ASX 200 futures flat, Wall Street ekes out gains, commodity prices slump

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 4 points lower, down -0.05% as of 8:30 am AEST.

S&P 500 SESSION CHART

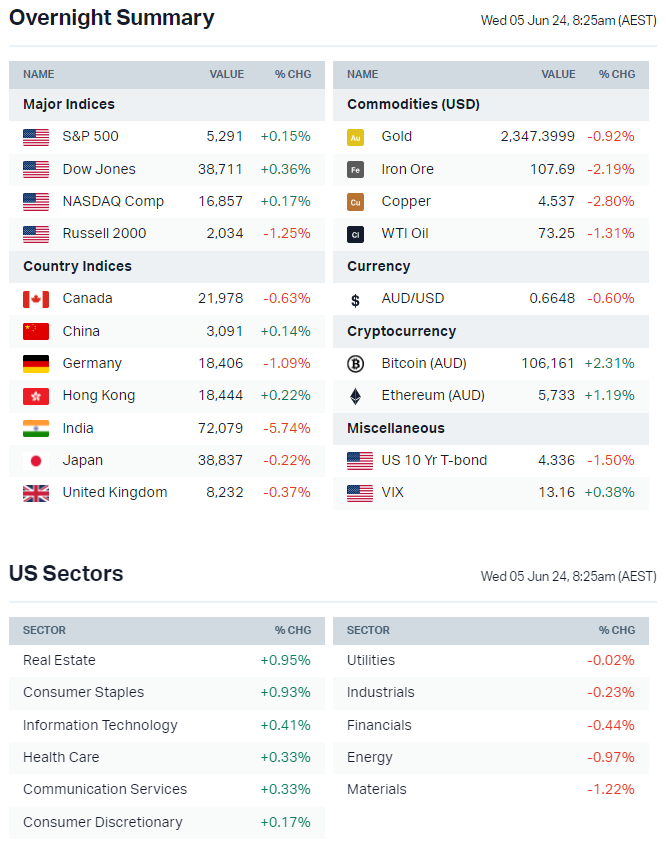

OVERNIGHT MARKETS

- Major US benchmarks ended mostly higher, closing near best levels

- Defensives, Big Tech and Staples outperformed while cyclicals like resources and energy led to the downside

- Russell 2000 underperformed massively, reflecting growth concerns and weakness in cyclical pockets of the market

- Bond yields continue to fall on weak US jobs data, the US 2-year is down 20 bps in the last five sessions and not far off a two-month low

- Every dollar allocated into the S&P 500 ETF, 27 cents goes into Apple, Amazon, Nvidia, Alphabet and Microsoft

- Big tech stocks hiding how scared investors are about the Fed keeping rates higher for longer (WSJ)

- Short interest in average S&P 500 stock hovering near lowest in more than two decades as bears retreat (Bloomberg)

- Morgan Stanley sees risks in being long dollar, underweight duration going into US election (Bloomberg)

INTERNATIONAL STOCKS

- Google to slash at least 100 jobs across cloud division (CNBC)

- Microsoft laying off hundreds at Azure cloud unit (Reuters)

- Tesla's China-made EV sales fall 6.6% y/y in May amid output cut (Reuters)

- Ford sees ~65% increases in May sales of EVs and hybrids (CNBC)

- Cisco announces plan to invest $1B in AI startups (Bloomberg)

- Maersk says global supply lines more impacted than previously expected by Red Sea disruption (Bloomberg)

CENTRAL BANKS

- ECB hawks and resilient data sow doubts over pace of rate cuts (Bloomberg)

GEOPOLITICS

- Netanyahu under pressure from right wing minister to reject US-backed ceasefire plan (Bloomberg)

- Japan PM Kishida will not call a snap election in Japan before current parliament session ends (Reuters)

- India's Modi wins election despite his party losing outright majority (CNBC)

ECONOMY

- US job openings fell more than expected in April, pushing the number of available jobs per job-seeker to the lowest in nearly three years (Reuters)

- German unemployment increased more than expected in May (Bloomberg)

- South Korean inflation falls by more than expected, keeping alive prospects of a central bank pivot (Bloomberg)

