A practical guide on how to tackle carbon emission

Can we be sure that we are removing the same amount of carbon dioxide from the atmosphere as we have emitted as a business? That was the simple question we looked to answer as we approached our business carbon neutrality this year with the same rigour as our stock analysis.

In the process of measuring emissions, researching offset projects, and then purchasing offsets, we were surprised at what we found. Not only is carbon offsetting a largely unregulated industry, but most carbon offsets don’t even remove carbon dioxide from the atmosphere!

Read on to find out how Firetrail enhanced our carbon emissions offsetting process for FY21. By doing our homework, and focusing on what matters, we strived to ensure Firetrail genuinely is a carbon-neutral business.

Measuring emissions

Firetrail expanded the scope of our emissions estimation process this year to include assessments on:

- Electricity usage

- Staff commutes and taxis

- Waste/water/paper/gas usage

- Flights and hotel stays

- Supply chain costs, including cleaning, software, and catering, and

- Working from home emissions when government restrictions were enforced, such as lighting, computer usage and heating

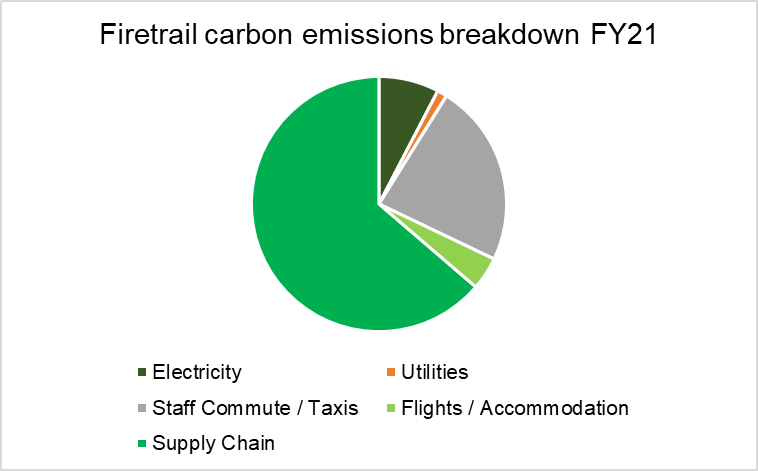

We worked in collaboration with Pinnacle, who have engaged in offsetting their business emissions for the last few years and achieved Climate Active Carbon Neutral certification for their FY20 emissions. Pinnacle also released their inaugural Corporate Sustainability Report in FY21, including details on their carbon inventory assessment, which can be found here. Firetrail’s calculated carbon emissions for FY21 were 134 tonnes of carbon dioxide equivalent. A breakdown of the contribution to total emissions is provided below.

There are a couple of anomalies to highlight in the emissions for the past year. The pandemic continued to impact daily life. This meant that business travel was virtually non-existent for the Firetrail team. We expect business travel to increase as border restrictions (both domestic and international) are eased, and as such expect that this portion of our carbon emissions will increase substantially in the future. We also avoided major lockdowns for the majority of the team in the July 2020-June 2021 period.

However, we expect working from home emissions will be a feature of the FY22 carbon emissions due to the extended lockdowns at the beginning of the period. We admit our measurement process is not perfect, and estimation methods are evolving and improving over time as we get access to better data. Where relevant, we erred on the conservative side through this process. Firetrail will look to enhance our approach as we continue in our offsetting efforts in the year ahead.

A tonne of carbon is not a tonne of carbon

Once we calculated our total business emissions, we began the search for an appropriate way to offset them. The atmosphere cannot tell the difference between a tonne of carbon dioxide removed from the atmosphere and a tonne of carbon dioxide emitted into the atmosphere. It doesn’t care how, or where this is done. It’s all one planet and it's all the same. But when it comes to offsetting, this isn’t the case! What really matters to us is ensuring that if we are offsetting our emissions, that we are genuinely removing carbon dioxide from the atmosphere.

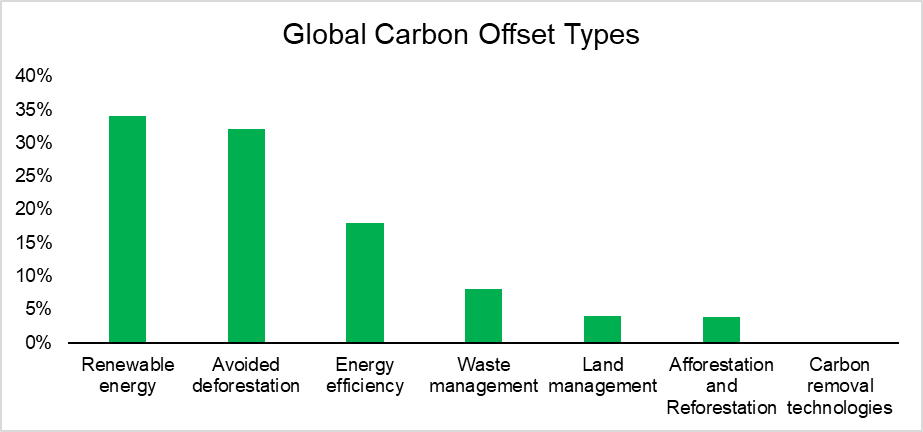

Source: Bloomberg

Carbon offset markets are evolving rapidly. Despite this evolution, less than 5% of carbon offsets are actually removing carbon dioxide from the atmosphere. These methods are Afforestation and Reforestation, and Carbon removal technologies (the far-right columns in the graph above). Most offsets still are firmly in the ‘prevention’ bucket, i.e. they are potentially stopping carbon from entering the atmosphere. The big question here is whether most of these projects would have gone ahead anyway.

