Chris Stott: Housing boom ahead and no fiscal cliff fears

The local market recovery will only accelerate over the next couple of years as property prices surge, interest rates stay low and the vaccine rollout gathers pace, says 1851 Capital’s co-founder and CIO Chris Stott.

The veteran fund manager, who spent more than a decade at Wilson Asset Management before hanging out his own shingle last February, joined portfolio manager Martin Hickson in a recent investor webinar. Their discussion ranged across the local economic outlook – including expectations for interest rates and property prices – alongside 1851’s stock selection process and projections for a handful of stocks.

“We expect the housing market to have a particularly strong 12 to 18 months, and I think we’re in the early stages of the next housing boom, to be frank,” Stott says. This bodes well for the manager’s flagship Emerging Companies fund, which holds several residential property-exposed stocks including real estate firm McGrath (ASX: MEA), mortgage broker Genworth (ASX: GMA) and non-bank lender Resimac (ASX: RMC).

But the duo is also maintaining a level of caution. “Clearly there’s a lot of FOMO (fear of missing out) driving property prices at the moment, and in the medium-term we see APRA stepping in, and over the medium- to long-term, we think that is a risk for the market,” says Hickson.

Overall, though, they’re very upbeat on the outlook for local markets, especially on the back of the landmark half-yearly corporate earnings season that concluded last month. This largely met Stott’s expectations voiced at his previous webinar, when he predicted a “spectacular” set of results.

“It’s been a really good run since third-quarter, including one of the best reporting seasons we’ve seen on record,” Stott says.

“It has been less volatile than expected, but generally the market has performed in line with our expectations. We remain bullish and think that the trajectory for equities continues to point to the upside.”

