Could the crypto crash become a 21st century Tulip Bulb Bubble?

In December 2019, Bitcoin, a decentralised digital currency without a government guarantee, conventional bank-backing, or demonstrated utility as a scalable medium of exchange, was trading around US$7,000. By late 2021, it had appreciated almost 10 times in value, trading at north of $67,700. And yet months later Bitcoin has suddenly halved in value as a result of a sudden correction in US equities precipitated by concerns about central banks lifting interest rates off their zero lower bound.

This has inflicted nontrivial losses on the droves of investors who rushed into the crypto craze over the last 12-18 months, including levered retail households, sophisticated institutional investors, such as pension and sovereign wealth funds, and even nation-states like El Salvador, which gave Bitcoin legal tender but has since suffered questions around the country's creditworthiness and ability to service its debts as crypto plummets in value.

For several years, we refused to offer an opinion on crypto. It was not something that was core to financial markets or the financial system. When repeatedly asked for a view, I would simply respond that it was not our area of expertise. Nonetheless, we know many highly intelligent individuals---whom I respect a great deal---that are fervent promoters of the crypto and decentralised (defi) finance thematics.

My own instincts on crypto and defi were not initially positive for a few reasons. The history of financial crises teaches us several lessons that call into question the prospective durability of both crypto and defi:

- Government-guaranteed cash is very hard to beat as a store of wealth, especially during an inflation shock when short-term interest rates soar (recall that the Fed's cash rate was almost 10% in 1990), crushing most risky asset-classes

- Scalable and trusted mediums of exchange normally require regulation and government guarantees (sovereign backing) and need to be intermediated by the government-backed banking system

- Non-bank entities outside of the banking system frequently fail during large shocks/recessions when they cannot rely on central bank liquidity and government guarantees to bail them out, as banks can

- And financial markets and the financial system are highly networked scale economies that, just like the Internet, strongly favour a very small number of winners (monopolists and oligopolists) in each vertical (eg, Amazon, Microsoft, Google, Facebook, Instagram etc), which leaves a large number of losers (consider the graveyard of failed Internet start-ups from the 1990s and 2000s). This is true globally of banking systems, with typically have a handful of concentrated oligopolists dominating in each country, which tend to scoop up failed non-bank rivals during big crises (consider all the non-banks bought by or merged into, traditional banks during and after the GFC).

Let's now reflect on why crypto surged in value following the 1-in-100 year pandemic and has more recently been subject to massive, circa 50% drawdowns. A key question is whether this tells us anything about the long-term prospects for the asset class.

It appears reasonable to infer that several extreme policy responses to the pandemic drove enormous interest in, and demand for, crypto.

TINA: Replacing zero-interest cash with "Digital Gold"

The first involved central banks slashing their interest rates to zero per cent. Banks followed suit with the interest rates on their cash deposits. This immediately undermined the value of conventional government-guaranteed and bank-backed cash as a store of wealth.

Retail and institutional investors faced the significant challenge of generating positive returns on highly liquid and safe cash investments when interest rates were at or near zero. Since you earned next to nothing on cash, the opportunity cost of switching into new alternatives like crypto appeared to be modest, especially given the positive price action.

Over 2020 shifting out of conventional cash into crypto became an increasingly attractive option for many open-minded investors. A positive feedback loop emerged as Bitcoin and crypto generally started to experience exponential price growth by late 2020, reinforcing the perception that these alternatives to conventional currencies were viable stores of wealth, or "Digital Gold", as some describe Bitcoin.

This also fostered a TINA ("there-is-no-alternative") dynamic, reinforced by central banks actively encouraging consumers to go out and spend their cash savings on riskier assets in the name of supporting the economic recovery. The entire point of monetary policy crushing the risk-free rate to zero was to incentivize borrowing, investment, speculation and "animal spirits".

Governments transfer record cash to households

Demand for crypto was further powered by several other policy dynamics. Alongside zero interest rates, governments have run some of the largest fiscal deficits in history, dropping unprecedented amounts of cash into the hands of households and companies.

