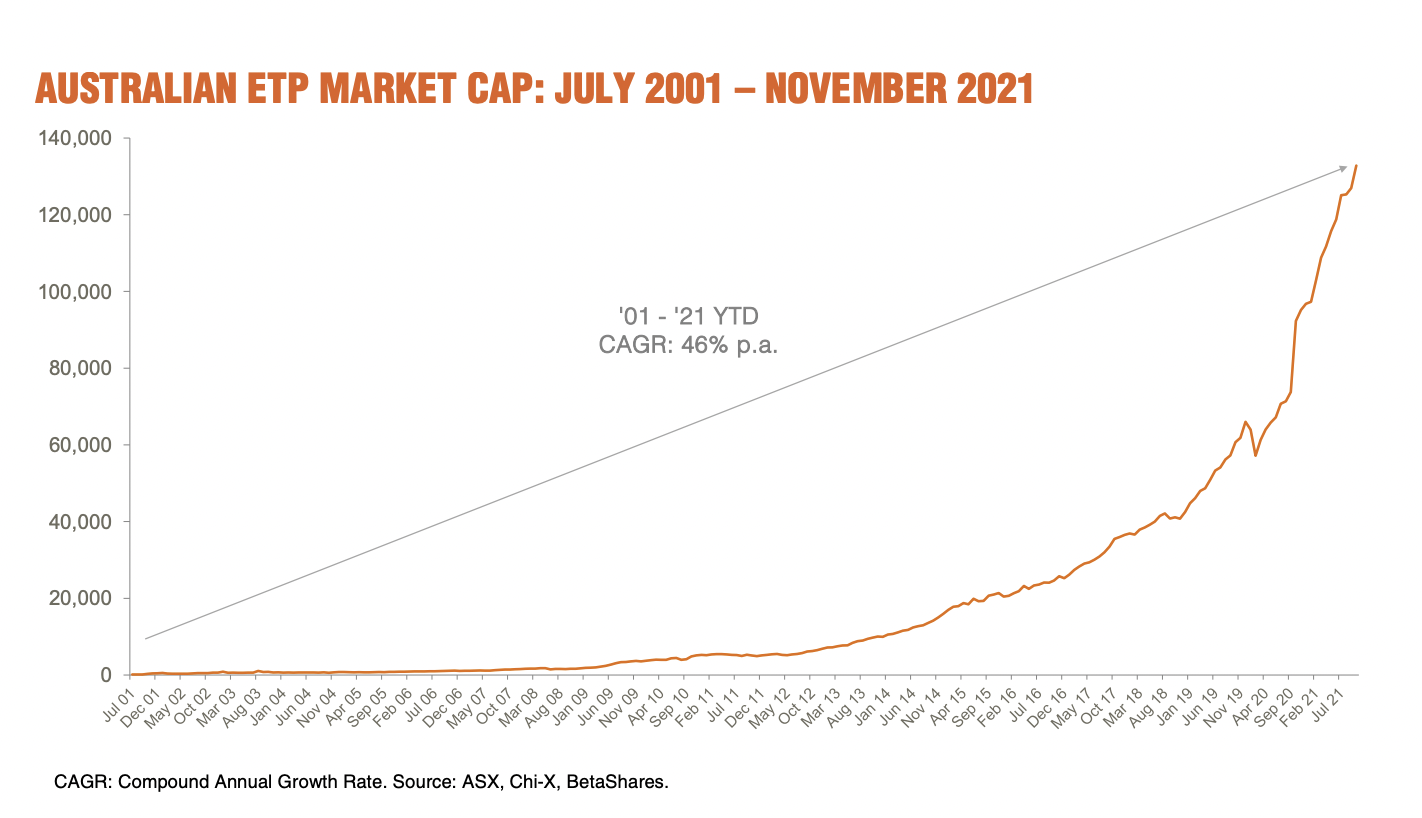

Over the past 12 months, serious money has flowed into Australia's exchange-traded fund industry. In fact, according to ASX and Chi-X data, the market cap of the industry has swelled nearly 44% to $132.8 billion by the end of November.

According to ETFTracker, financials, property and technology-focused ETFs generated the best returns so far in 2021, with the ETFs in each of these categories delivering investors an average total return of 21.46%, 20.67%, and 20.59% respectively.

So in this little article, I thought I would reach out to some of the industry's experts to see what themes they believe will outperform over the months ahead.

