A growing, profitable and undervalued tech stock

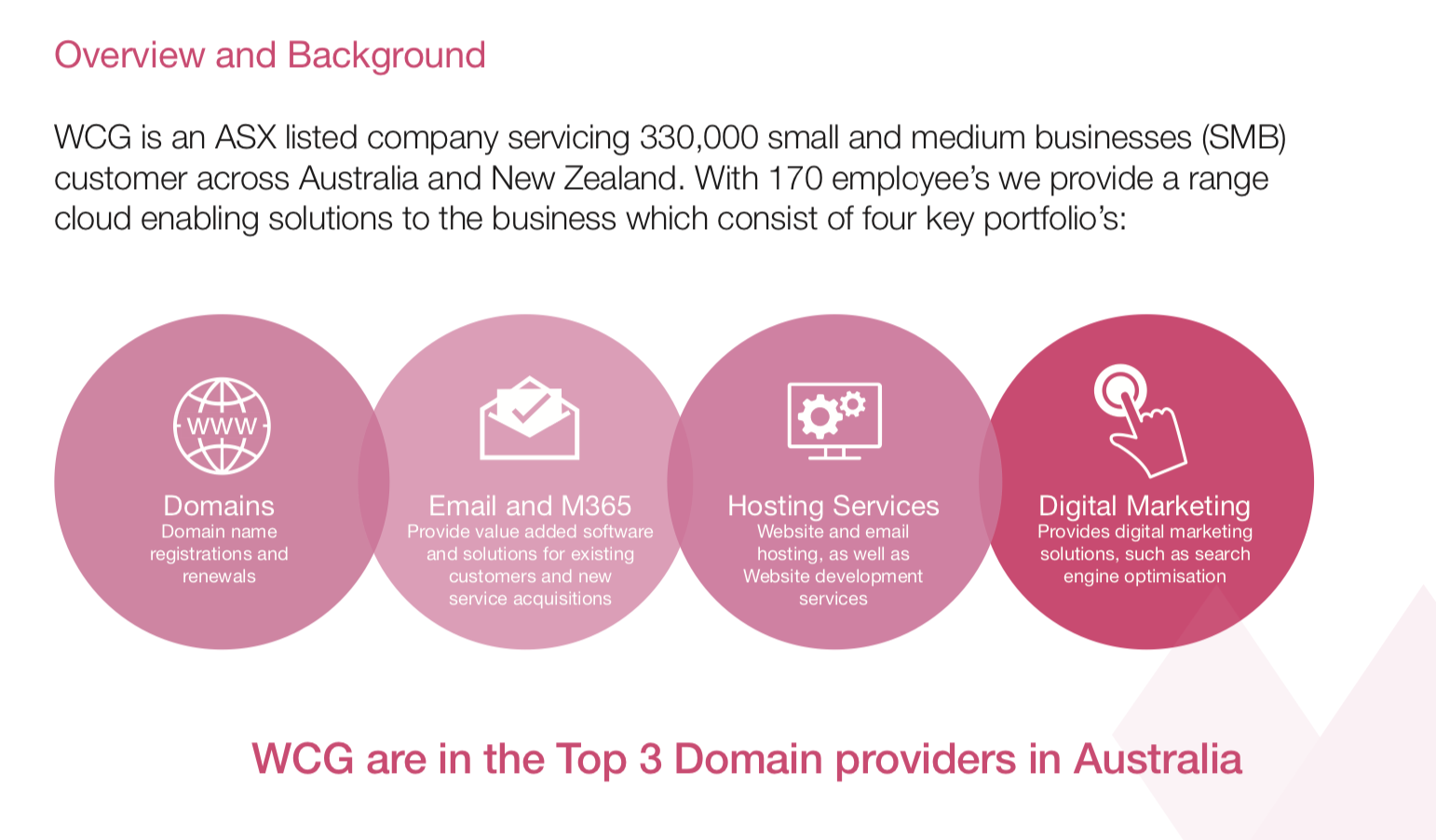

WebCentral (ASX:WCG) is one of the leading providers of domain names and hosting services in the Australian and New Zealand market, with 330k SMB customers across four brands.

Market observers will know of WCG from when it was called MelbourneIT. That company pioneered the .com.au market in Australia, flew high during the tech-boom and then used the massive cash flows from the core business to leverage up and go on an acquisition spree.

That strategy eventually came unstuck and a process of divestments and restructurings occurred over many years, until the company was left with just its core domain and hosting businesses. They changed the name to Arq Group and then finally, to WebCentral.

The core domain and hosting business, at its heart, is a good one. $60m+ of largely recurring revenue, strong margins, capital light, spits off $10m+ of free cash flow, able to be run with a bare-bones cost base and the cross-sell opportunity to the 330k+ domain customers is significant.

It is the type of business that in today’s market will warrant a lofty earnings multiple.

At $10m+ of EBITDA it also has sufficient scale to attract larger fund managers. Given the telco sector trades on 16x EBITDA, and tech peers trade well north of that, there is no reason WCG can’t trade on c.20x, rather than the 9-11x it trades on today.

