An overlooked asset class with big potential

As human beings, we fear what we don’t know. We’re generally unwilling to step into the abyss. At the very least, we need someone to take the step with us. Better yet, we need someone to be our guide.

When it comes to alternative investments, while we might inherently know that they can provide great opportunities, the opaque nature of the space and limited understanding can hold us back.

The Lucerne Alternative Investment Fund (LAIF) is breaking down those barriers. It has been built to overcome the very real problems of access, liquidity, and knowledge. In doing so, it is helping investors overcome the fear of the unknown, and instead allowing them to focus on the benefits that alternatives can provide.

In this Fund in Focus, I outline in greater detail how Lucerne has overcome the barriers to entry and built a winning strategy. Let Lucerne be your guide.

Edited transcript below

Hi there. My name's Anthony Murphy, the founder and CEO of Lucerne Investment Partners, and also investment committee member and director of the Lucerne Funds Management business. Today I'm here to talk to you about our flagship investment product, the Lucerne Alternative Investment Fund, better known as LAIF.

Lucerne was founded in October, 2015. At our core, we're a boutique investment group that specialises in partner and investor capital in the alternative investment space. We have three fund offerings under our stable, LAIF, LARK and LSAF.

We're here to focus on the Lucerne Alternative Investments Fund, which is a multi-strategy fund of funds founded in December, 2017. Since inception, the fund has targeted net returns of the RBA cash rate plus 6% per annum, and has exceeded those returns and has done so on reduced volatility when compared to equity markets. That volatility has been approximately 7% per annum since inception. Recently we were recognised for our achievements by taking home the Best Multi-Strategy Fund award at the Alternative Investment Management Awards for 2022.

Why alternatives? Alternatives as an asset class have always been an asset class that investors have kind of struggled with. It's generally been left for the big end of town. It's generally been a market or an asset class that's really only really gathered the attention of the institutional market and family offices as a whole. Alternatives can provide a great source of alpha in portfolios when your traditional equity classes such as equity, bonds and property are not working.

