An expert answers your top 10 questions on alternatives

Alternatives have long been the playground of institutional investors. But for investors like you and I, asset classes like infrastructure, private equity and debt, and hedge funds have been far more difficult to access.

That's a whole different story today, with PwC predicting that investments in alternative asset classes will surge to $21.1 trillion by 2025, making up 15% of global assets under management.

Recently, as part of our annual Alternatives in Focus series, we reached out to readers, like you, to learn how you are investing in this burgeoning area of the market.

Interestingly, around 59% of you told us you were already investing in alternatives - while around 46% said they were allocating about 10% of their portfolios to the asset class.

The main reason for this was diversification (77%), while 50% of you told us it was thanks to the attractiveness of returns on offer within alternatives.

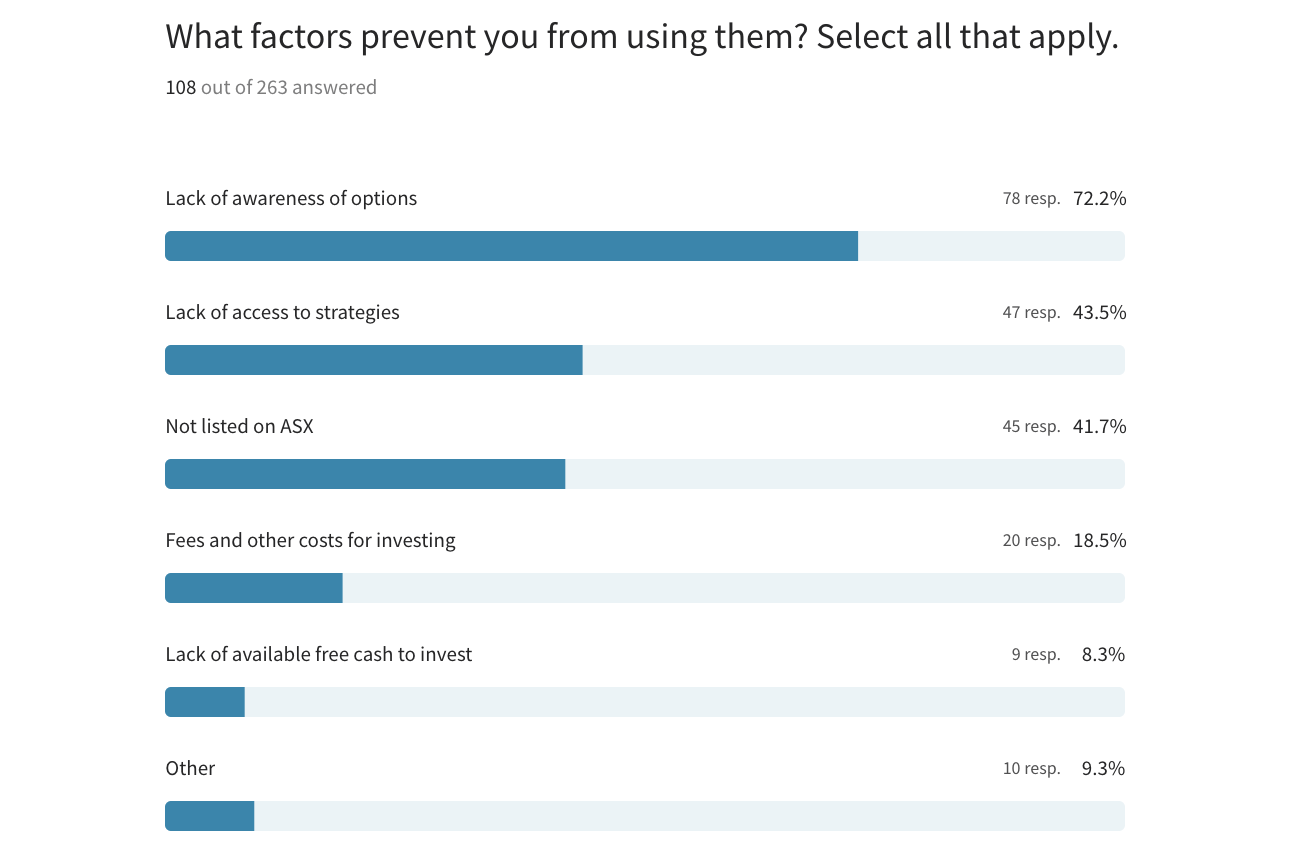

And yet, 72% of respondents said the lack of awareness of products available was stopping them from investing in the first place, while 44% blamed it on the difficulty of accessing these investments. Products or funds not being listed on the ASX (42%) and fees (19%) were also stopping readers from investing in alternatives.

Liquidity, the ability to invest and redeem when an investor wants or needs, was surprisingly not a major issue for our readers. 47% said they would be happy to invest capital for longer than three years, while only 9% said they were looking for liquidity when investing their hard-earned cash.

