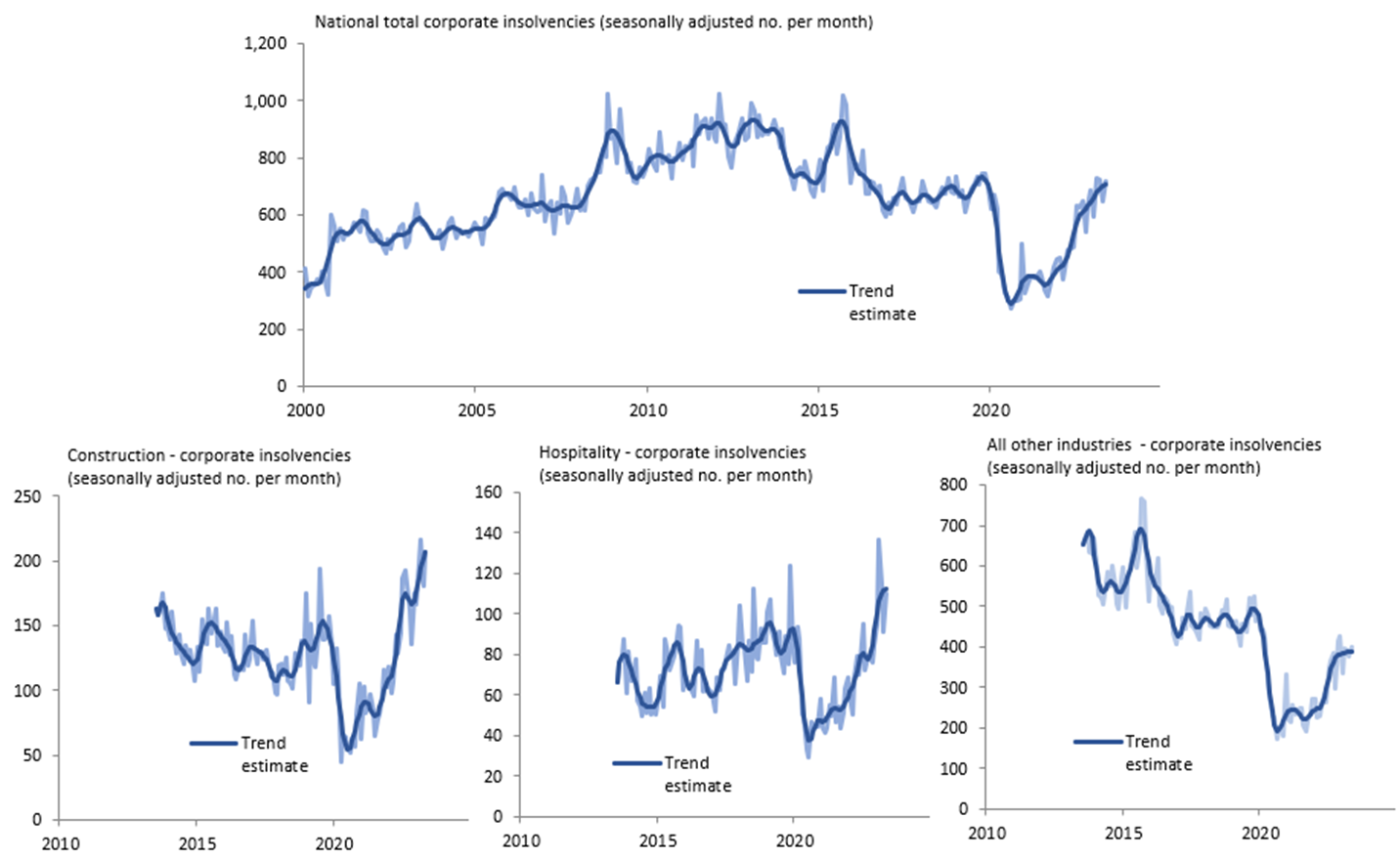

Aussie corporate insolvencies explode: 868 businesses go bust in May, highest since 2015

The latest ASIC data for corporate insolvencies continues to deteriorate with the regulator reporting that 868 businesses went bust in the month of May, which is the worst result since 2015. We seasonally-adjust these data and then run the ABS's method for estimating the trend change. The first chart below shows the total number of businesses going under each month in seasonally-adjusted terms. The final three charts highlight construction, hospitality and all other industries.