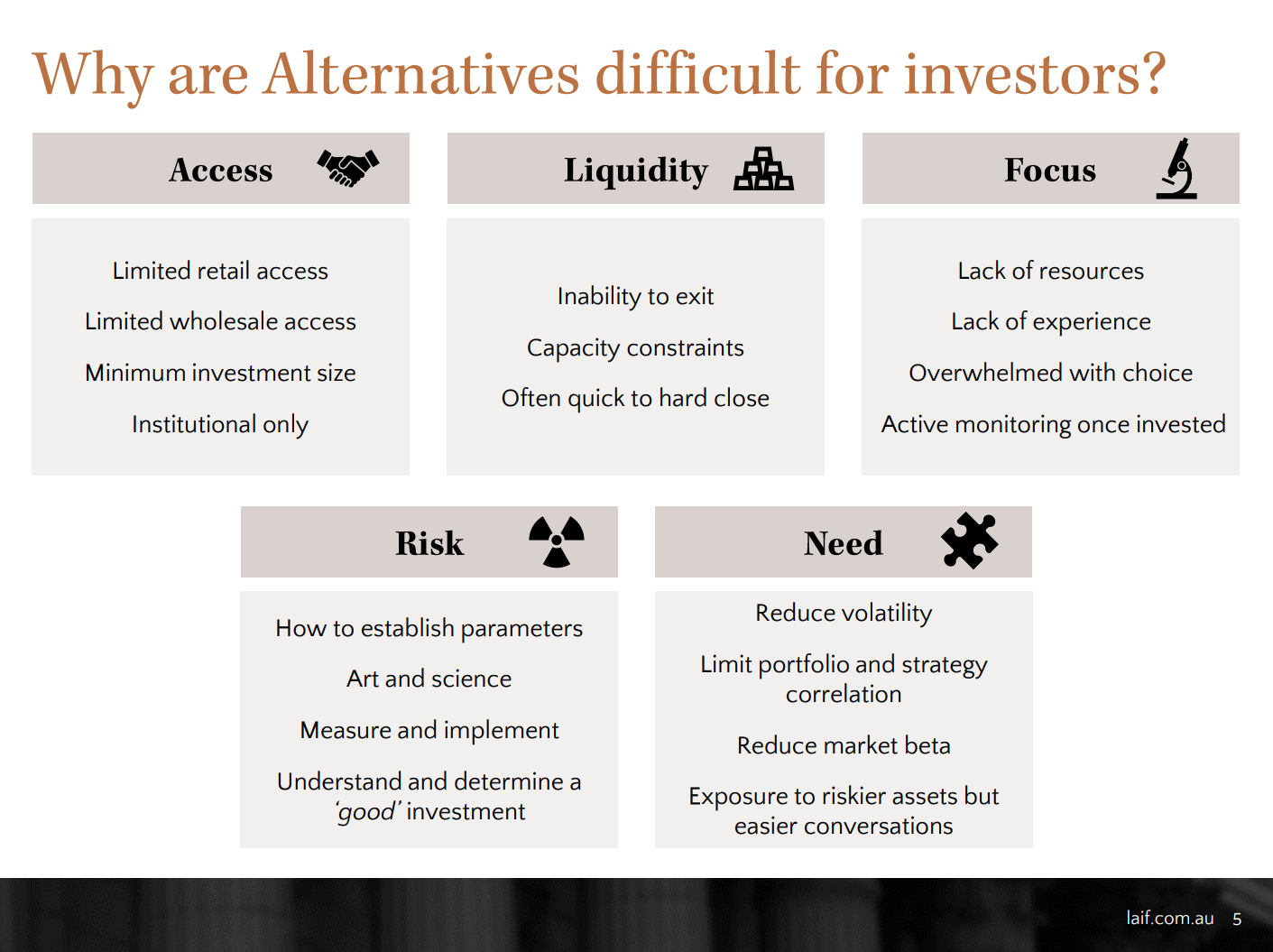

Let's unpack this a little bit and think about, well, why have alternatives often been ignored by investors historically. The first thing is access. Historically they've been incredibly difficult to access not only for the retail market, but for the wholesale market as well. Quite often, these alternative investment managers out there will have high barriers to entry, particularly when it comes to minimum ticket investment size within the said fund. We have seen examples of alternative investment managers out there, global hedge funds, that have minimum ticket sizes of USD $5 million, which basically then excludes a whole entire investor base that we're common to dealing with at Lucerne. Liquidity is another barrier to entry for alternative investment strategies. You think of private equity funds out there, you think of venture capital funds out there. Quite often, they're asking to hold onto that investor capital for five, even up to 10 years and beyond.

At Lucerne, through LAIF, we've solved for that problem, providing investors with monthly liquidity yet still being able to access those types of investment streams such as private equity and venture capital. Quite often these investment strategies or funds are very quick to hard close. Strategies will often be capital constrained to a certain investment pool. So, quite often we'll see investment strategies in the alternative space that will commit to only managing $50-100 million dollars of investor capital. So, they launched the fund on day one and then often within 12 months that fund is hard closed before even the broader investor community has come to know about that fund. So, at Lucerne, you know, we pride ourselves on getting investors' access to these strategies when they are first known to us and pretty much from day one.

Often time and focus is a big consideration in the alternative space. At Lucerne we pride ourselves on focusing on the alternative space and we would meet with over 150 investment managers per year. That's over three a week, and it is such a broad universe from resources to digital assets, to global hedge funds, to convertible notes, to global CTAs. It's just such a broad universe and it takes a lot of time, resources, and dedication. Behind LAIF we have a team of six individuals that are constantly working on the fund to better returns and performance for our investors over time. The risk associated with alternatives is something else to take into account. Quite often, I think unfairly, risk is really associated with alternatives, and that's one reason why investors tend to avoid. And that's right, it's paramount and really important to have a diversified approach when considering alternative asset class in one's portfolio there.

