ASX 200 flat + Macquarie shifts on the Big Four + Your guide to the July RBA meeting

US markets traded flat to higher on light volumes ahead of the July 4th holiday. Yesterday, the Chinese private sector activity read came in positive - but just barely. It'll raise more questions about how sustainable that post-reopening boost really was. In our neck of the woods, all eyes are on the RBA meeting at 2:30pm today. Rates markets are pricing in a 15bps hike and economists are just as split. And in our deeper dive, we're taking a look at Macquarie's less-than-convincing take on the big banks.

Let's dive in.

S&P 500 Session Chart

ECONOMY

Markets split on RBA rate path as inflation lingers

Millions of US borrowers brace for the return of student debt payments which will ripple through the economy as bills come due

Asian PMIs - China's weaker rebound weighs on regional manufacturing with soft demand clouding outlook for factories

Eurozone factory output shrinks faster than expected in June 2023 with industrial sector seen impacted by ECB rate hikes

UK manufacturing sector decline steepens in June, optimism fades with services sector now the main source of growth

Swiss inflation below SNB's 2% ceiling in June

BOJ Tankan survey shows Japan manufacturer sentiment rises in Q2 as raw material costs peaked, factory output rebounded

Australian home prices rise for 4th month in June as sustained squeeze on housing supply helps lift values nationwide

STOCKS

Tesla delivers record number of vehicles in Q2, topping market estimates

Netflix eyes new ad formats to boost revenue from ad-supported service

Apple forced to make major cuts to Vision Pro headset production plans on manufacturing problems