Why is the stock so cheap? It only just emerged from a bidding war and a complex transaction, with new management significantly improving the performance of the business.

Late last year, the company was still saddled with debt and the ‘for sale’ sign was put up by the previous board.

That attracted the attention of two bidders that saw the quality of the assets and the massive mis-pricing.

A Complex & Misunderstood Deal

The bidding war kicked off with Web.com, a large domain and hosting business backed by a New York private equity firm, launching a 10c all-cash bid. WCG was now ‘in-play’ and there were a number of other potential acquirers.

The first point worth noting was how leveraged WCG was to an aggressive bidding war. With $46m of debt at the time the first bid at 10c valued the equity at just $12m, for EV of $58m.

For example, a bidder could increase their total outlay (Enterprise Value) by just 5%, but the increase to the equity (share price) would be 24%. There were plenty of potential bidders. It was the perfect set up.

Then 5G Networks made an all-scrip bid. This was interesting to us as we knew of 5GN and had seen them turnaround other businesses before. We knew they were capable of turning around WCG and there were ample synergies between the two companies.

Web.com were offering all cash and 5GN all scrip. By definition, cash is worth more than scrip due to the certainty it offers and Web.com had the balance sheet to really blow 5GN out of the water.

But 5GN played it well by securing a 10% stake in WCG when they launched their bid, which worked as a blocking stake to any competing bid. Web.com went from offering 10c to 15.5c to 18c, and yet the previous WCG board still opted for 5GN’s all scrip deal because of the blocking stake.

Another reason the previous WCG board opted for 5GN’s offer was that with an all-scrip bid, shareholders would have the option to participate in the upside should WCG be successfully turned around. Given how significantly both offers undervalued the company, this made sense.

Despite the above, I was near certain that Web.com would come back once more at 20c+ to out-muscle 5GN. But, for whatever reason, they didn’t.

Given that we were expecting Web.com to come back with a higher offer and that 5GN’s offer still significantly undervalued the business, we decided to not accept it.

Another large shareholder at the time took the same view, and given we owned >10% combined, we knew it would stay listed (it prevented 5GN from getting to 90% where it could have compulsorily acquired the remaining shares).

5GN went on to take board & management control and, as expected, the stock started to rally almost as soon as the offer period closed reflecting the fact that 1) new management could fix the company, with some very low hanging fruit in front of them and 2) the debt issue, which was the main reason the stock was so depressed, had effectively been removed.

But one very important point that the market has missed is the alignment of incentives from the incoming board and management with minority WCG shareholders post the offer closing.

The key personnel from 5GN joining the WCG board took stock in WCG. They are now substantial shareholders in the company and have their own incentives aligned with minority holders.

The usual situation when a bidder fails to get to 100% of a target is that the now controlling shareholder is incentivized to keep the share price low, eventually mopping up minorities until they can compulsorily acquire the rest.

This situation is very different. The MD, Joe Demase, owns 15% of 5GN and 10% of WCG personally. He’s taking no cash salary in WCG. His WCG options vest on hitting $10m of annualized EBITDA in that company. He bought another $100k of stock on-market earlier this month.

In this case, the major shareholders are well aligned with minority shareholders.

From there we’re able to invest in the business by backing the new management team to 1) fix the excessive cost base, which is well progressed and 2) transition it to an organic and inorganic growth story.

First Stage – Fix The Cost Base

In February WCG told the market they were run-rating at $7-8m of annualized EBITDA already and that by March (i.e now), as a result of exiting a very expensive (c.$2m per annum) office lease, free cash flow would lift to $10-$12m per annum.

On face value this looks like a massive turnaround, and in some respect it is. But it’s actually the result of some fairly low hanging fruit and I think still has more to go.

For example, analysts at Bell Potter had WCG doing $10m of EBITDA in a ‘normal year’ even before these substantial cost outs. During the bid period WCG was hit not only by its inability to right-size the cost base, but the difficult operating conditions during COVID lockdowns, primarily for its digital marketing business.

Both of those issues have now reversed and are trending higher, with the company saying they expect all operating divisions to grow.

There have been redundancies, consolidation of suppliers, exiting of un-needed office space (both from downsizing and WFH), better terms with 5GN as a key supplier (public cloud, network and DC spend) and removal of advisory & consulting fees.

So, we now have a business run-rating at around $60m of revenue and doing $10-$12m of free cash flow per annum. There is still further cost-outs to come, but the big wins have been been made, and the stock looks cheap as a result, with an EV of $110m.

The next step is transitioning to a growth story, as that is what will push the stock well north of $1, but first they need to resolve the debt.

Resolving The Debt

As part of the all-scrip bid 5GN paid back the $46m of debt to WCG’s bankers and assumed it themselves. That has since been reduced down to $40m of net debt, or 3-4x free cash flow.

Now, the debt is owned by the controlling shareholder and we’ve already pointed out that the key people involved have an incentive for the WCG share price to trade higher, so we don’t need to worry about 5GN calling in the debt, diluting minority shareholders or anything along those lines.

But, 3-4x leverage is still too high, even for a highly cash generative business like this. Further, there’s a perception issue as people who don’t do the work on the company will take it at face value and assume that 5GN owning the debt is likely to be bad for minority shareholders.

