ASX 200 to fall as market rally cools + Gold and oil under pressure

ASX 200 futures are trading 29 points lower, down -0.40% as of 8:30 am AEST.

S&P 500 SESSION CHART

MARKETS

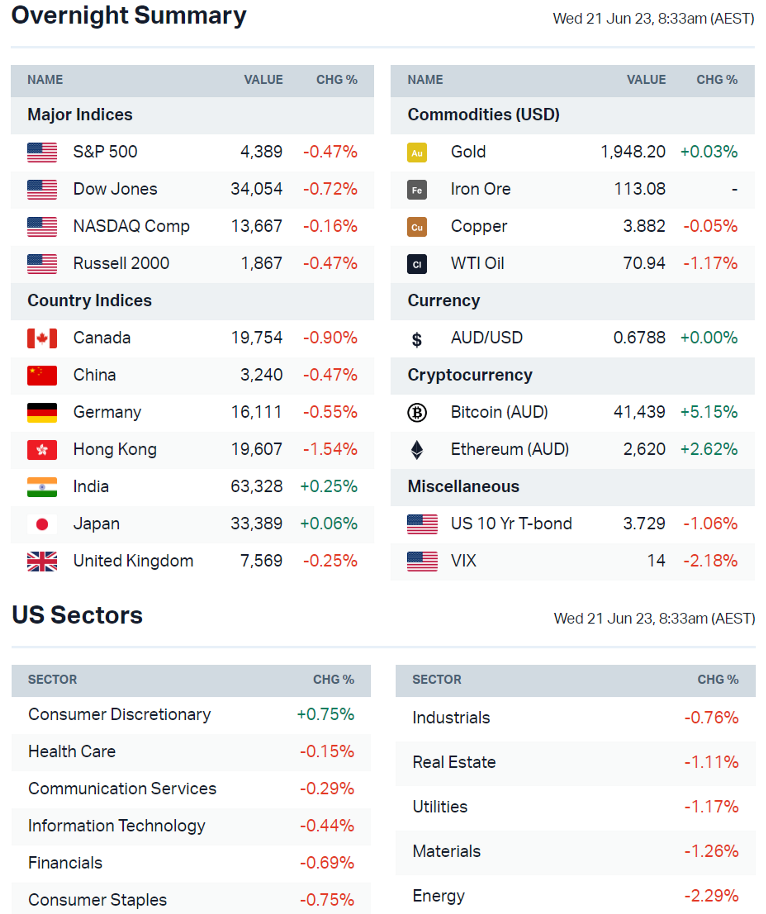

- S&P 500 lower but finished off worst levels of -0.96%

- Relatively uneventful session led by China’s economic worries

- News flow was rather quiet ahead of Powell’s congressional testimony tomorrow

- Oil falls below US$76 as risk-off mood outweighs China stimulus (Bloomberg)

- Morgan Stanley says stock bulls face rude awakening (Bloomberg)

- Investors trying to ‘catch up’ to stock gains (Bloomberg)

- Powell faces tricky task of explaining rate pause to congress (Bloomberg)

- Analysts rush to raise price targets on Japanese stocks (Bloomberg)

STOCKS

- Goldman Sachs sees improvement in IPO environment in 2H-23 (Bloomberg)

- Nio welcomes the Government of Abu Dhabi as major shareholder (Bloomberg)

- EV maker Rivian to adopt Tesla's charging standard (Reuters)

- PayPal and KKR deal – KKR will purchase up to $44bn of its BNPL loans (Reuters)

- Chevron, ExxonMobil slip on uncertainty around oil demand in China (CNBC)

- Intel to spend US$33bn on two semiconductor plants in Germany (Bloomberg)

- Alibaba CEO Zhang to step down to focus on cloud business (Reuters)

ECONOMY

- US housing starts jump 21.7% MoM in May, the most in three decades (Reuters)

- German producer prices rise at slowest pace in more than two years (Reuters)

- UK could tip into shallow recession if BoE hikes beyond 6.0% (Bloomberg)

- ECB's De Guindos says slowdown in core inflation may be limited (Bloomberg)

- China policy support measures blunted by ongoing consumer caution (NY Times)

- China's central bank cuts rates in bid to boost economic growth (FT)

- RBA decision to hike cash rate in June was finely balanced (Bloomberg)

DEEPER DIVE

S&P 500: What happens after the 52-week high

The S&P 500 hit a 52-week high last week from a 52-week low just 9 months ago.

When the S&P 500 makes a 52-week high after a 52-week low, it has been higher a year later 14 out of 14 times, according to data from Beat the Bench.

Of the 13 times this has happened (on average):

- 1 month: +1.7%

- 3 month: +4.3%

- 6 months: +8.5%

- 12 months: +16.1%

Sectors to Watch

Opposite day: S&P 500 sectors that fell more than 1% overnight include Energy, Materials, Utilities and Real Estate. Most of which were the best performing ASX 200 sectors on Tuesday.

Resources: Resource sectors were relatively heavy overnight as markets were unconvinced that China's 10 bp rate cut would be enough to revive slowing demand. Energy was the worst performing sector overnight. Could this see some negative flow into names like Woodside, which rallied 2.2% on Tuesday?

Gold: Gold prices fell 0.7% to US$1,936, marking its lowest close since 17 March. The weakness was more pronounced for gold miners, with the VanEck Gold Miners ETF down almost 4.0%.

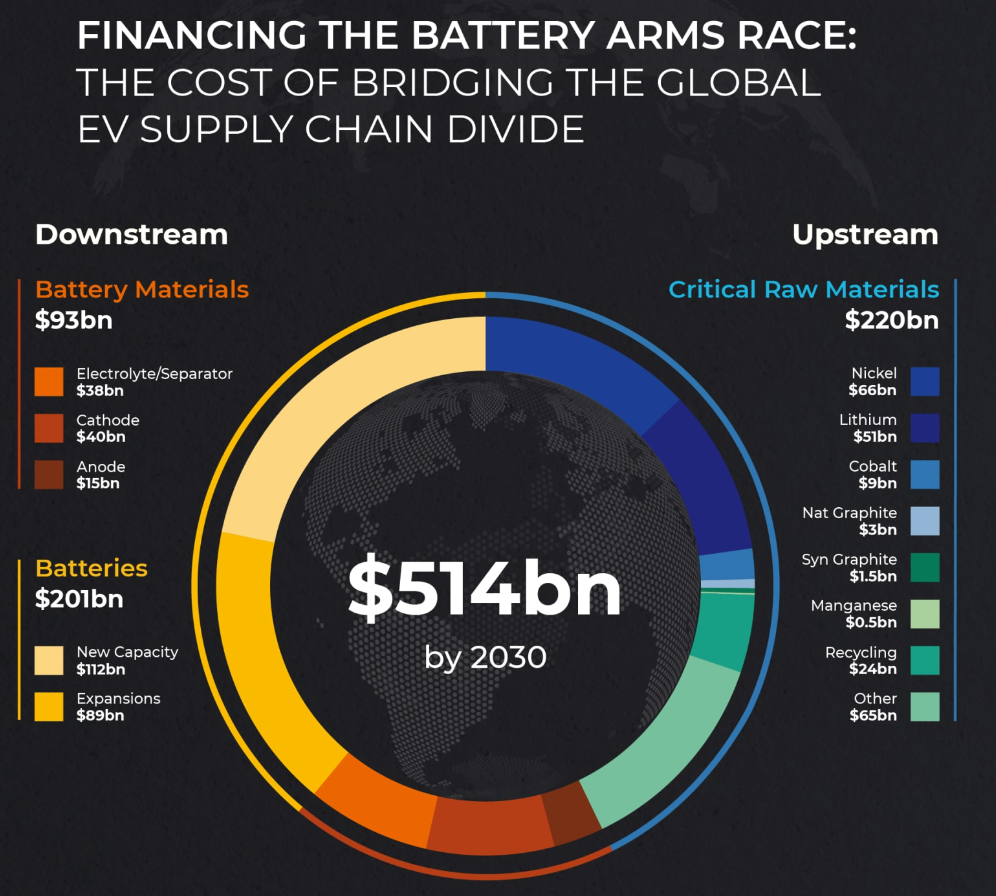

Financing the battery arms race

Benchmark Minerals Intelligence says the battery industry will need to invest at least US$514 billion across the whole supply chain to meet expected demand in 2030. This can be broken down into:

- US$220bn (43%) for producing critical raw materials, with nickel and lithium accounting for over half of the total amount

- US$201bn (39%) for manufacturing capacity

- US$93bn (18%) for midstream production of battery materials

Key Events

ASX corporate actions occurring today:

- Trading ex-div: None

- Dividends paid: Oceania Healthcare (OCA) – $0.01, Virgin Money UK (VUK) – $0.06, Vita Group (VTG) – $0.06

- Listing: None

Economic calendar (AEST):

- 4:00 pm: UK Inflation Rate

- 12:00 am: Fed Chair Powell Testimony

This Morning Wrap was first published for Market Index by Kerry Sun.

1 topic

1 contributor mentioned