An ASX rare earths IPO is now live. Here's everything you need to know

Rare earths newcomer DY6 Metals (ASX: DY6) has kicked off a $5-7 million IPO to fund drill-ready and high-grade rare earth targets. At listing, the company will own three prospective projects in Southern Malawi, a proven region for hosting economic rare earth deposits.

Before we get into things: The first thing that came to my mind was ‘What's a DY6?’.

Let me explain.

DY6 is exploring for heavy rare earths, a particular group of rare earth elements that possesses relatively heavy atomic weight like dysprosium (Dy) and Terbium (Tb). These elements are less abundant compared to their lighter counterparts like Neodymium (Nd) and Praseodymium (Pr) – which also makes them more valuable. To add some perspective, NdPr was trading around US$120/kg in 2022 compared to Dy at US$410/kg.

Dysprosium is the chemical element with the symbol “Dy” and the atomic number “66”, which is how they arrived with the company name “DY6”.

Dy and Tb are critical minerals used in the production of permanent magnets and high-end technology solutions for clean energy such as wind turbines and EV motors. There's not enough enough Dy and Tb to source projected demand forecasts and Adamas Intelligence expects a shortage equal to 2-3 times 2021 global output by 2035.

The IPO offer is now open and the company expects to make its ASX debut by June.

Key links:

- A high-level summary - IPO Leaflet

- A detailed overview - Investor Presentation [PDF]

- IPO Prospectus & Application Form - Online form

Three Projects: Machinga, Salambidwe and Ngala Hill

DY6 Metals has the right to acquire three prospective projects in Southern Malawi including:

Machinga – Heavy rare earths and Nb-Ta-Zr (Niobium, Tantalum and Zirconium)

- Covers approximately 200km2

- ~40km east of Lindian’s (ASX: LIN) globally significant Kangankunde project

- A 2010 trenching program included 7m @ 1.26% TREO

- A 2010 drilling program included hits of 11m @ 1.0% TREO from 12m

- 7km radiometric anomaly registering a 2.7 km by 0.3km

Salambidwe – HREE, Nb and Ta

- An early-stage prospect with limited previous exploration

- Covers an area of 24.9km2

- Previous rock chip sampling results returned numerous chips of more than 1.0% TREO including up to 2.05% TREO

- The project sits on the Salambidwe Ring Complex in the Chilwa Alkaline Province, which hosts the Kangankunde Deposit (2.5m tonne resource @ 4.2% TREO)

Ngala Hill – PGEs, copper and nickel

- Another early-stage prospect with limited previous exploration

- Aeromagnetic data has shown significant magnetic anomalies that extend over several kilometres beyond the outcrop and demonstrate widespread PGEs, copper and gold mineralisation

- 3 zones of palladium rich mineralisation has been identified

IPO and Peer Comparison

The IPO seeks to raise $5-7 million at 20 cents per share for an indicative market cap between $9-11 million. The company notes it will have an EV (enterprise value) of approximately $3.4 million post listing, which provides "good leverage to future news flow."

