ASX 200 bounces back, Wesfarmers' profit beat, Australia's unemployment rate hits 4.1%

Get up to date on today's market activity and big events.

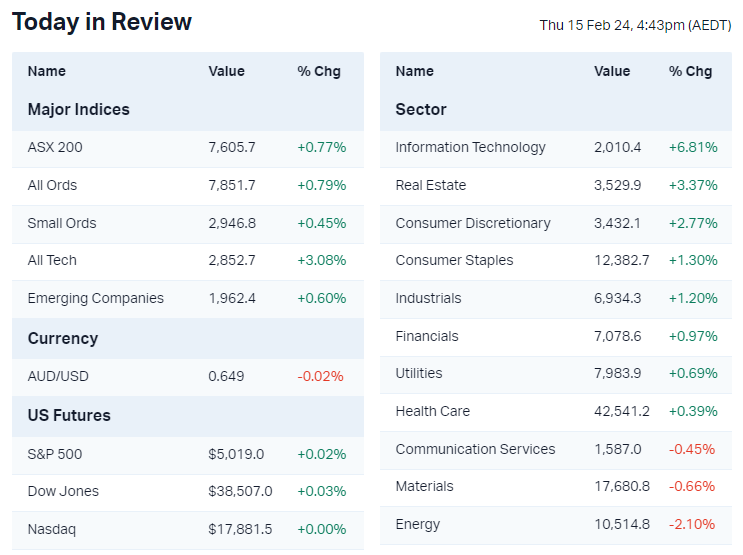

The S&P/ASX 200 finished 58 points higher, up 0.77%.

ASX 200 Session Chart

_%20Share%20Prices%20&%20Charts%20-%20Market%20Index.png)

Markets

Don't miss an ASX announcement this reporting season and set up and receive announcements direct to your inbox on Market Index: Create Alert Now

- The ASX 200 finished higher, near best levels and recouped all of yesterday's hotter-than-expected inflation data related losses

- Technology was the best performing sector after Altium entered into a scheme implementation deed to be acquired by Renesas Electronics at a 33.6% premium

- Altium's takeover offer, a pullback in bond yields and market bounce helped prop up most other tech names. Names like Wisetech, Xero, NextDC and Audinate finished the session 3-5% higher

- Top performing sectors like Real Estate, Discretionary and Staples were all influenced by better-than-expected results from heavyweights like Goodman Group and Wesfarmers

- Goodman Group (+7.0%) announced its 10th consecutive year of upgrading its full-year guidance and its earnings demonstrate its pivot into data centres

- Wesfarmers (+5.0%) earnings came out 9% ahead of Citi expectations, with Kmart smashing expectations. The 91 cents per share interim dividend was also 8% ahead of Citi forecasts

- Treasury Wine (+3.2%) earnings were largely in-line but statutory profit was 3% below consensus. The company plans to reallocate a portion of its Penfolds stock to China

- Telstra (-2.3%) earnings were largely in-line with expectations but trimmed its full-year guidance to reflect weaker earnings from its enterprise division. All other divisions including mobile, consumer and infrastructure services posted solid numbers

- Putting it all together – Several heavyweight companies reported better-than-expected results. The ASX 200 rallied thanks to a strong lead from Wall Street. Markets are generally recovering from the hot-CPI inspired selloff. That isn't to say we're out of the woods. But the price action has so far been constructive (and no panic selling). This is the kind of stuff you'd want to see after such a powerful Nov-Jan rally. Let's see if we can keep on kicking tomorrow

Economy

- Australia's unemployment rate unexpectedly ticked up to 4.1% in January from 3.9% in the previous month and above 4.0% consensus. “This was the first time in two years, since January 2022, that the unemployment rate had been above 4 per cent," said ABS Head of Labour Statistics

- Japan's economy unexpectedly slipped into a recession, with Q4 GDP down -0.1% after a -0.8% contraction in Q3. Economists expected Q4 GDP to rise by 0.3%. Japan lost its title as the world's third-biggest economy to Germany. Analysts are warning of another contraction in the current quarter amid weak demand from China

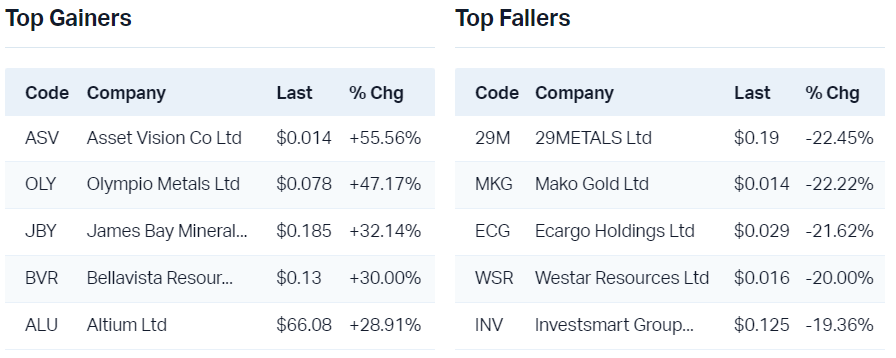

Interesting Movers

Trading higher

- +28.8% Altium (ALU) – Takeover offer at $68.50 per share

- +13.3% Sayona Mining (SYA) – Continuation rally

- +9.1% Mesoblast (MSB) – FDA grants orphan drug designation to rexlemestrocel

- +7.5% Winsome Resources (WR1) – Continuation rally

- +7.0% Goodman Group (GMG) – Earnings

- +6.4% Temple & Webster (TPW) – Post earnings continuation rally

- +5.9% Downer (DOW) – Post earnings continuation rally

- +5.0% Wesfarmers (WES) – Earnings

- +4.7% Domain Group (DHG) – Upgraded by multiple brokers

- +4.4% Magellan (MFG) – Earnings

- +3.6% Orica (ORI) – FY24 business update

Trading lower

- -13.1% Data#3 (DTL) – Earnings

- -13.0% Pro Medicus (PME) – Earnings

- -8.8% IDP Education (IDP) – Downgraded by multiple brokers

- -5.7% Whitehaven Coal (WHC) – Earnings

- -5.3% Fletcher Building (FBU) – Downgraded by multiple brokers

- -5.3% Maas Group (MGH) – Earnings

- -3.4% Accent Group (AX1) – Pullback

- -2.3% Telsta (TLS) – Earnings

- -1.7% BHP (BHP) – Nickel West impairment and higher provisions for Samarco dam failure

Broker Notes

-

AMP (AMP)

- Upgraded to buy from neutral at Citi; Price Target: $1.25 from $0.90

- Retained at equalweight at Morgan Stanley; Price Target: $1.06 from $0.97

- Retained at neutral at Jarden; Price Target: $1.15

- Retained at neutral at JP Morgan; Price Target: $1.04

- Retained at neutral at Barrenjoey; Price Target: $1.22

- Retained at hold at Jefferies; Price Target: $1.15 from $0.97

- Eagers Automotive (APE) initiated buy at Canaccord Genuity; Price Target: $16.00

-

BHP Group (BHP)

- Retained at outperform at Macquarie; Price Target: $49.00

- Retained at equalweight at Morgan Stanley; Price Target: $45.75

- Boral (BLD) retained at outperform at Macquarie; Price Target: $6.40

- Beamtree Holdings (BMT) retained at buy at Shaw and Partners; Price Target: $0.70

- Car Group (CAR) retained at overweight at Morgan Stanley; Price Target: $40.00 from $30.00

-

Commonwealth Bank of Australia (CBA)

- Downgraded to sell from neutral at UBS; Price Target: $105.00

- Retained at sell at Citi; Price Target: $82.00 from $84.00

- Retained at underperform at Macquarie; Price Target: $88.00

- Retained at underweight at Morgan Stanley; Price Target: $94.00 from $93.00

- Retained at underweight at Barrenjoey; Price Target: $90.00 from $85.00

- Retained at underweight at JP Morgan; Price Target: $89.00 from $88.00

- Retained at underperform at CSLA; Price Target: $109.70 from $110.00

- Retained at sell at Goldman Sachs; Price Target: $81.98 from $82.37

- Downgraded to reduce from hold at Morgans; Price Target: $91.28 from $90.18

-

Computershare (CPU)

- Retained at buy at UBS; Price Target: $31.00 from $32.00

- Retained at buy at Citi; Price Target: $30.00 from $29.00

- Retained at outperform at Macquarie; Price Target: $28.00

-

Domain Holdings Australia (DHG)

- Retained at buy at Bell Potter; Price Target: $3.90 from $3.95

- Retained at neutral at UBS; Price Target: $3.75 from $3.80

- Retained at neutral at JP Morgan; Price Target: $3.15 from $3.40

- Retained at buy at Jefferies; Price Target: $3.90 from $4.00

- Upgraded to overweight from neutral at Barrenjoey; Price Target: $3.75

- Upgraded to underperform from sell at CSLA; Price Target: $3.40

-

Downer EDI (DOW)

