Beyond the Magnificent 7: Exploring opportunities in Asia tech

The AI narrative has undoubtedly driven much of the US share market’s return over recent years. Mega cap US tech companies are spending billions of dollars each year to build compute capacity, and the US government is focused on accelerating AI innovation as part of its agenda.

However, Asian technology companies are rapidly emerging as a competing force in the AI arms race with the US, supported by strong manufacturing capabilities and top-down government support.

Many are critical to the broader semiconductor supply chain, including chip foundries, memory chip manufacturers, and those pioneering the development of more efficient, leading-edge AI models.

In this note, we highlight the compelling opportunity in Asian technology companies as a way for investors to both diversify their US exposure and capture the broader AI opportunity set.

China’s Strategic Pivot to Technology Leadership

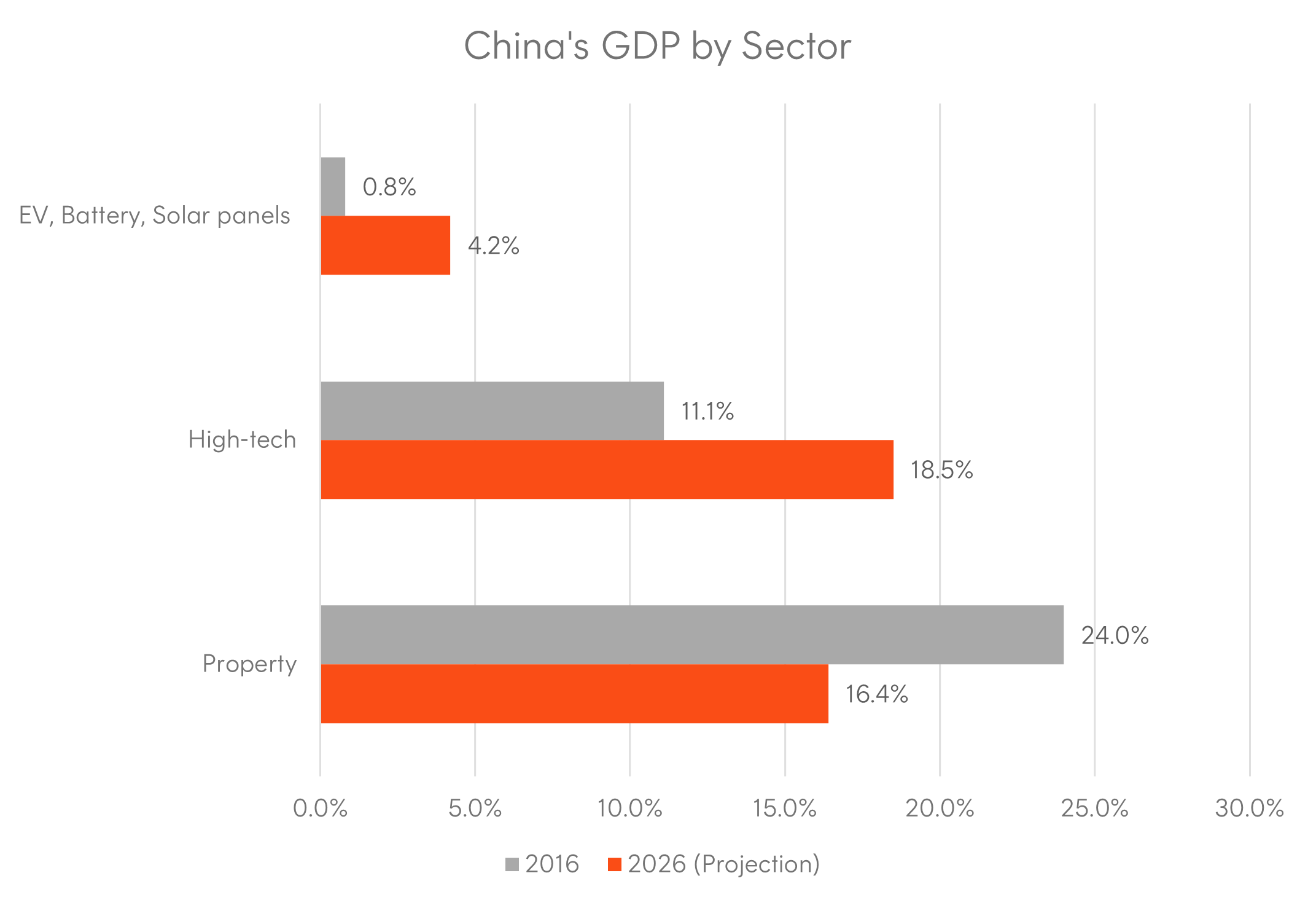

China is undergoing a fundamental economic transformation. For decades, the country’s growth engine was powered by manufacturing and export-led strategies, positioning it as the world’s factory and a key pillar of global trade. However, as structural headwinds mount, Beijing is pivoting decisively toward technology as the cornerstone of its next growth phase.

This strategic shift is not merely aspirational—it is essential. China faces deep-seated challenges that threaten its traditional growth model.

Population growth has slowed for the third straight year due to declining fertility rates and amid concerns for the broader economy1, reducing the demographic dividend that once supported rapid industrial expansion.

Meanwhile, years of excessive property investment have saddled the economy with high levels of debt. The property sector, a vital driver of domestic demand, has seen prices fall by 20% to 30% since 20212, eroding both household wealth and investor confidence. Against this backdrop, technology—particularly AI – has emerged as a new growth engine and a critical lever for economic resilience.

Opportunities Across the AI Supply Chain

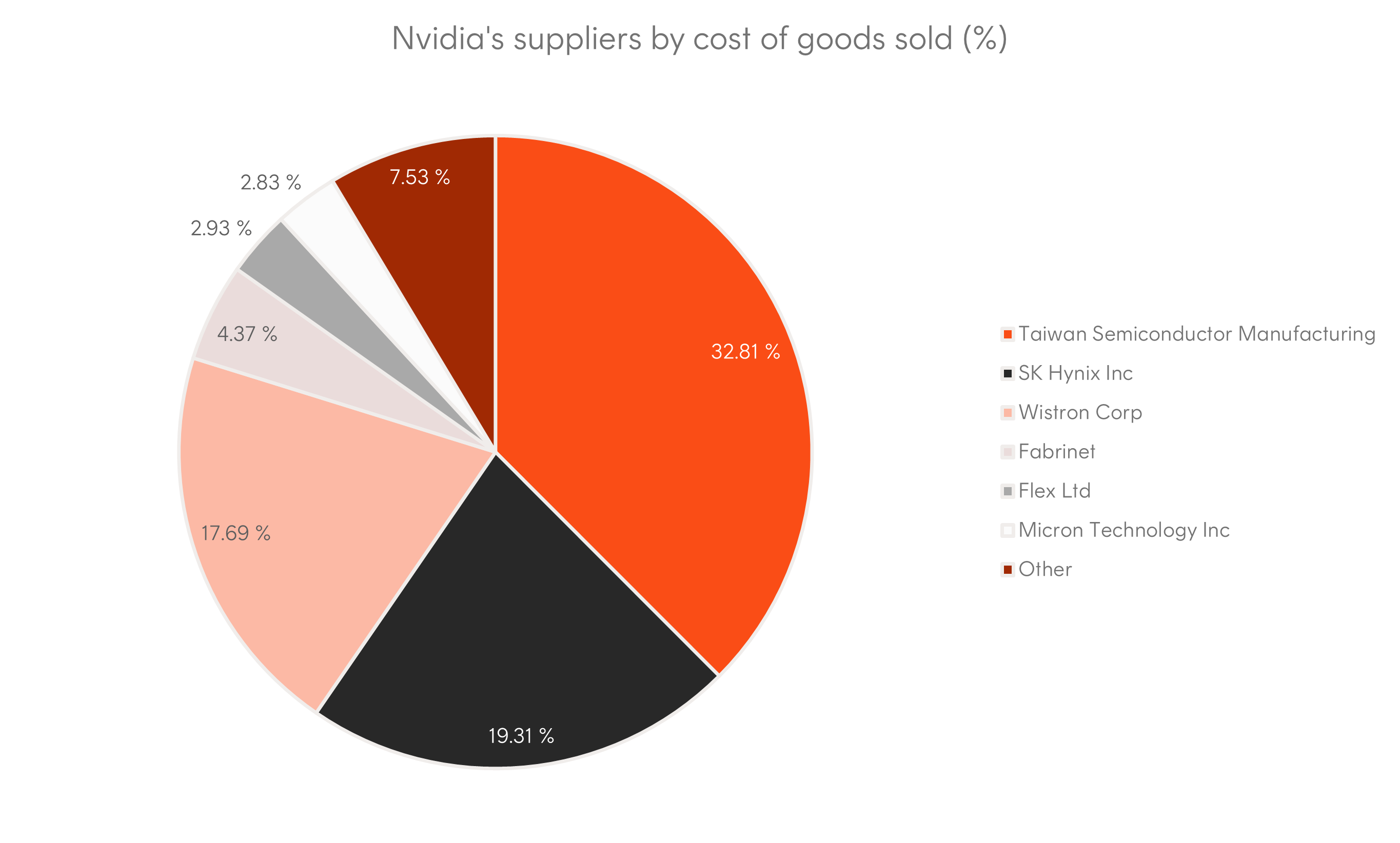

China is not alone in this technological ascent. Semiconductor leaders like TSMC in Taiwan and SK Hynix in South Korea are integral to the production of GPUs, the core processors powering generative AI models. In fact, these companies capture more than half of Nvidia’s cost of goods sold, ensuring they directly benefit from the unprecedented surge in AI-related investment—much of it driven by US technology firms racing to scale AI infrastructure.

Source: Bloomberg. As at 9 July 2025.

Investment Opportunities

The combination of government-backed infrastructure initiatives, rapid progress in AI software, and the dominance of Asian supply chain leaders creates opportunities that extend well beyond US borders.

Allocating exposure to Asian technology companies—both in China and across the broader region—offers a pathway to capture value from the global AI-driven expansion, while reducing exposure tied to the US megacaps.

Investors seeking exposure to this theme can consider the Betashares Asia Technology Tigers ETF (ASX: ASIA) which is home to some of the largest technology and online retail companies in Asia (ex-Japan) including Alibaba, Tencent, TSMC and SK Hynix.

Source: Bloomberg Economics. March 2025. Actual results may differ materially from estimates.

Technology as the New Bargaining Chip

Beyond domestic economic concerns, technology has become central to the global balance of power as the US and China compete for technological supremacy. For Beijing, technological leadership is not only an economic imperative but also a matter of national security and geopolitical influence.

The Chinese government recently approved 39 major data center projects in regions such as Xinjiang and Qinghai. These facilities are expected to deploy more than 115,000 Nvidia processors, underscoring China’s ambition to build world-class AI infrastructure at scale. While Washington’s export controls aim to restrict China’s access to these cutting-edge chips, these initiatives suggest Beijing is doubling down on capacity-building despite external pressures.

Local Champions Accelerate AI Development

China’s technology giants are responding to this strategic push with aggressive investment.

For example, Tencent and Alibaba are both scaling their cloud platforms and AI capabilities to compete with the likes of Amazon Web Services and Microsoft Azure in the US. However, beyond the infrastructure layer —Chinese firms are also innovating at the software layer.

DeepSeek’s launch of the R1 model in January marked a significant breakthrough in AI model efficiency and cost-performance optimisation. It also highlighted China’s ability to leverage homegrown innovation even as it navigates restrictions on access to top-tier semiconductor technology.

1 topic

1 stock mentioned

1 fund mentioned