Lucky enough, BetaShares' Justin Arzadon, VanEck Australia's Arian Neiron, ETF Securities' Kanish Chugh, State Street Global Advisors' Jonathan Shead and Vanguard's Ian Boater took the bait and shared the theme (and the ETF) they believe is likely to deliver investors outsized returns in 2022.

Theme: Growth of digital assets

ETF: BetaShares Crypto Innovators ETF (ASX: CRYP)

Justin Arzadon, BetaShares

Arzadon believes the most underestimated thematic that could play out in 2022 is in the digital assets space, but not in cryptocurrencies like Bitcoin or Ethereum. Instead, he argues it's the companies that service this ecosystem and allow these cryptocurrencies and other digital assets to enter the mainstream that could benefit.

"While cryptocurrencies have proven themselves to be the best performing asset class over the past 10 years, their success has been accompanied by a very high level of price volatility," he says.

"These two factors have ensured that cryptocurrencies generate daily news headlines, with many investors having strong convictions about the nascent asset class."

Bitcoin and Ethereum are likely here to stay, he says, but there are over 10,000 other cryptocurrencies and it is still uncertain which may have a long-term future.

"Regardless of which ones do, the companies that enable the crypto economy to thrive, such as the exchanges and custodians, crypto miners and asset managers, look to have a strong future ahead of them," Arzadon says.

"So, while cryptocurrencies dominate the headlines, an often-overlooked trade is the globally listed companies that service the digital assets ecosystem."

To play this thematic, Arzadon points to the BetaShares Crypto Innovators ETF (ASX: CRYP), which tracks the Bitwise Crypto Innovators Index (before fees and expenses), developed by Bitwise, one of the largest global crypto-asset managers.

"CRYP does not invest directly in cryptocurrencies and rather takes a 'picks and shovels' approach by offering investors dedicated exposure to the companies at the forefront of the crypto economy, in a familiar, liquid and cost-effective ETF structure," he says.

Currently, CRYP invests in crypto-focused businesses like Silvergate, Galaxy Digital, Marathon Digital, Coinbase and Microstrategy (these are its top five holdings).

"As part of a diversified portfolio, CRYP is a good way for investors to get exposure to the digital assets ecosystem," Arzadon says.

"It may be looked at by investors who are excited about the prospects of the crypto sector but who are not comfortable holding actual cryptocurrency, or for those investors with direct cryptocurrency exposure who are seeking diversification within the broader crypto ecosystem."

Theme: Quality

ETF: VanEck MSCI International Quality ETF (ASX: QUAL)

Arian Neiron, VanEck Australia

Just when we thought we were finally finished with lockdowns, a new COVID variant came to town (literally). Now, with questions hanging over the global recovery, markets have been on edge.

"Until recently, investor mindsets had shifted to a ‘living with COVID’ mentality, supported by abundant stimulus and expectations that vaccines would keep the virus in check," Neiron says.

"Yet, the market reaction to the latest coronavirus variant discovery has left many investors questioning how to position their portfolio going forward."

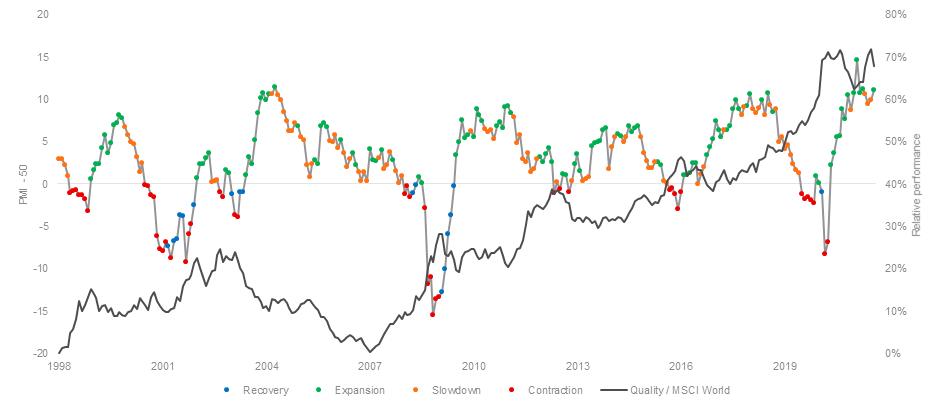

Chart 1 – US ISM Manufacturing PMI Index and MSCI World Quality versus MSCI World performance

.png)

The chart above demonstrates how quality companies typically outperform when manufacturing activity (a proxy for economic activity) decelerates and/or contracts.