UBS aims to avoid using $10B backstop for Credit Suisse

AstraZeneca underwhelms on lung cancer trial data

Deeper Dive

Your guide to the RBA Decision

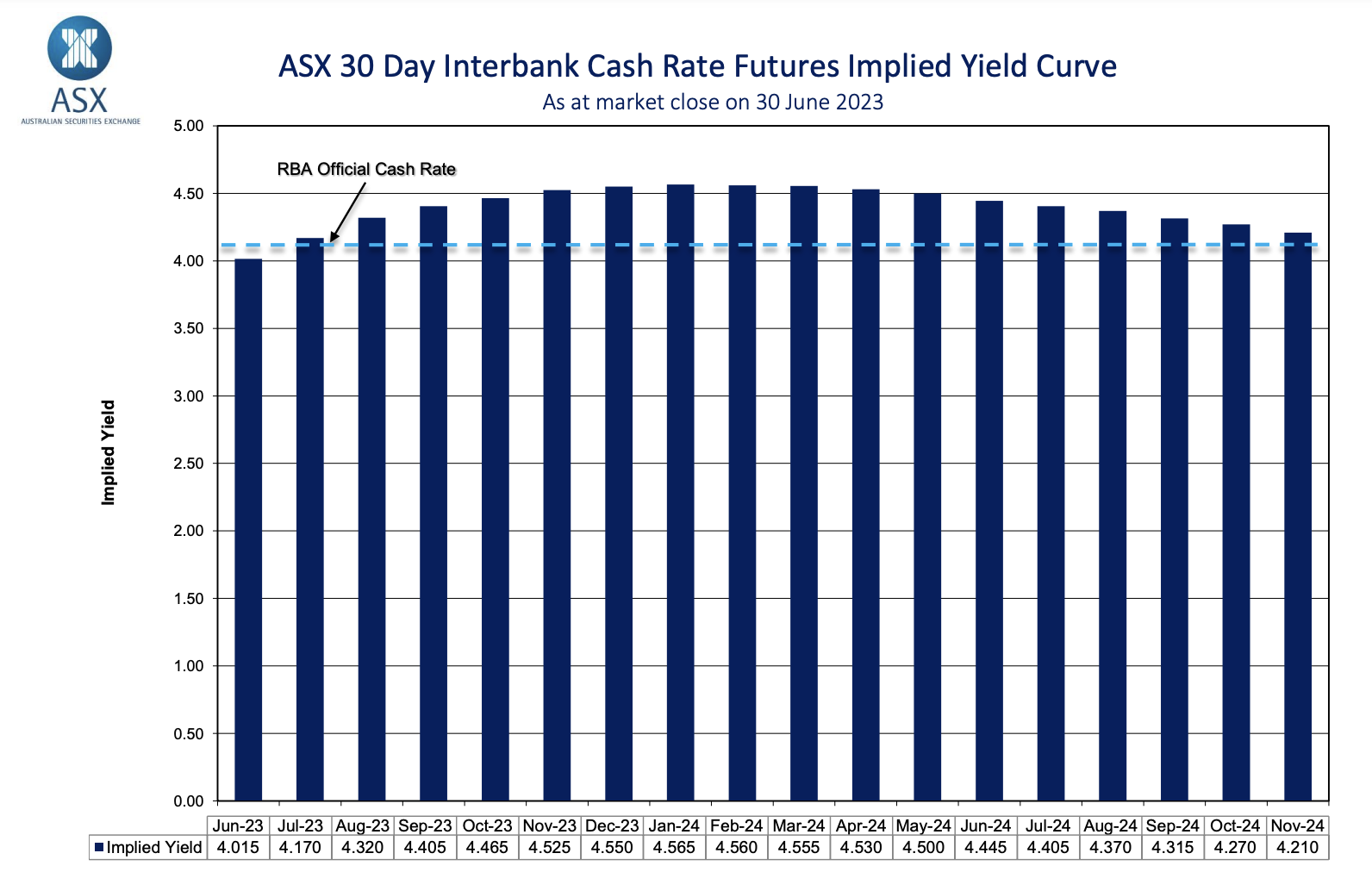

As we discussed on the newest episode of Signal or Noise, different data points are flashing different signals at investors. If you looked at the uptick in retail sales and PMIs, you'd think that the RBA should pause this afternoon. If you looked at inflation and investor sentiment, you would think that the central bank has to hike rates again.

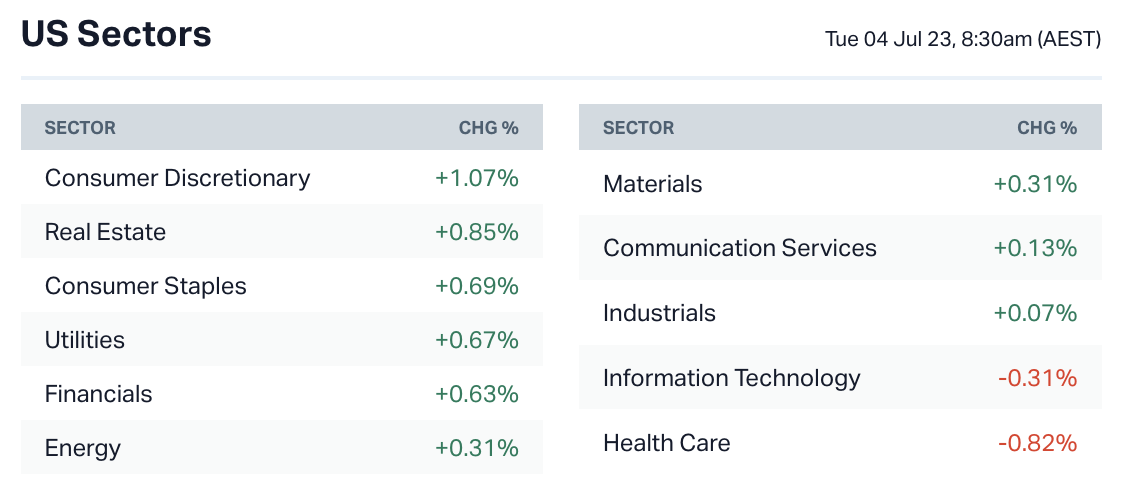

That same schism can be seen in the following chart. Rates traders have priced in a 15 basis point hike at this afternoon's meeting. But 13 out of 27 economists think they will still go the full 25 basis points (the other 19 think they will pause).

