9 reasons this selloff has been so fast

Markets have seen one of their sharpest & fastest selloffs in history. FOMO in January has now been replaced by sheer panic - when you are in the eye of the storm it looks bleak.

Only in January we saw FOMO (fear of missing out) as the dominant theme but that has been now replaced by - in just 3 weeks - panic, hysteria and irrationality - now in the front driver’s seat & taking the market on a wild & scary ride - up & down very steep hills. Aust, the US, Europe are all being whacked as we see the Quant Funds suddenly sellers –they were the same guys who were the main buyers just a few weeks ago.

Stocks look terrible– they are spinning out of control – this has gone from being a very nasty correction into a full blown crash - such is the speed & magnitude of the collapse, as we see the virus spreading across the globe leaving governments and medical professionals apparently confused & not sure what they can do contain the spread of the virus & to calm down the hysteria.

Given the 24/7 news cycle now – everyone has numerous news reports – through the day news about the spread increasing & the erratic behaviour with fighting in supermarkets over toilet paper..

So Coronavirus was the Black Swan event #1 - but we were also hit with 2nd Black Swan event - that is what has added to all the uncertainty. Then the Trump travel ban just added another layer to all the markets angst, then other countries have followed.

The second wave of selling hit in response to the Oil price collapsing -35% on Monday a week ago, after Russia & Saudi added fear of debt / credit issues with energy companies & the banks exposures to them – that just accelerated market anxiety at a time when it was already highlighted. This will though only become an issue - if Oil stays down for all of 2020 (as most debt is due in 2022).

So why has this selloff has been so fast

The reason that there is such angst in the markets, is because the speed at which this ‘correction’ (or do we now say bear market) has happened. It is the fastest bear market in history (that's if you consider a -20% is a bear market - more on that another time) and that is fuelled by a range of issue.

The rates on increase across other countries (outside China) are still increasing– so the fear of the unknown is gripping mkts & people.. Italy first Spain & now other European countries going into lock down (and closing their borders) adds to angst. Plus pure uncertainty here in Aust & the US adds to the panic we see every day

There is a fear that we could see a repeat of 2008/ 2009 as panic selling puts untested pressure on these new complex leveraged ETF’s. Then as the market goes lower, there are margin calls (forcing more selling), then the ETF’s need to sell more, moving averages & trend lines all get broken (forcing more selling), then we see that economic activity & earnings are now all going lower (forcing more selling). With all that - hysteria then takes over & more think they also better sell now before it gets really bad.

The joke in ETF’s is that they are meant to be “passive” ok when mkts going up, but as soon as they drop at a rapid rate, the machines switch into sellers – which then can cause more redemption's– which fuels even more selling . As I mentioned the other day 83% of all EFT’s flow recently was selling.

With new real time trading – where you can trade from your phone while sitting at a café or while doing the shopping – means the reactions can be far more immediate to events, as they unfold. Thus when they see the mkt dropping fast they just join in the selling.

The collapse of Oil (Black Swan event #2) added a new dimension & now fears of debt / credit are now being focused on.

Also the complex algorithmic investment strategies that completely fail when things move too rapidly or them to de-risk – adds to the ongoing selling pressure – with all that we have seen the fastest -20% correction ever in US history.

Value at risk (VaR) has been causing selling as those trading desks now manage their risk (better than they did in 2008, where some were wiped out as they did not follow this as they do now) so as mkt falls they need to sell to reduce the risk.. So that too has added to selling as well. VAR is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. VaR is typically used by firms and regulators in the financial industry to gauge the amount of assets needed to cover possible losses. For example, if a portfolio of stocks has a one-day 5% VaR of $1 million, that means that there is a 0.05 probability that the portfolio will fall in value by more than $1 million over a one-day period if there is no trading. Informally, a loss of $1 million or more on this portfolio is expected on 1 day out of 20 days (because of 5% probability).

The risk of a US recession (high), Australian recession (high) & world recession (not likely yet) has added to the fear in mkts. But with these recessions - is we get them - they should be short term if the virus is brought under control. But basically no one has any idea of anything right now -we are in uncharted waters...

Rates cuts don't stop the spread - but will they help?

With the sell-off in equities – that (as it always does) sees money pour into treasuries– which caused bond prices soaring and yields collapsing.

The US 10-year Bond is down to near its lowest yield ever 0.32% TODAY (which is now below the record low of just 0.39% last week)..

We have seen central bank action (RBA, PBOC & Canada last week, NZ & FED again today) – but many fear that it will do little to stop the panic that is coming from fear of the unknown – rates cuts don’t stop the virus spreading.

Australia has launched its massive $17b stimulus (but there will have to be another one in a month or 2) & the US (and China) will also soon have massive stimulus programs that will be unleashed on the economies across the world.

That will cause a huge dilemma for investors

Do they buy knowing that this will eventually help?

Or do they sit back & wait until the all clear siren rings & then buy only after they know it’s safe to go back in?

Problem is that history indicates again & again - that as soon as we think things are under control , markets would have already surged way off their lows.

When that time comes - and it could come at any time - from any trigger - we will see after a savage -33% collapse in the market, an equally astonishing rally - the mother of all rallies

But there are 2 questions that we need to ask .... no one will know the answer to these to until we look back in a (few hopefully) months from now..

When will the market finally exhaust the selling & the overall sheer panic

From what level (is it here or do we drop another -20% before it bottoms out)?

So investors have to decide how bad does this get, does it lead to recession or not?

Rate cuts don't make you feel better.

So for now though –most will say that these rate cuts seen so far do nothing to stop the spread of the virus or address cash flow issues

Many will ask will rate cuts really have any impact right now – those with mortgages may fell a bit better (but those with cash in the bank won't)

But they will turbo charge the rally - when it eventually comes...

What low rates will do is, as soon as the volatility dies & mkts stabilize– is fuel buying of growth stocks

only when rates are going to risev - will it kill the high PE / tech / growth stocks.

But for now they like everything else are swept up with blue chip leaders & good quality stocks in this indiscriminate across the board selling frenzy.

The last time we saw this type of panic was only 14 months ago – when world mkts got pummeled in December 2018.

What we saw then was as mkts fell, the panic set in & as the selling hit– it then precipitated more selling.

With the mkts falling so quickly it created huge waves of margin calls and that generated more selling (as we have seen this time).

Then as we see technical levels broken (like a knife though bitter) that saw more selling.

The absence of any ban on short selling – saw the shorts add to the selling as they heavily shorted many stocks– which then saw others sell them as they wondered why they were being hit so hard & they had better get out.

Then we saw the (now becoming more usual) blow up of a few leveraged complex ETFs – that saw more selling & with all that we saw volatility spike & that creates even more worries.

But as we (now know) markets staged a super charged rally & the US recession that was “defiantly” going to come in 2020 never materialized & world mkts ended up +20% in 2020.

But isn't this is different to the last sell down ...

Now straight away everyone will say – this is different – and yes it is - the factors are completely different –

all major mkt selloff are all different but the way the people react is always the same – human psychology is the same in 2020 as it was in 1988, 1950, 1940, 1900 & even in 1637 (the Tulip mania & collapse).

When sheer fear drives the mkts - they get way oversold & when things look to be at their worst – that is usually when a bottom is found (as mkts look forward).

So right now my head says this looks terrible, there is no way that mkts are going to go up with all this bad news emerging everyday.

There is so much unknown about this virus & the spread that we still have no idea about.

But at the same time all major mkt lows come at the height of uncertainty & when you are right in the eye of the storm & you cannot see any way out for a long time..

It 'feels like" its going a lot lower & when everyone agrees with that - that that is consensus & mkts don't always do what everyone thinks they will.

This is not a long term problem - it's a short (medium?) term massive disruption - it will eventually pass

There is an assumption, that I believe, that is that there is limited long-term impact– there will be massive short term disruptions & maybe even perceived mayhem when it is at its peak – but when you look back at this in a year you will realize that the real impact may have been very very hard at the height of this crisis – but in the long term it will be merely a blip.