ASX TODAY

- ASX 200 set for a relatively flat open as a positive overnight lead and lower bond yields is offset by a drop in commodity prices

- Goldman Sachs' Commodities Index has marked its worst four-day stretch of the year, reflecting a sharp pullback for several soft and hard commodities

- Overnight commodity snapshot: Silver (-3.5%), Copper (-2.6%), Nickel (-2.5%), Aluminium (-1.9%), Brent Crude (-1.3%) and Gold (-0.9%)

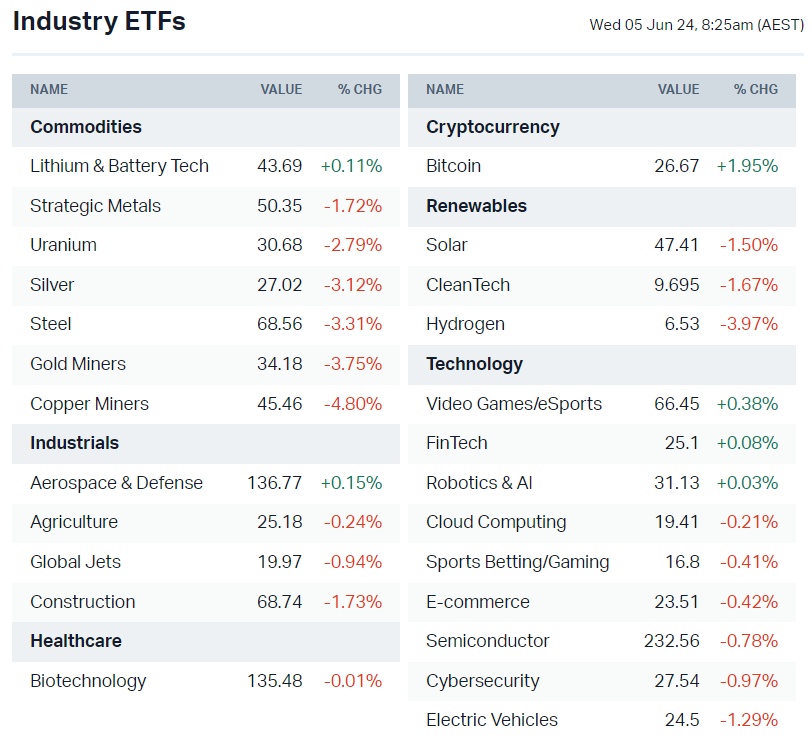

- Several overnight commodity-related ETFs we track also sold off, including the Global X Copper Miners ETF (-4.8%), Sprott Nickel Miners ETF (-3.8%), VanEck Gold Miners ETF (-3.7%) and Global X Uranium ETF (-2.8%)

- Flight attendants union to launch legal action against Qantas regarding pay of indirectly employed cabin crew (The Aus)

- IPD Group CEO Michael Sainsbury discloses sale of 353,000 shares (IPG)

- Treasury Wine Estates reaffirms FY mid-to-high single digit EBITS (TWE)

- Woodside and Aramco in talks to invest in Tellurian’s Driftwood LNG Project (Bloomberg)

- Xero launches offering of $850m convertible notes (XRO)

- Xero block trade of $380m offered at 2.5% to 4.5% discount, related to delta hedging for the above convertible notes offering (AFR)

BROKER MOVES

- Cooper Energy upgraded to Buy from Speculative Buy; target up to $0.27 from $0.25 (Canaccord Genuity)

- Integral Diagnostics downgraded to Neutral from Positive; target remains $2.40 (E&P)

KEY EVENTS

Companies trading ex-dividend:

- Wed 5 June: Qualitas Real Estate Income Fund (QRI) – $0.012, Hancock & Gore (HNG) – $0.01, Infratil (IFT) – $0.017

- Thu 6 June: None

- Fri 7 June: None

- Mon 10 June: None

- Tue 11 June: None

Other ASX corporate actions today:

- Dividends paid: None

- Listing: None

Economic calendar (AEST):

- 9:00 am: Australia Industry Index (May)

- 11:30 am: Australia GDP (Q1)

- 11:45 pm: Bank of Canada Interest Rate Decision

- 12:00 am: US ISM Services PMI (May)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment