How to assess micro-cap volatility

Nick Maggiulli, from personal wealth blog Of Dollars & Data, recently conducted some excellent analysis from on how crazy March 2020 was for the Dow Jones Industrial Average. Following on from this, I decided to take Nick’s methodology and see what it would reveal about the S&P/ASX Emerging Companies Index (ASX: XEC) for 2020.

The methodology allows us to look at the index’s volatility by using the cumulative absolute percentage change in the S&P/ASX Emerging Companies Index daily returns when grouped into various times periods. Thus, if the index returned +1% on day 1, +3% on day 2, - 1% on day 3, then over the three days the index has travelled 5% in absolute terms. By taking these absolute daily index moves both backwards and forwards it gives us the cumulative absolute percentage change or distance travelled by the index for a period.

I decided to look at the cumulative absolute percentage change of all the daily index returns

over the course of a calendar year, quarter and month to see what it would reveal about ASX

micro-cap volatility over recent times and how this compared to historical periods. The

S&P/ASX Emerging Companies Index goes back to Jan 1, 2004, so I have just over 17 years of returns and 4,341 individual daily return observations in my analysis.

The first thing we can see is that the distance travelled for 2020 was the furthest on record since the index started 17 years ago. It was also one of only two times the index has surpassed travelling over 300% in the year, with the last time being 2008 in the depths of the GFC. The mean and median distance travelled in a normal year are 195% and 171% respectively. 2020 is almost double the distance travelled in a normal year.

Secondly, when we drill down into quarterly distance travelled, we can immediately see that Q120 was an only shade behind the 139% recorded Q308, during the height of the GFC. The distance travelled of 137% in March 2020 is far above the mean and median quarterly distance travelled of 48.8% and 41.8% respectively in a normal quarter. Furthermore, I note that Q120 and Q308 are the only two quarters where the distance travelled reached triple digits. Just two quarters out of a sample size of 68 quarters tells us that the March 2020 quarter was indeed exceptional even if it missed out being a record-breaker by a whisker.

Thirdly, as can be easily seen from Chart 3 (above), the monthly distance travelled in March 2020 was a record-breaker and by some distance! It was 99.54% to be precise, but I rounded up to 100 for the chart to give it some added emphasis. This result is way above the next closet month of October 2008, which recorded a distance travelled of 73.68%. March 2020 is 35.1% ahead of next closet observation. So, if you thought March 2020 was a volatile month for ASX micro-caps, it was. March 2020 was the most volatile month in the last 17 years/204 months at least, and way ahead of any month seen during the GFC. For some additional context, the monthly mean and median distances travelled are 16.3% and 13.40% respectively. In terms of a standard bell curve distribution, we are well out on the tail end in terms of distance travelled in March 2020.

Outside of the volatility experienced intra-month for March 2020, the absolute return for the

S&P/ASX Emerging Companies Index for March 2020 was -31.05% also a record in its own

right. The March 2020 return surpassed the -28.55% absolute index return experienced in

October 2008. This was then followed up by the index recording its best ever monthly return

when it returned 25.79% in April 2020. That’s right, the worst ever month for the index what

subsequently followed by the best ever month for the index.

Daily

I didn’t produce a daily chart as it would have been impossible to visually make sense of it given the high number of observations. However, I did manage to pull some interesting points of the data.

The most striking thing about the above table is that five, or 50%, of the worst days for the

S&P/ASX Emerging Companies Index came in March 2020 alone. These five days are drawn out of a total sample size of 4,341 daily returns, and they all came in March 2020.

Indeed, to underscore the size of the moves and volatility seen in March 2020, if we divide the

distance travelled for the month of 99.54% and then divided this by the 22 trading days in

March 2020 you get an average distance travelled in March 2020 of 4.52%.

Conversely, the above table highlights the equally astonishing fact that three of the five best micro-caps for the S&P/ASX Emerging Companies Index in 2020, came from March 2020 alone. Amazingly, the best daily return for the index ever (+7.43%) was recorded in March, when the index was down by 31.05% for the month. Volatility and whipsaw markets anyone?

The Z-Score (or standard score) is used in statistics to determine the value’s relationship to the mean of a set of numbers. The Z-Score is measured in terms of standard deviations from the mean. If a Z-score is 0, it indicates that the value is identical to the mean. For example, the mean is two, and the value is also two; thus, the Z-Score is 0. I won’t get into the nitty-gritty of the calculation here but suffice to say a Z-Score of +2.0/-2.0 (i.e. two standard deviations above/below the mean) would indicate a value well outside of the norm. Z-Scores of +/-6 and above are recorded on multiple March daily positive and negative returns, as noted in the preceding daily returns tables. These Z-Scores give you some additional indication of just how far away from normality these moves were compared to the general daily returns ASX micro-cap investors have experienced in the last 17 years.

International Comparisons

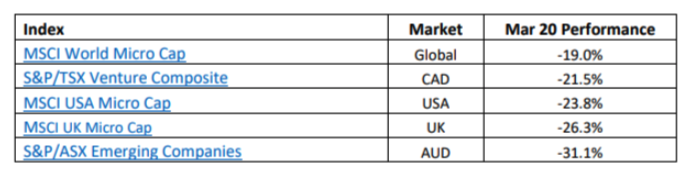

Now, most people will say yes, but equity markets were terrible in March 2020 globally as everything got smashed, so the ASX micro-cap market was no different. Looking at the local price returns of some other micro-cap indices, we can see again that Australian micro-cap investors probably felt more pain than most.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics