ASX 200 set to rise + Are stocks expensive right now?

ASX 200 futures are trading 26 points higher, up 0.36% as of 8:30 am AEST.

S&P 500 SESSION CHART

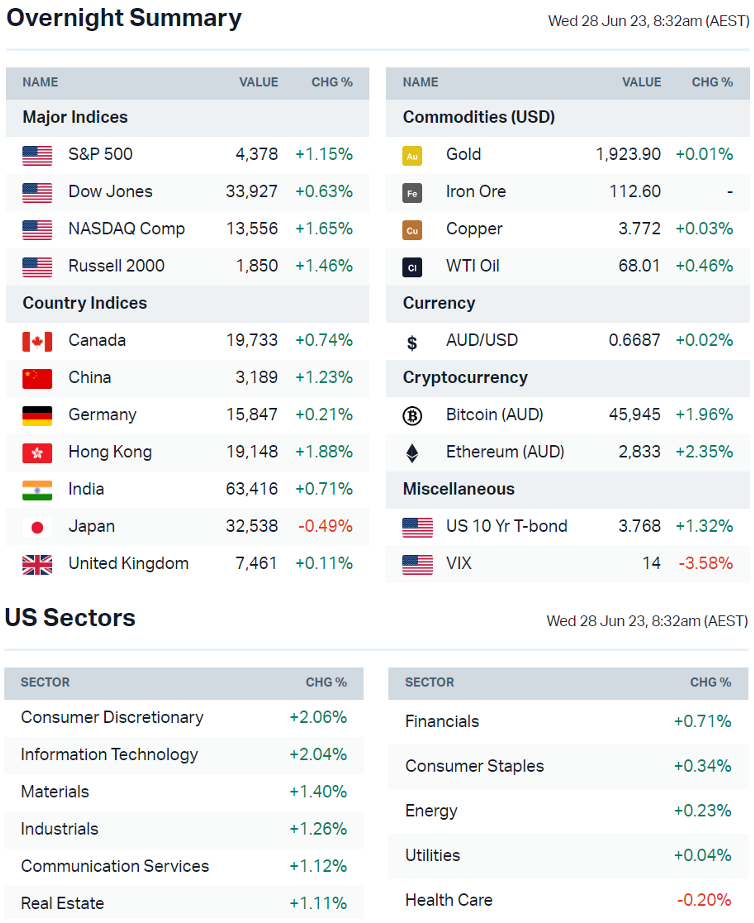

MARKETS

- S&P 500 higher, finished near best levels after softness on Tuesday

- Strong set of economic data bolstered soft landing expectations, including better-than-expected US durable goods, consumer confidence and home sales data

- Big tech downgrades continue to pick up (Yahoo)

- Quarter-end rebalancing could drive outsized equity selling (Reuters)

- JPMorgan says potential quarter-end selling could see US$50bn for sale in US equities, Goldman Sachs estimates US$27bn of stocks to sell for the month

- Morgan Stanley warns the first negative payrolls data could come in August or September, while JPMorgan says this could result in an early end to the Fed’s tightening cycle

STOCKS

- Delta Airlines shares rally after guiding to the top end of its full-year guidance (CNBC)

- Insurance firm American Equity Investment Life rallies on rumours that Brookfield was close to making a deal to buy the company for approximately US$4.3bn (CNBC)

- Coinbase shares surge as Fidelity set to submit an application for a spot Bitcoin ETF

- Microsoft CEO Nadella said last year goal is to reach $500bn in revenue by 2030 (CNBC)

- Baidu says its ChatGPT-style service outperforms OpenAI on key measures (Bloomberg)

- Robinhood to lay off 7% of workforce amid decline in trading activity

- Goldman Sachs to layoff 125 Managing Directors globally (Times)

- EV maker Lordstown Motors files for bankruptcy (CNBC)

ECONOMY

- US durable goods orders top expectations, increase for a second month (Bloomberg)

- US consumer confidence jumps to a 17-month high (Reuters)

- US new home sales surge to fastest pace since Feb 22, up 12% MoM (Bloomberg)

- China Premier Li says economy on track to hit growth target (Bloomberg)

- ECB's Lagarde says rate hike pauses possible in coming months (Bloomberg)

- BoE expected to hike two more times, will tip UK into recession (Bloomberg)

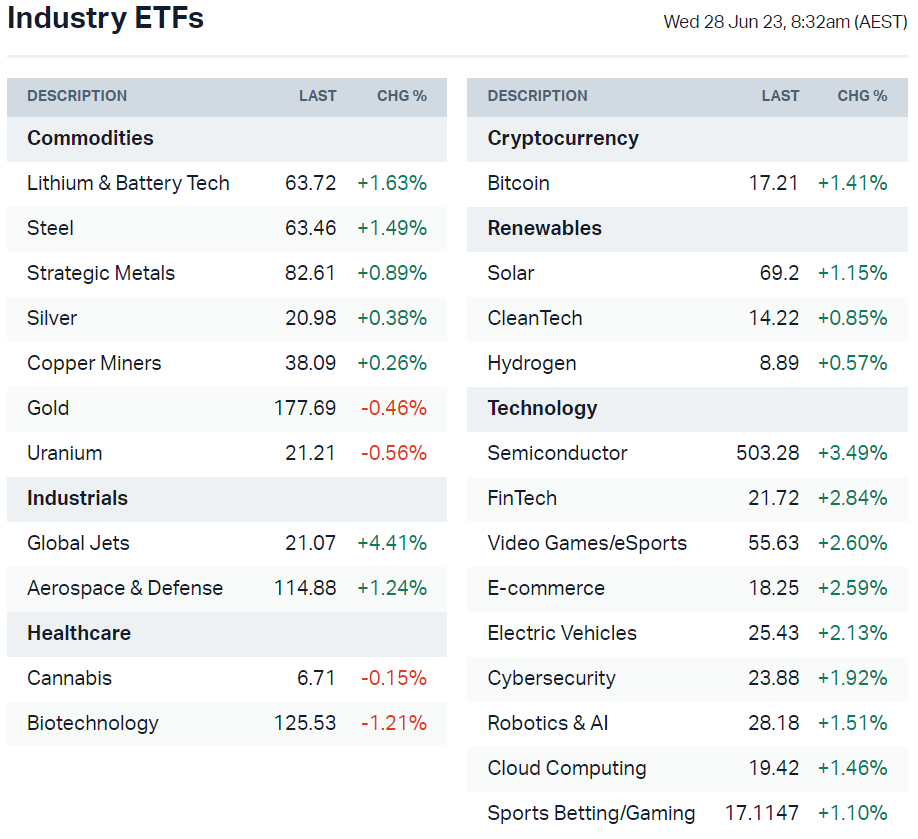

The Nickel and Aluminium ETFs have been removed and will be replaced by Invesco Agriculture ETF (DBA) and Invesco Construction ETF (PKB). Changes coming soon. A new education piece is out about the above ETF list. If you want to learn more about why this list can be helpful (or you just want to suss what the tickers are) read here.

DEEPER DIVE

S&P 500: Where are we now

From a technical perspective, the S&P 500 is rather bullish. It bounced from the 20-day moving average overnight, up 1.15% after a shallow 2.7% pullback from recent highs.

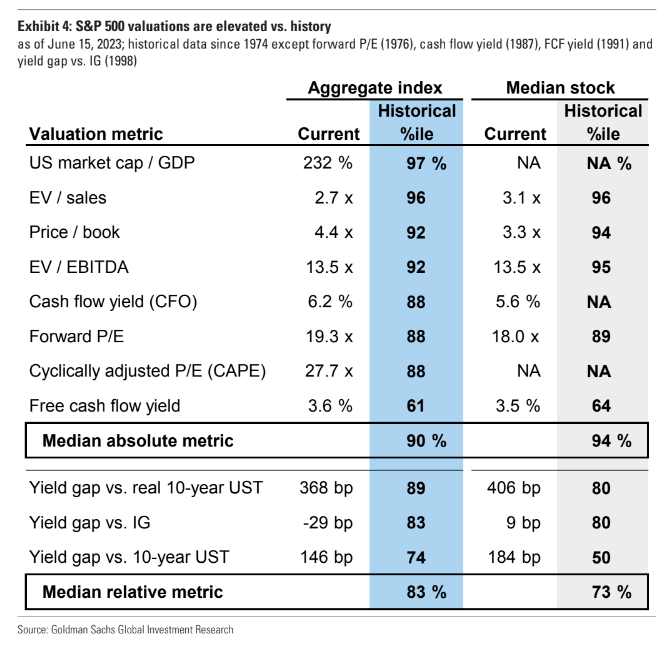

But from a valuation perspective, boy is it expensive. Just about every valuation metric for US stocks is in the 90th percentile.

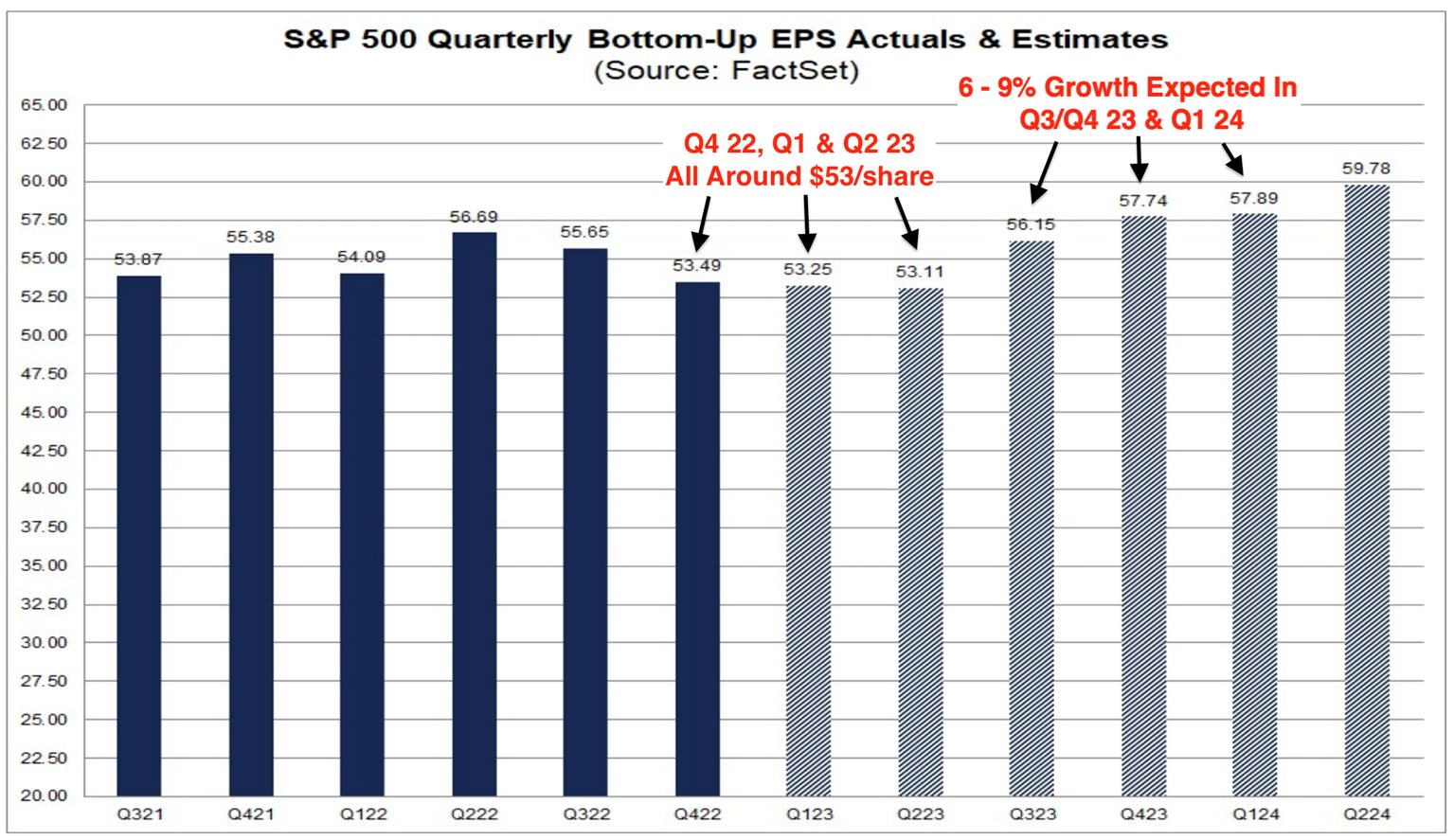

At the same time, we know that markets have a tendency to lead the economy by 2-3 quarters. The second quarter of 2023 is expected to mark the trough for S&P 500 earnings, followed by a rebound from the third quarter onwards. By the fourth quarter of 2023, analysts expect earnings to be in record territory.

If the Fed is truly done with its hiking cycle and earnings are bottoming, then valuations might not be that expensive after all.

Key Events

ASX corporate actions occurring today:

- Trading ex-div: None

- Dividends paid: GQG Partners (GQG) – $0.02

- Listing: None

Economic calendar (AEST):

- 11:30 am: Australia Monthly CPI Indicator

- 11:30 am: Fed Chair Powell Speech

This Morning Wrap was first published for Market Index by Kerry Sun.

1 topic

1 contributor mentioned