"Quality stocks have outperformed over the past six months as US manufacturing activity has slowed and this could potentially continue should more variants emerge," Neiron says.

With this in mind, Neiron points to the VanEck International Quality ETF (ASX: QUAL) as a winner for the year ahead.

"When we launched QUAL it was the first smart beta international equity ETF on the ASX and since that time QUAL has been one of the best performing international equities strategies available to Australian investors," he says.

"We have said for some time that smart beta has the potential to disrupt active management. QUAL is an example of this in practice."

Theme: Semiconductors

ETF: ETFS Semiconductor ETF (ASX: SEMI)

Kanish Chugh, ETF Securities

What do electric cars, cryptocurrency, video games, cloud computing, and clean energy all have in common? The answer, my friends, is semiconductors.

"Often overlooked as nerdy, semiconductors are in the spotlight thanks to an ongoing global shortage," Chugh says.

"The shortage has made PlayStation 5’s impossible to find and turned once-obscure companies like ASML, AMD and Nvidia into household names. Meanwhile, their share prices have soared."

This shortage shows no sign of stopping in 2022, with many industry insiders believing it could last until 2023 or even 2023.

Chugh says this shortage has been caused by a classic supply and demand mismatch.

"Demand for semiconductors has skyrocketed as several megatrends (think electric cars, cryptocurrencies, clean energy and the professionalization of video games) have converged around them all at once," he says.

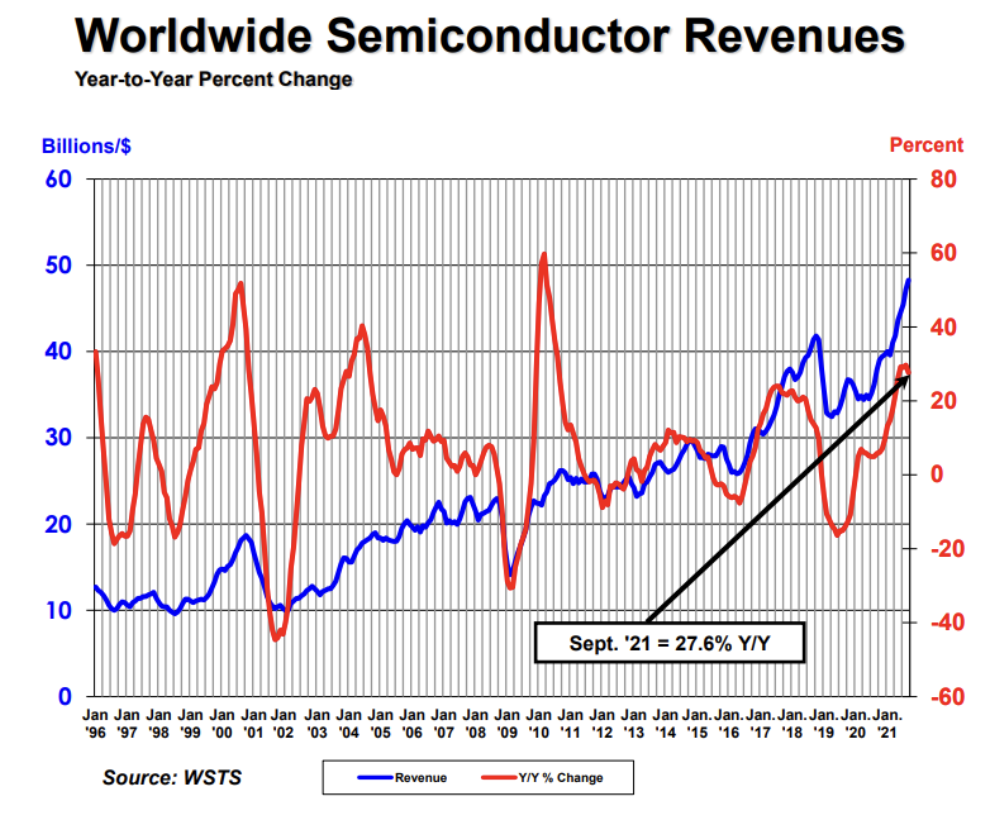

"This has meant global semiconductor sales in September 2021 were $48.3 billion, up 27.6% year-over-year, the latest data release from industry lobby the Semiconductor Industry Association indicates."

