A (key)word says 1000 pictures – reporting season analysis

With the FY25 reporting season fast approaching, a time when the ASX is alight with financial results, presentations, earnings calls and investor roadshows. All of this information can be overwhelming, and discerning what matters from what is noise can be a challenging task.

At NAOS, we enjoy reading lots of company transcripts across all sorts of event types as part of our investment process and efforts behind our weekly CEO Insights publication. During reporting season, many companies hold results calls at the same time, making it hard to follow everything live but the beauty of earnings call transcripts, released after the calls, let you catch up at your own pace.

When a company shares its results, it provides carefully prepared information, such as earnings releases, investor presentations, and scripted remarks. However, the Q&A section of an earnings call offers unscripted insights, where you can find more details on specific topics or discover new perspectives you hadn’t considered. We tend to focus heavily on these Q&A sections to gain a deeper understanding.

Company results presentations often include useful charts and images. But to see the bigger picture, we need a way to spot common themes across different companies, industries, and sectors. To achieve this, we searched for 34 specific keywords in the earnings call transcripts of ASX 200 companies. This covered the periods from the 1H FY23 reporting season (Feb-23) to the 1H FY25 reporting season (Aug-25).

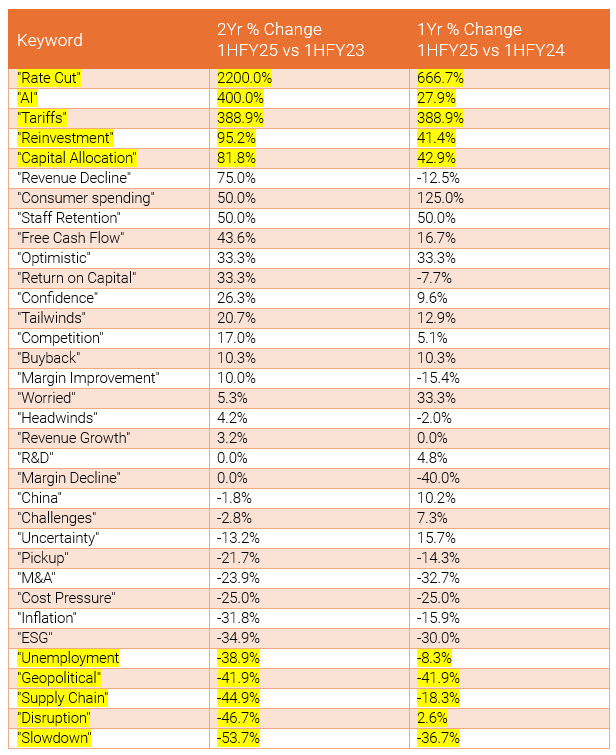

Table 1 – Keyword Changes

We ranked the 34 keywords based on the percentage change in how many companies mentioned them, comparing over one year and two years. As expected, "Rate Cut," "AI," and "Tariffs" showed the biggest increases and topped the list. On the other end, mentions of words like "Disruption," "Slowdown," and "Supply Chain" decreased, signalling a return to normal after post-COVID disruptions.

Source: AlphaSense, NAOS

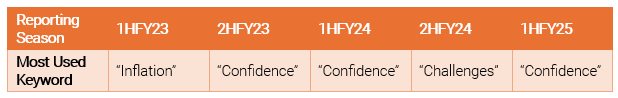

Table 2 – Leading Keywords

Among the 34 keywords, the chart below shows which one was mentioned by the most ASX 200 companies in each reporting season. As expected, "Inflation" has dropped down the list. Interestingly, the top word shifted from "Confidence" to "Challenges" and then back to "Confidence."

