AOA

Ausmon Resources Ltd

ASX:AOA

Followed by 36 people

KLR

Kaili Resources Ltd

ASX:KLR

Followed by 4 people

Livewire Markets

AOA

Ausmon Resources Ltd

ASX:AOA

Followed by 36 people

KLR

Kaili Resources Ltd

ASX:KLR

Followed by 4 people

Livewire Markets

Advertisement

WAM

WAM Capital Ltd

ASX:WAM

Followed by 285 people

WMI

Wam Microcap Ltd

ASX:WMI

Followed by 102 people

Wilson Asset Management

PPE

Peoplein Ltd

ASX:PPE

Followed by 65 people

PSQ

Pacific Smiles Group Ltd

ASX:PSQ

Followed by 24 people

QVG Capital

CMP

Compumedics Ltd

ASX:CMP

Followed by 18 people

Merewether Capital

SPZ

Smart Parking Ltd

ASX:SPZ

Followed by 26 people

Merewether Capital

MAD

Mader Group Ltd

ASX:MAD

Followed by 59 people

MHJ

Michael Hill International Ltd

ASX:MHJ

Followed by 26 people

NZM

NZME Ltd

ASX:NZM

Followed by 11 people

HIT

Hitech Group Australia Ltd

ASX:HIT

Followed by 11 people

HUB

HUB24 Ltd

ASX:HUB

Followed by 115 people

PIQ

Proteomics International Laboratories Ltd

ASX:PIQ

Followed by 16 people

Equitable Investors

5GN

5G Networks Ltd

ASX:5GN

Followed by 782 people

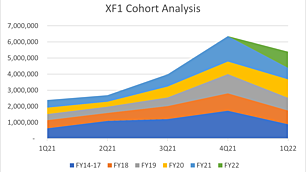

WCG

Webcentral Ltd

ASX:WCG

Followed by 48 people

HD Capital Partners

ACQ

Acorn Capital Investment Fund Ltd

ASX:ACQ

Followed by 141 people

FOR

Forager Australian Shares Fund

ASX:FOR

Followed by 22 people

GC1

Glennon Small Companies Ltd

ASX:GC1

Followed by 5 people

Coffee Microcaps

1-20 of 84

.jpg)

.png)