Barry Dargan: finding indestructible stocks

Livewire Markets

Barry Dargan knows a crisis. The CEO and founder of Intermede Investment Partners started his investment career not long before the 1987 crash and proceeded to work around the globe through every major crisis since.

He lived in Japan through the 1990s super-long bear market. He invested through the emerging market crash of South East Asia and the Russian Financial Crisis of 1997/98, the dot-com bust of the early 2000s, the GFC in 2008 and, of course, the COVID-induced crash of March 2020.

He is a financial crisis savant.

Dargan spoke with us recently on the lessons from working through crises and the startling research showing only 4% of available stocks provide most of the returns in the market.

Lessons in a crisis

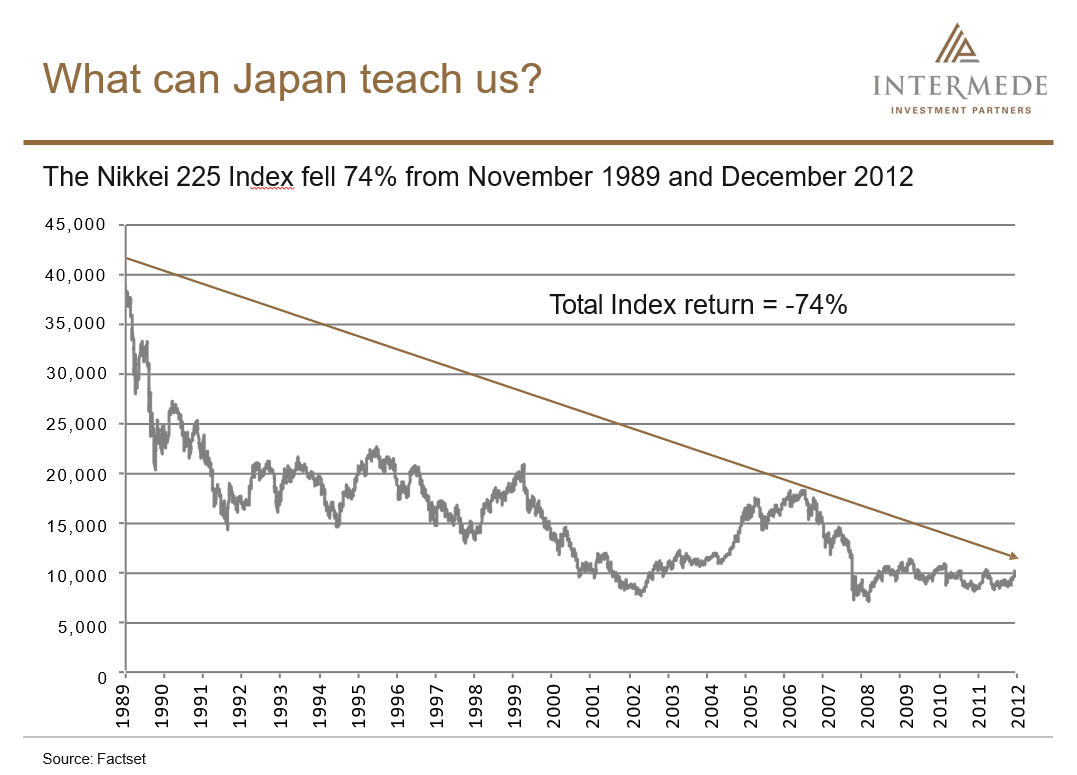

Dargan managed to stay successfully invested through Japan's drawn-out bear market. Between 1989 and December 2012, the market fell continuously, dropping 74% over the period.

Not many stocks will work in a market like that, said Dargan, but those that do work will make you money.

In fact, only 19 stocks made positive returns over the 22 year period.

Source: Intermede/Supplied.

Along the way, Dargan has picked up a few lessons on how to assess and choose long term holdings that would survive, and even thrive, through a crisis.