Not scared of a cliff-fall

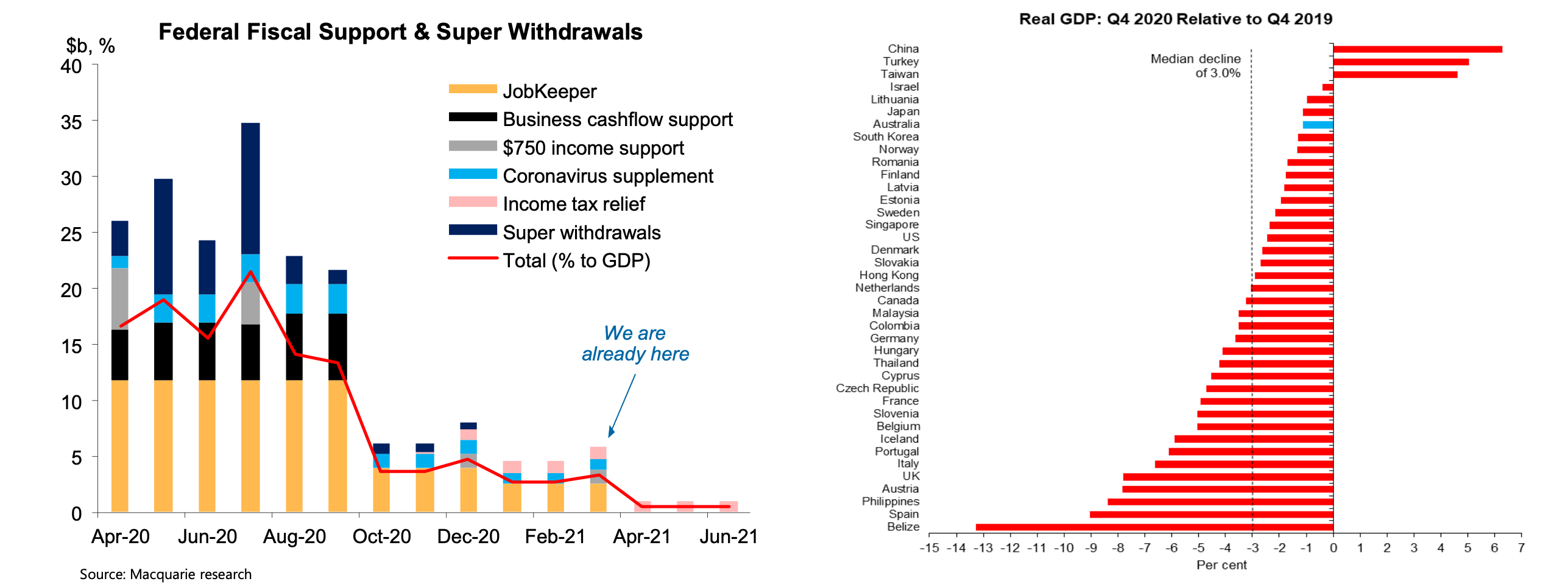

So, investors awaiting another stock sell-off before scooping up bargains will likely be disappointed in the short-term - particularly if they’re expecting a post-JobKeeper slump. Despite the doomsday predictions ahead of the $85 billion government stimulus package’s cancellation on 28 March, Stott says: “We’re not fearful about JobKeeper ending, we had our fiscal cliff in October last year." JobKeeper payment eligibility criteria were tightened and the payment reduced on 28 September 2020, after being extended from the original July cut-off.

Though he lauds JobKeeper as one of the most important pieces of legislation Australia has ever seen, Stott also alludes to the delicate balancing act of running such a program. Having recently caught up with the management of A2B Australia (ASX: A2B), which runs the Cabcharge payment system, one of their biggest issues over the last 12 months was “getting cabbies off the couch collecting JobKeeper and back on the road,” Stott says.

Travel, telco winning themes

The fund’s portfolio manager Hickson also spoke about some of the other themes he and Stott are most bullish on as the recovery gathers pace, including travel and telecommunications. “The share market is always a lead indicator, and we believe that the travel sector will improve as that vaccine delivery rolls out,” he says.

Online travel booking companies Flight Centre (ASX: FLT) and Corporate Travel Management (ASX: CTD) are both stocks in which the fund has re-established positions since last March. As examples, Hickson points to the experiences of both China and New Zealand, where domestic travel is now back to pre-pandemic levels. “And here in Australia, bookings for Jetstar are now just 15% below where they were pre-pandemic,” he says.

Telecommunications is another sector Hickson and Stott have liked for a number of months, particularly attracted to the strong visibility of revenue and earnings for some companies in the space, including Aussie Broadband (ASX: ABB).

Another internet service provider, Uniti Group (ASX: UWL) is the strategy’s largest position, with a 6% portfolio allocation. Hickson concedes the firm has been highly acquisitive more recently, but also expects impressive earnings on the back of organic growth in the future. “We believe sell-side expectations have understated the level of organic growth ahead,” he says.

PSC Insurance (ASX: PSI), which operates an insurance brokerage and other related business in Australia, the UK and New Zealand, is also a top-five holding.

Another locally-listed company with international operations, marketing and communications firm Enero Group (ASX: EGG), is also singled out by Hickson. The firm counts Facebook, EBay and Zoom among its public relations clients, alongside a digital advertising platform called OB Media. “With a very strong balance sheet, $55 million of net cash and the optionality to deploy into acquisitions or to return to shareholders, it’s still very heap in our opinion, trading at just 10-times PE.”

Enero Group performance since mid-2020

Source: ASX, 1851 Capital

The duo’s optimism also extends to the retail space. One of its holdings in this sector is fashion retailer Universal Store (ASX: UNI), which Hickson believes could grow its online penetration by between 20% and 30% in the next few years and take market share from incumbents. He also cites its growing physical footprint, which could double to 120 stores from 60 in the next year.

“At 13.5-times PE, it’s still very cheap, and we think over the next few years Universal could grow earnings to 20%,” Hickson says.

Want more micro- and small-cap ideas?

-

Buy Hold Sell: 5 undiscovered micro-cap gems

- How to uncover the next Afterpay

- 12 winners from Wilson Asset Management's Oscar Oberg

Not an existing Livewire subscriber?

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a like.

1 topic

8 stocks mentioned

2 contributors mentioned