ASX 200 to fall, S&P 500 snaps 5-week winning streak, Russia back in focus

ASX 200 futures are trading 16 points lower, down -0.23% as of 8:30 am AEST.

.png)

S&P 500 SESSION CHART

MARKETS

- S&P 500 lower, closed towards lows from session highs of 0.26%

- S&P 500 finishes the week down 1.4%, snapping a five-week winning streak

- Markets focused on bearish talking points including: Overbought conditions, Fed tightening bias, more aggressive global tightening cycle (RBA, BoE and Norges Bank hiking), growth worries (easing job market and yield curve inversion near 42-year record), cooling AI hype and renewed bank weakness

- BofA says investors are fleeing tech stocks (Bloomberg)

- Gold prices set for worst week almost five months on hawkish Fed (Reuters)

- Oil resumes slide on demand worries after latest round of rate hikes (Reuters)

- Lithium producers warn global supplies may not meet EV demand (Reuters)

- Yen weakness spurs intervention speculation (Bloomberg)

- Global central banks maintain hawkish stance as inflation sticks (Bloomberg)

- Powell says rates will rise again in 2023 (Yahoo)

- Barkin 'unconvinced' inflation in decline, will not prejudice July meeting (Reuters)

- Swaps traders have pushed out rate cit expectations until next year (Bloomberg)

STOCKS

- 3M reaches tentative US$10.3bn deal over US 'forever chemicals' claims (Reuters)

- Ford preparing another round of layoffs for US salaried workers (Detroit News)

- Siemens Energy scraps profit outlook as wind turbine troubles deepen (Reuters)

- Starbucks set to face strikes in response to claims that the coffee chain is not allowing Pride decorations at cafes (CNBC)

- C3.ai shares tumbled after Deutsche Bank reiterated a sell rating, citing “until we get more comfort in some of the leading indicators, magnitude of new deals and signs of sustained new business traction we maintain our Sell rating.” (CNBC)

ECONOMY

- US manufacturing PMI misses expectations, lowest since December (Reuters)

- Eurozone activity almost stalls as recession rebound fades (Bloomberg)

- UK services continues to support growth, price pressures remain high (Reuters)

- German economy loses momentum in June, services sector weighs (Bloomberg)

- French PMI tumbles, points to 0.5% contraction in Q2 GDP (Bloomberg)

- Japan core inflation tops forecasts, BoJ price view in focus (Bloomberg)

- Yellen sees lower US recession risks, says slowdown is needed (Bloomberg)

RUSSIA

- Russian mercenary tycoon and leader of the Wagner group Yevgeny Prigozhin accused Russian military forces of attacking their encampments. Russian generals accused Prigozhin of trying to initiate a coup against Putin

- The Wagner group claimed to have control over parts of military headquarters in southern Russia, but it is unclear how much control or threat they pose to the Kremlin

- Putin called the actions "a stab in the back of our country and our people" and vowed to take "decisive actions"

- Prigozhin abruptly announces short insurrection over, halts advance on Moscow (CNBC)

- Kremlin scraps criminal charges against Prigozhin, who will leave Russia for Belarus (Axios)

-

US Secretary of State Blinken says brief rebellion in Russia shows 'cracks in façade' of Putin's authoritarian leadership (Washington Post)