Stocks like TSMC have benefited from electric vehicle sales, while companies like Nvidia - which makes specialist chips for crypto mining – has also been a winner, he says. Meantime, clean energy semiconductor play Enphase Energy has also been a major benefactor, and with the video game industry generating more revenue than North American sports and cinema combined, AMD has seen a huge lift in its share price.

"Faced with these megatrends, the supply of semiconductors has been slow to respond," Chugh says.

"Building semiconductor factories is fabulously expensive. It costs billions of dollars to build new factories, and they take several years to complete. Meaning that boosting supply takes years."

The US Senate recently approved vast subsidies to the industry to help it build new factories, Chugh explains, with Intel and TSMC announcing plans to build new factories in the country since.

"For investors wanting access to this promising sector, the ETFS Semiconductor ETF (ASX: SEMI) provides one solution," he says.

"SEMI buys the world’s 30 largest semiconductor businesses, spanning from foundries to designers to equipment makers. It is the only semiconductor ETF listed in Australia."

Theme: ESG investing

ETF: Vanguard Ethically Conscious Australian Shares ETF (ASX: VETH)

Ian Boater, Vanguard

Boater believes that ESG is a trend likely to grow (and endure) well into the future, with products designed with a sustainable investment objective in mind recently receiving significant attention from both retail and institutional investors.

"Perhaps originally spurred on by millennials who prioritised responsible investing alongside financial returns, we’re now seeing investors of all ages turn their focus to investment products that factor in environmental, social and governance considerations, or ones that more closely reflect their values and beliefs," he says.

"As investor demand continues to grow, it’s likely that the number of ESG products issued on the market will too."

These ESG ETFs can be incorporated into a portfolio in many ways, he says, including as a core investment to avoid ESG risk or as a satellite to selectively allocate capital to companies with a higher relative ESG rating.

However, before investing in this trend, Boater recommends investors first school themselves on the different ESG strategies that underpin these products, as no two strategies are created equal.

Boater outlines that the four common approaches to ESG investing are:

- Portfolio screening - selecting investments from a universe of investments that meet specific screening criteria. This can include exclusionary screening (when certain sectors, countries and securities are excluded from an investment universe) or inclusionary screening (when certain sectors, companies or securities are proactively invested in because of their higher ESG rating).

- Impact investing – targeted investing with a dual objective of generating ESG impact with some level of financial return.

- ESG integration – assessing financially material ESG information when conducting research and making investment decisions.

- Active ownership – when active managers use various resources to positively influence corporate behaviour on ESG-related issues.

Boater points to the Vanguard Ethically Conscious Australian Shares ETF (ASX: VETH) as a great "core investment" to play this theme.

"VETH seeks to track the return of the FTSE Australia 300 Choice Index, providing exposure to shares listed on the ASX that are negatively screened for the above business activities while still ensuring broad diversification across industries," he says.

"VETH intends to offer investors the ability to invest according to their values in a low-cost, transparent way, while still achieving their long-term financial goals. When used alongside other ESG ETFs that provide exposure to different asset classes and markets, VETH helps to form a strong and stable investment foundation."

Theme: Quality and Low Volatility

ETF: SPDR MSCI World Quality Mix Fund (ASX: QMIX)

Jonathan Shead, State Street Global Advisors

While equity markets performed strongly in 2021, Shead believes the coming year paints a complex picture as uncertainty grows around the global recovery.

"We continue to favor global developed market equities compared with other asset classes, because they still offer relatively attractive excess returns," he says.

"However, we don’t think the opportunities are consistent across global equity markets, which leads us to three possible themes to pursue in 2022."

Firstly, Shead believes that Quality will surpass Growth as inflationary pressures rise.

"Massive monetary and fiscal stimulus has helped Growth be the clear factor winner since the start of the pandemic, but we believe the baton will now pass to Quality," he says.

Second, he argues that we are likely to see increased volatility over the coming 12 months, and believes that low volatility exposures "make sense" against this backdrop.

"We expect equity markets to rise and fall in response to the ebb and flow of the global pandemic," he says.

"We expect volatility in response to policy signalling from central banks as they try to manage inflation without crushing the recovery."

Shead points to the SPDR MSCI World Quality Mix Fund (ASX: QMIX) as his pick for the year ahead, which provides diversified exposure to Quality, Low Volatility and Value themes.

Never miss an update

Enjoy this wire? Hit the 'like' button to let us know. Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

5 stocks mentioned

5 funds mentioned

3 contributors mentioned