Australia's population growth roars back

Australia’s population and economic outlook has roared back to life with the latest available arrivals and visa data.

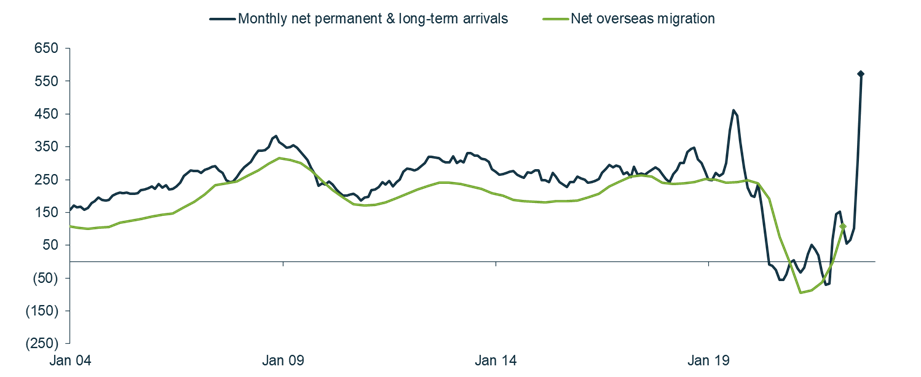

Permanent and long-term net arrivals is an excellent monthly proxy for Australia’s net migration trends. Pleasingly, this statistic is now painting a far rosier picture in comparison of the COVID-19 lows.

We find this metric worth watching as population growth is a key contributor to the growing demand profile for real assets, and the return of migration is a major driver underpinning our accelerating growth outlook for the sector in this post-COVID-19 world. Here we look at what the latest figures tell us about Australia’s virtuous cycle of population growth.

Arrivals are a strong leading indicator for long-term population growth

The significant turnaround in net arrivals paints a rosy picture for Australia’s net migration and long-term prosperity from strong population growth. As can be seen in the following chart, the August 2022 release of permanent and long-term net arrival metrics have surpassed previous highs by an order of magnitude.

Permanent and long-term net arrivals (rolling 12 months, in thousands)

Source: Australian Bureau of Statistics (ABS); as of 30 August 2022.

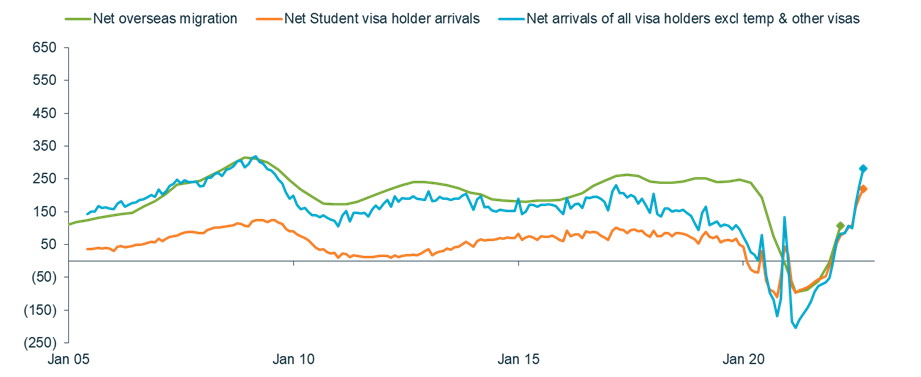

Student visas are leading the revival

Students have always been a sizeable part of Australia’s long-term visa mix. The latest visa data continues to suggest that most of the increase in Australia’s net overseas migration has been in net international student arrivals.

Permanent and long-term net arrivals by source (rolling 12 months, in thousands)

Source: Australian Bureau of Statistics (ABS); as of 30 August 2022.

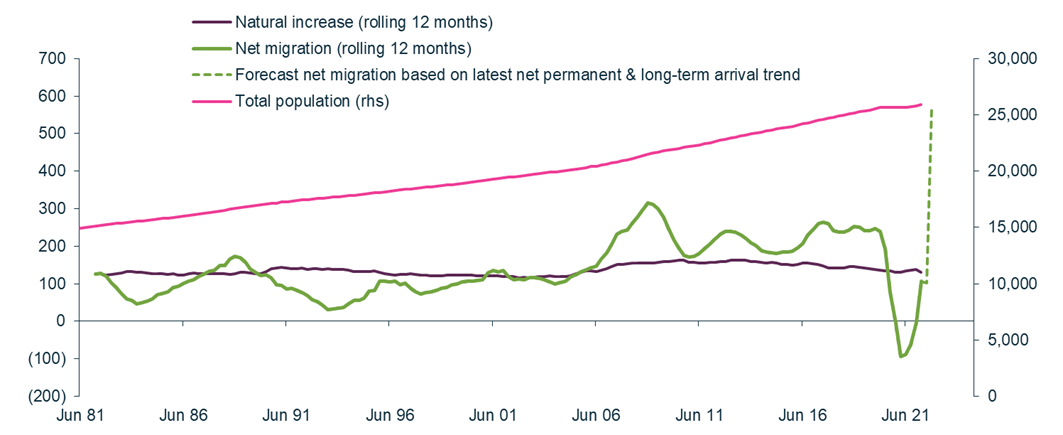

Australia’s natural population growth is supercharged by strong net migration

Improving migration is also a ‘super-charging’ factor in improving Australia’s already high natural rate of increase relative to both the developed and developing world.

Long term population trends (thousand people)

Source: Martin Currie Australia, Australian Bureau of Statistics (ABS); as of 30 September 2022.

The virtuous circle of population growth for Real Assets

Our key investment thesis for the listed Real Assets we invest in for our income strategies is that as the population grows, so too will demand for Real Assets to service everyday needs. These recent metrics are both exciting and reassuring news that Australia’s population growth story is back on track. This is good news for the broader economy and our listed Real Asset investments.

In my view, a virtuous cycle of population growth is the “secret sauce” of Australia’s long-term ‘business model’.

More specifically, by attracting relatively young, well-educated new citizens with their future economic prosperity ahead of them, Australia maintains an enviable position globally.

One of the ways we do this is through student migration intake; whereby once students have completed their studies, the prospect of remaining in Australia holds strong appeal by accumulating points with a view to becoming a long-term resident and eventually an Australian citizen.

Re-enforcing these strong drivers of population growth, October 2022’s Federal mini-budget saw migration expectations upgraded to 235k net arrivals in FY23 from the prior expectation of 180k. This would see population growth rebound to 1.4% year on year. Based on recent arrivals measures, these government forecasts may prove to be conservative.

While parts of Asia (most notably China) have retained elements of lockdown, I think Australia’s appeal as a global destination has only increased post-Covid. We remain a popular destination given all that our lifestyle offers, the abundant employment opportunities and generally being a wonderful place to raise a family.

This virtuous cycle looks set to continue for the long term.

Learn more

The Martin Currie Real Income strategy is designed for investors looking for a high, stable and growing income stream, with lower volatility than the broader equity market. Find out more by visiting our website.

1 topic

1 fund mentioned