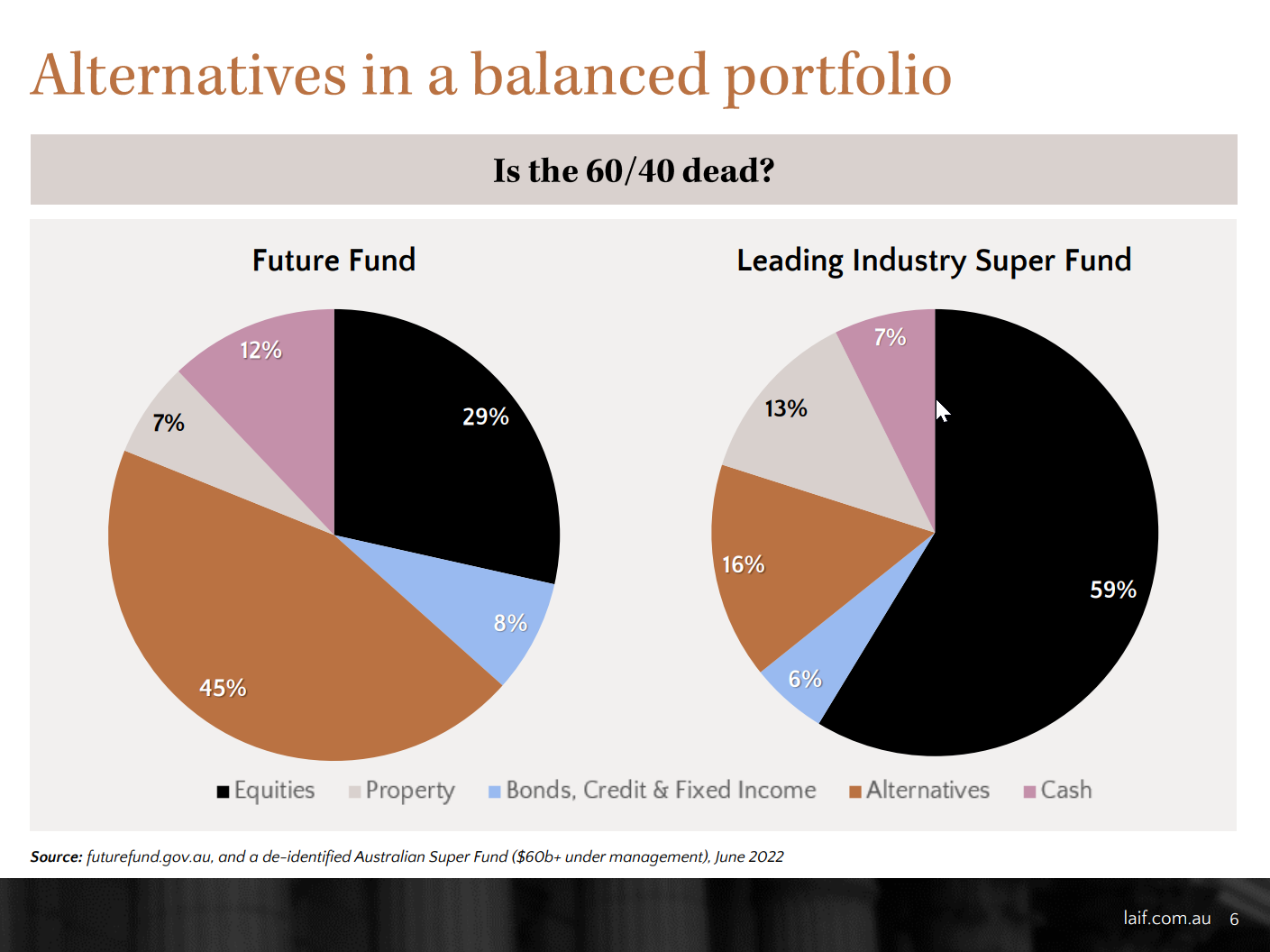

So, let's think about that from a portfolio perspective. Alternatives really predominant in some traditional portfolios out there. Well, let's take two examples and let's look at our own sovereign wealth fund being that of the Future Fund. You can see here from the slide in front of you that the Future Fund now holds up to 45% of the portfolio in alternatives as of the 30th of June this year. And they have been a real trailblazer and I take my hat off to them in terms of having a decent amount of exposure in the alternative space. But then again, they're a sovereign wealth fund. They have patient and sticky capital, and can afford to go into these investment strategies that often will keep capital for five to 10 years plus. That is a luxury they have. So, it's considered more of a liquid balance portfolio, that being one of Australia's leading industry super funds. And even today, they have exposure of up to 16% in the alternative space. So, both these groups are recognising alternatives as a key component of their investment strategy going forward.

We believe that at Lucerne as well that alternatives are a really important part of one's investment portfolio, and that's why we created LAIF. And LAIF is a proven alternative manager now with a five-year track record. We provide access to a very diversified portfolio of true alternatives on a global basis. It is an actively managed, all-encompassing solution. As a result of this - an actively managed, all-encompassing solution - we've been able to provide risk-adjusted returns consistently on an ongoing basis, and these returns have been superior for our investors. We have an experienced and disciplined investment committee. We pride ourselves on selecting best-in-class managers and equally avoiding those that are not best-in-class. And we've been recognised for these efforts recently, taking home the Best Multi-Strategy Fund at the Alternative Investment Management Awards.

What is core to our investment thesis? The macro view and then the thematic view. On a monthly basis, our investment committee sits down and considers the macro and economic environment. We consider things such as inflation, geopolitical risk, resources, decarbonization, deglobalisation, all really important factors that form our overall investment thesis.

