Compelling Commodities

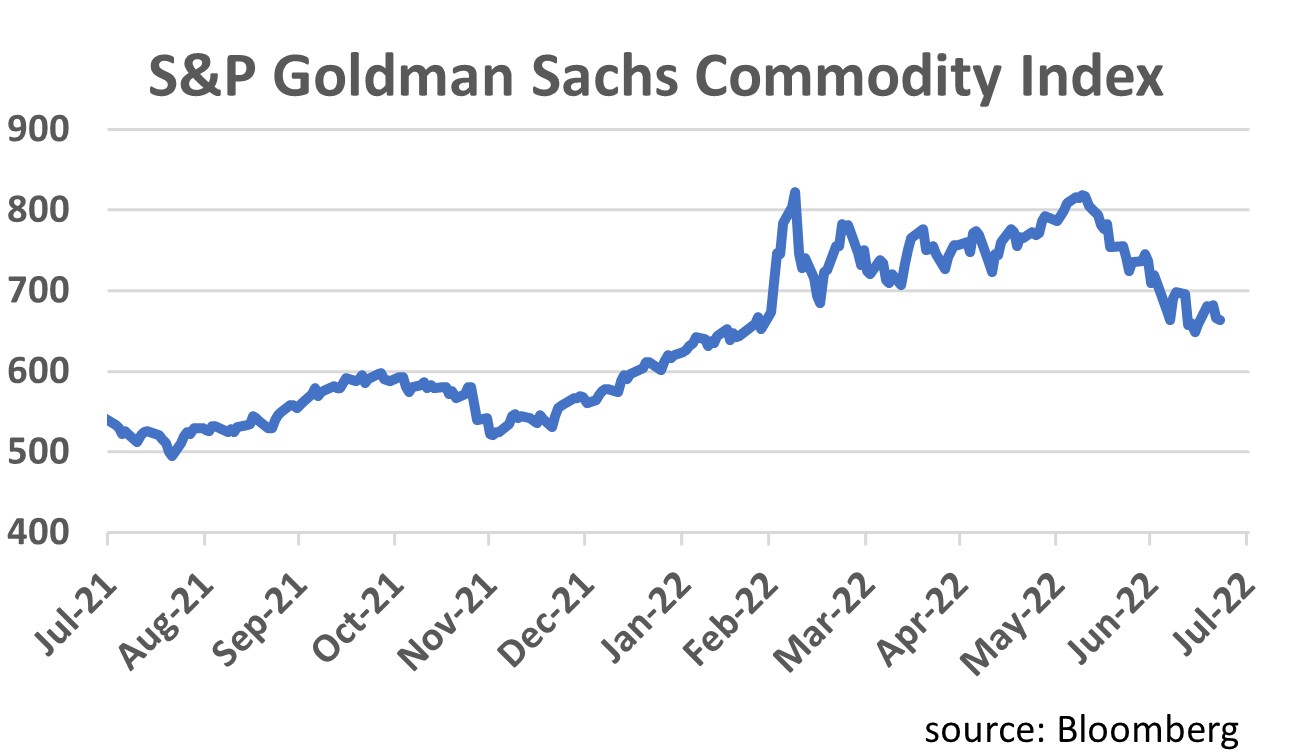

The current outlook for commodities is polarising investors. Commodity prices and resource stocks have declined (see chart) as the market has incorporated the increased possibility of a global recession.

However, not all commodities are equal.

A case in point is copper, a commodity of fundamental importance to the transition to more renewable forms of energy. For example, a typical plug-in electric vehicle (EV) requires 60kg of copper, more than double that required for a standard non-EV vehicle. This is in addition to the copper needed for EV charging stations, solar panels and wind farms. While expectations for the general economic environment have deteriorated, demand for copper continues to accelerate.

On the other hand, gold, which is supposed to act as a hedge against inflation, simply hasn’t worked in the current environment. Since peaking in March at over US$2000 an ounce, it has fallen by almost 20%.

Oil is also interesting. It is used in the manufacture or propulsion of more than 6,000 everyday products, from cars to planes to dishwashing liquid and many things in between. With ongoing Russian sanctions and OPEC unwilling to increase output, supply remains tight.

Iron ore is Australia’s largest export and the reason China is so important to us. While many western world countries are attempting to slow their economies, China might just be doing the opposite. In May, Chinese Banks cut the 5-year loan prime rate, a reference for home mortgages. Any potential efforts to re-stimulate would be a significant boost for iron ore and Australia, as it was during the GFC.

Typically with commodities, there is a cycle that one shouldn’t fight. So, why is it different this time? Historically when prices have risen, over-investments have occurred with a consequent increase in supply. This is not the case today. In some cases, the industry has learnt from previous mistakes, while in others, access to capital has been more complicated. Either way, improved corporate discipline is the outcome.

Meanwhile, some resource companies are

generating substantial free cash flow, trading on single digit forward PE

multiples while also offering the potential for shareholder friendly capital management

initiatives. We continue to selectively accumulate global best in class

resource names with strong balance sheets at historically attractive

valuations.

2 topics