And up through the ground come a bubblin crude

Oil that is, black gold, Texas tea

Oil demand is a key barometer of economic activity, and its price can have significant inflation implications.

Since the end of May, the price of oil has risen by 30% to reach a 10-month high.

It’s the perfect storm. On the supply side, OPEC and Russia have extended production cuts. The Saudi’s (infrastructure projects, check NEOM for example) and the Russians (war) need to maintain higher oil prices.

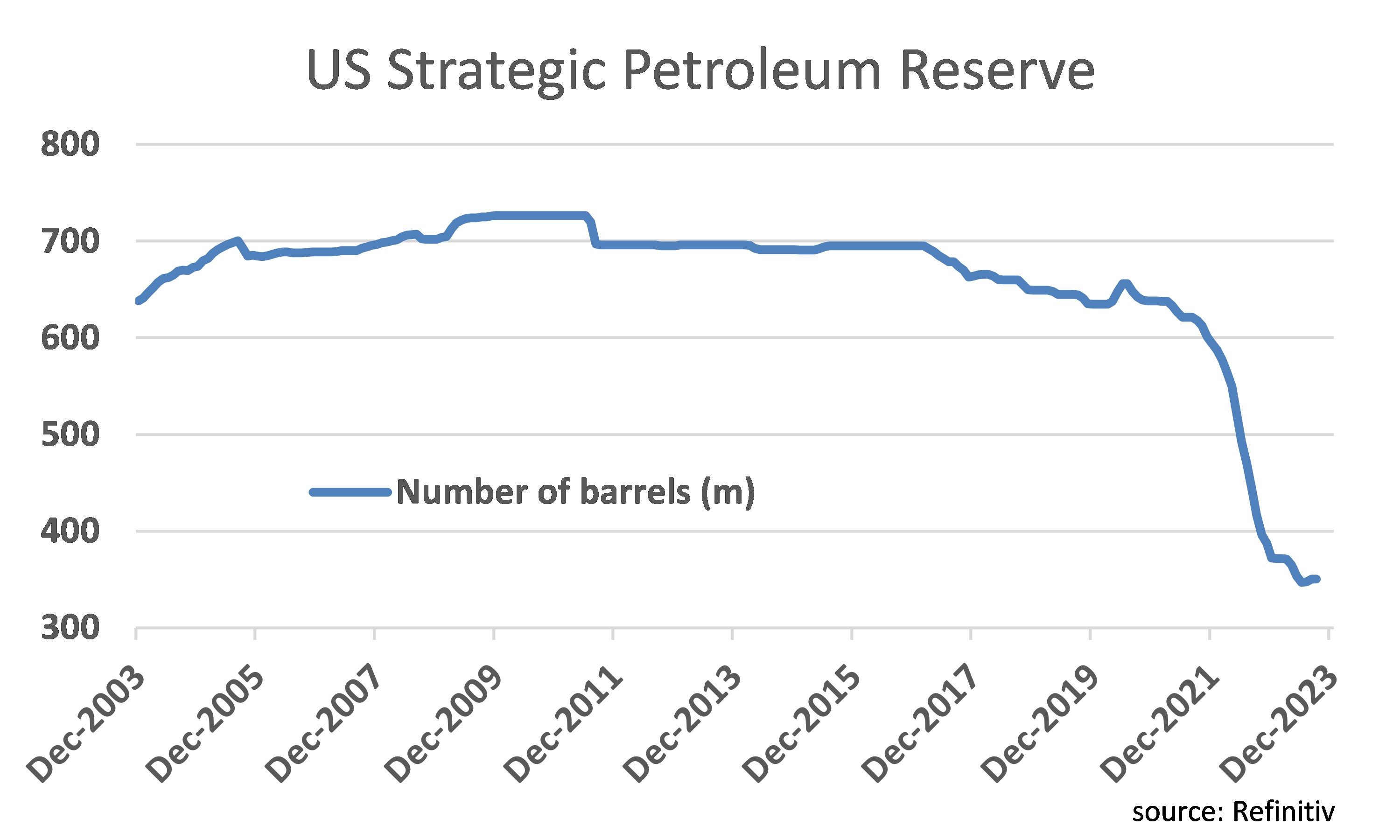

In addition, lack of investment from the major oil companies over the last 5-10 years is now taking effect. Previously, when OPEC cut the USA would plug the hole. This is no longer the case. Instead, Biden elected to deplete the nation’s strategic oil reserves which now needs to be replenished (see chart below).

Predictions of collapsing demand have not eventuated as the global economy remains robust. Any hint of a recovery in China will further stoke demand.

It is what’s happening in places like Germany, which has a green oriented government, that we find most interesting. They are slowly realising that the transition to net zero will take considerably longer and cost considerably more than expected. The economic reality of uncompetitive energy costs is forcing Germany to backpedal on their fossil fuel mix. The economics will get you. It always does. And Germany is not alone. Similar actions are being taken in California and NSW.

The current supply/demand dynamics indicate that oil has further room to run. For consumers, a rising oil price has a similar impact to increasing interest rates.

Is oil going to do the heavy lifting for central banks?

1 topic