A 112-year-old e-commerce champion

Founded in Paris in 1909, L’Oreal is the world’s largest beauty company. Don’t let its age fool you – L’Oreal is a force to be reckoned with in e-commerce, where it’s outrunning its younger peers and has accelerated its lead over the last year. What are the secrets to this success?

A digital winner

The beauty market has rapidly shifted online in recent years, a trend that naturally has been accelerated by the COVID-19 pandemic. E-commerce accounts for roughly 26% of L’Oreal’s sales today and the company expects this proportion to double in the coming years. L’Oreal has a higher share of the beauty market online than offline, so it is a clear beneficiary of the shift to e-commerce. Moreover, its e-commerce market share is rising. In 2019 its online sales rose 52%, 2x the rate of the market, while last year its online sales rose 62% in an online beauty market which grew 40%.

In 2014 L'Oreal launched Makeup Genius, a mobile app that uses augmented reality and artificial intelligence to allow users to 'virtually' apply make-up products to a digital image of themselves. A few years later they acquired Modiface, the Canadian company whose technology powers the app. Modiface has been renowned for its ease of use and its accuracy and reliability in measuring skin tones, which improves over time with advancements in smartphone camera and image processing power. L’Oreal’s market leadership and trusted brand have enabled the wide acceptance and adoption of this technology, and it has been a key contributor to their success in digital. Modiface is even being used by Amazon to power virtual "try-ons" in their beauty category.

