Commodity shock - Australia's outperformance

In early March, the decision to adjust our regional equity tilts was viewed particularly through the lens of relative exposure to sustained higher energy prices. This month, we dig a little deeper into why Australia is a relative beneficiary of a commodity shock, reflecting its status as a net energy exporter (and why domestic equities deserve an overweight status). We also take a look at how the commodity-led income boost is transmitted to the economy, which includes the just-released 2022-23 federal budget.

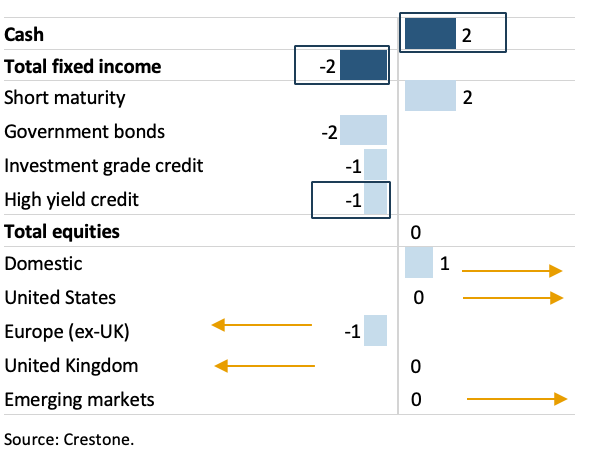

We’ve tilted regional equity allocations through an energy lens

We remain comfortable with our central case outlook, which sees the global economy continuing to recover strongly in 2022 and inflation eventually (and belatedly) moderating into mid-year. This should pave the way for a more constructive equity market environment (and for risk generally) in H2 2022.

However, the intensification of developments in the Russia-Ukraine conflict, including the severity of sanctions and upward pressure on oil and other commodity prices, suggests previous forecasts for a well above trend global growth in 2022 face downside risks, mostly via reduced consumer purchasing power. Central banks also have little option than to begin lifting rates (and in some cases quickly), given inflation outcomes. The timing for some relief on inflation pressures has also drifted further into mid-year from early Q1.

Reflecting the increase in the probability of a ‘tail risk’ event (particularly inflation moving even higher, central bank action that materially slows global growth below trend, or a broadening in the Russia-Ukraine conflict), we made some adjustments on 10 March to our regional equity allocations (see Reducing risk in our regional equity allocations).

In short, we reduced allocations to Europe and the UK (with Europe now underweight) and upweighted allocations to the US and Australia (with Australia now overweight). Key considerations centred on relative exposures to the war in Ukraine and the vulnerability to elevated energy (and commodity) prices.

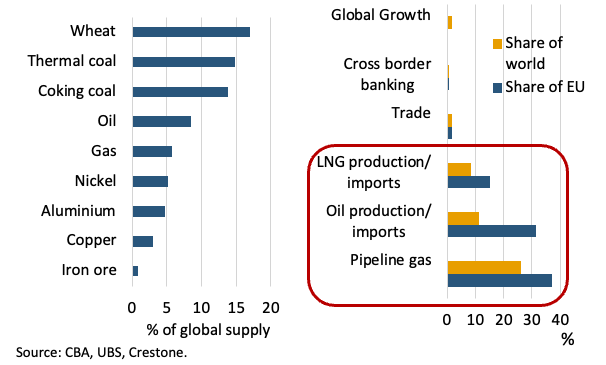

While there remains an uncertain path to resolution in the Russia-Ukraine conflict, what appears relatively clear is that sanctions on Russia, and thus pressures on energy prices, will persist for some time. And this extends beyond just oil and gas to a broad range of metals and other commodities (such as wheat). Thus, while these developments are broadly negative overall, in a relative sense they benefit countries that are energy self-sufficient (such as the US) or a net energy/commodity exporter (like Australia).