It sounds impossible right now as the world is caving in - but this is not the first crisis the world has faced. In the next few days I'll explain what I mean by that..

Unless you really think that a very bad US or world recession will evenuate (which it could if things just get worse & we all don't recover as they already have in China) -then just stay away ....

If you are buying stocks here then you know that with all the volatility anything can move up or down 20% very quickly - so you have to know you are buying for the long term. So yes I may be 100% wrong in buying stocks here myself right now & stocks go a lot lower.

But I’m relaxed with that because I do know that almost all of these stocks I bought will be - in a worst case scenario - a lot higher in the next 2 or 3 years.

It’s like when people bought A2Milk {14.39 -1.32 -8.40%} a few years ago – many said the whole time they were the biggest sell as PE was too high – but anyone who bought back then & is still holding probably cannot remember the exact price they bought at was it $2 or$3. That will be the same for many stocks we are seeing that have been smashed right now.

For long term investors we all know you never buy at the bottom & so those who are concerned should at a minimum be slowly dollar cost averaging. One thing I would not be doing is buying anything here on margin leverage - if you can't handle another -20% down (which we know could easily happen) then stay away..

Now there are 3 ways this can go –

Scenario 1: the cases slow across the globe or a vaccine is found (there are many working on that right now & if just 1 makes a break through - just watch markets move then) – so on that scenario the mkt rallies back very hard - that looks like its not going to happen soon (but it is in China).

Scenario 2 this goes on & on & disrupts global supply, travel, airlines & causes business with too much debt & now reduced cash flows to go bust - but with Govt stimulus & as less people get it - & things get back to normal in a month or 2 & thus doesn't smash the economy .. If that's the case then any further downside would be limited from here.

Scenario 3 this goes on & on all year & disrupts global supply, travel, airlines & causes business with too much debt & now reduced cash flows to go bust & we end up with a global recession. In that case mkt goes down another -10% to -30%, if it got really really bad.

So you pick..

Back in 2008 I bought some stocks BEFORE Lehman's collapse & mkt fell another -20%

Buying for the long term in a crisis

Back in September 2008 – mkts look awful with US &Australia mkts down -35% – but this was before Lehman’s went bust & the mkts all dropped another -20% to take mkts at their lows to down -55%.

I had been sitting all year & waiting for when I thought the mkt would be at its worst & in Sept 2008 – I thought that time wasthen.

So 1 bought 3 US stocks(A$ was 83.47c)

Google, Disney & Goldman Sachs

The prices I paid on 26th Sept 2008

Google US$455

Disney US$32.69

Goldman Sachs US$136

After Lehman’s collapsed US mkt dropped another -20% -

The 3 stocks were trading at

Google US$288 (in March 2009 – but did go as low as $246 in Nov 2008)

Disney US$15.32(in March 2009)

Goldman Sachs US$73 (in March 2009)

So at those prices I was being smashed, I was down

Google -36%

Disney -65%

Goldman Sachs -46%

Yes I was – but only if I sold them.

So I bought too early – yes – but I was set & as it was along term investment.

We now know March 2009 was when the bull mkt started

Later on in early March 2009 everything was so bad & so many indicators (to me) indicated the worst (point of maximum pain) had to be close – everyone had given up & at that time almost everyone was still so very bearish & convinced it was going a lot lower (-55% to me was about as bad as it could get I thought plus – we had from just Jan highs to early March dropped -18.2%, as we re-tested the Nov lows).

Many thought mkt was stuffed & when myself & just 1 colleague on the desk (lets call him Preston) went & bought beaten up (Aussie) stocks in early March 2008 – many on the desk at GS who I worked with, thought it was the dumbest things they had seen – was I not aware of all the problems in the world & mkts were still stuffed. Things were without doubt very bleak at the time. But I had a long term view that even if mkt got hammered again these were great long term prices for good quality companies

Back then we saw the initial lows in November 2008 were re-tested in March 2009 & after they held the bull mkt was off and running.

But no one knew it was the start of the new bull mkt until years later when we all looked back.

