Aussie small caps in the slipstream, and 4 stocks we’re backing

Australia is moving into an environment where the majority of the economic pistons will be firing in unison, which will be highly advantageous for smaller capitalised companies.

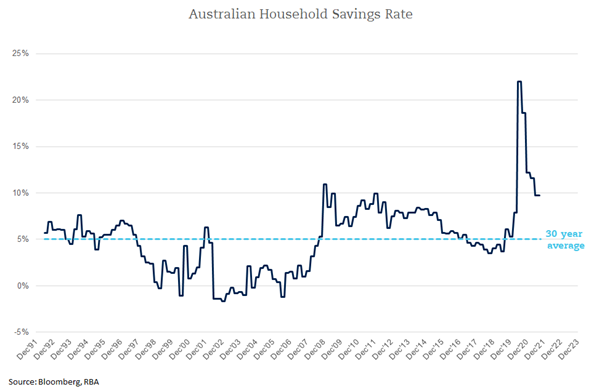

The national Household Savings Rate (HSR) is currently twice as high as the average rate over the past 30 years. An elevated HSR typically co-exists with low levels of confidence and adverse business trading conditions.

It is our expectation that Australia’s HSR will decline below 5% throughout 2022 and beyond, driving economic growth expectations to around 3%pa. To our mind, the Reserve Bank of Australia may be too conservative with its current GDP growth projections.

Australian Household Savings Rate (HSR) over the past 30-years

Smaller capitalised companies tend to be more leveraged to economic cycles. Typically, when trading conditions are robust, confidence is high and growth opportunities are embraced by management teams.

Conversely, when economic activity is stagnant, business leaders lose confidence and growth pursuits are quickly stifled.

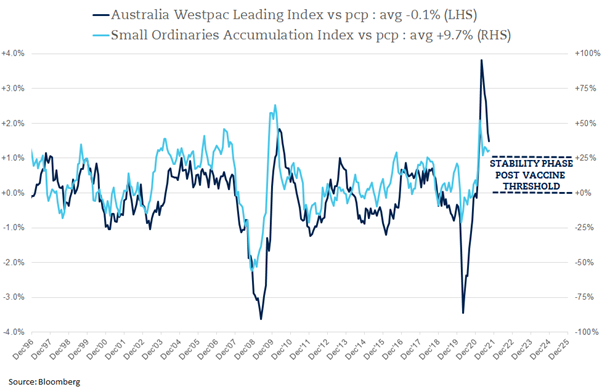

As a result, we believe that economic leading indicators are an insightful tool for gauging the mood of business leaders, particularly those within smaller companies.

Ultimately, when leading economic indicators are positive and stable, the share prices of smaller companies respond positively.

It is our expectation that 2022 will be a year of more economic stability and we anticipate that leading indicators in Australia will stay stronger for longer. This backdrop would be conducive to a sustained period of attractive total returns from smaller companies.

Australian Leading Economic Index (LEI) and the S&P/ASX Small Ords Index. Strong and stable LEIs is positive for the small-cap sector

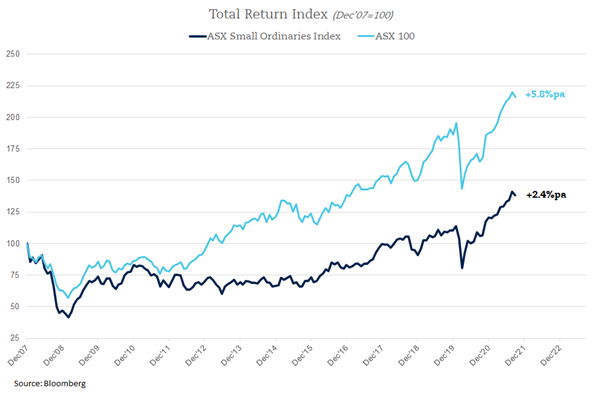

Since the end of 2007, the Small Ordinaries Index delivered a total return of just 2.4%pa; this was marginally higher than the rate of inflation which expanded by 2.1%pa over the same period.

We believe that this meagre performance can be explained by a series of events that were particularly detrimental to Australian small companies.

Australian S&P/ASX Small Ords Index vs the S&P/ASX 100 performance leading into the GFC in late 2007. Looking for the small-cap segment to close the gap

The first setback for Australian smaller companies occurred in 2009 when the RBA embarked upon a rate tightening cycle; between 2009 and 2010 the central bank lifted rates seven times.

This was followed by the introduction of the Basel III capital requirements in 2012; banking risk weights changed which corralled lending capital away from smaller companies.

In 2014 the Australian Government delivered an austerity based Budget that caused a rapid decline in consumer confidence about their financial prospects over the year ahead. This coincided with a slowdown in China’s economic activity and an 18- month sharp decline in commodity prices.

In 2017 the Royal Commission commenced and caused large disruptions to Australian lending activities. Considering all of these headwinds, it is little wonder that the share prices of Australian small companies have underperformed their large-cap peers.

We believe that Australian small companies are finally in a position to make up the lost ground. Over the coming years, we feel that borrowings will increasingly become available to smaller Australian companies at competitive prices.

We anticipate that the cost efficiencies that small companies have implemented over the past decade will be sustained. And we expect that the embracement of current technological advancements will ensure that small companies can cede profitable market share from their larger incumbent competitors. Holdings within the K2 Australian Small Cap Fund that satisfy these traits are:

- Seven Group Holdings (ASX: SVW)

- MA Financial Group (ASX: MAF)

- Cedar Woods Properties (ASX: CWP)

- People Infrastructure (ASX: PPE).

Australian smaller companies now have the wind squarely at their backs and this should persist for a few years to come.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

2 topics

4 stocks mentioned