Russia is a significant provider of commodities to the world and EU

Australia is a relative beneficiary of a commodity shock

In last month’s Core Offerings, we highlighted our positive outlook for the Australian economy. In particular, we noted positive drivers such as:

- an above-trend global growth backdrop, as well as expectations that China (and its property sector) will be recovering through H2 2022;

- a strong consumer sector (a consistent story across the globe), fresh out of lockdown and flush with cash; and

- relatively low inflation and wage growth relative to offshore, with the Reserve Bank of Australia (RBA) set to hike at less than half the pace of the US Federal Reserve (Fed) in 2022.

Since then, the invasion of Ukraine has led to significant cuts to consensus for global growth for 2022 and 2023, reflecting a much higher peak for global inflation, more aggressive global central bank tightening of monetary policy, and the eroding of consumers’ purchasing power due to rising energy prices.

However, for Australia, the Russian-Ukraine driven spike in commodity prices is likely to push Australia’s terms of trade (the relative price of our exports compared to our imports) to a new record high, pushing up the income we earn as an economy.

Australia’s net energy exposure…a positive for near-term growth

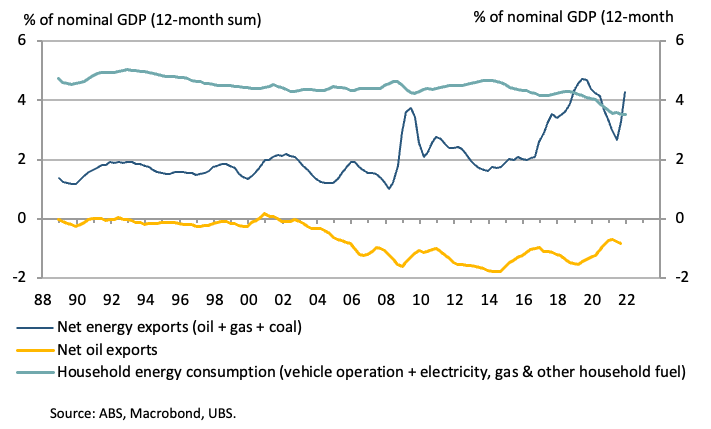

- Australia is a net importer of oil (see the chart below) — While supplies from the Bass Strait supported a more ‘balanced’ position during the last couple of decades of the last century, since around 2005, net oil imports have cost the economy around 1% of national output.

- Australia is a net exporter of energy — However, as also shown below, once liquid natural gas (LNG) and coal are included, Australia is a net exporter of energy, equivalent to 4% of output (up from below 2% prior to 2008). Global LNG and coal prices have spiked dramatically recently.

There are two other points worth considering. Firstly, while iron ore and other metals are not necessarily ‘energy’, they are almost double the size of net energy exports. The recent spike in metal prices will also contribute to the boost in Australia’s income. Gold, aluminium and copper are in Australia’s top 10 goods exports, behind the top three which are iron ore, coal and LNG.

Secondly, as shown in the chart overleaf, the share of energy consumed by households has been falling (a similar picture globally), likely mitigating some of the impact of rising energy prices on consumer’s real purchasing power.

Australia is a net oil importer, but net energy exporter

How does rising export income feed through to the economy?

A sharply rising terms of trade, or export income, feeds through to the overall economy via a number of channels.

- Resource company earnings that feed into resources capex. In the last commodity boom, rising resource earnings underpinned a significant uplift in resource-related investment, as well as stronger mining services expenditure generally. With resource companies recently adopting a more conservative capex program, the impact could be more muted in this cycle.

- Resource company earnings that flow to shareholders. Resource companies are increasingly likely to be in a position to pay higher dividends (particularly to the extent capex plans remain conservative). While there is significant offshore ownership, there is still likely to be a strong stream of income flowing to domestic shareholders in the period ahead.

- Resources tax revenue distributed via government budgets. One of the primary channels by which a commodity boom in income is distributed to the economy is via state and federal budgets. As discussed below, sharp increases in royalty revenues typically find their way into fiscal stimulus via income tax cuts or additional infrastructure expenditure.

Of course, operating in the other direction, rising commodity prices (as we also highlighted last month) have historically put upward pressure on the Australian dollar. This can act as a drag on economic growth, biasing consumer demand to imports rather than domestic production.