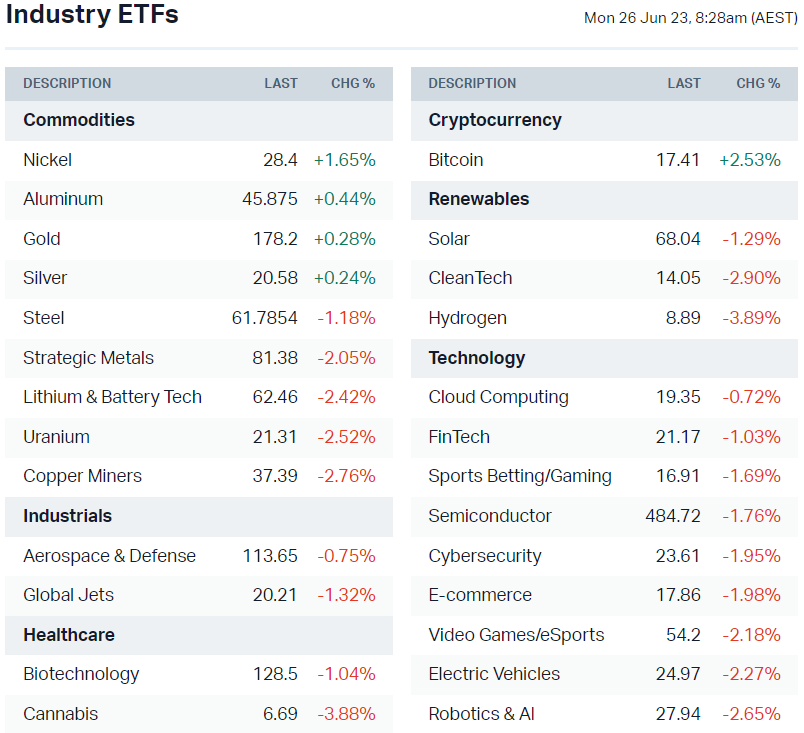

Note: Aluminium and Nickel ETFs have been de-listed. We are working on a solution (or rather new ETFs to replace them. For the time being, the % changes will remain the same)

DEEPER DIVE

Sectors to Watch

It was a rather heavy session overnight. All 11 S&P 500 sectors finished red while several of our commodity and tech-related ETFs are down 2-3%. The market is in the midst of a pullback but unlike the S&P 500, which is up 4.0% since June, the ASX 200 has been pummeled the last three sessions and at risk of breaking down to a three-month low. Can the Index muster up a bounce or stabilise at these levels?

- Tech: The Nasdaq led to the downside (-1.0%). Bank of America says tech has seen its largest outflow in 10 weeks. Do we see tech weakness continue for local names like Wisetech, Xero and Altium?

- Copper: Copper prices fell 2.2% overnight. BHP and Rio Tinto ADRs were down 2.6% and 2.5% respectively.

- Russia-related commodities: This Russia situation is a mess. Let's see if key exports like oil, gas, wheat and platinum catch a bid on potential supply disruptions.

- Uranium: Uranium has been a top-performing sector in the past few weeks. But the Global X Uranium ETF fell 2.5% overnight and was down 5.5% in the last four sessions.

JPMorgan: US Equity Strategy

A few highlights from JPMorgan's Dubravko Lakos-Bujas and Marko Kolanovic. Might be helpful for local markets too.

- Next leg: "Some argue the next leg up for the market will be supported by laggards leading in 2H23. However, we see this as a tall order given that underperformers are generally more cyclical with lower pricing lower and higher interest rate sensitivity."

- Multiple expansion: "Multiple expansion is the main driver of performance YTD (PE has expanded by ~14% while pricing power is starting to erode and NTM estimates have fallen by ~3%), we see unattractive risk-reward for equities and increasing investor complacency ahead of our expectation that the business cycle will further deteriorate in 2H ..."

- Bearish focus points: "Consumers are starting to show signs of weakness, fiscal tailwinds are fading with student loan repayment expected to start this September and the accumulated excess savings will likely be exhausted by October (currently estimated at ~$500bn remaining vs. high of ~$2.2tn)."

Key Events

ASX corporate actions occurring today:

- Trading ex-div: Fisher & Paykel (FPH) – $0.214

- Dividends paid: None

- Listing: Ashby Mining (AMG) – 11:00 am AEST

Economic calendar (AEST):

- 6:00 pm: German IFO Business Climate

- 3:30 am: ECB President Lagarde Speech

This Morning Wrap was first published for Market Index by Kerry Sun.

1 topic

1 contributor mentioned