So how are readers investing?

- 64% said they were invested in private markets (debt and equity)

- 52% in real estate

- 45% in infrastructure

- 33% in long/short equity strategies

- 29% in commodities/agriculture

- 20% in hedge funds

- 17% in structured products

- 14% in global macro strategies/funds

- 10% in managed futures

- 8% in collectibles (alcohol, cars, art, jewellery etc)

You can check out the rest of the results here.

In this wire, I call on Lucerne Investment Partners's founder and CEO, Anthony Murphy, to answer some of the most common questions we received from readers on alternatives so that you can better invest within this asset class.

Your questions answered

Which metrics do you use to calculate returns and the fair value of your assets? How often are these assets valued?

Anthony Murphy: That's a pretty open-ended question because it depends on the underlying strategy. So if you're running a long/short equity fund, for example, you should be able to calculate the fair value of those assets daily. If you're running something that's more long-dated, like a private equity or venture capital strategy, those assets tend to be marked yearly unless there's a significant price event.

Either way, a good discipline for all alternative managers should be that if there is a significant price event, i.e. a capital raising, particularly to the downside, that asset should be marked down immediately, or if the trading conditions of that underlying investment have changed to the downside, then that should be marked down significantly.

We've seen this in recent times, with Canva, which has been an Australian darling. It took offshore institutions to start marking that asset down before Australian institutions followed suit.

So, it depends on the strategy. If it's a listed or liquid strategy, you get a fair value of those assets every day. If it's something more opaque, like a private equity or venture capital strategy, they should be audited yearly. But in the interim, those valuations should change particularly if there's a mark-down.

In terms of returns... Returns on an underlying investment from a capital growth or loss perspective should be calculated and finalised when that asset is disposed of, until a significant valuation event occurs or until that asset is sold, it should be held at cost.

How do you deal with liquidity and what processes are in place to exit an investment if required? How long does it typically take to redeem?

It depends on the underlying strategy. So if you're an alternative manager, and you're running a highly liquid strategy, like a long/short equity fund, you should be able to demonstrate to investors that you can liquidate that portfolio within a month, if not within a week, depending on that strategy. If you're running an alternative strategy that trades futures, which is a highly illiquid market, you should be able to liquidate that in days. So that's one extreme.

At the other end of the spectrum, if you're managing a venture capital fund or a private equity fund, you should educate your investors upfront. It's a closed-ended strategy of say five years with two years plus on top in case some assets still need to be disposed of after five years. So you need to back that fund to be reliable in selling all your underlying assets at the time of maturity.

You should be preparing the fund to sell those assets two to three years out because it can take time. So again, it's very strategy-dependent in the listed space. I would expect alternative managers to be able to accommodate in a short period of time, in weeks or a month in the private equity and venture capitals based on the pre-IPO space. I would expect the manager to adhere to their maturity deadline and start preparing the portfolio well in advance of that maturity deadline.

Are alternatives short or long-term investments? I'm 70 years old, would these be suitable for a retiree?

That's a really good question. So I think they're both. We adopt alternatives with both short, medium and long-term thematics in mind. Some alternative strategies suit the short term, for example, precious metals or gold and a high inflationary period.

Historically, gold has tended to do very well but not so well when that period ends. So that's a good example of obtaining investment holdings for the short term. A long-term investment in the alternative space can be something like infrastructure. We're looking to hold that asset over some time and generate a consistent return over that period.

Are they suitable for a retiree? Absolutely. Even the large super funds and pension funds in this country have long-term investment mandates and a large portion of their underlying investors tend to be retirees - and they have a very large allocation to alternatives in a balanced portfolio.

Even closer to home, our Future Fund, the government's superannuation fund, effectively has nearly 40% of its portfolio in alternatives at the moment. So provided you have a good balance between alternatives and liquid assets, and traditional assets, like bonds and equities, I don't think age is a barrier when it comes to considering alternatives. You just want to be in the right alternative funds.

How actively involved should I be when investing in alternatives?

Incredibly active, from our perspective. A well-managed diversified alternative portfolio will demonstrate turnover of somewhere between 40% and 70% per annum and that can even be higher in volatile market conditions.

Because alternatives cover such a broad range of strategies, you have some strategies, in particular, that only really suit a short period of time and that's when you need to be active. If you're holding that strategy too long, then you can have significant drawdowns or downside risk in the alternative space.

I'd argue you need to be far more active than you would in traditional asset classes, such as equities.

For example, volatility and arbitrage, as well as gold and precious metals. Those types of alternative strategies can be very good for a certain period of time. For example, some of the world's most established global quantitative trend funds, which are true alternative strategies, might make 80% of their five-year performance in 12 months, but they tend to perform incredibly well when markets dislocate. That's why you need to be very active in adopting strategies like that.

What is the difference between listed and not listed alternative funds? Why do managers choose NOT to list?

I wouldn't say all managers choose not to list, but most fund managers around the world are very conscious of their intellectual property, so they tend to stay within a fund environment, whether that be equities right through to private equity. That's your intellectual property that makes you unique in the market.

These days, more alternative managers are providing listed opportunities or listed vehicles because globally institutions are requiring more liquidity. For example, private equity funds that are offering a liquid version of their mandate.

But historically, most alternative managers tend to remain private or not listed to protect their intellectual property. Also, quite often, a number of these strategies tend to be more long-dated, like private equity and venture capital, which is not appropriate for the listed environment.

What is the ideal mix of alternatives?

At the asset class level, we think an allocation to alternatives in the current prevailing market conditions of 20-30% is appropriate - with about half of that in relatively liquid assets, so it can be redeemed within a three-month period max, and the other half in more long-dated, traditional private equity, venture capital assets.

From a mixed perspective, if you were to allocate circa 20% to 30% of your portfolio to alternatives, we would recommend you at least have five strategies in the alternative space. And, to be clear, one strategy might capture 10 to 14 themes. So you want to park your capital in three to four allocations to different managers.

Some long/short equities strategies have a history of carrying a very low correlation with equity markets, which is a very good place to be right now, provided you select the right manager.

Within our diversified strategy, we're currently running a nearly 35% to 40% allocation to long/short equities with a very low if not negative correlation to traditional equity markets. In addition to that, we are complementing that with volatility and credit default swap strategies as well, which are performing very well in current market conditions.

What is the correlation between alternatives, equities and bonds? Do alternatives actually outperform the risk-free rate?

There's an old saying that when the proverbial hits the fan, everything correlates. But that's not true. So, if you can find good alternative managers that have a history of protecting capital, particularly during market drawdowns on numerous occasions - and nothing is guaranteed - that's a very good sign that they've got very flexible, nimble mandates, and they can move quickly to adhere to changing market conditions in the short, medium and long term.

So if you're holding a good basket of alternatives in correlation with equity indices should be 0.2-0.3. Whereas traditional long-only equity strategies will have a 0.9 correlation with indices.

A well-run actively managed portfolio should beat the risk-free rate - otherwise, why would you invest in it? You are investing with the wrong managers if they are not outperforming the risk-free rate.

How do these funds perform in a high interest rate, high inflation, and high geopolitical risk environment? What are the major risks of investing in alternatives today?

That's a really good question. So if they're managed well, and you're allocated to the right strategies, like a trend-following strategy, volatility strategy, or a long/short equity strategy that could move quickly within a forever-changing market environment, you should actually perform quite well.

In this environment, the major risk in considering alternatives is the different types of debt mandates that are coming out from institutions at the moment. That's high-yielding corporate debt, which seems to be the flavour of the month. We are steering clear of that because if market conditions worsen, then expensive debt becomes very difficult for those underlying borrowers (companies) to actually service. So that's one of the asset classes we're concerned about at the moment.

The other risk is, of course, around liquidity. If you're in an alternative strategy, and then that strategy starts to perform poorly, then alternative managers have the right to gate or lock that fund, effectively. So you really want to stay on top of your managers to make sure they're adhering to their investment mandates, performing in line with those mandates and have sufficient liquidity to meet redemptions should they be forthcoming,

Which options are available on the ASX?

So, there are listed private equity options on the ASX these days. There are ETFs like Global X Physical Gold (ASX: GOLD), which represents an underlying exposure to the spot price of gold. But outside of that, most traditional alternatives tend to not be available on the listed market.

Listed markets around the world are getting better at providing alternative options, but they're still quite scarce and most of them have been provided via ETFs like GOLD or some of the larger private equity firms offering a similar strategy to their underlying strategy in the unlisted space, but keeping a lot of cash on the sidelines to create liquidity if required.

On that, a private equity manager that's fully invested in their strategy long term will tend to outperform a listed strategy where that manager has to hold on to a lot of cash for redemptions. I think when it comes to alternatives, you can sacrifice performance by going into the listed space.

Where would you invest for a reasonable return (more than 7%) over the next 10 years?

In addition to that, if you get a good blend of alternative exposure, we really like the private space at the moment. There are fewer competitors in that space, so the pricing terms really sit with the investor. As these private companies actually require capital in such market conditions, it really becomes a price-makers environment, not for price-takers. So if you back good private equity venture capital managers to buy good businesses at very cheap prices in the current market environment, I think you'll really benefit from that performance over the next five to seven years.

Want to learn more?

Thanks to Anthony for taking the time to answer these questions. You can learn more about the funds he manages in the presentation below:

How all investors can access the best alternative funds (and their top ideas)

4 topics

1 stock mentioned

3 funds mentioned

1 contributor mentioned