His time spent working and investing in Japan also gave Dargan a unique insight into COVID-19, as he had already navigated the local response to the SARS virus, when it struck Japan in 2003 .

Dargan was reviewing the portfolio in early January 2020 and stress testing the stocks to see what would likely perform if a one to two-year lockdown came about.

"I lived in Japan during the SARS epidemic and knew that you had to take these pandemics quite seriously. Going back to January and February 2020, we did an exercise on the portfolio on our watch list to see which companies were vulnerable and also under what circumstances. We were coming up to a scenario where we thought the world might stop for a year or two, which actually turned out, was the case," said Dargan.

This exercise helped review and better understand the intrinsic value of a business even when it was going through a "disaster scenario".

One example is Disney (NYSE: DIS), which collapsed 40% in the COVID-crash.

"We knew that the value lost was not more than about 20%, so this was a great opportunity to pick up some great long term growth companies that normally trade quite richly at deeply discounted prices," said Dargan.

Buy the 4%

So, with Dargan's wealth of experience through market highs and lows, what lessons can be drawn from the vagaries of market cycles?

The number one lesson is quality.

"Stick with high quality, globally-leading great businesses, and you'll come out the other side, probably better than you went in because a lot of the weaker competitors get knocked out. But these battleships make it through the storm and then they come out better, stronger, on the other side of this," said Dargan.

"We think if you get distracted and you look at other things you dilute your ambition and you end up getting a few duds. And so it's best just to focus on these great companies," he said

Dargan's life-long investment strategy has more recently been backed back academic research, which he highly commends.

Academic research by Hendrick Bessembinder, a Professor of Finance at Arizona State University unearthed a rather terrifying fact:

- Only 4% of companies account for all of the net stock market gains

- Out of 26,000 stocks studied between 1926 to 2016, less than half generated a positive lifetime return.

- Over the same time period, only just over 42% have a return greater than the one-month Treasury bill, which is as close to risk-free as you can get in investing.

The magic 4% of companies is what Dargan homes in on.

How do you find the winners?

Dargan has previously shown how the Intermede screening process works. He calls it the "5-10-15" criteria.

One tool we employ in our screening process to find winners is the ‘5-10-15’ rule: annual average growth of 5% in revenues, 10% in earnings per share, and 15% and rising return on equity (ROE) over previous 10 years.

Related article:

Overall, he finds about 600 stocks will pass this "5-10-15" screening process, but with COVID-19 having a negative impact on rising ROE, this number is now closer to 350 stocks.

Then this is further whittled down to just 40 stocks, based on more qualitative factors such as good management.

"We spend a lot of time qualifying a company to make it into the portfolio," said Dargan.

But the important thing to do is to let the thesis work, and that takes time.

"One of the things I've learned is to be patient. And don't second guess yourself if you've done a lot of work you've qualified it," he said clarifying that you have to still stay on top of the initial investment thesis.

"The worst thing you can do is pick a great company, own it for a year or 18 months, and then you just move on to the next thing. Then you look back five years later and actually that company went up tenfold," he said.

However, he throws down the gauntlet to challenge Aussie-only investors. Why would you want to limit yourself, he asks, when the best company in any given industry could be based in US or Japan or China? He wants exposure to the best companies no matter where in the world they are.

"If we have another crisis, and I'm sure we will at some point ... we'll be in good shape if we are in the right companies."

Never miss an insight

Barry and the Intermede team apply laser-like focus to just one thing – high quality global companies that they expect to consistently deliver double digit percentage earnings growth, year in, year out. Hit the follow button on his profile to be the first to read his Livewire content.

For more information on the Intermede Global Equities fund, please visit here. If you are a financial adviser, please contact your MLC representative here. If you are a direct investor, please speak to your financial adviser or invest directly through the Product Disclosure Statement (PDS) here.

1 contributor mentioned

Mia Kwok is a former content editor at Livewire Markets. Mia has extensive experience in media and communications for business, financial services and policy. Mia has written for and edited several business and finance publications, such as...