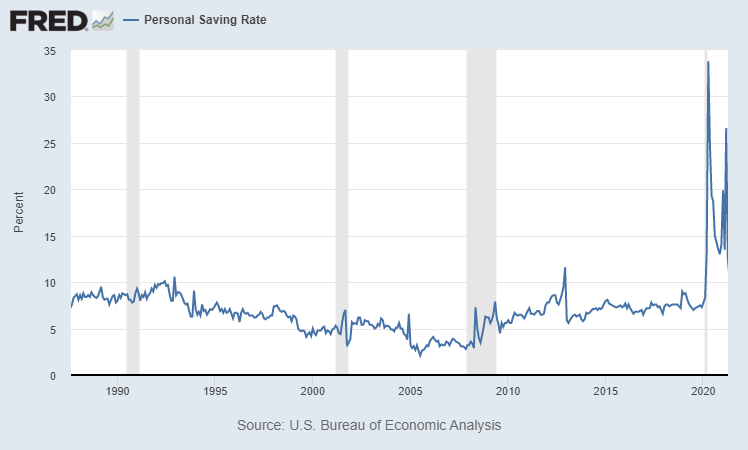

Notwithstanding initial concerns that the pandemic would precipitate a depression and possibly deflation, the public policy response left households with record savings rates. Concurrently, communities were placed in lockdown, making it very hard to go out and spend this money.

With untapped cash piles and a lot of time on their hands, it seems that many consumers started experimenting with investing in the stock market, lubricated by the recent advent of zero commission brokerages (eg, Robinhood), and allocating to cryptocurrencies.

The extraordinary performance of both asset classes over the course of 2020 and 2021 left these new inductees to stocks and crypto with a very positive initial experience. Those who had not yet taken the leap were further motivated to do so by the stunning returns and the emergence of a clear FOMO ("fear-of-missing-out") influence.

Equities and crypto increasingly felt like one-way bets, especially when central banks always had the market's back: that is to say, investors could rely on the so-called Greenspan/Bernanke/Powell put option to bail them out if markets ever crashed, as had been the case in 2001, 2008, 2019, and 2020.

The great inflation hedge

Another tailwind for crypto has been fears that the unprecedented public policy stimulus, including record money printing by central banks, would result in a fierce inflation cycle that would undermine the value of conventional currency and cash.

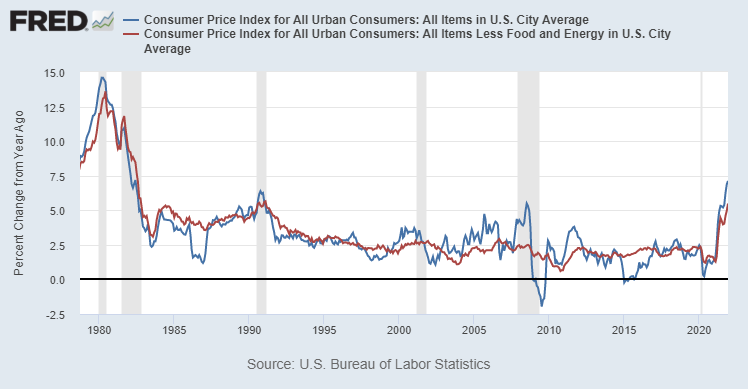

These fears are certainly playing-out right now with incredible inflation and wage growth in both the US and most other developed economies. Core inflation in the US is running somewhere between 4.7% to 5.5%, depending on how you measure it. While this has been boosted by supply-side blockages attributable to the pandemic, it is now being amplified by demand-side pressures from extremely strong wage growth that reflects ultra-tight labour markets. The global economy is, therefore, in the grips of both demand-pull and cost-push inflation.

Cracks emerge in the crypto dream

Crypto has generally been sold to investors on the basis of several core value propositions:

- It is a viable store of wealth outside of centralised governments

- It will be a powerful inflation hedge in a world awash with money printing

- It can serve as a tractable medium of exchange

Decentralised finance or defi has been pitched on the basis that it offers an alternative to the centralised banking system, much like non-bank securitisers have in the past. Yet there are some reasonable questions one can ask in respect of the integrity of each of these ideas.

A viable store of wealth?

The first challenge crypto faces is that it is a non-income producing asset (in contrast to say equities, bonds, cash deposits and/or property) that has a value determined solely by its efficacy as a store of wealth and medium of exchange. And in contrast to precious metals like Gold, Bitcoin has no other practical utility (eg, jewellery, medicine, electronics, central bank reserves etc). Yes, you can make money lending against crypto, but that is just another credit investment with the associated default, loss and liquidity risks.

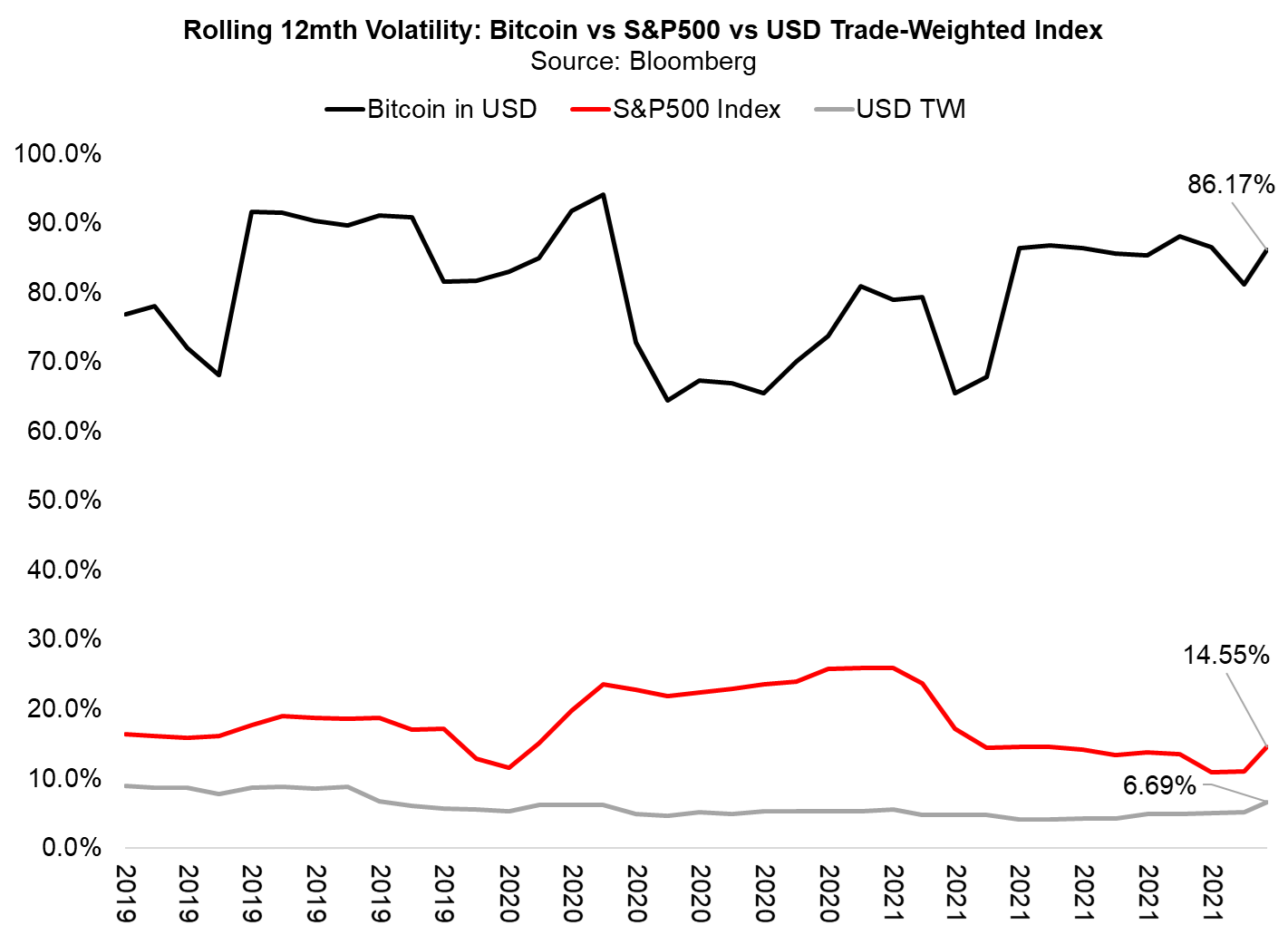

The next concern with crypto is it is not a stable store of wealth. The chart below shows the rolling annual volatility of Bitcoin in USD compared to the S&P500 Index and the USD trade-weighted index. Bitcoin is almost 6x more volatile than US equities and 18x more volatile than the US dollar. Also compare this to the change in the value of risk-free bank deposits, or cash investments, which have zero volatility since they are held at par (ie, not marked-to-market).