- Retained at neutral at UBS; Price Target: $4.90 from $4.55

- Retained at neutral at Macquarie; Price Target: $4.90 from $4.10

- Retained at neutral at JP Morgan; Price Target: $4.70 from $4.10

- Retained at neutral at Barrenjoey; Price Target: $4.90 from $4.60

-

Dexus (DXS)

- Retained at neutral at Citi; Price Target: $8.20

- Retained at neutral at Macquarie; Price Target: $7.38 from $7.36

- Retained at underperform at Morgan Stanley; Price Target: $7.65

-

Evolution Mining (EVN)

- Retained at buy at UBS; Price Target: $3.50 from $3.55

- Retained at outperform at Macquarie; Price Target: $3.80

- Retained at equalweight at Morgan Stanley; Price Target: $3.35 from $3.55

- Upgraded to buy from outperform at CLSA; Price Target: $3.75 from $3.50

- Upgraded to overweight from neutral at JPMorgan; Price Target: $3.50 from $3.30

-

Fletcher Building (FBU)

- Retained at equalweight at Morgan Stanley; Price Target: $5.23 from $3.67

- Downgraded to neutral from buy at Goldman Sachs; Price Target: $3.70 from $4.65

- Fortescue (FMG) retained at underweight at Morgan Stanley; Price Target: $62.50

- Goodman Group (GMG) retained at buy at Citi; Price Target: $25.50

-

Graincorp Class A (GNC)

- Retained at buy at Bell Potter; Price Target: $9.30 from $9.50

- Retained at buy at UBS; Price Target: $8.80 from $9.00

- Retained at outperform at Macquarie; Price Target: $9.26 from $9.70

- Upgraded to add from hold at Morgans; Price Target: $8.55 from $8.08

-

G.U.D. Holdings (GUD)

- Retained at buy at UBS; Price Target: $12.80 from $13.00

- Upgraded to buy from neutral at Citi; Price Target: $12.80 from $12.90

- Retained at outperform at Macquarie; Price Target: $12.85 from $13.25

-

IDP Education (IEL)

- Downgraded to hold from buy at Bell Potter; Price Target: $23.60 from $25.00

- Retained at buy at UBS; Price Target: $28.00 from $27.60

- Retained at overweight at Morgan Stanley; Price Target: $27.50

- Downgraded to neutral from overweight at JPMorgan; Price Target: $23.00 from $25.00

- Retained at hold at Morgans; Price Target: $23.10 from $23.45

- Retained at underperform at Jefferies; Price Target: $18.00 from $19.00

- Retained at overweight at Jarden; Price Target: $29.45 from $27.25

- Mineral Resources (MIN) retained at equalweight at Morgan Stanley; Price Target: $18.80

- Medibank Private (MPL) retained at equalweight at Morgan Stanley; Price Target: $3.66

- Ridley Corporation (RIC) retained at buy at UBS; Price Target: $2.80

- Rio Tinto (RIO) retained at overweight at Morgan Stanley; Price Target: $144.50

-

Seven Group Holdings (SVW)

- Upgraded to buy from hold at Bell Potter; Price Target: $44.30 from $38.00

- Retained at buy at UBS; Price Target: $45.00 from $34.50

- Downgraded to neutral from outperform at Macquarie; Price Target: $42.10 from $33.60

- Retained at hold at Jefferies; Price Target: $31.20

- Retained at neutral at JP Morgan; Price Target: $40.15 from $34.50

- Retained at buy at Goldman Sachs; Price Target: $42.10 from $32.50

- The Lottery Corporation (TLC) retained at buy at Citi; Price Target: $5.60

- Telstra Group (TLS) retained at buy at Goldman Sachs; Price Target: $4.65

-

Temple & Webster Group (TPW)

- Retained at hold at Bell Potter; Price Target: $11.30 from $8.00

- Retained at neutral at UBS; Price Target: $10.70 from $7.00

- Treasury Wine Estates (TWE) retained at neutral at Citi; Price Target: $11.00

- Wesfarmers (WES) retained at sell at Citi; Price Target: $45.00

SCANS

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Kerry is a Content Strategist at Market Index. He writes the daily Morning Wrap and Weekend Newsletter. Kerry is passionate about trading and the catalysts that influence the market. His content focuses on highlighting the key data and insights that matter most to investors.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

21 ASX stocks that should be on your radar

Livewire Markets

Equities

Wisetech tanks 17% on earnings miss but margins shine

Livewire Markets