Buffett’s rule reversed? The 17 ASX and Kiwi stocks that made Macquarie’s screen

Few lines are quoted more often by investors than Warren Buffett’s 1989 proverb:

“It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

The late Charlie Munger, Buffett’s long-time partner at Berkshire Hathaway (NYSE: BRK.B), reinforced that thinking throughout his career, nudging the Oracle of Omaha toward high-quality businesses that could compound for decades, even if they didn’t look cheap on the surface.

This philosophy has become a cornerstone of modern investing: paying up for quality at a reasonable price is seen as buying durable assets at a discount to their long-term potential.

But what if the reverse is sometimes true... and investors are better off buying fair businesses at wonderful prices?

That’s the question Macquarie’s global quant team tackled in its latest Style 2.0 research. By backtesting 30 years of data across 10 global markets, they found that fair companies at wonderful (cheap) prices often outperformed wonderful companies bought at fair valuations.

.jpg)

How Macquarie tested Buffett

Macquarie built two models to explore the Buffett/Munger proposition:

- Fundamentals Model – measuring how “wonderful” a company is based on profitability, returns on equity, stability of earnings, and growth persistence.

- Valuations Model – scoring how cheap or expensive a stock looks relative to those fundamentals.

By conditioning one on the other, the team identified “fundamentally cheap” stocks – businesses with fair-to-solid fundamentals that the market hasn’t fully priced in. These were then split into three buckets:

- Wonderful Companies at Fair Price (WCFP)

- Fair Companies at Wonderful Price (FCWP)

- Mixed Group in between

“We found that fundamentally cheap stocks outperformed investing based on valuation or fundamentals alone, with lower volatility and higher consistency,” the report notes.

When backtested, FCWP outperformed WCFP in nine of 10 markets, with the ASX 300 the only exception - but that doesn't mean this methodology is ineffective for Australian investors.

Styles win in different regimes

Macquarie stresses that both strategies work, but they lead at different points in the cycle.

As the analysts explain: “That said, both strategies did outperform. And WCFP proved to be more defensive, particularly during periods of rising risk or economic downturns. This was evident from regime returns for MSCI World, [MSCI All Countries Asia Ex Japan], and ASX 300."

"Conversely, FCWP excelled when risk subsided, performing better during recovery and expansion phases.”

That distinction matters. Investors who overweight WCFP names — the Buffett favourites — are likely to hold up better in crises. Those tilting toward FCWP benefit more from multiple expansion when conditions normalise.

Macquarie adds: “The reasons behind FCWP’s outperformance require further investigation. However, one notable factor is the greater potential for multiple expansion in FCWP companies compared to WCFP companies, which likely contributes to their superior performance in certain market conditions.”

The key point is that it's about recognising that valuation sensitivity cycles in and out of leadership.

What Buffett actually owns

Macquarie also applied its “Style Counsel Tool” to Berkshire Hathaway’s Q2 2025 filings. The results show Buffett is most heavily tilted toward cheap quality and low-risk value, while strongly avoiding expensive growth.

In other words, even Buffett’s current portfolio sits closer to the “fair at wonderful” side of the ledger than many of his famous quotes would suggest.

The Australia and New Zealand stock screen

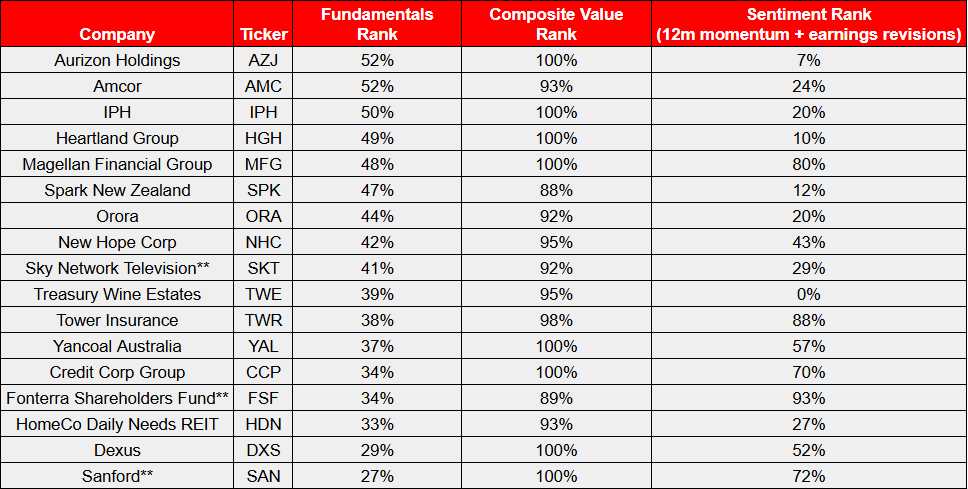

To make the research practical, Macquarie ran its Style 2.0 framework across the local market. The output is a list of ASX-listed companies with fair fundamentals, cheap valuations, and sentiment that hasn’t entirely turned negative.

Here’s a reconstructed version of the table focusing on the three most useful model ranks (percentiles vs the full universe; higher is better).

S&P/ASX 300 & NZ All Ordinaries screen of Fair Company, Wonderful Price

What does it mean for investors?

The Buffett/Munger mantra of buying quality endures, but Macquarie’s research suggests investors should also be flexible. Sometimes, fair companies at wonderful prices are the ones best positioned to deliver outsized returns.

The practical lessons for investors:

- Valuation discipline remains crucial. Don’t dismiss “average” companies if they’re trading at compelling prices.

- Cycle awareness matters. WCFP leads in downturns, FCWP in recoveries. Know which environment you’re in.

- Screens create a starting point. The ASX list above isn’t a buy list, but it highlights potential mispricings worth deeper research.

Buffett’s line about wonderful companies at fair prices may be timeless, but Macquarie’s work suggests investors should be flexible. Styles rotate, multiples expand and contract, and opportunity comes from knowing where to lean at the right time.

1 topic