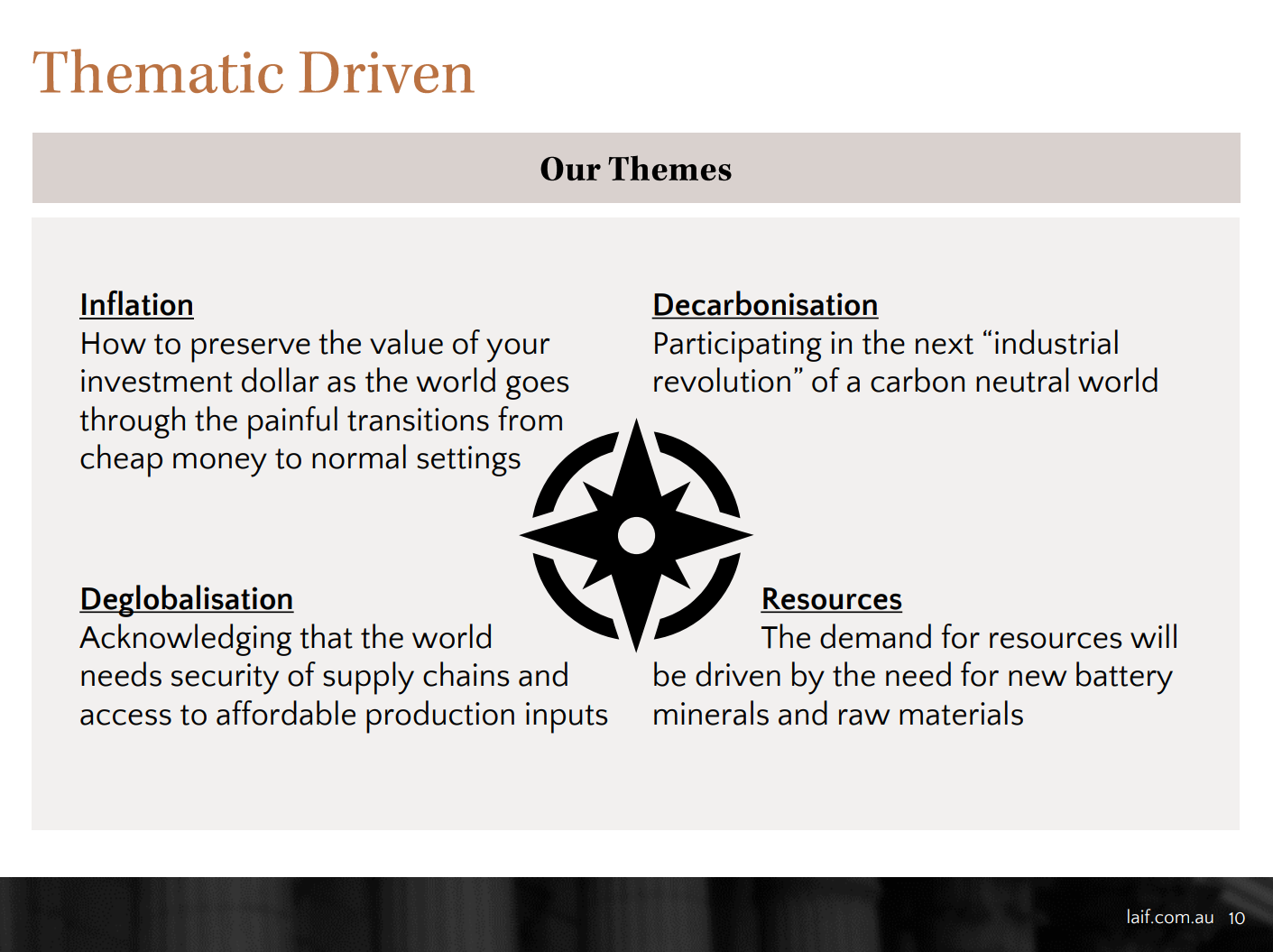

Once we've taken into account that macro environment, we think about the thematics that are going to drive that macro piece. And it's those thematics that are really core to our investment decision-making process. If we take the view that inflation is here to stay, like we did in July last year, despite governments and central banks around the world wanting us to believe that inflation was transitory, which we thought couldn't have been further from the truth, we took our own view as an investment committee and thought, "Well, how do we want to own specific themes in the market that are relevant towards inflation?" And we took those biases in the portfolio as a result and it's been a very good move for us.

We then think about the world and where the world will be in 10 years time. And we think about, what are the key themes that are going to drive our portfolio decision-making? And we take that into the LAIF portfolio and think about, well, not only do we want to own, say a thematic towards resources, but what is the best risk-adjusted way that we can own that thematic? And then, we allocate accordingly to those underlying investment managers that we believe will be the best custodians of our clients' and investors' capital during such period.

Four key themes that we're thinking about at the moment that have been driving a lot of debate at the investment committee level have been inflation, decarbonization, deglobalization and resources. We believe these four thematics are going to be very predominant in investment decision-making going forward.