If they do go again, it'll be all about inflation. A partial, non seasonally adjusted read of 5.6% is still too high and well above the RBA's 2-3% target. If they pause, then it will be down to sour sentiment as well as realising that last quarter's 0.2% GDP read is too close to its worst-case hard landing scenario. In addition, a pause this time could suggest that the pause in rate hikes will actually stick this time.

We'll find out which way they go at 2:30pm this afternoon.

Macquarie on the Big Four Banks

Speaking of Signal or Noise, Simon Doyle from Schroders made the astute observation that holding a lot of your portfolio in cash or term deposits is not a bad idea given you're now being paid to hold said cash. After all, term deposit rates are at near-decade highs. And while that's great news for savers and consumers, that's not good news for banks.

Here's what Macquarie analysts wrote yesterday.

Banks continued to raise their deposit pricing as most institutions passed through rate increases through base savings rates, potentially signalling the end of further margin accretion from savings accounts. TD rates also increased meaningfully during the month, with one-year special TDs lifting by around 30bps. We don't expect these benefits to be sustained.

They added that they are now forecasting a 3 to 8bps fall in margins across the Big Four for FY24 another 8 basis points in FY25. While you think that might not be too much at face value, it's actually a big drop considering some bank margins are under 2%.

Hans' Chart of the Day

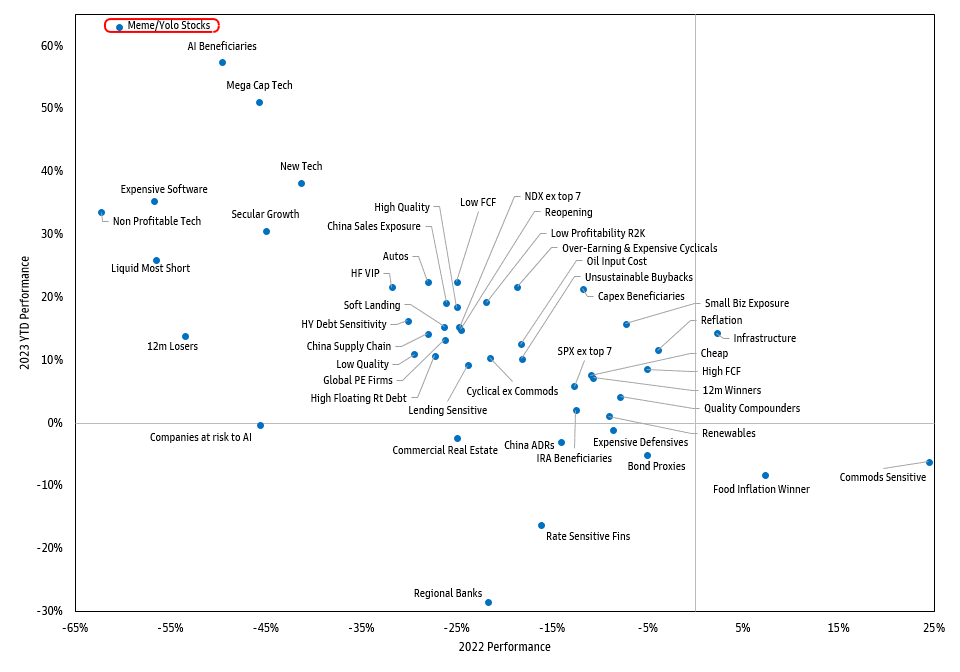

Proving everything old is new again, my chart of the day comes to us from Goldman Sachs. Meme and "YOLO" (you only live once) stocks may have fallen sharply in 2022 but they are right back up again in 2023. Instant gratification is a weird beast.

Key Events

ASX Corporate Actions:

Trading ex-div: Sunland Group, 20cps

Listings: Chilwa Minerals (CHW) @ 1pm today

Economic Calendar:

2:30 pm: RBA Cash Rate and Statement

Today's Morning Wrap was written by Chris Conway and Hans Lee. Kerry Sun is away today.

2 topics

2 contributors mentioned