Source: AlphaSense, NAOS

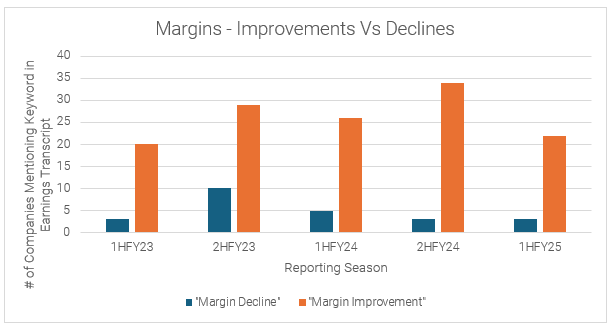

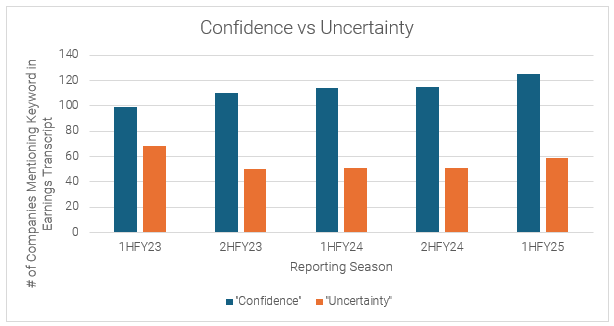

Juxtaposing Charts

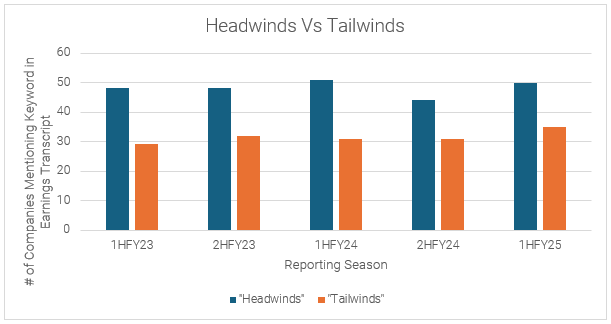

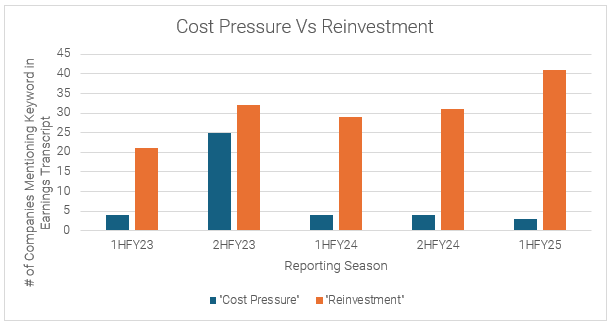

The charts below attempt to highlight the differences in juxtaposing keyword sets. The key focus isn't on how many companies mentioned each keyword set in a single season. Instead, it's about tracking trends in their usage over several reporting periods. Call outs include:

- “Margin Decline” is being used less and less.

- “Confidence” is gradually increasing whilst “Uncertainty” has remained relatively stable over the past few periods.

- After a big spike during 2H FY23 for the use of “Cost Pressure”, this has returned to normal, whilst the trend of “Reinvestment” is a positive one.

Source: AlphaSense, NAOS

Source: AlphaSense, NAOS

Source: AlphaSense, NAOS

Source: AlphaSense, NAOS

What Can We Expect for the Upcoming Reporting Season?

Given that all of the data compiled is from February (1HFY25) 2025 and earlier, naturally, it is retrospective. A lot has happened in the world since February on the geopolitical front. If we were to hazard a guess, we would expect the following list of keywords to be reasonably prevalent in August:

- “Geopolitical”

- “Tariffs”

- “AI”

- “China”

- “Uncertainty”

- “Consumer Spending”

At NAOS, we focus on investing in ASX-listed emerging companies. We take the view that macroeconomic forces are impossible to control, but good businesses should be able to withstand challenges thrown their way. Where we spend our time is on the fundamental research aspects of a particular company, trying to understand the industry dynamics, growth drivers and potential headwinds that underpin a company’s ability to grow revenues over the medium term. We will be paying particular attention to words such as “Reinvestment”, “Free Cash Flow”, “Return on Capital”, “Margin Improvement” and “Tailwinds” when we are poring over transcripts this reporting season. What keywords will you be focusing on?

4 topics