While some of this represents a normalisation of corporate insolvencies from the very low pandemic nadir when many struggling businesses were bailed-out by extreme fiscal and monetary policy largesse, the trend is highly unfavourable and looks like escalating to historically elevated levels.

Globally, we know that corporate defaults are now the highest since 2010. In the US, which has been subject to about 500 basis points of interest rate hikes from the Fed (in contrast to the 400bps delivered thus far by the RBA), insolvencies are likewise the worst since 2010.

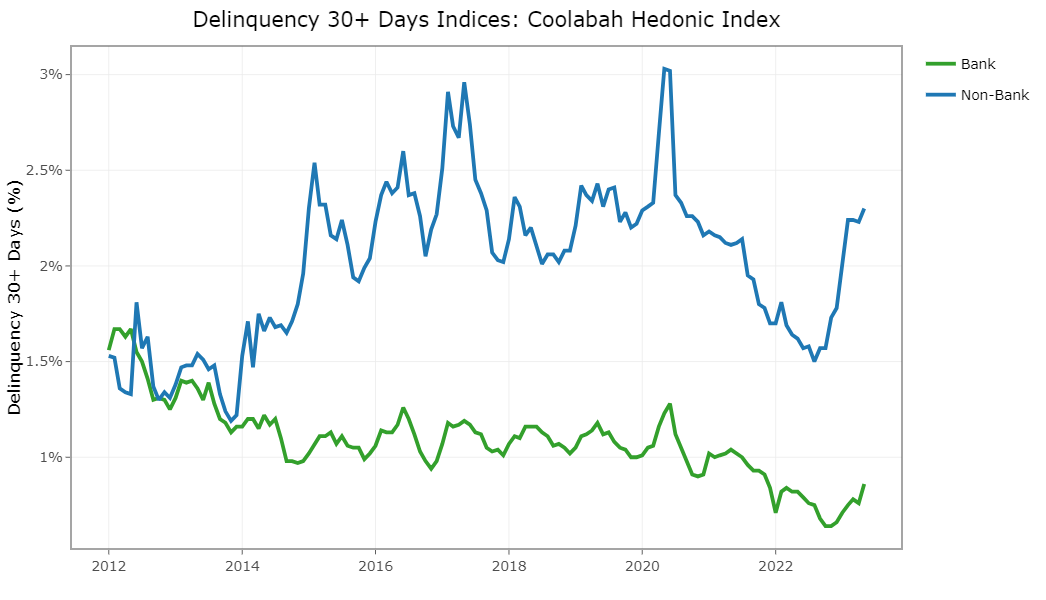

Sadly, we are observing similar developments in the Aussie home loan market. We track the 30+ days delinquencies on all Aussie home loans issued by both banks and unregulated non-banks, which are then subsequently securitised. We further remove statistical biases from these data via a proprietary hedonic regression methodology, which we pioneered in 2018.

As you can see from the fifth chart, non-bank home loan delinquencies (blue line) have increased sharply from their lows in 2022. In contrast, bank delinquencies (green line) have risen only quite modestly. Some have argued that this is a function of the fact that non-banks generally write much riskier loans than banks, which are classified as "non-conforming" mortgages (a euphemism for sub-prime loans). They assert that when you compare non-banks' "prime" loans with bank prime products, they actually have similar (or even lower) default rates than banks. This is completely false.