The currency has already risen from around USD 0.70 at the end of January (as Russian troops amassed on the Ukraine border) to around USD 0.75 currently, a rise of over 7%. Foreign exchange strategy teams at CBA continue to look for the Australian dollar to rise to be USD 0.78-80 by end-2022, a further 6-7% from current levels.

We moved domestic equities overweight on 10 March

Reflecting Australia’s role as a net energy exporter, we moved domestic equities from neutral to overweight when we adjusted our regional equity tilts early in March. The latest reporting season was strong, and valuations remain a full point below the five-year average (and in line with the 10-year average).

Domestic equities should also act as somewhat of a defensive exposure given yields, balance sheets, geographic distance from the Russia-Ukraine conflict, and exposure to China, which has recently announced a relatively ambitious growth target of “around 5.5%”, which will likely require additional easing.

Finally, currency market moves are an important consideration. While the Australian dollar has already strengthened somewhat, our expectation is that elevated commodity prices will maintain upward pressure on the currency, reducing returns of unhedged foreign currency exposures. Therefore, our decision included a reduction in foreign currency exposure as a whole.

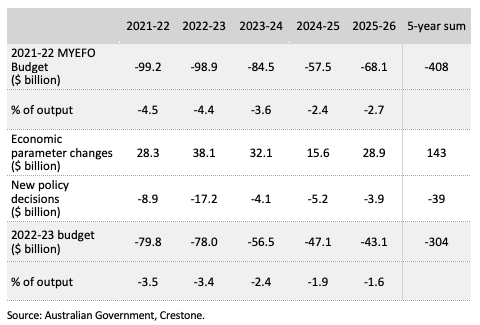

The 2022-23 budget—transmitting the commodity shock

Treasurer Frydenberg delivered Australia’s federal budget for 2022-23 in late March. Given the Government’s narrow parliamentary majority and a looming election (likely to be held in May), this year’s budget was, predictably, targeted to provide cost-of-living relief (given the impact of rising energy prices on consumer confidence). There was also significant additional expenditure on infrastructure and defence.

The Government was also able to embark on its second phase of its fiscal strategy, which is to stabilise and reduce debt. The Government also needed to deliver the necessary fiscal consolidation to ensure maintenance of Australia’s AAA credit rating. Its ability to strike some balance between these two goals was largely afforded by 1) the faster-than-expected fall in the unemployment rate (boosting tax revenue and reducing unemployment benefit payments) and 2) the recent spike in commodity prices.

These two factors largely contributed to the $143 billion budget windfall in the table overleaf, shown in the ‘Economic parameter’ row. With the budget conservatively forecasting a return to long-run trend commodity prices by September 2022, the revenue impact of the current energy and commodity price boom is likely understated in 2022-23 and 2023-24, according to CBA.

The improvement in the underlying budget position has funded a number of new spending policies. Indeed, new spending of $26 billion over the next 15 months (1.1% of output) is a weighty stimulus that could pressure inflation and rates higher. More pre-election spending may also be announced ahead.

Key policies in this budget and the transmission of commodity shock to the broader consumer sector included:

- Cost of living policies—including temporarily lowering the fuel excise by 22.1 cents, $250 payments to welfare recipients, and boosting the low- and middle-income tax offset by $420 to $1,500 for those earning less than $120,000 per annum (worth $8.6 billion).

- Infrastructure expenditure—including $17.9 billion in spending for new and existing infrastructure projects. These range from new spending on the NBN, gas supplies, roads and rail, dams and water security.

The Government’s decision to add stimulus to an economy already growing well above trend is both understandable prior to an election but also not without risk in terms of contributing to higher-than-expected inflation and interest rates over the coming year. Still, the extra stimulus is consistent with our expectation the economy will continue to grow strongly, that consumer spending will continue to be buoyant, and corporate earnings will be relatively resilient. Q1 inflation data end-April will be key to the rates outlook.

Cumulative five-year budget figures

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management offers one of the most comprehensive and global product and service offerings in Australian wealth management.

Click 'CONTACT' to find out more.

4 topics