Still many did not buy stocks all through 2009 & thought that it was simply a “bear market rally”& they were not going to be sucked in.

So when did these stocks get back to the prices I paid for them?

Google US$455 by July 2009 – 10 months later

Disney US$32.69 by December 2009 – 15 months later

Goldman SachsUS$136 by May 2009 – 8 months later.

Most importantly I did not sell any of them..

So I still have them and from the buy price they are all now (with $A at 61.6c) even after US mkt has just collapsed -20%...

Google despite at once stage being down -36%, they are now up +637%

Disney despite at once stage being down -65%, they are now up +324%

Goldman Sachs despite at once stage being down -46%, they are now up +75% (has been the worst performer).

Long term buying (and not on leverage) means you can weather the storm that is raging around you

Ok had I waited until things got really bad I would have obviously have done a lot better.

But at the same time when it was in free fall back in early 2009 it would have been even harder to buy - we all thought the world was completely stuffed - it looked like there was just no way out at that time.

So I am always happy getting set on the way down – ok it won’t be the bottom, but when the V recovery comes – as it does every time – eventually – I’m set & don’t then have to then panic buy – or miss it as it rallies back.

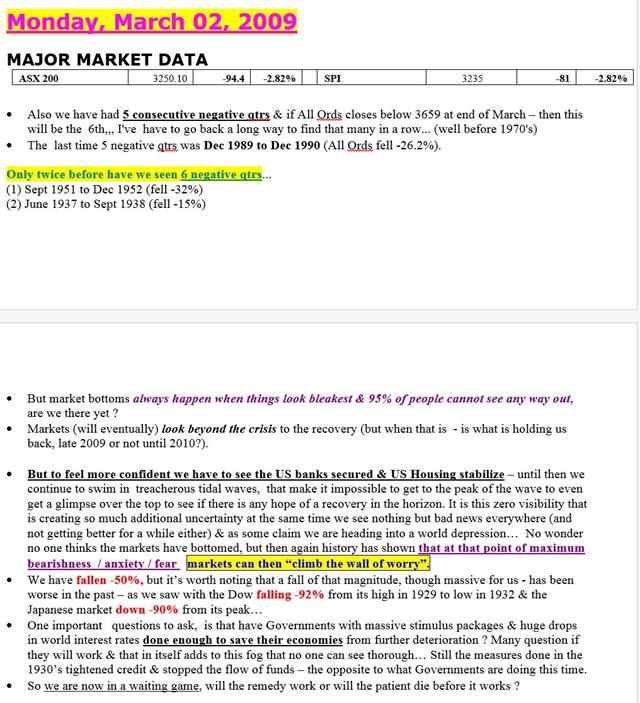

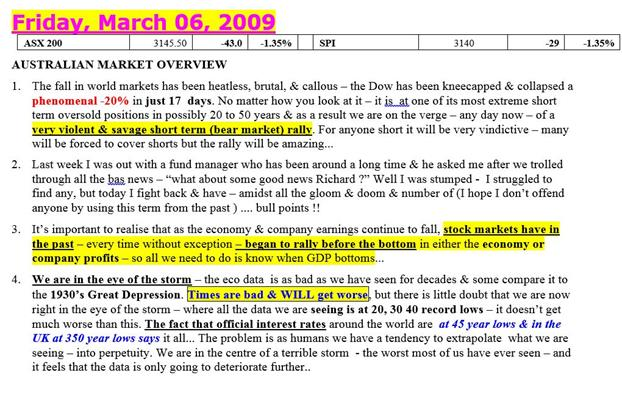

These are 2 of my reports when at GS back in early March 2009

These are from 11 years ago to show what it was like at the time as we were right on the bottom and the seeds of a bull market were actually being laid right then...

--

Get more insights from the insto desk in the Coppo report

This article is an excerpt from The Coppo Report contributed to Livewire by Richard Coppleson, Director - Institutional Sales and Trading, Bell Potter. You can find out more by clicking here.

You can also stay up to date with the latest news from me by hitting the 'follow' button below and you'll be notified every time I post a wire.

2 topics