ASX 200 to snap three-day losing streak, US stocks slump on tech weakness

Get up to date on overnight market activity and the big events for the day.

ASX 200 futures are trading 50 points higher, up 0.65% as of 8:20 am AEST.

S&P 500 SESSION CHART

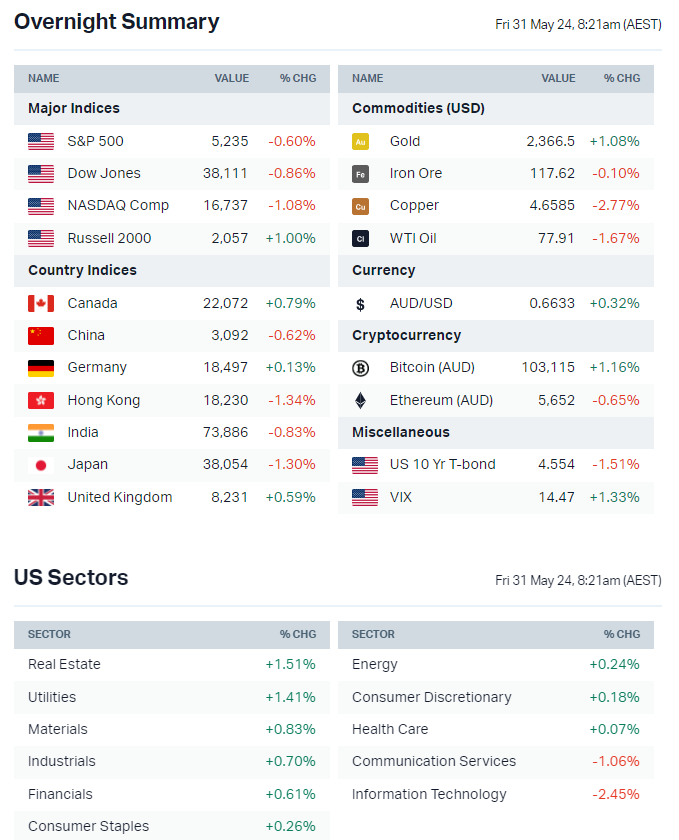

OVERNIGHT MARKETS

- Major US benchmarks lower and finished around worst levels

- Nasdaq and S&P 500 on track for weekly declines after five straight weeks of gains

- Megacap tech was the notable drag on benchmarks, led by Nvidia (-3.7%), Microsoft (-3.3%), Alphabet (-2.1%) and Meta (-1.5%)

- Tech under scrutiny after weaker-than-expected guidance from Salesforce, sparking concerns of AI competition

- Russell 2000 outperformed – perhaps hedge funds are de-grossing their Russell 2000 shorts and Nasdaq longs

- Bond yields take a breather after the recent bear steepening move that pushed the US 2-year yield to just under 5.0%

- Today's 80-minute glitch in printing Dow, S&P index levels had little overall impact on trading (Bloomberg)

- Record US market riding on questionable AI assumptions (Yahoo)

INTERNATIONAL STOCKS

- Salesforce guides for record low sales growth (Bloomberg)

- Nelson Peltz sells entire Disney stake after losing proxy battle (CNBC)

- Amazon receives FAA regulatory approval for expansion in drone delivery service (CNBC)

- BofA's Moynihan sees investment banking results on track, though net interest margins may be weaker than expected (Bloomberg)

CENTRAL BANKS

- NY Fed President Williams expects inflation to resume moderating in the second half of 2024 (NY Fed)

GEOPOLITICS

- Hamas says it is ready to reach agreement on ceasefire if Israel stops war (Reuters)

- Russia announces tax hikes on corporates and citizens, expected to add extra US$30bn to state budget next year (Reuters)

- EU set to delay decision on China EV tariffs (Reuters)

ECONOMY

- US economy grew at a slower pace in the first quarter than initially reported reflecting softer consumer spending on goods (Bloomberg)

ASX TODAY

- ASX 200 set to bounce after falling to a four week low on Thursday

- Nothing too interesting on the sector front – most commodity prices were a little weak overnight, megacap tech weakness could follow through for local names and bond yield breather could see some reprieve for yield-sensitive sectors

- Food for thought – Qantas shares rallied 2.7% on Thursday after Goldman Sachs said the company had "structurally improved earnings capacity not reflect in valuation" and slapped on a buy rating with a $8.05 target price. This is interesting because a US peer like American Airlines trades at an even cheaper PE multiple ... and it just downgraded its earnings outlook

- BHP confirms it will not make a firm offer for Anglo American after failing to convince its board (Reuters)

- HMC Capital submits bid to acquire stake in Symphony Infrastructure Partners (AFR)

BROKER MOVES

- Bega Cheese upgraded to Outperform from Underperform; target up to $4.65 from $4.0 (CLSA)

- Lottery Corp upgraded to Add from Hold; target up to $5.60 from $5.40 (Morgans)

- Pro Medicus upgraded to Hold from Sell; target up to $115 from $75 (Bell Potter)

- West African Resources initiated Speculative Buy with $3.10 target (Argonaut)

KEY EVENTS

Companies trading ex-dividend:

- Fri 31 May: None

- Mon 3 June: Newmont (NEM) – $0.268

- Tue 4 June: None

- Wed 5 June: Hancock & Gore (HNG) – $0.01, Infratil (IFT) – $0.017

- Thu 6 June: None

Other ASX corporate actions today:

- Dividends paid: Acrow (ACF) – $0.02, Autosports Group (ASG) – $0.10, Kogan (KGN) – $0.075

- Listing: None

Economic calendar (AEST):

- 11:30 am: China Manufacturing PMI (May)

- 11:30 am: China Services PMI (May)

- 7:00 pm: Eurozone Inflation (May)

- 10:00 pm: India GDP (Q1)

- 10:30 pm: Canada GDP (Q1)

- 10:30 pm: US Core PCE (Apr)

This Morning Wrap was written by Kerry Sun.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

Livewire and Market Index's pre-opening bell news and analysis wrap. Available weekday mornings and written by Kerry Sun.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

1 contributor mentioned

Comments

Comments

Sign In or Join Free to comment