For as long as Bitcoin has been soaring in value given zero cash interest rates and huge fiscal injections of money onto household balance sheets, the upside volatility was tolerable. But the downside risk has recently come home to roost, as highlighted in the chart below. This shows the value of Bitcoin over the last 12 months when a great deal of the money that flooded into this asset class would have arrived. Depending on your timing, you could be facing losses of 40%-50% over the past year. Also observe that since widespread worries about persistent, rather than transitory, inflation emerged in late 2021 coupled with the expectation of much higher interest rates on cash, the value of Bitcoin has declined precipitously.

An inflation hedge?

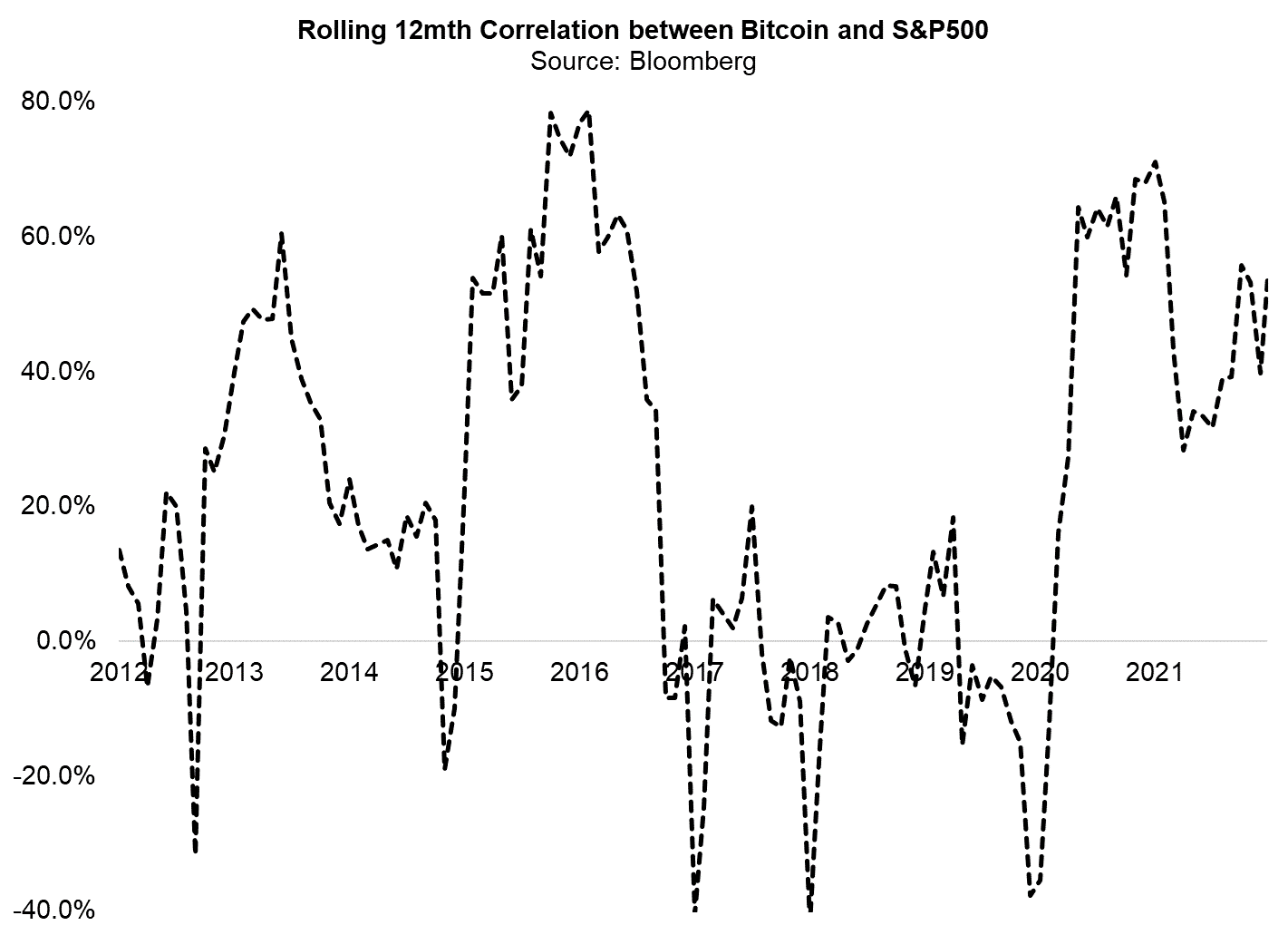

To compound these concerns, Bitcoin, and other correlated cryptocurrencies (see below), appear to be trading not as inflation hedges, but rather as simple equity risk proxies. In the last year, the correlation between Bitcoin and US equities has jumped to north of 50%. In big risk-off