ASX 200 to bounce after worst weekly performance since Sep-23, S&P 500 extends selloff

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 27 points higher, up 0.35% as of 8:30 am AEST.

S&P 500 SESSION CHART

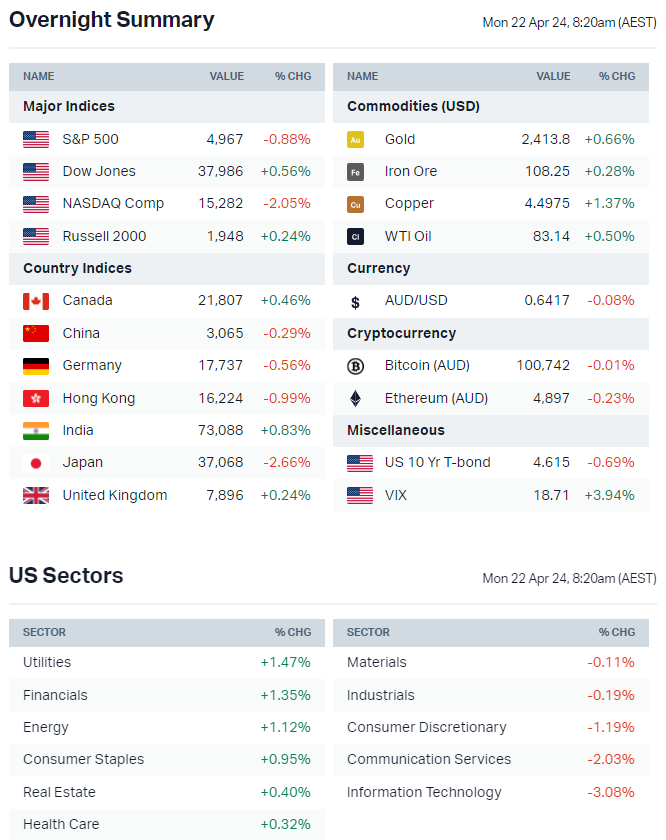

MARKETS

- S&P 500 and Nasdaq lower last Friday and finished near worst levels despite opening in positive territory

- Equal-weighted S&P finished in positive territory and outperformed by over 100 bps, reflecting tech-led selloff

- US equities finished mostly lower last week, led by the Nasdaq (-5.5%), S&P 500 (-3.05%) and Russell 2000 (-2.77%) while the Dow rose 0.01%

- Market struggled to shake off the hawkish repricing of Fed rate cut expectations and heightened war tensions in the Middle East

- Global equities added to last week's US$19.6bn outflow with another US$9.1bn outflow, according to EPFR data

- Citi noted this week that of US$52bn long positions on S&P 500, 88% in a loss

- Strategists say tech selloff driven by expectations toward slower earnings growth (FT)

- High bar into tech earnings with group trading at 31x forward earnings (Bloomberg)

- China driving gold rally with strong demand from individuals, funds and its central bank (Bloomberg)

- US junk bond funds experience biggest outflow in 14 months amid spike in Treasury yields (Bloomberg)

ASX TODAY

- ASX 200 set to open higher after a 2.84% drop last week, which marked its worst weekly performance since mid-September 2023.

- ASX 200 somewhat bounced last Friday, finishing the session down -0.98% from session lows of -1.96%

- Sectors to watch on Monday include banks (Citi downgraded major Australian banks), copper miners (copper prices hit US$4.5/lb overnight), nickel miners (nickel prices rallied 5.5% to hit highest since Sep-23), tech (tech-led selloff on Wall Street overnight) and airlines (Air New Zealand downgraded its FY24 earnings)

- Air New Zealand cuts full-year guidance on deteriorating economic and operational conditions (AIZ)

- Cettire's major holder LHC sells stake (AFR)

- Cochlear receives FDA clearance to lower age for the Osia to 5-years old (COH)

- KKR named preferred bidder for Perpetual’s Corporate Trust and Wealth Management units, suggests EQT is no longer in contention (The Aus)

- Origin Energy CEO Frank Calabria discloses sale of ~211,000 shares (ORG)

- Paladin Energy completes ten-for-one- share consolidation (PDN)

BROKER MOVES

A few broker notes of interest - Most have come out after market close on Friday.

- ANZ downgraded to Sell from Neutral; target remains $26.00 (Citi)

- Goodman Group downgraded to Neutral from Overweight but target increased to $30.00 from $28.00 (Barrenjoey)

- Karoon Energy downgraded to Sector Perform from Outperform; target cut to $2.25 from $2.30 (RBC Capital Markets)

- Lovisa initiated Buy with $39.00 target (Jefferies)

- Netwealth downgraded to Sell from Neutral at Citi but target increased to $18.65 from $18.35 (Citi)

- Pilbara Minerals downgraded to Underweight from Neutral; target cut to $3.10 from $3.25 due to valuation (JPMorgan)

- Westpac downgraded to Sell from Neutral; target remains $22.25 (Citi)

- Whitehaven Coal upgraded to Add from Hold; target increased to $8.90 from $7.75 (Morgans)

INTERNATIONAL STOCKS

- Netflix subscriber growth easily tops estimates following password sharing crackdown, but revenue forecast underwhelms (Bloomberg)

- Apple removes WhatsApp and Threads from China app stores at request of China's internet regulator (Bloomberg)

- Google announces workplace restructure to streamline rollout of AI products (FT)

- American Express shares soar on earnings beat, US consumer spending increased 8% from a year earlier (Barron’s)

- Tesla cuts prices on cars by US$2,000 and FSD software by a third (Bloomberg)

CENTRAL BANKS

- Atlanta Fed President Bostic doesn't believe it is appropriate to ease until towards end of 2024 (Bloomberg)

- Minneapolis Fed President Kashkari says rates could potentially remain unchanged in 2024 (Bloomberg)

- BOJ Governor Ueda reaffirms potential policy change if yen weakness pushes up inflation (Reuters)

- ECB's Simkus says several rate cuts are most likely but does not need to chart the course precisely (Reuters)

- China to leave benchmark lending rates unchanged on Monday (Reuters)

GEOPOLITICS

- Israel carefully calibrated its response to reduce the risk of escalation (NY Times)

- Israel strikes targets inside Iran, according to US officials (NY Times)

- US and Israel held a high-level virtual meeting about a possible Israeli operation in Rafah (Axios)

ECONOMY

- Japan CPI cools more than expected as 'core core' measure falls below 3% for first time since Nov-2022 (Reuters)

KEY EVENTS

Companies trading ex-dividend:

- Mon 22 April: MFF Capital (MFF) – $0.06

- Tue 23 April: Naomi Cotton (NAM) – $0.01

- Wed 24 April None

- Thu 25 April: None

- Fri 26 April: None

Other ASX corporate actions today:

- Dividends paid: Gowing Bros (GOW) – $0.03

- Listing: None

Economic calendar (AEST):

No major economic announcements today.

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment

most popular

Equities

The Magnificent Seven can’t carry the market forever

Pzena Investment Management