The efficacy of the two biggest sources of offsets is questionable:

- Renewable energy projects. The logic here is by building a solar farm or wind farm, you would displace energy that previously came from a fossil fuel source and should earn credits for it. There is no due diligence however on whether this occurs. Secondly, the projects would have likely gone ahead anyway given the lower cost of renewables development. Fortunately – most voluntary carbon credit schemes are now starting to disallow these forms of credits.

- Avoided deforestation. Best described as “Unless you pay me, I will chop that forest down”. It’s very hard (if not impossible) to prove whether the trees would have stayed anyway. In many cases, the land is protected by covenants or planning restrictions also. And even if the trees do stay – it’s just the status quo for the atmosphere!

Of the two options which genuinely offset carbon emissions:

- Carbon removal technologies are very expensive. For the fee of 960 Euros (AUD ~$1,500), Climeworks will suck 1 tonne of CO2 out of the atmosphere. Read more here.

- Forest planting is a far lower cost option. As a tree grows, about half its mass is carbon, formed by breathing carbon dioxide in from the atmosphere. In Australia, the cost is ~$20 for this – depending on land prices.

To ensure that offsets pass the pub test, offset projects should be 1) a project that is not the status quo and 2) truly reduces carbon in the atmosphere.

Investing in the Flanders Carbon Project

Our science-based, fundamental approach led Firetrail to purchase offset units from a Queensland native vegetation regeneration project called ‘The Flanders Carbon Project’. The project is subject to independent audit as well as review by the Clean Energy Regulator.

Once we purchased these Australian carbon credit units (“ACCUs”), we cancelled them in the Australian National Registry of Emissions Units, so that no one else can buy them. Doing this and avoiding any double-counting means the offsetting is real. At $33 per tonne, the cost of doing this was more than double the cost of other carbon offsets we investigated.

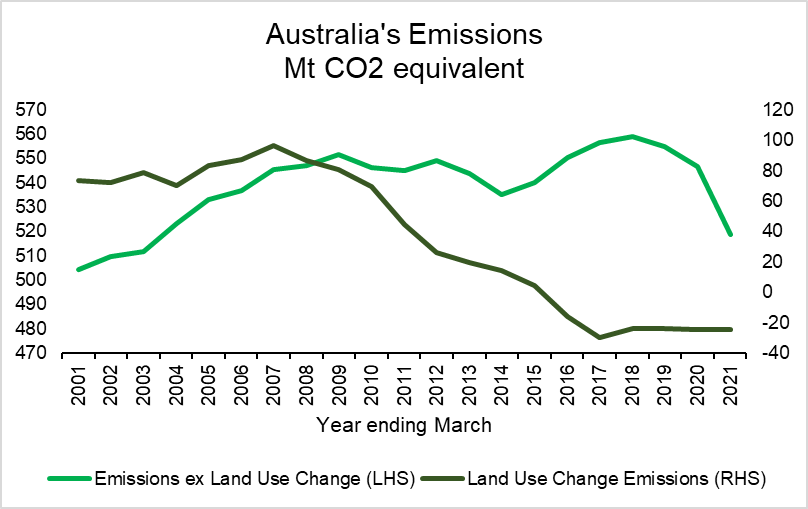

The Flanders Carbon Project is situated in the southwest Darling Downs region of Queensland. Vegetation is growing and removing carbon dioxide from the atmosphere on land which was previously intensively overgrazed. The Flanders Project is spread over 32,000 hectares, and in FY21 140,976 tonnes of CO2 will be removed from the atmosphere. From an Australian national emissions perspective, the reforestation of Queensland is also critical.

During the 2000s the rate of land clearing (destroying plants) was adding almost 100 million tonnes per annum to Australia’s emissions. This process is now reversing through projects such as the Flanders project and reforestation – this can be seen in the dark green line below. Excluding this Australia’s emissions reductions are minimal (ex-Covid impacts).

Source: Australian National Greenhouse Gas Inventory

Conclusion

Firetrail are dedicated to playing our part in creating a positive future environment for all our stakeholders and continue to make significant progress in our approach to responsible investing and sustainability. Our journey to carbon neutrality was an eye-opening experience this year, as we enhanced our methodology on not only emissions measurement, but choice in offsets. Carbon markets are certainly evolving, and our advice would be to do your due diligence when embarking on your carbon offsetting endeavour!

FOLLOW us for more investment insights

We are very happy to share more on what we have learnt thus far and hope to keep developing our knowledge through engagement with our clients, portfolio companies and peers. If you'd like to receive our exclusive reports first, hit 'FOLLOW' below.

2 topics