AND

Ansarada Group Ltd

ASX:AND

Followed by 50 people

ASX

ASX Ltd

ASX:ASX

Followed by 3077 people

EVO

Embark Early Education Ltd

ASX:EVO

Followed by 8 people

Wilson Asset Management

PLS

Pilbara Minerals Ltd

ASX:PLS

Followed by 932 people

PME

Pro Medicus Ltd

ASX:PME

Followed by 334 people

Livewire Markets

Advertisement

WCG

Webcentral Ltd

ASX:WCG

Followed by 48 people

HD Capital Partners

ADH

Adairs Ltd

ASX:ADH

Followed by 764 people

DVR

Diverger Ltd

ASX:DVR

Followed by 5 people

EOL

Energy One Ltd

ASX:EOL

Followed by 38 people

Livewire Markets

SEC

Spheria Emerging Companies Ltd

ASX:SEC

Followed by 17 people

Spheria Asset Management

ACL

Australian Clinical Labs Ltd

ASX:ACL

Followed by 218 people

TLX

TELIX Pharmaceuticals Ltd

ASX:TLX

Followed by 272 people

ABB

Aussie Broadband Ltd

ASX:ABB

Followed by 728 people

ARC

ARC Funds Ltd

ASX:ARC

Followed by 74 people

EGL

Environmental Group Ltd (the)

ASX:EGL

Followed by 45 people

HD Capital Partners

8CO

8COMMON Ltd

ASX:8CO

Followed by 36 people

XF1

Xref Ltd

ASX:XF1

Followed by 11 people

Livewire Markets

RMD

Resmed Inc

ASX:RMD

Followed by 607 people

ALC

Alcidion Group Ltd

ASX:ALC

Followed by 323 people

APT

AFTERPAY LIMITED

ASX:APT

Followed by 3562 people

BAL

BELLAMY'S AUSTRALIA LIMITED

ASX:BAL

Followed by 60 people

Livewire Markets

CGS

Cogstate Ltd

ASX:CGS

Followed by 31 people

PRO

Prophecy International Holdings Ltd

ASX:PRO

Followed by 20 people

RCW

Rightcrowd Ltd

ASX:RCW

Followed by 4 people

Livewire Markets

STM

Sunstone Metals Ltd

ASX:STM

Followed by 25 people

XF1

Xref Ltd

ASX:XF1

Followed by 11 people

Lucerne Funds Pty Ltd

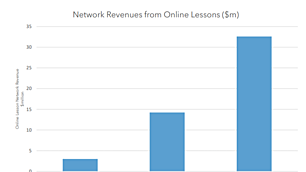

KME

Kip Mcgrath Education Centres Ltd

ASX:KME

Followed by 23 people

Merewether Capital

1-20 of 85

.png)

.png)

.png)

.png)

.jpg)