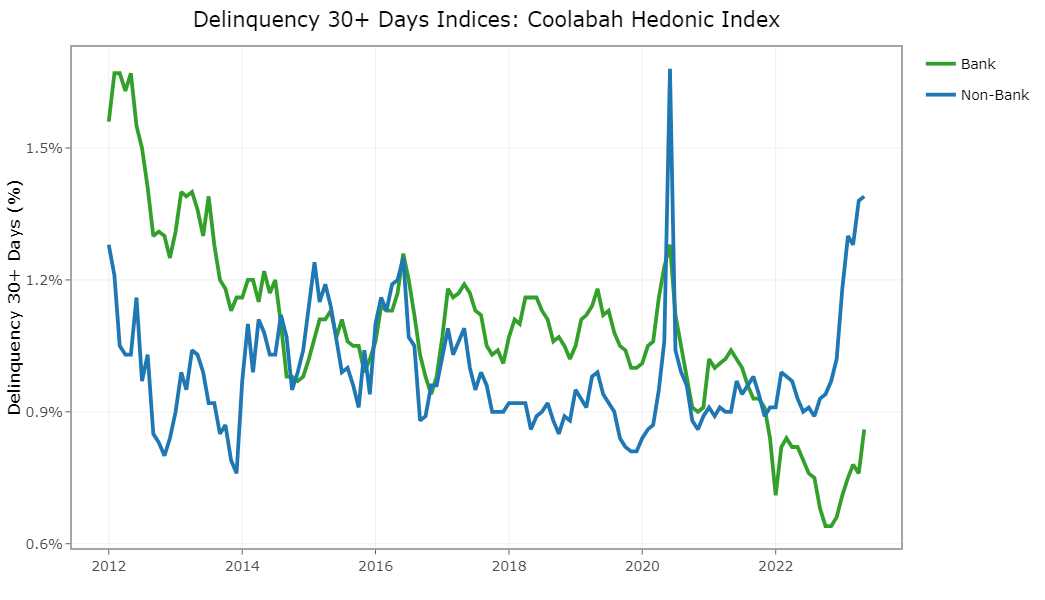

As our sixth chart highlights, non-bank 30+ days arrears rates for prime loans have rocketed through the roof in the last six months (blue line) and are running at 3-5x the arrears rates that regulated banks report on their prime products.

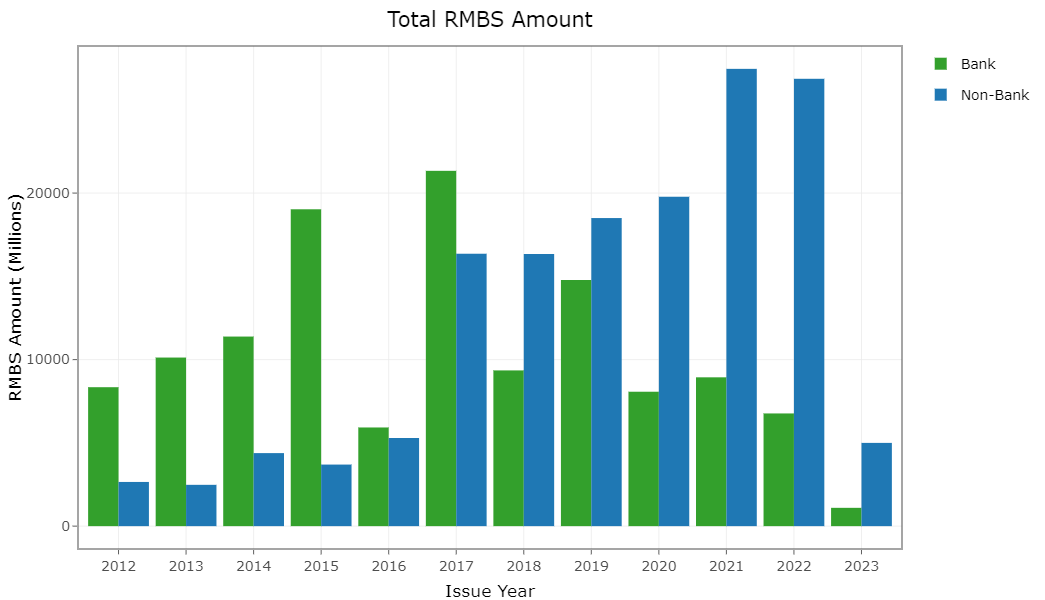

Some observers arrived at the conclusion that non-bank arrears were (remarkably) lower than bank arrears by only looking at the raw, unadjusted default data averaged across all RMBS deals. As a result of huge non-bank RMBS issuance volumes in recent years (in contrast to banks that have issued very little RMBS), there is a completely spurious--ie, fake--reduction in delinquencies because new RMBS deals that come to market must be clean portfolios that are selected to be default-free. Once you statistically control for the bias associated with the surge in default-free non-bank RMBS supply via a compositional-adjustment methodology, you see a massive difference in bank vs non-bank default rates.

Unfortunately, this default cycle is only just beginning and likely to get a lot worse as the RBA continues to lift its cash rate in line with global central bank peers.

You can find out more about Coolabah's market-leading fixed-income strategies here.

2 topics