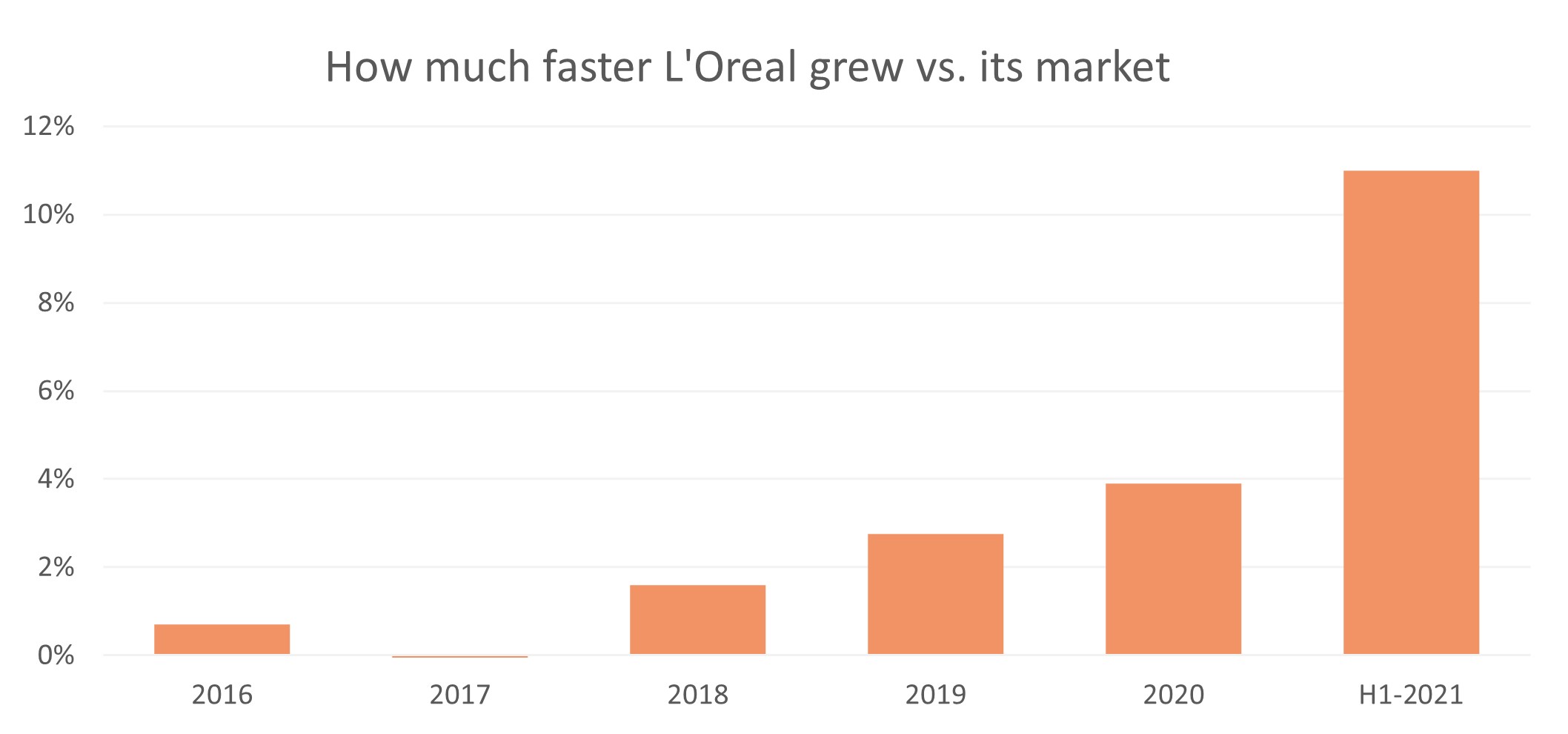

L'Oreal has a long history of growing sales faster than the global beauty market. Helped by its e-commerce prowess, L’Oreal’s market share is rising at an accelerating rate. After outperforming its market by 4% in 2020, the company's best result in over three decades, L'Oreal's sales growth in H1 of 2021 exceeded its peer average by a stunning 11% , as shown below.

Below I look at some of the factors that have made L’Oreal a digital winner.

Early and committed

L’Oréal has benefited enormously from the accelerated shift to e-commerce, partly because it committed, and it committed early. Eleven years ago, its CEO declared 2010 the ‘Year of Digital’. Early last year, the CEO said:

‘If you ask any manager at L’Oréal, wherever he or she is in the world, what their #1 priority is, he or she would tell you e-commerce. We have given the instruction to consider e-commerce, even in countries where it’s still small, not as the cherry on the cake but as the new cake.’

Digital favours the biggest brands

The move to e-commerce would, on the surface, seem to lower the barriers to entry for new brands. It’s relatively easy to create a product, outsource the manufacturing, build an online following and have it distributed via Amazon or T-mall. In reality, digital communication and e-commerce have proven to further amplify the big, global consumer brands, provided they are supported with innovation and advertising, at which L’Oreal excels. L’Oreal has a 12% share of the global beauty market by sales, but more than 25% share of the beauty traffic on YouTube, with 7.4 billion views last year.

If a consumer is searching on Google or Amazon for beauty products, they will rarely scroll past page 3. All the action is on pages 1–2, which is where the largest brands are. Furthermore, the search and e-commerce algorithms are friends of the big brands. Google’s ranking algorithm factors in the likelihood that someone will click on the ad. This means L’Oreal receives much better placement on Google search per dollar of advertising it spends than is the case for independent brands. Many of L’Oreal’s fastest-growing brands in recent years have been its largest brands.

As is well documented, consumers get overwhelmed by choice, so they naturally gravitate to brands they know. There is much more choice online than in stores, so this ‘paradox of choice’ effect is strongest online, amplifying the benefit that big brands get in the online world.

An industry participant informed us that over the period 2016 to 2018, around 2,000 new make-up brands were launched in the UK. Yet, at the end of these two years, only five of them had revenue of more than £500,000 (let alone profits!). So, digital may well have lowered the barriers to entry online, but it has also raised the barriers to success.

L’Oreal has embraced digital/social media as a communication and engagement tool as forcefully as it has embraced e-commerce as a sales channel. Digital accounted for 72% of L’Oreal’s advertising spend in the first half of 2021, about double what it was just a few years ago.

A winning business made stronger by digital

To find an e-commerce winner you don’t need to own an unprofitable or unproven company. L’Oreal’s strong global brands and an early commitment to e-commerce have made it a digital winner, driving rapid market share gains. In the Aoris International Fund we own a 15-stock portfolio of winning businesses, like L’Oreal. You can find out more about our portfolio and our distinctive investment approach on our website.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics