Bruised, but not broken

Fiftyone Capital

Welcome to 2022! If you weren’t strapped in and hedged you have probably been thrown around and ended up with some cuts and bruises. But amongst the rubble we can now see some green shoots for a convincing exhaustion rally. While longer term we remain cautiously optimistic, we think the market sell-off is done for now given the extreme moves and indicators mentioned in this article.

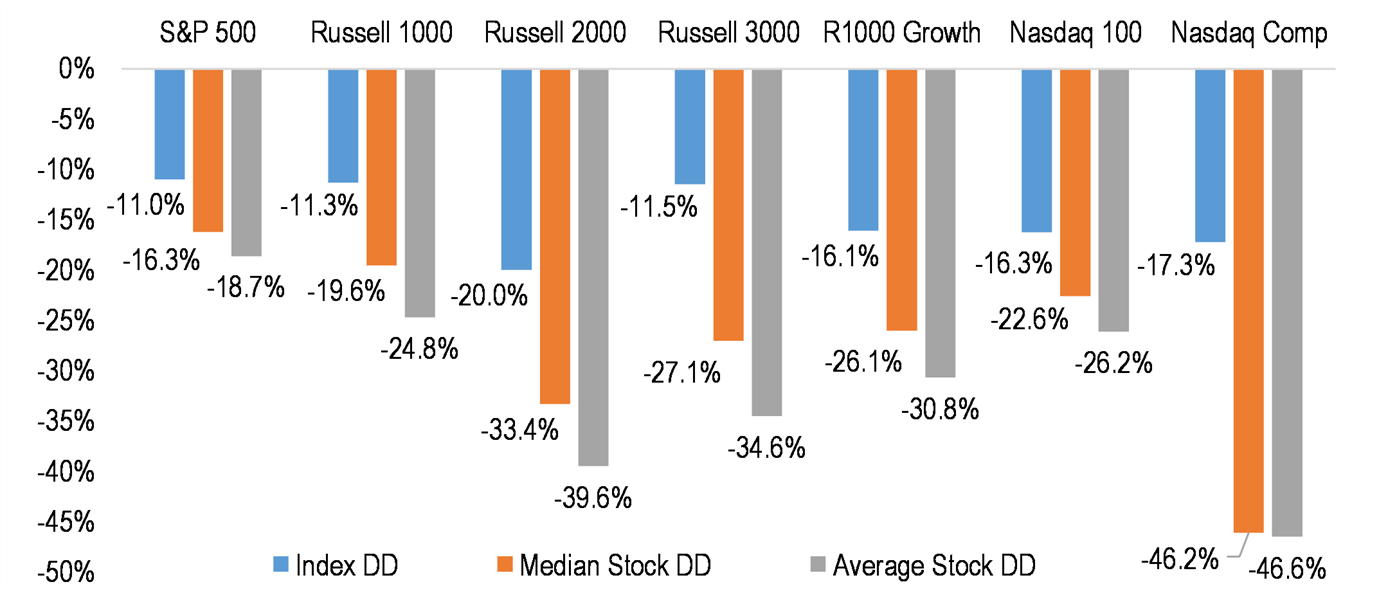

If you didn’t hear, markets were down big in January, but even if you did, they were down bigger than you think. Following the major sell-off on Monday 24th January, the S&P 500 was down 11% for the month, which some labelled a nice correction. But looking at the average stock, that is, each member given a weighting of 0.02, the S&P 500 was down 18.7% demonstrating a broader sell-off. The Russell and Nasdaq indices fared much worse, entering bear market territory for the average stock which is illustrated in the below in the chart from JP Morgan. All this in less than 20 trading days…

Investors were scared and rushed for portfolio protection, which recorded the highest number of puts traded ever in the US. Panic!

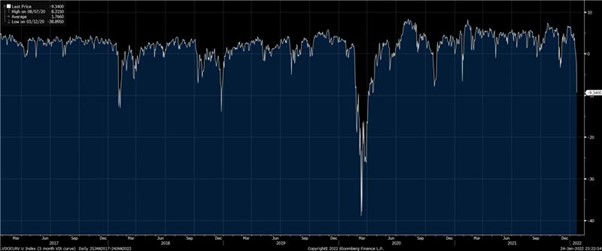

One of our favourite fear gauges is the VIX Index 3-month swap curve. In simple terms, it compares where the market is pricing risk in three months compared to today. Normally, it should be in contango, or a result above zero. When it goes into backwardation, or negative, the market is pricing risk today higher than in three months into the future, which is a reliable indicator of extreme fear and panic. In January the curve hit -9. Except for the turmoil in March 2020 (due to Covid-19), this was the most extreme the curve has been since Dec 2018.

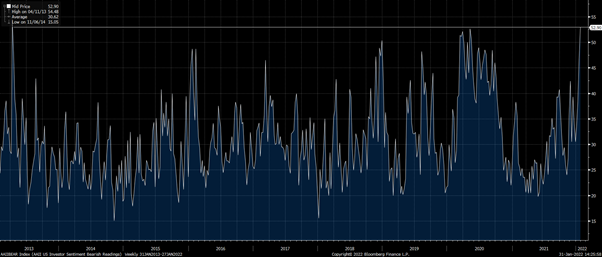

Further, the AAII Bear Index hit its highest level since 2013, even higher than March 2020.

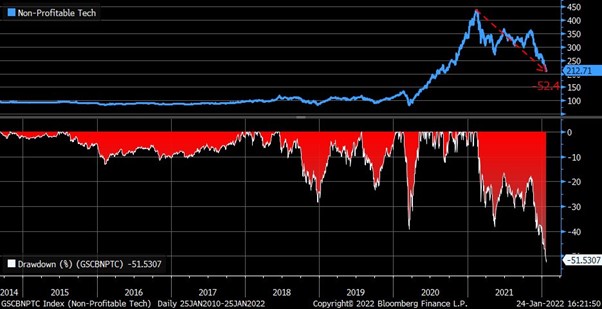

The index of non-profitable tech stocks suffered its worst drawdown since inception…declining more than 50% from its peak in January 2021.

The SPAC Index is down 44% from the January 2020 highs and only 6% above water since the index was created.

And the froth in the SPAC market is most defiantly flat with more than 14 planned listings with a combined $4billion in raising in January alone being pulled from the market.

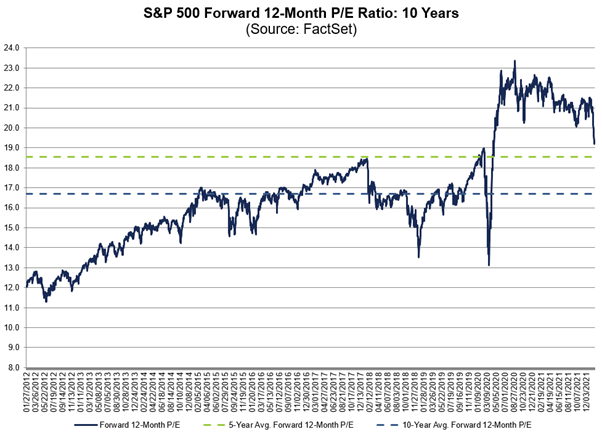

So, with all the overextended indicators mentioned here, we need to address market valuation. Valuations are now relatively undemanding with the S&P 500 forward price/earnings ratio of 19.2x. That’s only one point higher than the index’s valuation at the end of 2019, before the Covid-19 pandemic hit, and before Tesla (TSLA) joined the S&P 500.

As Barrons recently pointed out, since the S&P 500 was created in 1957, the index has averaged one 10% decline and more than three 5% declines every year, according to Dow Jones Market Data. The good news is that sell-offs create opportunities, and 2022 is unlikely to be different.

I'm a global long-short fund manager, and in respect of both the long and the short side of the portfolio I look at business fundamentals and a catalyst to highlight those fundamentals. We invest in themes and trends that we find powerful,...

Expertise

I'm a global long-short fund manager, and in respect of both the long and the short side of the portfolio I look at business fundamentals and a catalyst to highlight those fundamentals. We invest in themes and trends that we find powerful,...