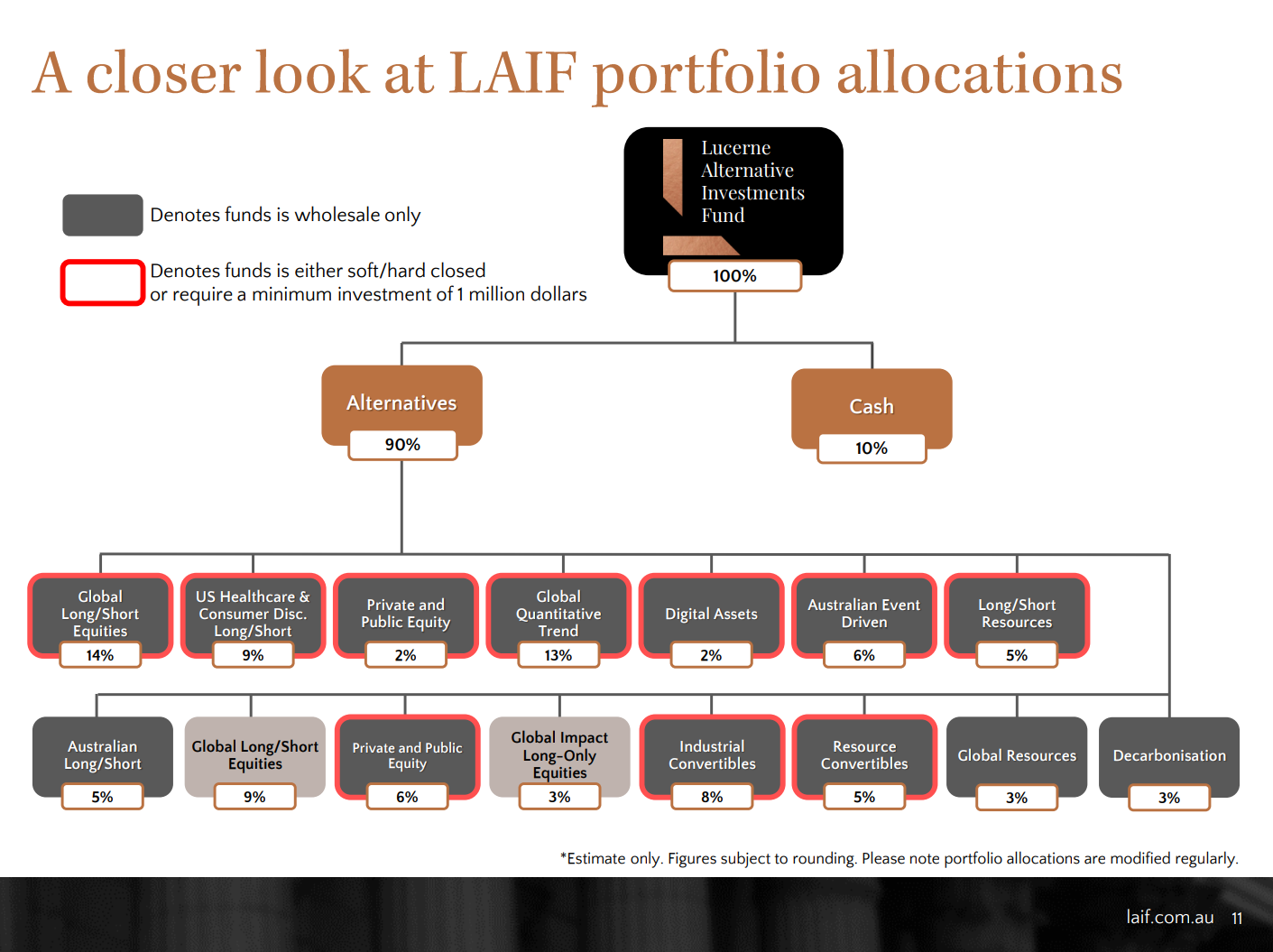

The slide in front of you now actually gives you an overview of the underlying portfolio that LAIF is currently holding. And bear in mind this is a portfolio that is forever changing. In fact, on a monthly basis, we've been active, we are actively managing this portfolio and quite often making investment decisions, and therefore appropriate portfolio changes. And, on average, the underlying portfolio will turn over about 40% per annum. So, it is very active indeed. You can see here from the underlying illustration, I want to point out two things in particular. The first being all those boxes outlined in red denotes either funds that are soft or hard close, or have those very high entry minimum ticket sizes.

And this comes back to what I said before is, LAIF is all about democratising access to everyday investors and providing investors access to these types of strategies and funds they could only ever dream of. The dark grey also denotes the fact that they are for wholesale or sophisticated investors only. There are only two strategies that LAIF currently holds that have retail access as well. So, putting all this together, LAIF provides both wholesale and retail investors access to a universe of investments that are generally only considered for the institutional or family office market, such as our very own Future Fund.

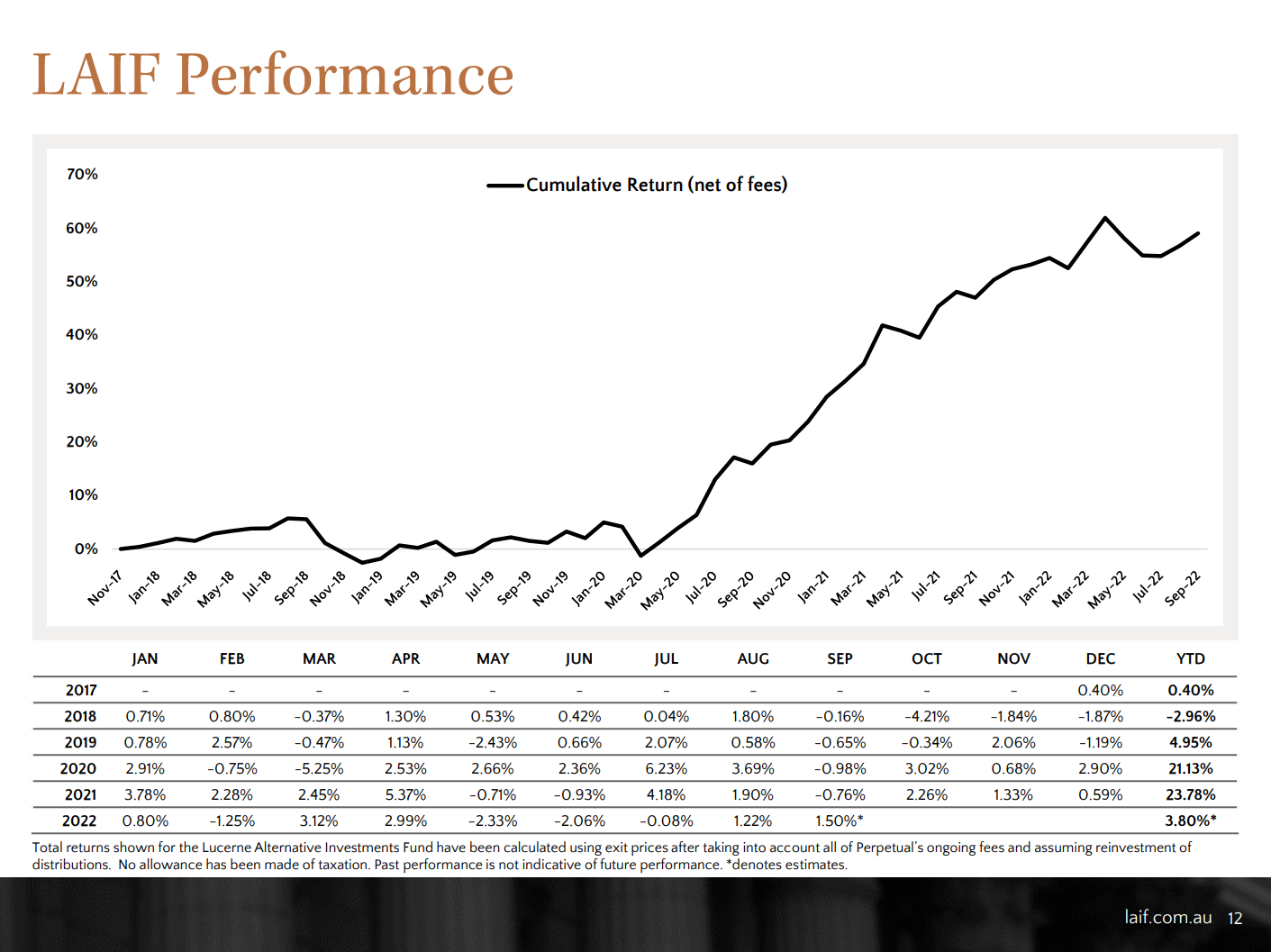

The next chart depicts LAIF's performance since inception. And the observation from this chart one can see is, well, what happened in the first two years and then what happened thereafter? I'll be the first to say that it took two years in running this fund of funds approach to really gain a very good understanding of how one approaches the alternative investments market, and how we own and operate that space in a proactive manner. And over the last three years, we feel that LAIF has now really hit its straps. And not only has demonstrated its unique ability in preserving capital when there are significant drawdowns in traditional asset classes, but also growing those returns consistently over time whilst minimising market risk and beta in our portfolio.

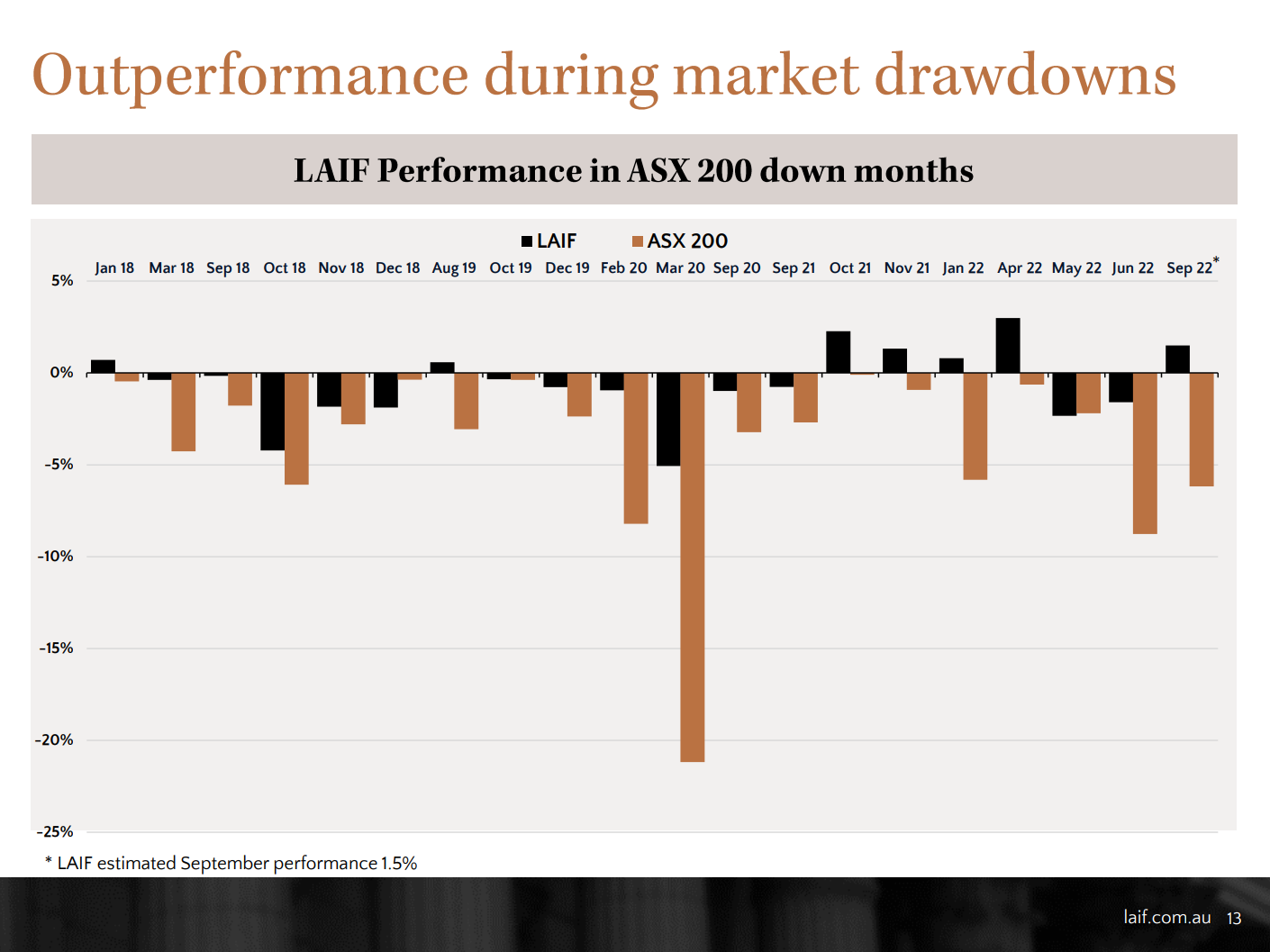

This chart here has really been the driver of LAIF's performance, particularly over the last three years. We've been able to remove ourselves from a lot of significant draw-down periods in the market. And let's think about the worst one that we've had in the last three years, and that's a global pandemic that we don't really want to talk about anymore. In February-March, 2020 when the market significantly dislocated and fell approximately 30% here in Australia, LAIF also had a drawdown, but that drawdown was limited to approximately 6%. By May that year, so two months later, LAIF was already back to its all-time highs.

We've then had this almost Goldilocks environment since mid-2020 until the start of this year, where everything just went up. And we thought that was unsustainable and it was not going to continue. So, come the middle of last year, we really started de-risking the portfolio and taking ourselves more and more away from the market, and that's paid off for our investors, particularly in 2022. If we think about three significant drawdowns in 2022 being January, June and September, LAIF has significantly outperformed the market in that period. And two out of those three months, it's actually produced positive returns for our investors.

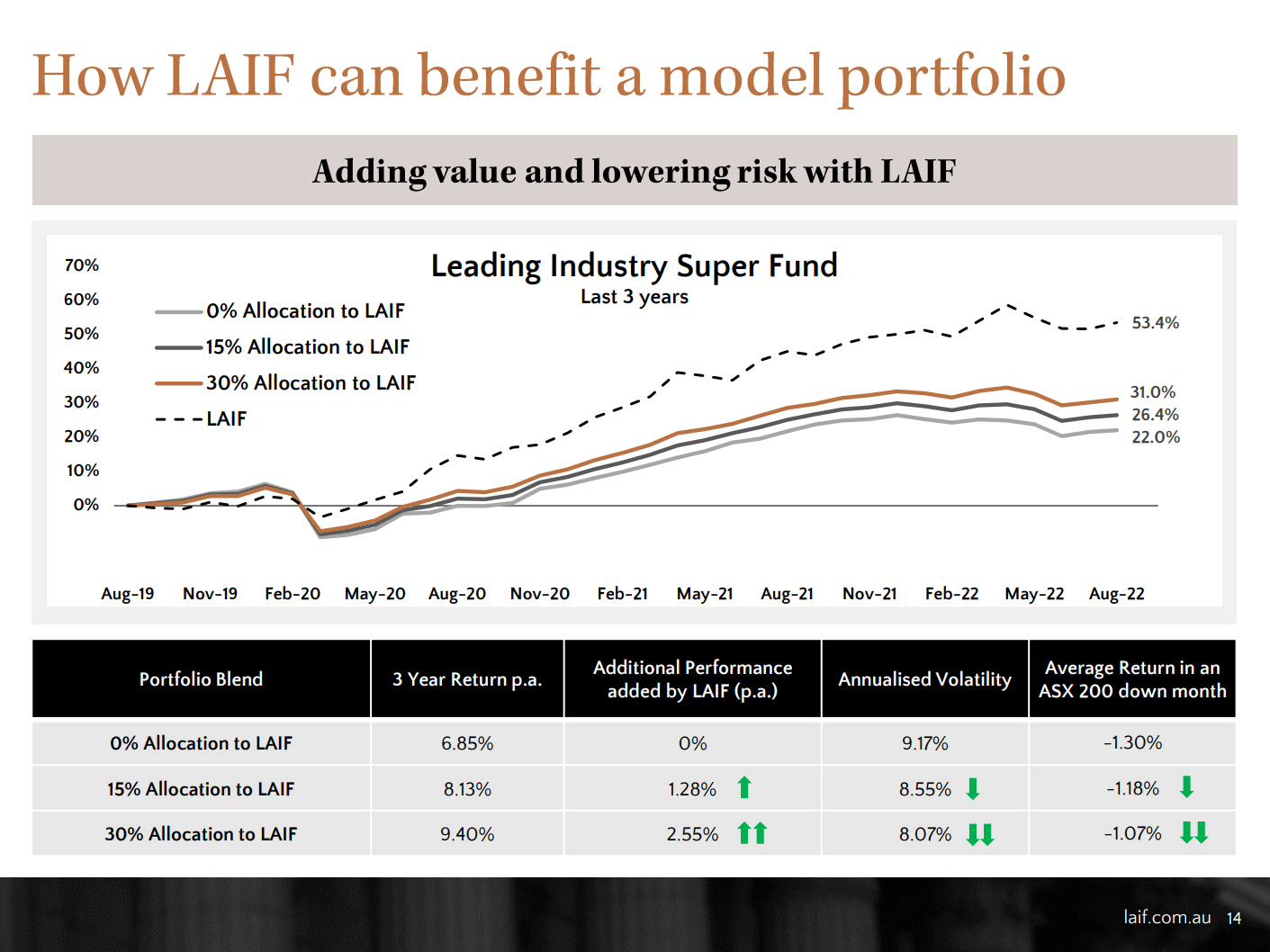

How does LAIF add value in one's portfolio? So, when one thinks about having exposure to equities, bonds, property, fixed income and whatever else one wants to put into their model portfolio, we showed here on a simulation how adding the LAIF to a traditional balanced portfolio of an industry super fund, for example, can not only provide better quality returns over the last three years, but do that with a reduced level of risk. And that's really important, because investors, when they think about additional returns or chasing alpha, they think that has to be done with more risk. Whereas at Lucerne, how we think about actually generating superior returns, it's by removing ourselves most significant draw-down periods in the market. And that's what this table and chart is actually showing you here. If you make assumptions for different allocations to LAIF over time, you can see here that your return profile actually increases, but equally, your draw-down period and your annualised volatility actually decrease, which is exactly what you want in an investment portfolio. And it comes back to what I said before, reducing quality risk-adjusted returns.