So, it needs to be fixed. Here are the ways we think it might play out:

1) Capital raise/external bank funding – Given WCG is now spitting off cash it can support some debt so there would be no need for a large raise, but a modest cash injection (up to $10m) would accelerate the debt reduction process and help re-rate the share price. There is also the prospect to replace some of 5GN’s debt with traditional bank funding to reduce the need to raise equity capital. A combination of these two options would be good for the stock and help it trade at least on a market multiple.

2) 5GN/WCG merger – This would make a lot of sense. The combined group would be doing $25m+ EBITDA and become a mid-cap domain, telco & data centre play, attracting larger capital flows and trading on a higher multiple. 5GN already have 45% of WCG directly and could launch an all scrip bid. If it went ahead with this structure, 5GN would also be a strong buy. As a large shareholder, assuming terms are favourable, we would be highly supportive of this.

3) Pay down debt with free cash – The company has flagged to the market they expect to repay the $40m of debt so that much is clear. But the important point is that it is not urgent. With $10-$12m of free cashflow, if the capital market options listed here weren’t favourable for whatever reason, they could simply repay the debt organically over time. In the meantime, as operating performance improves and debt is reduced, the stock should continue to trend higher.

4) Debt to equity conversion – This would require shareholder approval. As a large shareholder, we would only approve it if it was accretive to minority shareholders. It would result in 5GN’s shareholding increasing, making an eventual bid/merger more likely, and the market would probably price that in ahead of time, helping to re-rate the stock.

5) Combination of some/all of the above.

Once the debt issue is resolved, I’d expect the stock to start trading at least in line with the telco sector (16x EV/EBITDA) as a first target, or 72-85c.

But fixing the balance sheet also means the company can start to acquire, so there is significant upside to those numbers both from an earnings and a multiple perspective.

And then there is a nice industry tailwind that kicks in from FY22.

Next Stage – Growth Story

In July 2021, AuDA (which administers .au domain names in Australia) will release the .au extension. For example, if you own the .com.au domain name for your business you will now be able to buy the same for .au.

You’ll have 6 months to buy it off your existing supplier, which is done so that others can’t come in and buy it first, then try to sell it back to you at some exorbitant price. This is unfortunately quite a common practice.

If you think from the perspective of a business owner, the logical decision is to just buy the domain in order to protect your brand. The risk is that someone else buys it and either you have confused customers sent to the wrong website, or a fight on your hands. It’s a small outlay each year for this security and peace of mind.

In the UK when they released .uk domains the industry grew revenues by 20-30%, which is the reason that WCG have given early guidance around why they expect domain registrations to rise by a similar amount on the release of .au domains. .uk domains have since become the dominant extension and I would think that in a few years the same will happen here.

The new rules launch from 12th April and WCG will be able to begin pre-selling domain names at this point.

Whilst it’s a one-off boost to revenue, it’ll be recurring every year as domains need to be renewed. It also kicks in at the very start of FY22, which is nice from a timing perspective for the financial markets.

Domains are typically the pull through for other WCG services too. You buy a domain, then hosting, emails, security, online marketing, etc. so the other parts of the WCG business should benefit, but to what extent is difficult to measure.

Gross margins in the domain business for WCG are >40%. A 20-30% lift in domain revenues would be $4-$7m of incremental revenue and $1.6-$3m of gross profit, all of which would drop to EBITDA given the cost of acquisition for this up-sell is minimal.

So, it is a sustainable lift in EBITDA of up to 30% as a result of the .au release (assuming EBITDA is $10m annualized today), before any benefit in the other business divisions. The growth should drive the earnings multiple higher too. As the market figures this out it should help drive the stock as it is a catalyst that could drive a material increase in the value of the business.

The next part of the growth story is acquisitions.

With $12m+ of free cash flow per annum from FY22, a rising share price and a stronger balance sheet, WCG has a good platform from which to acquire. They can either continue to consolidate the domain and hosting businesses in Australia and New Zealand or buy businesses that can cross-sell to the 330k customer base.

It becomes another roll-up play, and those trade a lot higher than c.10x EBITDA.

Sentiment Shift is the Catalyst

Sentiment shifts can be very powerful catalysts. What I think will happen here is that the market will go from viewing WCG as a cash cow to a growing, highly recurring tech business that is making acquisitions.

As we’ve seen, businesses like that don’t trade on 8-10x EBITDA multiples, they are more like 20-30x in this market. Many are higher still. Even the telcos, which are typically lower growth profile, trade on 16x as a sector.

WCG is trading on 9-11x today assuming $10-$12m of annual free cash flow or cash EBITDA. There’s a clear path for it to be generating closer to $15m of free cash flow within 12 months from further costs outs, the auDA release of .au and growth returning to each business division. Acquisitions will likely bolster earnings further from FY22.

With a clean balance sheet, sticky/recurring revenues, strong cash flows, growing top line and an appetite for acquisitions I’d argue WCG deserves 20x EBITDA. That would put the stock above $1.

2 topics

2 stocks mentioned