moves, such as the savage recent US equity market correction, the correlation appears to be almost perfect. Since the equity losses have been triggered by fears of higher interest rates to quell inflation, Bitcoin has been behaving as an inflation risk amplifier rather than a mitigant. When positive interest rates finally arrive on risk-free cash deposits, this will significantly increase the opportunity cost of switching into crypto, undermining its demand. This demand will have also been materially dented by investor experience with the recent downside risk.

A diversifier?

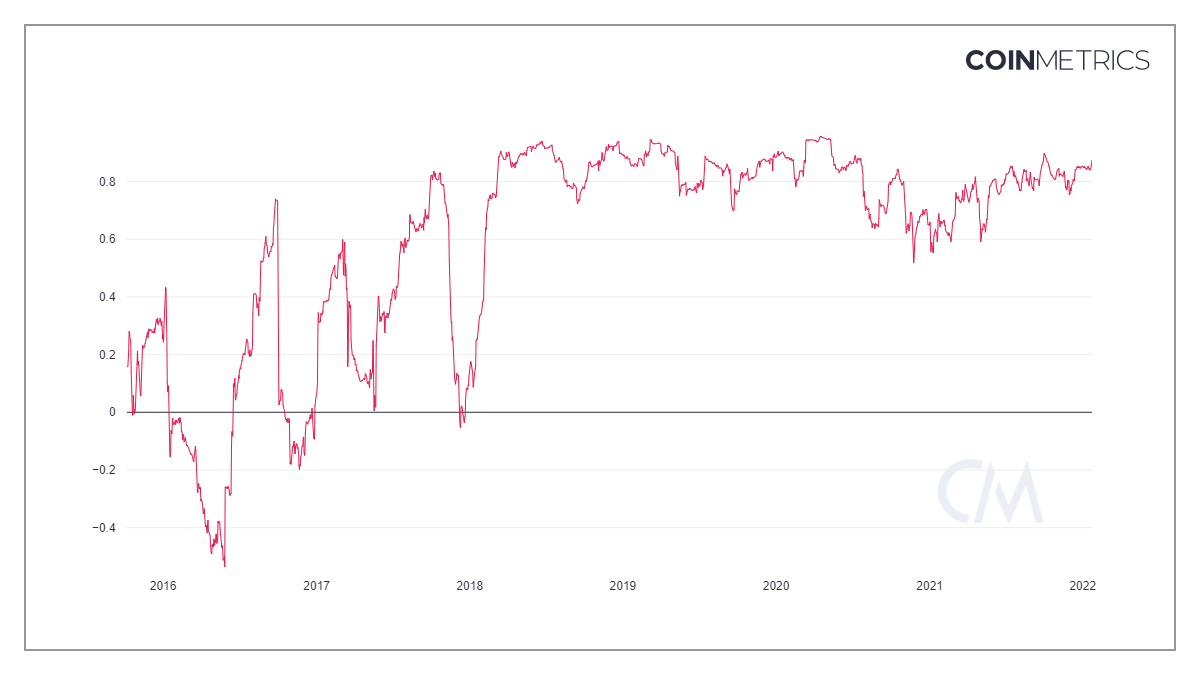

Many investors believe that one possible solution to the crypto risk problem is diversification. They accordingly hold a range of other cryptocurrencies. Yet Bitcoin and other digital currencies are proving to be highly correlated with both equities and themselves. The chart below shows the correlation between Bitcoin and Ethereum, which has averaged around 75%-85%. Put differently, loading up on crypto appears to be just another form of equity-related risk.