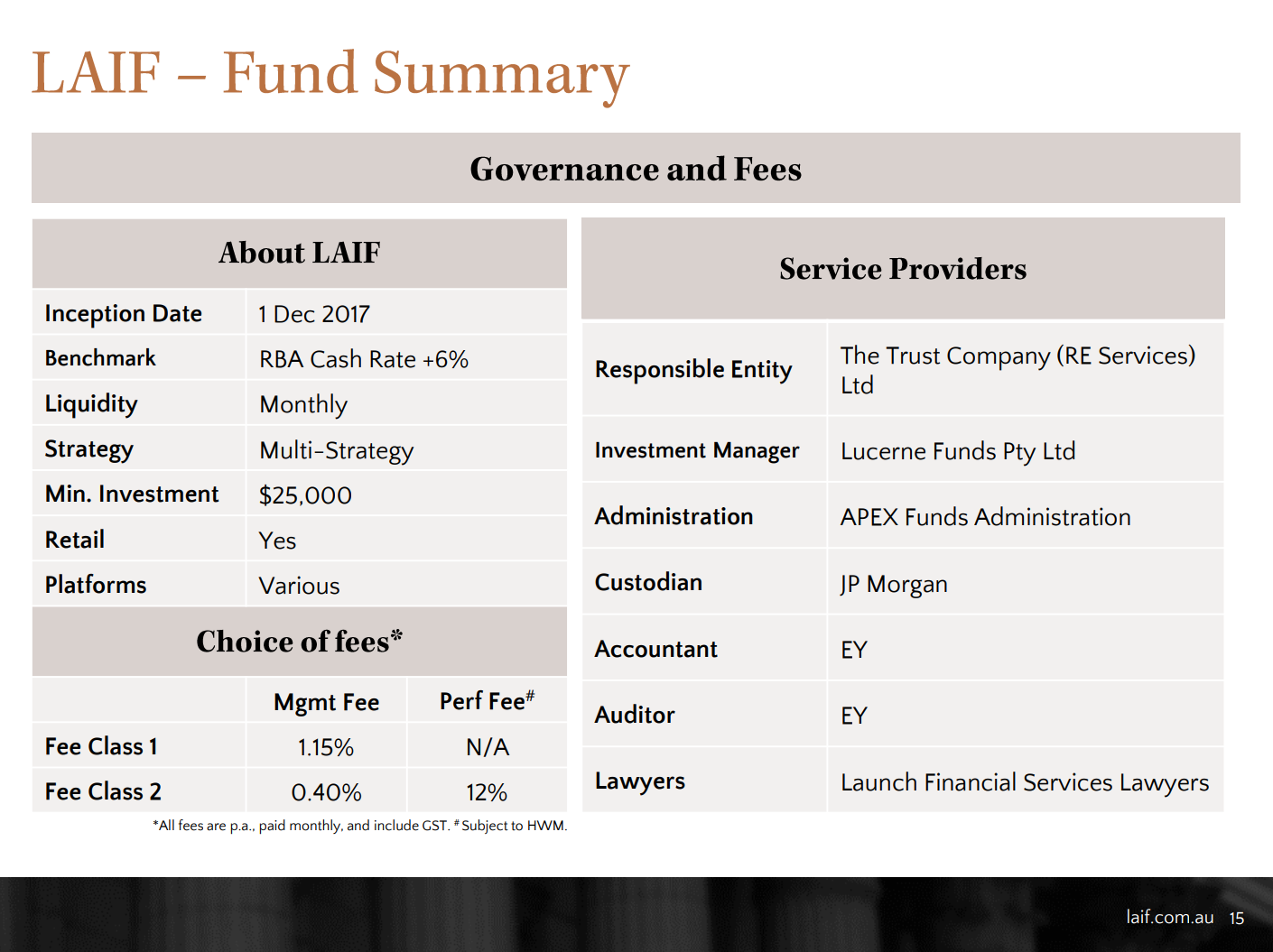

Finally, I'd just like to leave you here with a summary of the fund. It's really important when we established this vehicle that we had key institutional-grade stakeholders around the fund. And you can see we've done that here with our service providers by having Apex as our fund administrator, JP Morgan our custodian and Ernst & Young as our accountant and auditor. We also believe investors choose how to remunerate the investment committee, or LAIF, as a manager. And that's why we believe in providing a choice when it comes to remuneration through fees, and you'll see that's indicated here under Fee Class 1 and Fee Class 2.

In summary, I'd just like to thank you for your time and thank you for learning more about the alternative asset class as a whole, and the space in which Lucerne operates and the Lucerne Alternative Investments Fund. As I said at the start of the presentation, we're really about democratising access to the alternative space, an asset class that has really been unique and biased towards institutional capital and family office capital historically. But through vehicles such as LAIF and other vehicles that we're seeing emerge in the market, it's about bringing that investment class to every day wholesale and retail investors. Thank you for your time.

Learn more

Lucerne Alternative Investments Fund (LAIF) was recently awarded ‘Best Multi Strategy Fund’ at the 2022 Australian Alternative Investment Awards. Providing investors access to an actively managed portfolio of funds designed to have a low correlation to equity markets, you can find out more here.

1 fund mentioned