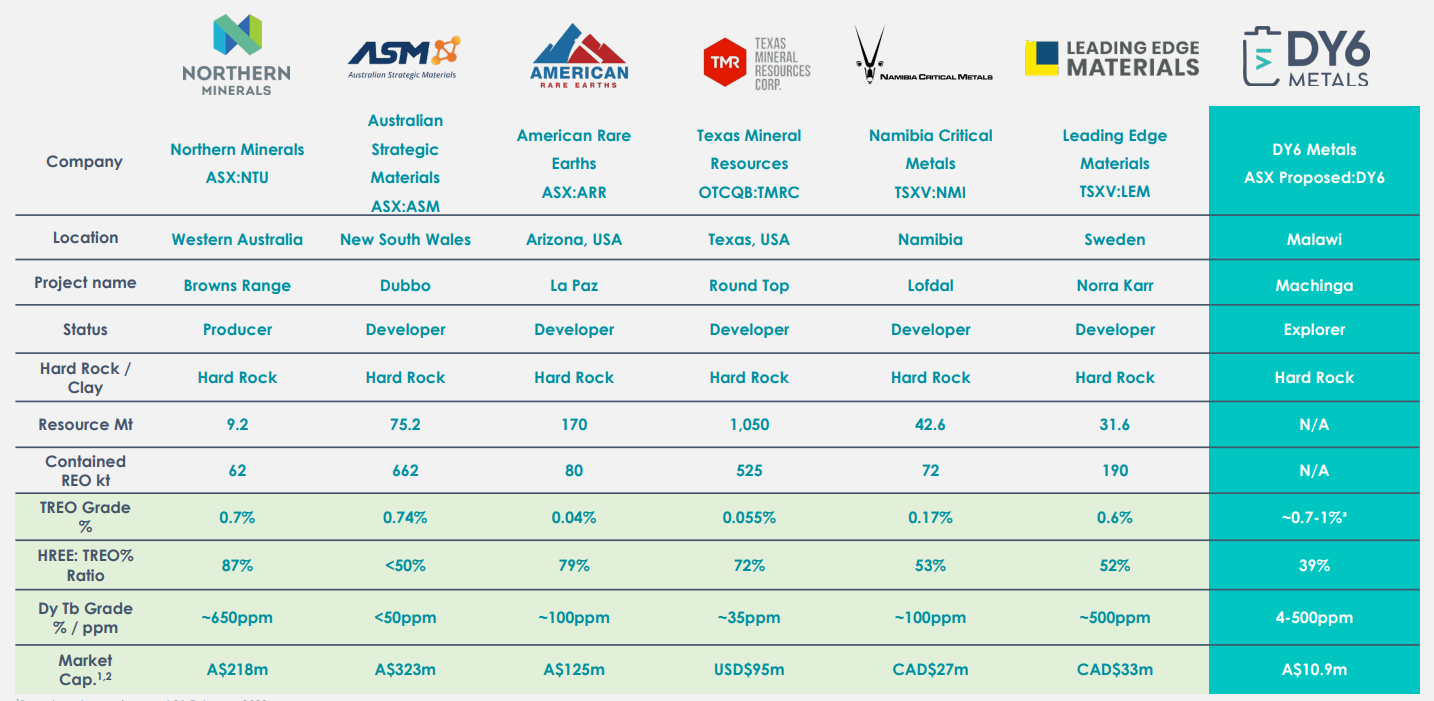

The ASX-listed heavy rare earths space is relatively sparse, with three notable peers including Northern Minerals (ASX: NTU), Australian Strategic Metals (ASX: ASM) and American Rare Earths (ASX: ARR).

What 2023-24 looks like

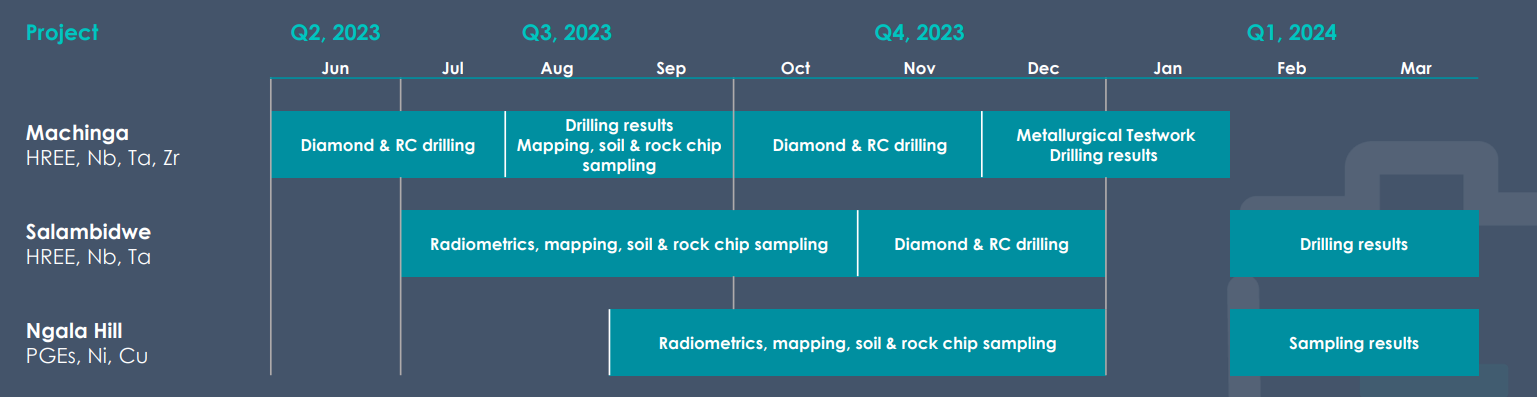

DY6 Metals wants to hit the ground running via the drill-ready Machinga. There’s approximately 5,000 metres of drilling planned for the June quarter 2023, with exploration to focus on the significant historical drill areas. Drill results are expected to be released in the September quarter.

Outside of Machinga, early-stage exploration activities such as geophysics, mapping and soil & rock chip sampling is scheduled for both Salambidwe and Ngala Hill.

If all goes to plan – both projects will be drill ready by year end.

Rare earths: Near-term volatility

Rare earth prices have been under pressure amid higher production quotas in China (March total REO mining up 19% year-on-year) and Tesla’s announcement that it is working on a way to eliminate or significantly reduce REEs in its next generation EV models.

NdPr prices have fallen from March 2022 highs of US$170/kg to US$80/kg – below September 2022 lows of US$83/kg and a fresh two year low. Though, prices are still double pre-Covid levels.

“We continue to expect a tight NdPr market despite a small surplus in the near term,” Macquarie said in a note last month.

“The market balance could be easily shifted by any unplanned production disruptions or restocking activities along the magnets supply chain.”

“We forecast NdPr prices to trade below US$100/kg in the next six months and rise above US$100/kg driven by a rebound in demand.”

Macquarie expects dysprosium prices to moderate to US$316.85/kg in 2023 but bounce to US$350/kg in 2024, with a long-term forecasts of US$300/kg.

This article was first published for Market Index on Monday, 17 April.

1 topic