A viable medium of exchange?

For all the hope and promise of crypto acting as a viable medium of exchange, we have yet to see its widespread take-up. To this day, we rely almost exclusively on electronic cash protected by the government-guaranteed banking and payment system, and the associated credit card oligopoly. Pioneering countries like El Salvador that adopted Bitcoin as legal tender have run into financial problems as a direct consequence, which will likely deter others.

And slowly but surely nation-states are predictably moving to crush unregulated crypto-threats to their own currencies and payments/banking systems, often on the basis of claims that crypto is being used by criminals and terrorists as an anonymized medium of exchange. China banned crypto in 2021 and Russia is now proposing to follow suit. Fortune Magazine comments on the burgeoning wave of crypto bans across the globe:

China made big headlines when it banned crypto last year, but it is only one of dozens of countries and jurisdictions that have either banned cryptocurrencies outright or severely restricted it over the past few years.

Egypt, Iraq, Qatar, Oman, Morocco, Algeria, Tunisia, Bangladesh, and China have all banned cryptocurrency. Forty-two other countries, including Algeria, Bahrain, Bangladesh, and Bolivia, have implicitly banned digital currencies by putting restrictions on the ability for banks to deal with crypto, or prohibiting cryptocurrency exchanges, according to a 2021 summary report by the Law Library of Congress published in November.

The number of countries and jurisdictions that have banned crypto either completely or implicitly has more than doubled since 2018, when the organization first published a report on the subject.

Some governments that have banned crypto have said that cryptocurrencies are being used to funnel money to illegal sources and argued that the rise of crypto could destabilize their financial systems. Although not all governments are moving to ban crypto, many are looking into how to regulate digital currency, including the U.S.

Concluding thoughts

There are doubtless many important technology innovations, such as Blockchain, that have been developed as part of the crypto ecosystem. These innovations may endure and become immensely valuable over time.

Yet the cryptocurrency craze appears to share some commonalities with the great Tulip Bulb Bubble in the 1600s. In contrast to some of the more hyperbolic claims:

- Crypto is not a stable store of wealth with 6x the volatility of US equities and 18x the volatility of the US dollar

- Crypto is not an inflation hedge or a hedge against the much higher interest rates that accompany elevated core inflation. In fact, crypto appears to be an equity risk proxy and is highly correlated with stocks

- Crypto is not being used as a widespread medium of exchange, and its adoption as such is being blanket banned by numerous nation-states. Western countries may ultimately regulate it out of existence

- As a non-income producing asset, the value of crypto relies on its efficacy as a store of wealth and a medium of exchange, both of which are being called into question

- Future demand for crypto is likely to be undermined by the return of materially positive interest rates on risk-free cash deposits, which will dramatically increase the opportunity cost of switching into crypto

Finally, for those who are hoping to rely on the central bank put option to bail-out equities and hence crypto, this time is different. We have not seen a fully employed US economy with wages and inflation characteristics like this since the early 1990s. The worry is that Omicron is only fanning these flames by introducing yet more constraints on the availability of labour and therefore supply chains. The risk is that elevated consumer inflation expectations remain stubbornly high and eventually bleed into wage-price spirals as the balance of negotiating power in labour markets shifts from employers to employees.

To underscore the expiry of the Powell put option, when was the last time you can remember a US president egging on the Fed to crush inflation and raise interest rates? When do you last recall inflation being a major US political issue? The post-GFC period has been defined by politicians trying to strong-arm central banks into easier, not tighter, monetary policy settings.

The arrival of a genuine inflation cycle means that central banks will have to try to normalise their cash rates irrespective of the financial market (and crypto) volatility that this might induce in the short term. This significantly raises the downside risks.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics